Straightup Announces Property Option for RLX North, RLX South and Belanger Properties

Straightup Resources Inc. (the “Company” or “Straightup”) (CSE: ST) is pleased to announce that it has entered into a property option agreement (the “Option Agreement”) dated June 3, 2020 (the “Effective Date”) with an arm’s length vendor (the “Vendor”), whereby it has been granted the sole, exclusive and irrevocable right and option (the “Option”) to acquire a 100% undivided interest in certain unpatented mining claims comprising the RLX North, RLX South and Belanger properties (collectively, the “Property”) located in the District of Red Lake, Ontario, Canada, subject to a 3% net smelter returns royalty.

Straightup Resources Inc. (the “Company” or “Straightup”) (CSE: ST) is pleased to announce that it has entered into a property option agreement (the “Option Agreement”) dated June 3, 2020 (the “Effective Date”) with an arm’s length vendor (the “Vendor”), whereby it has been granted the sole, exclusive and irrevocable right and option (the “Option”) to acquire a 100% undivided interest in certain unpatented mining claims comprising the RLX North, RLX South and Belanger properties (collectively, the “Property”) located in the District of Red Lake, Ontario, Canada, subject to a 3% net smelter returns royalty.

“We are excited to move forward with exploration of the RLX North, RLX South and Belanger properties,” stated Matthew Coltura, President and CEO of Straightup Resources, “With the Red Lake district being known to host some of the richest gold deposits in the world and the recent success in the region by Great Bear Resources, we are pleased to be in a position to further survey the area and potentially uncover profitable mineralization.”

Readers are cautioned that the Company has no interest in or right to acquire any interest in any property in Figure 1 other than the Property, and that mineral deposits, and the results of any mining thereof, on adjacent or similar properties are not indicative of mineral deposits on the Company’s properties or any potential exploitation thereof.

