Mining Investor Guide: The Alamos-AuRico Merger, Part 3

Cipher Research breaks down the proposed merger between Alamos Gold and AuRico Gold. In this third and final part of the series, the firm analyzes what the merged entity is likely to look like.

Keeping a finger on the industry pulse, looking for growth opportunities, Cipher Research applies its GEONOMICS analyses on the potential merger between Alamos Gold Inc. and AuRico Gold Inc. announced on April 13. The two Canadian mid-sized gold companies will be merging in a $1.5-billion (U.S.) friendly deal. Shareholders of Alamos Gold Inc. and AuRico Gold Inc. would each own half of the new company.

The following is a brief overview of Cipher’s analysis in a three part series.

- Part 1: Alamos Gold Company Analysis

- Part 2: AuRico Gold Company Analysis

- Part 3: Merged Entity Analysis

PART 3: MERGED ENTITY ANALYSIS

Merged Entity Overview

- Project

- Quality of Operations – LOW

- The majority of Operations have been poor for the last 3 years but with OPEX and IMP accounting for well over 100% of Revenues. The fact that Mulatos operations have dropped to negative cash flows from highly positive is a concern and even it it returns to positive territory it will not along be enough to make up for the other operations. Expectations are for production to increase and for IMP to drop but without a much higher gold price these operations will not provide positive Adjusted Free Cash Flows.

- Quality of Reserves – LOW

- Quality of Resources – LOW

- The Merged Entity will have a total R&R of over 19.7 million oz Au but other than the 4.8 million oz producing resources in Mexico and the 1.2 million oz resource at Lynn Lake, and the fact that 6.4 million oz R&R are producing the remaining 7.4 million oz have little or no value at current gold prices

- Quality of Operations – LOW

- Capital

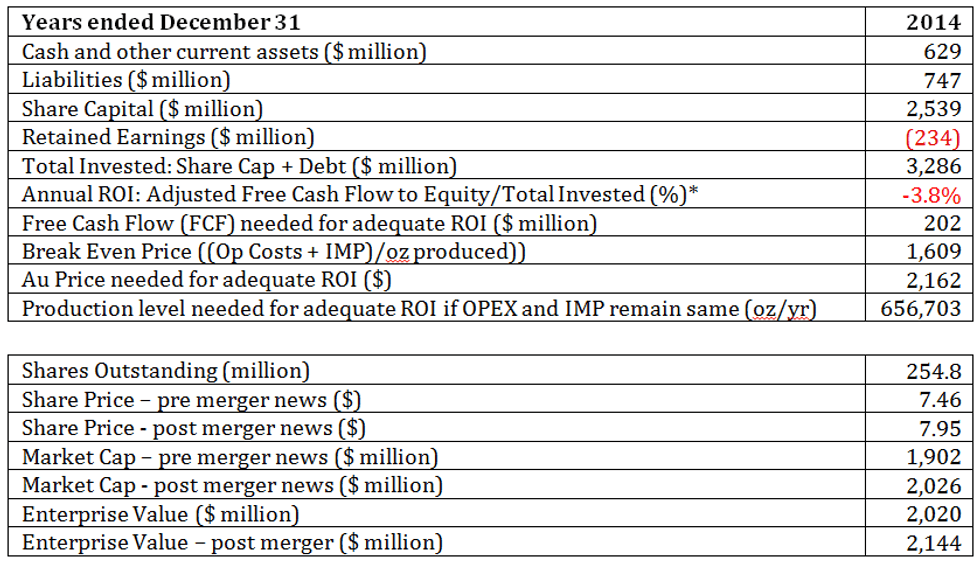

- Quality of Financials – LOW-MODERATE

- The company has $425 million in cash ($625 Mi in current assets) and $750 million in total debts and has a -3.8% annual ROI based on 2014 numbers. Significantly higher gold prices and/or lower average costs are needed before a positive return is generated

- Quality of Structure – LOW-MODERATE

- The Company has total share capital of $2.54 billion issued through conventional equity offerings, exercise of stock options and for acquisitions. Investors will have provided a large amount of capital and will have not see a positive return on it until gold prices rise considerably

- Quality of Liquidity & Valuation – LOW

- The liquidity ranks very high with an annual 1.0 turnover ratio

- The Market Cap and EV have will be high relative to the quality of the assets

- Quality of Financials – LOW-MODERATE

- People

- Quality of Management – MODERATE

- Well qualified management team committed to a sound growth strategy of merger and acquisitions

- Quality of Management – MODERATE

In our opinion both companies are pursuing a sound growth strategy however Alamos Gold seems to be selling itself short with the proposed 50%-50% structure. Unless there is more to the story, we do not consider the companies to be equals.

