Nexus Gold Contracts Driller for McKenzie Gold Project, Red Lake, Ontario

Nexus Gold Corp. has engaged Chibougamau Diamond Drilling Ltd to conduct its upcoming diamond drilling program at the McKenzie Gold Project.

Nexus Gold Corp. (“Nexus” or the “Company”) (TSXV:NXS) (OTC:NXXGF) (FSE:N6E) is pleased to report that after a thorough review of potential candidates it has engaged Chibougamau Diamond Drilling Ltd to conduct its upcoming diamond drilling program at the Company’s 100%-owned McKenzie Gold Project, located in Red Lake, Ontario.

As reported in a Company news release dated April 22, 2020, Nexus recently received, through the Ontario Ministry of Energy, Northern Development and Mines, an exploration drill permit for its proposed phase one drill campaign at the McKenzie Gold Project.

The phase one drill program will be managed by the Company’s onsite contractor, Rimini Exploration, and will consist of a minimum of 1000 meters of diamond drilling to test the mineralization potential of several gold targets occurring within a corridor along the southern contact of the Dome Stock with felsic Volcanics of the Balmer Assemblage.

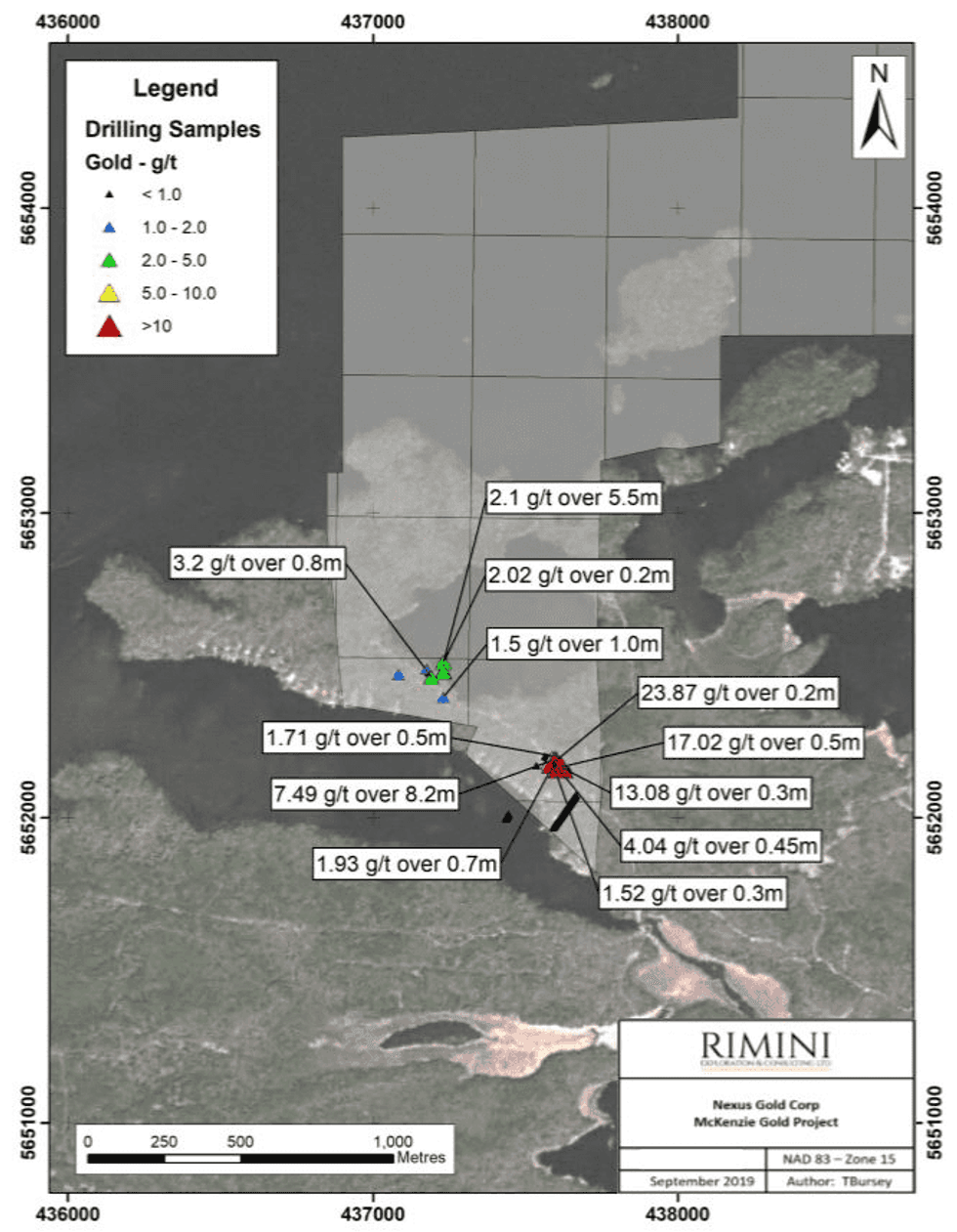

Historic drilling conducted in 2005 along this corridor returned significant values, including 7.49 grams-per-tonne (“g/t”) gold (“Au”) over 8.2 meters, 15.54 g/t Au over .8 meter (includes 23.4 g/t over 0.3 meter), 4.47 g/t gold over 1.4 meters, 17.02 g/t Au over .5 meter, 23.87 g/t Au over .2 meter, and 2.1 g/t Au over 5.5 meters* (see figure 2).

