The Core Shack Dozen: Kaminak Switches Focus to Develop Oxide Resource at Coffee

Wayne Hewgill, a geologist, discusses Kaminak Gold’s Coffee project.

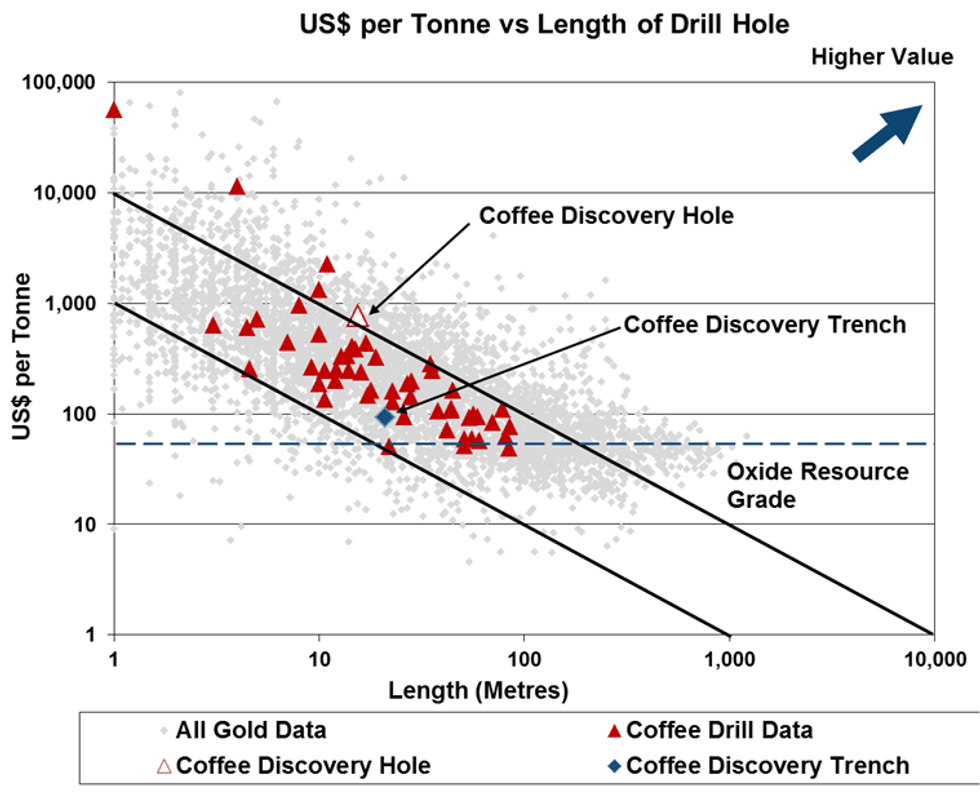

The “Drill Tracker” highlights early stage drilling and trenching results, giving a metric to evaluate exploration results and compare them against their peer group. In this report we highlight a dozen exploration companies displaying their projects in the Core Shack at the AME BC Roundup held in Vancouver between January 26 and 29, 2014.