Property Details

RLX North and RLX South

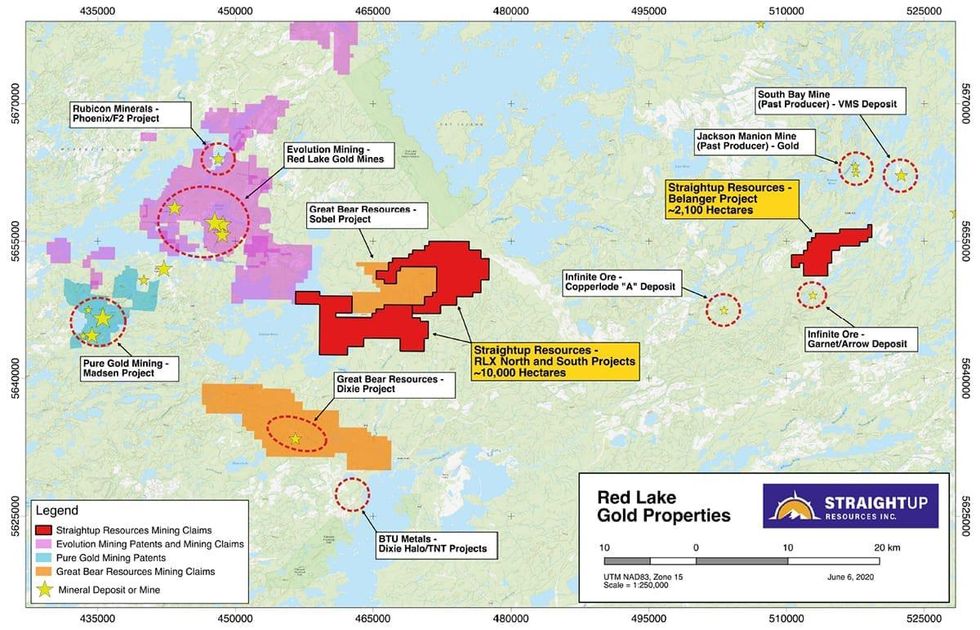

The RLX North and RLX South properties form a large (approximately 10,000 hectare) land package contiguous to, and almost entirely surrounding, Great Bear Resources Ltd.’s (“Great Bear”) Sobel property (Figure 1). Upon acquiring its Sobel property in March 2019, Great Bear interpreted the presence of important D2 fold axial planes (major regional-scale controls on gold mineralization) extending into the Sobel property. The RLX North and RLX South properties are also situated along the same geological trend as the Red Lake Gold Mines, now operated by Evolution Mining Limited, with gold endowment of 29.63 Moz Au at an average grade of 21 g/t Au (based on reported reserves of 840 tonnes of gold at 21 g/t and a conversion of 35,273.96 ounces per tonne of gold).

Readers are cautioned that the Company has no interest in or right to acquire any interest in any property in Figure 1, including Great Bear’s Sobel property and the Red Lake Gold Mines, other than the Property, and that mineral deposits, and the results of any mining thereof, on adjacent or similar properties are not indicative of mineral deposits on the Company’s properties or any potential exploitation thereof.

The RLX North property is interpreted to be underlain primarily by the 2.99 Ga Balmer Assemblage. The majority of historic gold production in the Red Lake District has been mined from this metavolcanic sequence. The RLX South property is interpreted to be underlain by the 2.74 Ga Confederation Assemblage. This sequence is also prospective for gold, but also has potential for VMS-style base metal deposits, such as the historic South Bay Mine (a VMS deposit), and the TNT target being actively explored by BTU Metals Corp. at its Dixie Halo property. Notably, the geological contact between the Balmer and Confederation Assemblages is also interpreted to be present on the RLX North and RLX South properties, and the most significant gold deposits in Red Lake have been found within several hundred meters of this geological contact.

Figure 1. Red Lake Gold Properties.

Like many other projects in this portion of the Red Lake Greenstone Belt (including Great Bear’s nearby Dixie project located 6 km to the south of the Property), thick overburden cover, particularly in the eastern portion of the RLX North property, has resulted in the area being historically underexplored, and presents excellent opportunity for a new discovery using a combination of traditional and modern exploration techniques.

Planned exploration activities in 2020 are expected to consist of historical data review and re-interpretation, geological mapping and sampling, and geophysical surveys (airborne), all of which may be conducted prior to the issuance of an exploration permit and are not ground-disturbing activities. Exploration permit applications have been submitted and are anticipated to be issued in the near-term. The issuance of an exploration permit will allow more advanced exploration activities on these projects in the future, if warranted, such as diamond drilling of high-priority targets identified by the early exploration program.