The initial drill program at McKenzie is designed to follow up on anomalous rock samples that were collected as part of the 2019 fall prospecting program completed in the St. Paul’s Bay area of the property. The prospecting program traced the mineralized contact corridor to the property’s eastern boundary to further determine areas of interest on the property’s southern end. The focus of the prospecting was concentrated in and around Perch Lake, in the Saint Paul’s Bay area, located in the southernmost section of the 1,348.5-hectare property.

This initial drill program is expandable, and the Company is currently reviewing additional targets to test if the decision is made in the near term to expand phase one meterage.

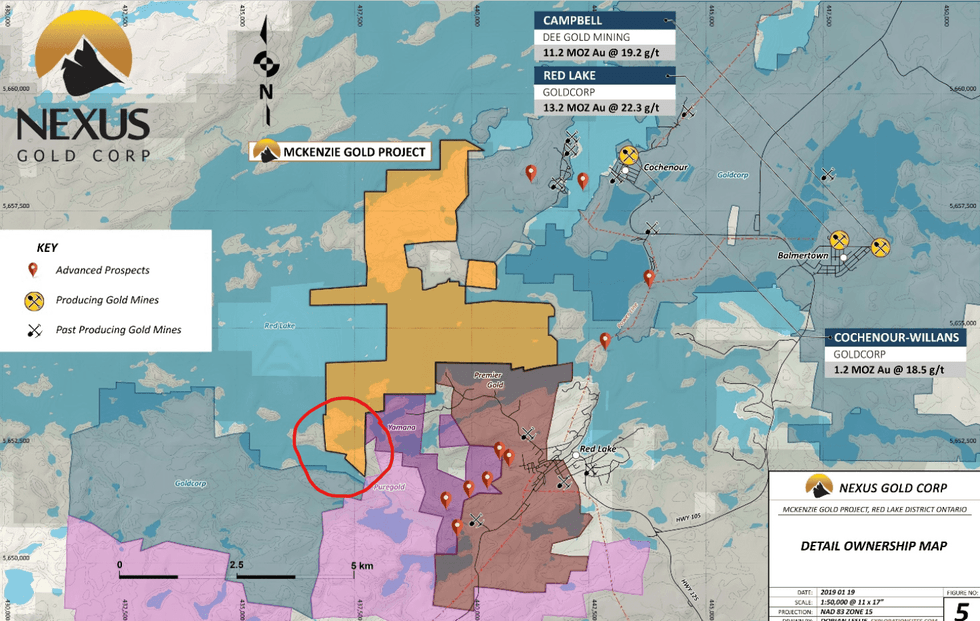

Figure 1: McKenzie Gold Project, Red Lake, Ontario, with area for upcoming drill program circled in red

Drill targeting is underway in consultation between Company geologist Warren Robb and representatives of Rimini Exploration. Updates regarding the location of phase one targets, crew and equipment mobilization, and drilling commencement, will be issued in the coming weeks.

Figure 2: Historic drill results in the southern section of the McKenzie Gold Project, Red Lake, Ontario

The southern portion of the McKenzie Gold Project is bordered by Premier Gold Mines Ltd Hasaga property and Pure Gold Mining’s Madsen Gold property.