Merged Entity Detailed Analysis

The planned merger will result in creation of two new companies: the first one will be the Merged Entity and the second will be a royalty company that will collect royalties form 3 mines and will have the Kemess Gold-Copper project in British Columbia Canada. The royalty company will generate approximately $6 million in revenues in the first year based on current levels of production at he mines, in addition to the $20 million in cash they will receive following the merger. This should allow the company to go to market and raise money in order to purchase additional royalties. The royalty payments will allow the company to sustain itself however any growth or return to shareholders would depend on management’s abilities to identify additional quality target that are willing to sell royalties and to raise additional funds on the market.

The proposed royalty company has potential however given the relatively small initial value to shareholders we will limit our analysis to the valuation of the Merged Entity.

In our opinion the Merged Entity has several challenges to overcome before it will become a quality mining company.

Following a brief company introduction our analysis is divided as follows, applying a 5-point grading scale:

- Project

- Quality of Operations

- Quality of Reserves

- Quality of Resources

- Capital

- Quality of Financials

- Quality of Structure

- Quality of Liquidity & Valuation

- People

- Quality of Management

Merged Entity will be an intermediate gold mining and exploration company with production form three mines, two in Sonora, Mexico and one in Ontario Canada.

In addition Merged Entity will have several development stage projects: Esperanza Gold Project, Morelos State Mexico, Kirazli, Agi Dagi & Camyurt Project, Canakkale Province Turkey, Quatz Mountain Gold Project, Oregon, USA and the Lynn Lake gold projects, Manitoba, Canada.

PROJECT

Quality of Operations

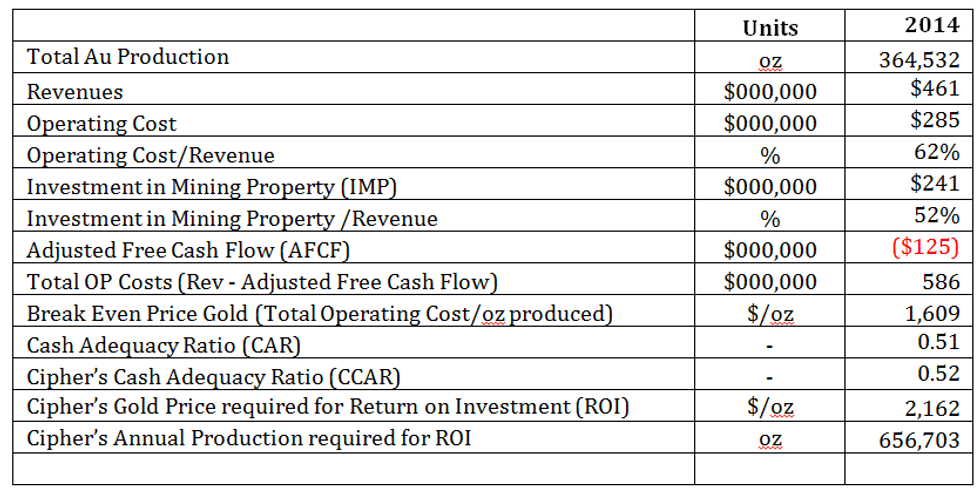

Cipher’s unique analysis of key operating parameters on a pro forma basis of the Merged Entity for 2014 is summarized in the following table:

Production Levels and Revenues

Management reports that combined production is expected to reach 375,000-425,000 ounces in 2015; however costs will also rise. On the positive side the combined Investment in Mining Properties will decrease by at least $50 million in 2015 but will likely only be a temporary reprieve as the underground operations will require significant investment over the years to maintain production levels.

Average Grade and Operating Costs

With combined Operating Costs of over 62% of revenues for 2014, there is concern that the combined operations will not be sustainable over the long term. Even if production reaches the target, it is unlikely that the percentage of operating costs to revenues will change much in 2015. In order to see an appreciable change the price of gold will need to rise considerably.

Investments in Mining Properties

IMP is expected to decline somewhat as the Young-Davidson mine gets closer to full-scale production. In order to have an impact on profitability IMP will need to fall considerably lower than the current level of over 50% of combined revenues. With OPEX and IMP totaling over 110% of revenues It will require significant reduction in costs and higher gold prices before the operations are profitable.

Adjusted Free Cash Flow (AFCF)

AFCF is cash flows from operations (CFO) adjusted for changes in non-cash working capital less Investment in Mining Property (IMP). Cipher uses this number as its measure of the real profitability of the operations. As shown this combined number is -125 million in 2014 so there is a long way to go before it will be positive.

