The Conversation (0)

PROJECT UPDATE: Klondex Secures Producing Mine for $83 Million

Dec. 05, 2013 12:01PM PST

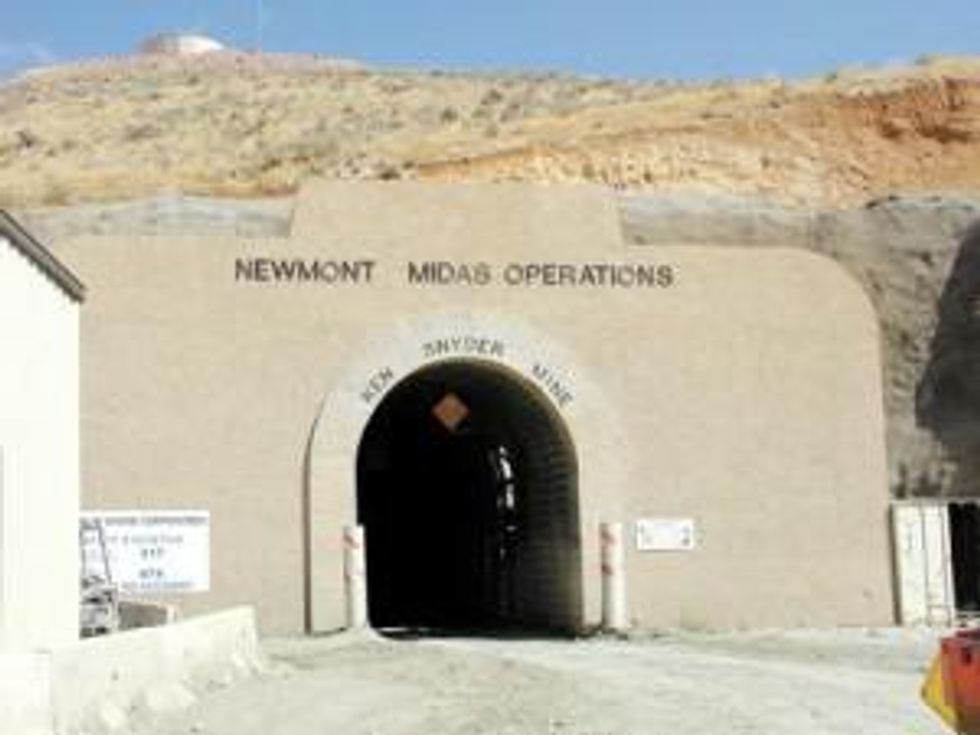

Precious Metals InvestingKlondex Mines (TSX:KDX), working to put its Fire Creek gold project in Nevada into production, on Wednesday said it will pay Newmont Mining (NYSE:NEM) about $83 million for its Midas mine and milling facility in the same state.

Klondex Mines (TSX:KDX), working to put its Fire Creek gold project in Nevada into production, on Wednesday said it will pay Newmont Mining (NYSE:NEM) about $83 million for its Midas mine and milling facility in the same state.

“This acquisition is transformational for Klondex, during a pivotal point in our company’s development,” Klondex President and CEO Paul Huet said in a statement, adding:

“I am confident that Klondex’s management team can leverage past experience, with some of the core leadership team having previously worked at Midas, to vastly benefit from the synergies and to unlock continued value in Klondex for shareholders going forward. Our team is extremely pleased to be working alongside Newmont to bring together two excellent epithermal deposits with a high-quality central mill.”

The $83-million price tag includes $55 million in cash, about $28 million through the replacement of Newmont surety arrangements with Nevada and federal regulatory authorities, along with 5 million common share purchase warrants Klondex will issue to Newmont, the gold major stated.

Newmont acquired the Midas underground mine and mill through its merger with Normandy in 2002.

According to Proactive Investors, the deal is expected to boost Klondex’s long-term cash flow and margins by adding a producing property to its portfolio. “Substantial synergies” are expected through shared equipment, employees and improved efficiencies.

In October, the company completed the excavation of a secondary egress allowing it to commence a bulk sampling program; and around the same time mobilized a second drill rig for following up on previously explored targets and to initiate a three-phase program in the West Zone.

Klondex is expected to deliver a preliminary economic assessment on Fire Creek in the first quarter of 2014.

Securities Disclosure: I, Andrew Topf, hold no investment interest in any of the companies mentioned.

Editorial Disclosure: Klondex Mines is an advertising client of the Investing News Network. This article is not paid-for content.

“This acquisition is transformational for Klondex, during a pivotal point in our company’s development,” Klondex President and CEO Paul Huet said in a statement, adding:

“I am confident that Klondex’s management team can leverage past experience, with some of the core leadership team having previously worked at Midas, to vastly benefit from the synergies and to unlock continued value in Klondex for shareholders going forward. Our team is extremely pleased to be working alongside Newmont to bring together two excellent epithermal deposits with a high-quality central mill.”

The $83-million price tag includes $55 million in cash, about $28 million through the replacement of Newmont surety arrangements with Nevada and federal regulatory authorities, along with 5 million common share purchase warrants Klondex will issue to Newmont, the gold major stated.

Newmont acquired the Midas underground mine and mill through its merger with Normandy in 2002.

According to Proactive Investors, the deal is expected to boost Klondex’s long-term cash flow and margins by adding a producing property to its portfolio. “Substantial synergies” are expected through shared equipment, employees and improved efficiencies.

In October, the company completed the excavation of a secondary egress allowing it to commence a bulk sampling program; and around the same time mobilized a second drill rig for following up on previously explored targets and to initiate a three-phase program in the West Zone.

Klondex is expected to deliver a preliminary economic assessment on Fire Creek in the first quarter of 2014.

Securities Disclosure: I, Andrew Topf, hold no investment interest in any of the companies mentioned.

Editorial Disclosure: Klondex Mines is an advertising client of the Investing News Network. This article is not paid-for content.