* Note the reported lengths are intercepts and are not true widths

Warren Robb P.Geo., Vice President, Exploration, is the designated Qualified Person as defined by National Instrument 43-101 and is responsible for the technical information contained in this release.

Compilation Summary – McKenzie Gold Project

As reported in a Company news release dated October 11, 2019, Nexus received a compilation summary of important historic data from project geological consultants, Rimini Exploration. The compilation integrated the regional geological and regional geophysical data, thus allowing the Company’s geological staff to compare these trends to the information obtained through ground exploration conducted to date on the property. The more comprehensive data from the summary, coupled with the new data from the phase two prospecting program, was utilized in determining suitable areas to drill test.

The Rimini compilation summary produced historical data the Company was previously unaware of regarding multiple historical grab samples taken on the McKenzie claim block. The Company had previously disclosed several high-grade historical grab sample results on the property, including 331.14 g/t Au, 212.8 g/t Au, 313 g/t Au, 18.02 g/t Au and 9.37 g/t Au. In the summer of 2019 Nexus conducted it’s first ground reconnaissance program at McKenzie and results returned notable sample assays, including 135.4 g/t Au and 9.3 g/t Au (see Company news release dated June 25, 2019).

Additional high-grade historical grab samples previously unknown to the Company and revealed in the Rimini summary include several high-grade assays, including 142.49 g/t Au, 115.2 g/t Au, 114.57 g/t Au, 93.71 g/t Au, 68.03 g/t Au, 53.01 g/t Au, and 16.65 g/t Au from areas located on McKenzie Island (north block).

The data compilation summary also indicated that little to no exploration has been conducted over the actual lake portion of the claim block. The Company has noted from the regional data that a number of northerly trending geophysical trends extend within the lake itself and is viewing these trends as potential faults or breaks within the Dome Stock.

Preliminary review of lake sediment sampling conducted on the property in 1989 indicates coincidental anomalous gold geochemical values occurring. Historical values obtained from the analysis of +150 mesh screened lake sediment samples returned values of 0.159 ounce-per-ton (5.45 g/t) Au, 0.154 ounce per ton (5.28 g/t) Au, and 0.116 once per ton (3.98 g/t) Au. The Company now intends to conduct more exploration activity within the lake-bound portion of the project area to determine the prospectivity of a large underexplored section of the property.

Debt Settlement and Consulting

The Company announces that it has reached an agreement with an arms’-length creditor to settle outstanding indebtedness of $15,750 related to services previously provided to the Company. The Company intends to settle the indebtedness through the issuance of 315,000 common shares, at a deemed price of $0.05 per share.

The Company also announces that it has engaged MTHM Consulting Ltd., an arms-length third-party, to assist the Company with the identification and analysis of acquisition and development opportunities in the natural resources sector, and to advise on the marketing and positioning of the Company within that sector. The engagement is for an initial term of twelve months, through until April 2021. In consideration for the services provided, the Company has agreed to pay $50,000, which will be satisfied through the issuance of 1,000,000 common shares, at a deemed price of $0.05 per share. The shares will be issuable in four equal tranches of 250,000 shares each quarter, during the term of the engagement, as services are provided to the Company.

All shares issued in connection with the settlement and the service arrangement will be subject to a four-month-and-one-day statutory hold period in accordance with applicable securities laws. Completion of the settlement, and the issuance of shares under the service arrangement, remains subject to the approval of the TSX Venture Exchange.

About the Company

Nexus Gold is a Canadian-based gold development company with an extensive portfolio of eleven exploration projects in Canada and West Africa. The Company’s West African-based portfolio totals five projects encompassing over 750-sq kms of land located on active gold belts and proven mineralized trends, while it’s 100%-owned Canadian projects include the McKenzie Gold Project in Red Lake, Ontario, the New Pilot Project, located in British Columbia’s historic Bridge River Mining Camp, and four prospective gold and gold-copper projects (3,700-ha) in the Province of Newfoundland. The Company is focusing on the development of several core assets while seeking joint-venture, earn-in, and strategic partnerships for other projects in its growing portfolio.

For more information please visit nexus.gold.

On behalf of the Board of Directors of

NEXUS GOLD CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Click here to connect with Nexus Gold (TSXV:NXS, OTC:NXXGF, FSE:N6E) for an Investor Presentation.