Total Operating Cost and Break Even Price of Gold

Total Operating Cost is calculated as Revenues less Adjusted Free Cash Flow (AFCF) and represents the total cost incurred running the mining operations. Calculated this way we are sure to capture all of the costs associated with the operations. When divided by the total ounces produced we derive the break-even price. This is the price of gold, which would sustain operations but not allow for growth or other return on investment. As shown, the Total Operating Costs in 2014 were $586 million resulting in a Break Even price of gold of $1609/oz at which there is still no cash left for growth or other return on investment.

Adequacy Ratios

Cipher calculates 2 Adequacy Ratios, the first one Cash Adequacy Ratio (CAR) is based on actual inflows and outflows for the company and is calculated as Revenues/Total Operating Costs + Dividends paid + Debt Repayments. The CAR for Merged Entity for 2014 would have been very poor at 0.51.

The second is Cipher’s Cash Adequacy Ratio (CCAR) where we measure the ability of the company to offer reasonable returns on investment. In this measure we use total debt plus share capital as the measure of the company’s total investment. We deem 10% on debt and 5% on equity as reasonable returns for those investments and use them in the denominator in place of actual dividends and debt repayments. This is our most comprehensive measure of corporate health. As we see the CCAR for Merged Entity for 2014 would have been 0.52.

Since it is well below 1.0, we must analyze further to see if the risk to Merged Entity.

Based on current production levels, we determine the company requires an average gold price of $2162/oz in order for the CCAR to reach healthy levels of greater than 1.0. Conversely, based on current gold prices and operating costs the company would need to produce 657,000 ounces per year in order for the CCAR to return to greater than 1.0. However it is unlikely that OPEX and IMP would stay the same and still allow for production to reach this level. Therefore the real production level for adequate returns is likely much higher.

It is important to note that management expects production to rise to over 700,000 oz per year through the development of its assets in Turkey and Oregon. While this is possible it should be noted that the average grade of the projects in Turkey and Oregon are low and Cipher feels that profits will be hard to come by at these operations, meaning that the company will struggle to break even below $1600/oz and will need $1800/oz in order to provide adequate ROI.

Based on the most recent years of operations we rate the Quality of Operations as VERY LOW (1.75). Production levels will need to rise considerably with minimal cost increases and/or the gold price will need to rise considerably before this rating will change.

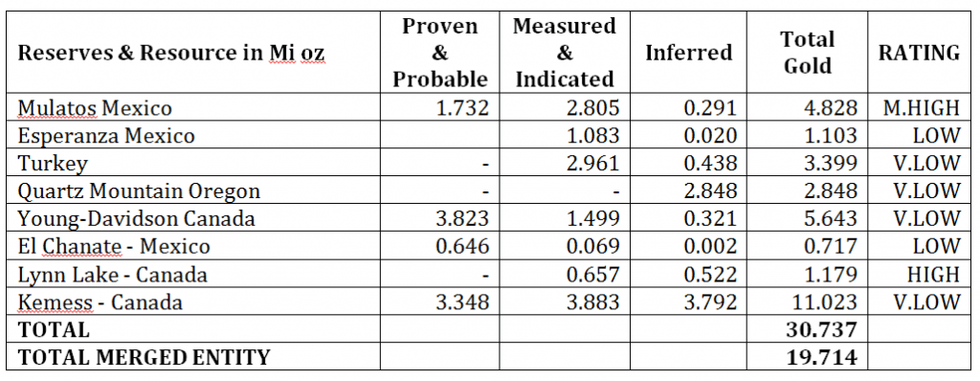

Quality of Reserves and Mineable Resource

Since we detailed the each Reserve and Resource for each of the properties of the respective companies in the separate company analysis e previous parts we will limit our discussion to totals for the Merged Entity:

The only operations that have demonstrated the ability to generate positive cash flows are the Mulatos mine and the El Chanate mine in Mexico and decreasing grades will likely result in negative cash flows for the next couple of years. The underground mine in Ontario is close to full-scale production but at current gold prices will continue to operate in the red until there is a significant movement upward in the price of gold.

Overall the Resources would be graded as LOW (1.8), with the Producing Canadian Resources VERY LOW (1.0), the Producing Mexican Resources HIGH (4.0), the remaining Resources VERY LOW (1.0), the Lynn Lake Resources grading MODERATE-HIGH (4.0)

CAPITAL

Quality of Financials

The Merged Entity will have $425 million in cash ($625 million in current assets) and over $750 million in total liabilities and is expected to have negative Adjusted Free Cash Flow, at least for the next few years. The liabilities can be managed and the loans are not due for several years so the company combined company will be in a position to manage its financial position until gold prices rise or production is increased with lower unit costs.

The operations would not be able to sustain all of its costs and this company will continue to struggle unless the gold price rises to over $1600 per ounce.

