Noble Announces Completion of Crawford Nickel Project Property Transfer and Increase in Canada Nickel Private Placement to $6.5 million

Noble Mineral Exploration Inc. is pleased to announce the completion of the transfer of the Crawford Nickel-Sulphide property to Canada Nickel Company.

Noble Mineral Exploration Inc. (TSXV:NOB, OTC:NLPXF) (“Noble” or the “Company”) is pleased to announce the completion of the transfer of the Crawford Nickel-Sulphide property (“Crawford” or the “Project”) to Canada Nickel Company Inc. (“Canada Nickel”). The transfer was completed pursuant to an implementation agreement dated as of November 14, 2019 (the “Implementation Agreement”) that was previously announced by Noble in its news release of November 28, 2019. In consideration of that transfer, Noble is being issued 12 million shares of Canada Nickel and $2 million in cash.

“I am very pleased to have completed these important steps in the planned consolidation of the Crawford property into Canada Nickel, and in the reduction of the royalty applicable to large portions of our Project 81 and advance to the next stage where we seek shareholder and subsequent court approval of the distribution of 10,000,000 Canada Nickel shares to the Noble shareholders”, said H. Vance White, President & CEO of Noble.

Noble has received conditional approval from the TSX Venture Exchange for the transfer of the Crawford property to Canada Nickel, as well as for purchase of the 5% royalty and replacement of that royalty with a 2% royalty.

Concurrently with the completion of the transfer, Noble has made a payment of $950,000 to the holder of the 5% net smelter return royalty that currently applies to the patented properties that are located within Noble’s Project 81. As announced by Noble on October 24, 2019, the Company has entered into an agreement to repurchase that royalty for a payment of $2 million in three instalments. Today’s payment of $950,000 is the second of those payments, and a final payment of $1 million remains to be paid by Noble. As announced by the Company on November 28, 2019, Noble has entered into agreements that would result in the 5% royalty, once purchased by Noble, being terminated and replaced by a 2% royalty payable.

Canada Nickel Update – Financing Increased to $6.5 million and Board appointed

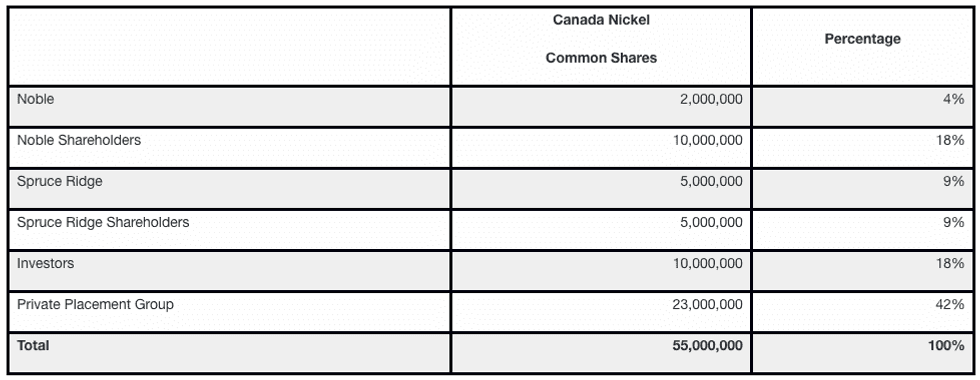

Noble has also been advised by Canada Nickel that it has raised $2.9 million under the non-brokered private placement (the “Private Placement”) described in Noble’s news release dated October 1, 2019. Due to investor demand, the fully subscribed financing has been increased to $6.5 million. Upon completion of the Private Placement and the other transactions described in the Implementation Agreement, Canada Nickel will have 55 million shares outstanding and $4.5 million available to fund ongoing mineral exploration of the Crawford project and related working capital. The following table updates the expected holdings of those 55 million shares of Canada Nickel after the Crawford project consolidation under the Implementation Agreement:

Canada Nickel has also advised that David Smith, John Leddy, Mike Cox, and Russell Starr have been appointed to that company’s Board of Directors, joining Mr. Mark Selby as Chairman.