Belanger

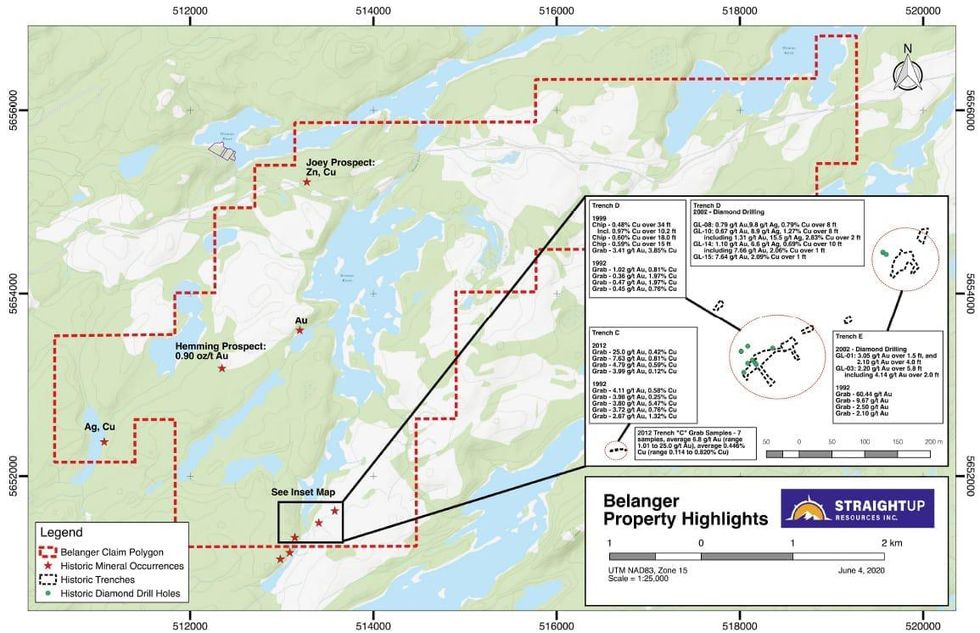

The Belanger property is an approximately 2,100 hectare property located 2.2 km north of Infinite Ore Corp.’s Garnet/Arrow deposit (Figure 1) in the District of Red Lake, Ontario. The Belanger property is interpreted to be primarily underlain by the 2.74 Ga Confederation Assemblage. Historic exploration on the Belanger property has identified three significant gold-copper occurrences over an interpreted strike length of 600 meters. These were historically referred to as Trench “C”, Trench “D” and Trench “E”.

Figure 2. Belanger Property.

Historic grab samples from Trench “C” have returned up to 25.0 g/t Au (range 0.038 to 25.0 g/t Au), and up to 5.47% Cu (range 0.01 to 5.47% Cu). Trench C has yet to be tested by diamond drilling. Historic grab samples from Trench “D” have returned up to 3.41 g/t Au (range 0.004 to 3.41 g/t Au) and up to 3.85% Cu (range 0.76 to 3.85% Cu). A limited diamond drilling program completed in 2002 also returned significant intercepts, such as 1.10 g/t Au, 6.6 g/t Ag and 0.69% Cu over 10 ft (including a narrower higher grade intercept of 7.66 g/t Au and 2.06% cu over 1 ft) in drill hole GL-14 (-43° dip / 142°azimuth), drilled by King’s Bay Gold Corporation. The diamond drilling program also returned significant intercepts beneath Trench “E”, including 2.20 g/t Au over 5.8 ft in drill hole GL-03 (-55° dip / 168° azimuth). Historic grab samples from Trench “E” have also returned numerous anomalous gold assays.

Readers are cautioned that the above-mentioned grab samples are selective and likely biased by nature and therefore are not necessarily representative of the overall grade and extent of any mineralization that could occur on the subject areas of the Belanger property.

Assays of the drill samples were completed by Accurassay Laboratories in Thunder Bay, Ontario. Although the Company believes the source of the historical information to be generally reliable, such information is subject to interpretation and cannot be verified with complete certainty due to limits on the availability and reliability of raw data and other inherent limitations and uncertainties.

It is significant that in all three trenches, gold and copper mineralization is exposed on the surface. Historical mechanical stripping of overburden will allow for re-interpretation of the underlying structural controls on mineralization. Intensely folded quartz veins occupying broad zones of shearing suggest significant deformation, the thorough interpretation of which may allow for predicting and targeting of higher grade zones farther along the strike and at depth.

Planned exploration activities in 2020 are expected to consist of historical data review and re-interpretation, geological mapping and sampling (including validating the historical sampling results in Trenches “C”, “D” and “E”), and geophysical surveys (airborne), all of which may be conducted prior to the issuance of an exploration permit. Exploration permit applications have recently been submitted and are anticipated to be issued in in the near-term. The issuance of an exploration permit will allow more advanced exploration activities on the Belanger property in the future, if warranted, such as diamond drilling of high-priority targets identified by the early exploration program.