The Merged Entity would have invested a combined total of $3.2 billion to date acquiring and developing its assets and yet would provide negative net returns on that investment and until either: gold rises considerably; production increases significantly; costs are cut dramatically or a combination of the three.

The Quality of Financials is LOW-MODERATE and gets a grade of 2.0

Quality of Structure

The Merged Entity will have share capital totaling $2.54 billion and 255 million shares issued.

Management of both companies have exercised stock options each year since 2006 and as a result has been well compensated with increases in share price. This practice is likely to continue for the Merged Entity

The companies’ practice of granting stock options to directors, management and other key persons has helped ensure that management has incentive to perform well and have that reflected in share price.

The public has financed these companies via the exercise and sale of stock options at levels above what would have been deemed fair value by Cipher but they were able to as a result of the market exuberance.

The Quality of Structure is LOW-MODERATE and grades 2.5

Quality of Liquidity & Valuation

Both companies have had relatively high levels of liquidity since 2006 and it is expected to continue or possibly improve for the Merged Entity, as it will be larger than either of the original companies; each company had an annual share turnover of over 1.0 for the last 8 years and recent turnovers of over 0.75 which is very good.

The annual average market capitalization for each company peaked in 2011 at over $3.3 billion and averaged nearly $1.5 billion from 2006 – 2012. Since 2012 the average annual market capitalization has averaged closer to $1 billion. The “expected market capitalization of the Merged Entity is expected to be approximately $2 billion. The average Adjusted Free Cash Flow (AFCF) of the Merged Entity would have been ($125) million for 2014, and until this can be addressed the Valuation may be too high.

The Quality of Liquidity is HIGH and grades 4.0, and Quality of Valuation is LOW and grades 1.5

PEOPLE

Quality of Management

Directors, Officers and Management all have good credentials, both groups have executed built a company with producing mines and a significant combined Reserve and Resource Base (30.5 million (19.7 million when Kemess is transferred) ounce Au equivalent). The quality of the combined operation and resources is not of very high quality but management maybe felt that gold prices would continue to maintain the $1800 level reached in 2011.

Since 2006 stock options have been exercised at prices well below the average trading price giving management the opportunity to profit significantly from the increase in share prices along with shareholders.

Based on insiders report on Sedi, management owns a very low percentage of equity, which could indicate misalignment with shareholders interest.

Salaries and benefits to related parties and the overall administrative costs totaled less then 10% of revenues over the last 2 years and are on the high side of acceptable but within reason. Management uses stock options to ensure key people can be rewarded with rising share prices and has done this very well in the past.

Management appears intent on building a larger mining company, which will be in the best interest of all investors provided it can improve the efficiency of current operations.

The Quality of Management is MODERATE and grades 2.5

CIPHER VALUE

The market value of a mining company roughly follows the market value of its reserves and resources which based on Cipher’s research is currently ranging between $150-$ 350 per oz of gold in the ground. The value of an exploration and development company with a non-producing reserve or resource has been examined by Cipher as well and the results show that 80% are worth $90/oz or less. Companies with quality operations (particularly with long history of it) are valued higher on the range; if the quality of operations is not as good the company is discounted accordingly.

In the case of both Alamos and AuRico, due to the low quality of production for 2014, we value the producing reserves and resources (11.2 Mi oz) on the lower end of the range – at $150 with caution. We will adjust that value as the production levels are shown to grow or as gold price rises towards the $1600 level.

At $150/oz for the producing reserves and resources of 11.2 we derive a cautious Value of $1,680 million. Our valuation would be adjusted down unless we see a significant improvement in operations. Cipher will monitor the company closely.

The Lynn Lake Resources (1.1 million ounces) rank high and are valued at $90/oz or $100 million.

The remaining 7.4 million ounces in resources attributable to Turkey and Oregon were rated very low and Cipher assigns very little value to them. For this purpose we will value them at cost or $90 million.

We currently value the Merged Entity as follows:

- $1680 million Value of producing reserves and resource, plus

- $100 million paid for the Lynn Lake resource, plus

- $90 million for remaining resources

- -$100 million (cash – debt)

Resulting in total Value of $1,770 million or $6.95 per share.

With a current combined market capitalization of just over $2,000 million, Cipher considers the Merged Entity a cautious hold.

Note: Since this report the share price has risen from $3.78 on the day of the announced merger to $4.31 as of the close on 28 Apr 2015.

Columnist Rod Husband is a partner at Cipher Research. Cipher Research is an independent research and analysis company that covers the mining and metals sector of the commodity markets. For more information on this topic or on Cipher Research please visit: https://www.cipherresearch.com or contact info@cipherresearch.com.