David Smith, Director, is Senior Vice-President, Finance and Chief Financial Officer of Agnico Eagle Mines Limited, a position he has held since October 24, 2012. Prior to that, he was Senior Vice-President, Strategic Planning and Investor Relations, a position he held since January 1, 2011, prior to that he was Senior Vice-President, Investor Relations and prior to that he was Vice-President, Investor Relations. He started work in investor relations at Agnico Eagle in February 2005. Prior to that, Mr. Smith was a mining analyst for more than five years and held a variety of mining engineering positions, both in Canada and abroad. Mr. Smith is a Chartered Director and an alternate Director of the World Gold Council. Mr. Smith is a director of eCobalt Solutions Inc. (a mining exploration company) traded on the Toronto Stock Exchange. He is a graduate of Queen’s University (B.Sc.) and the University of Arizona (M.Sc.). Mr. Smith is a Professional Engineer.

John Leddy, Director, is Senior Advisor, Legal and Strategic Matters at Royal Nickel Corporation. Mr. Leddy has over 20 years’ experience as a business lawyer and in private equity, specializing in M&A, capital raising & structuring and other strategic transactions. He is a former Partner in the Business Law Group (M&A) at Osler, a leading Canadian corporate law firm. Mr. Leddy is a member of the Law Society of Upper Canada, a director of Salt Lake Mining Pty. Ltd and Orford Mining Corporation, and a member of the Audit Committee of Magneto Investments Limited Partnership.

Mike Cox, Director, has over thirty years of experience in Base Metal operations with Inco Ltd and Vale SA. He has held a number of senior leadership positions in Europe, Canada and Asia. Most recently, Mr. Cox was Head of UK and Asian Refineries at Vale with responsibility for a portfolio of precious metal and nickel refineries. He is now a Managing Partner at CoDa Associates, a consultancy that provides a range of advisory services to the corporate and public sectors in Europe and Asia. Mr. Cox holds a BSc (Hons) in Chemistry and an MBA, both from the University Of Glamorgan.

Russell Starr, Director, is an entrepreneur and financial professional focused on private and public mining/exploration and corporate advisory with over 19 years of corporate finance, investment and business development experience. Mr. Starr held senior positions and advisory roles with financial institutions including RBC Capital Markets, Scotia Capital, Orion Securities, and Blackmont. After leaving Bay Street, Russell held an executive position and board appointment with Cayden Resources, acquired by Agnico Eagle Mines Limited in 2014. As a SVP with Cayden Resources and board member, Mr. Starr was integral in the marketing, financing, development and ultimate sale of Cayden for CAD$205 million to Agnico Eagle Mines. Mr. Starr holds a MBA from the Richard Ivey School of Business, a Master of Arts degree in Economics from the University of Victoria and a Bachelor of Arts degree in Economics from Queens University. Mr. Starr was also a PhD candidate at McGill University in Econometrics.

Contacts (Noble):

H. Vance White, President

Phone: 416-214-2250 Fax: 416-367-1954 Email: info@noblemineralexploration.com

Investor Relations Email: ir@noblemineralexploration.com

Contacts (Canada Nickel Company):

Russell Starr

Phone:647-669-9801

email: RussellStarr@canadanickel.com

About Noble Mineral Exploration Inc.

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company which, in addition to its shareholdings in in Spruce Ridge Resources Ltd. and MacDonald Mines Exploration Ltd., and its interest in the Holdsworth gold exploration property in the area of Wawa, Ontario, holds in excess of 79,000 hectares of mineral rights in the Timmins-Cochrane areas of Northern Ontario known as Project 81. Project 81 hosts diversified drill-ready gold, nickel-cobalt and base metal exploration targets at various stages of exploration. More detailed information is available on the website at www.noblemineralexploration.com.

Noble’s common shares trade on the TSX Venture Exchange under the symbol “NOB”.

Forward-Looking Information

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain information that may constitute “forward-looking information” under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, timing for completion of the proposed transaction, the amount and uses of proceeds, strategic plans, including future exploration and development results, and corporate and technical objectives. Forward-looking information is necessarily based upon a number of assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information, including the risks inherent to the mining industry, adverse economic and market developments and the risks identified in Noble’s publicly available documents filed under SEDAR. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this press release is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. Noble disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES

Source