Commercial Terms

In order to exercise the Option in full, Straightup will be required to: (i) make cash payments to the Vendor in the aggregate amount of $150,000; and (ii) issue common shares in the capital of the Company (the “Consideration Shares”) having an aggregate cash value of $300,000 to the Vendor, to be paid and delivered as set out below (collectively, the “Option Payments”):

| DATE | CASH (CAD) | CONSIDERATION SHARES |

|---|---|---|

| Upon execution and delivery of the Property Option Agreement | $25,000 | 300,000 Consideration Shares |

| On or before the first anniversary of the Effective Date | $25,000 | Consideration Shares having a cash value of $30,000 in accordance with the Option Agreement |

| On or before the second anniversary of the Effective Date | $50,000 | Consideration Shares having a cash value of $100,000 in accordance with the Option Agreement |

| On or before the third anniversary of the Effective Date | $50,000 | Consideration Shares having a cash value of $140,000 in accordance with the Option Agreement |

Upon completion of the Option Payments, the Company will be deemed to have exercised the Option and will have earned an undivided 100% legal and beneficial interest in and to the Property, subject to a 3% Net Smelter Returns Royalty (“NSR Royalty”) to be granted to the Vendor. The Company will have a right at any time to purchase from the Vendor two-thirds (being 2%) of the NSR Royalty from the Vendor for $1,000,000 per percentage point of the NSR Royalty (an aggregate of $2,000,000 for 2%), payable in cash or common shares of the Company.

During the Option period, the Company will be responsible for maintaining the Property in good standing, paying all exploration licenses fees and taking such other steps as may be required to carry out the foregoing. There will be no other work commitments, and any work carried out on the Property will be at the sole discretion of the Company.

Qualified Person

John Hiner, Licensed Geologist and Registered Member of SME (Society for Mining, Metallurgy and Exploration), a qualified person as defined by NI 43-101, has reviewed the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Hiner is not independent of the Company as he is a director of the Company, and holds incentive stock options in the Company.

For further details on the Company and the Property readers are referred to the Company’s web site at www.straightupresources.com.

About Straightup Resources Inc.

Straightup is engaged in the business of mineral exploration and the acquisition of mineral property assets in Canada. Its objective is to locate and develop economic precious and base metal properties of merit and to conduct its exploration program on the Hi-Mars Property. The Hi-Mars Property consists of 11 contiguous mineral titles covering an area of 1,788 hectares located approximately 17 kilometres northeast of the City of Powell River in the southwest British Columbia, Canada, within the Vancouver Mining Division.

On Behalf of the Board of Directors

Matthew Coltura

Chief Executive Officer, President and Director

For further information, please contact:

Matthew Coltura

Chief Executive Officer, President and Director

(778) 886-6200

Forward-Looking Statements:

This news release includes certain forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the exercise of the Option, the NSR Royalty, anticipated exploration program results from exploration activities on the Property, the discovery and delineation of mineral deposits/resources/reserves and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as “pro forma”, “plans”, “expects”, “will”, “may”, “should”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “potential” or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements are based on certain assumptions regarding the Company including, without limitation, that market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration and development of the Company’s projects in a timely manner, the availability of financing on suitable terms for the exploration and development of the Company’s projects and the Company’s ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, statements as to the anticipated business plans and timing of future activities of the Company, including the Company’s option to acquire the Property, the proposed exploration work thereon, the fact that the Company’s interest in the Property is an option only and there is no guarantee that such interest, if earned, will be certain, the timing and amount of estimated future production, the costs of production, capital expenditures, the costs and timing of the development of new deposits, requirements for additional capital, future prices of gold, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, accidents, labour disputes and other risks of the mining industry, the ability of the Company to obtain sufficient financing to fund its business activities and plans, delays in obtaining governmental and regulatory approvals (including of the Canadian Securities Exchange), permits or financing, risks relating to epidemics or pandemics such as COVID–19, including the impact of COVID–19 on the Company’s business, financial condition and results of operations, changes in laws, regulations and policies affecting mining operations, the Company’s limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed under the heading “Risk Factors” in the Company’s prospectus dated January 22, 2020 and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company’s profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this presentation or incorporated by reference herein, except as otherwise required by law.