"Integra 2.0" Completes Resource Estimate for New Gold-Silver Project

Integra Resources, run by many of the people behind recently acquired Integra Gold, has released a resource estimate for its DeLamar project.

Integra Resources (CSE:ITR) announced late Tuesday (October 10) that it has completed an initial resource estimate for the DeLamar gold-silver project.

Nicknamed “Integra 2.0,” the company is led by many of the same people behind Integra Gold, a Quebec-focused explorer acquired earlier this year by Eldorado Gold (TSX:ELD,NYSE:EGO).

The team reunited as Integra Resources over the summer, and last month announced plans to purchase DeLamar from a subsidiary of Kinross Gold (TSX:K,NYSE:KGC). Using 1,550 historical holes drilled to an average depth of 120 meters, the company was able to quickly define an inferred resource for the project.

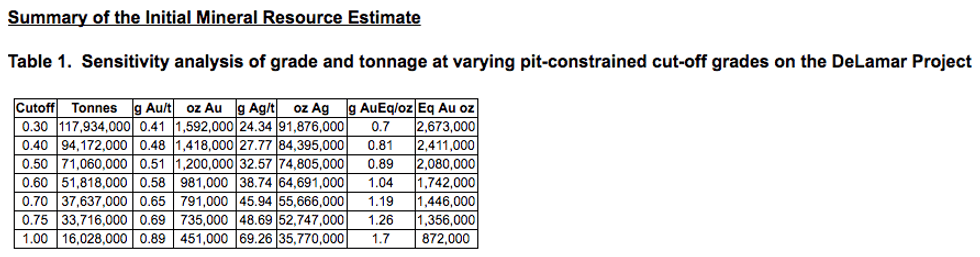

At a cutoff of 0.3 g/t gold equivalent, Idaho-based DeLamar has an inferred resource of 117,934,000 tonnes grading 0.41 g/t gold and 24.34 silver for a total of 1,592,000 ounces of gold and 91,876,000 ounces of silver. That works out to 2,673,000 gold equivalent ounces averaging 0.7 g/t gold equivalent.

The table below shows a variety of other cutoff grade scenarios:

Table via Integra Resources.

The company believes DeLamar “exhibits significant exploration upside,” and notes that it remains open at depth with limited historical deep drilling below 250 meters.

“With the maiden resource results in hand, we are excited by both this significant initial inferred resource estimate on the property, and the scenario that has been laid out for current and future shareholders,” said George Salamis, president and CEO of Integra Resources.

He added, “[i]t is one that highlights significant potential for further near surface bulk tonnage low-grade resources as well as the series of high grade veins inferred from historic drill intercepts at deeper levels, to occur beneath the lower grade open-pit resource defined by MDA.”

The company has agreed to pay C$7.5 million for the project, and will issue Kinross 9.9 percent of its issued and outstanding shares once the transaction closes; Kinross will also retain a variable net smelter royalty on the project.

DeLamar is located in the greater DeLamar-Florida Mountain district, which Integra Resources believes “hosts one of the largest gold-silver low sulphidation epithermal systems in the Western US.” In order to build out its position in the area, it has also signed binding letters of intent with two private entities regarding the acquisition of past-producing patented claims that border DeLamar to the east.

Integra Resources’ acquisition of DeLamar is conditional on the closure of a C$25-million private placement of subscription receipts announced on Tuesday. The company hopes to close it by the end of the month, and will begin exploration work at DeLamar once all the pieces fall into place. A 20,000-meter drill program is tentatively scheduled to start in the first quarter of 2018, along with other work.

“One of the things we did really well [at Integra Gold] was just focusing on drilling, just drilling a lot of meters and constantly keeping rigs active,” Salamis said over the summer. “I think that’s a key ingredient in our success, [and] that’s certainly what we’re going to focus on at our next asset.”

At close of day Wednesday (October 11), Integra Resources’ share price was sitting at C$1 on the CSE.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.