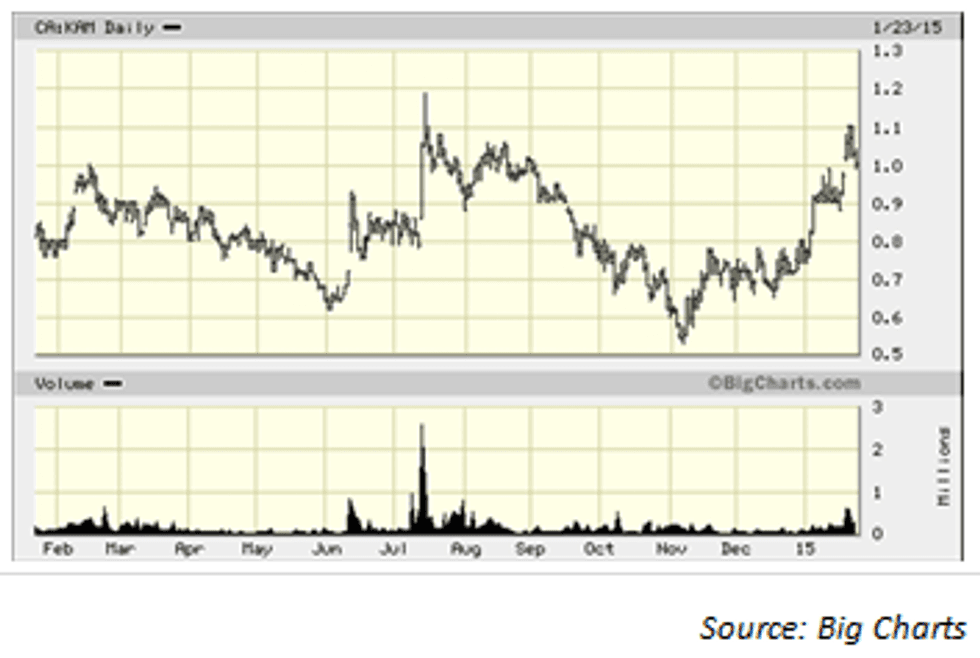

Kaminak Gold (TSXV:KAM)

Price: $1

Market cap: $126 million

Cash estimate: $15.7 million

Project: Coffee

Country: Yukon, Canada

Ownership: 100 percent

- In May 2010, Kaminak Gold announced the discovery of gold at its 100-percent-owned Coffee project in the Yukon after releasing impressive trenching results at the end of the field season in 2009. We have included the advanced-stage Coffee project due to the change in focus to developing the relatively deep oxide resources.

- Highlights from the oxide zone include:

- Discovery trench: 21 meters at 2.3 g/t gold

- Discovery hole: 15.5 meters at 17.07 g/t gold

- 5 meters at 37.6 g/t gold

- 6.1 meters at 32.8 g/t gold

- While the project has a total resource of approximately 4 million ounces, including 2.5 million ounces in oxide, the recent PEA focuses on the oxide portion of the project, which is expected to produce an average of 167,000 ounces of gold for 11 years at an all-in sustaining cost of US$688 per ounce. The PEA projects a post-tax payback of two years with a $330-million NPV (5 percent) and 26.2-percent IRR.

- Metallurgical testwork to date on the Supremo/Latte oxide material indicates between 90 and 95 percent recoveries in a 40-day, 0.5-inch column leach test. The testwork demonstrates an initial high recovery rate of up to 92 percent over the first 15 days. A 6-inch crush returned 85-percent recovery over 152 days. The average life-of-mine recovery is expected to be approximately 88 percent. The company is moving straight to a full feasibility study, which is expected to be completed in Q4 2015.

Project status: Feasibility

Resource (oxide heap leach): Material in mine plan sits at 53.4 million tonnes at 1.23 g/t gold (diluted grade)

Catalysts: Feasibility study Q4 2015

Watch Eira Thomas, Kaminak’s president, CEO and director, discuss Coffee and the company’s plans for 2015 at Cambridge House International’s recent Vancouver Resource Investment Conference.

Disclosure: I, Wayne Hewgill, certify that the information in this report is sourced through public documents that are believed to be reliable, but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report.

At the date of this release the author, Wayne Hewgill, owns shares in the following companies:

This report makes not recommendations to buy sell or hold.

Wayne Hewgill is a geologist with extensive knowledge of the global mining industry gained through 30 years of diversified experience in mineral exploration and new business development in Canada, as well as 10 years living in Africa, New Zealand and Australia. He was previously senior research officer at BHP Billiton, an executive with an exploration company working in Argentina and a mining analyst at three Vancouver-based financial groups where he developed the Drill Tracker database in 2006. He holds a B.Sc. in Geology from the University of British Columbia and is registered as a Professional Geoscientist (P.Geo) with APEGBC.