A Sinking Boat Without A Life Raft In A Sea Of Sharks-Can You Survive?

Darren V Long is senior analyst with Guildhall Wealth Management discusses the global economy, debt and what investors can expect from precious metals.

A Sinking Boat Without A Life RaftIn A Sea Of Sharks-Can You Survive?

By Darren V. Long Guildhallwealth.com

September 23, 2014

If you have not already figured it out, witnessed it for yourself, read about it, or otherwise experienced it firsthand, the developed world is swimming in debt in a proverbial sea of sharks without a life raft anywhere to be found. If we have learned nothing about ourselves since 2008 we should now at bare minimum know this. There are really only two viable options or outcomes to the furtive policies of our lovely central bankers and governments of the developed world.

One option is a global economic melancholy while the other remains very high inflation. It is our contention at Guildhall that the policymakers have preselected door number two and that over the following years we will experience the anguish of severe inflation.

The basic premise for this argument is a simple one. The US government, “arguably” still the largest economy in the world, is staring at total obligations of US$115 trillion with a debt-to-GDP ratio which is off the charts, at last check over 101%.

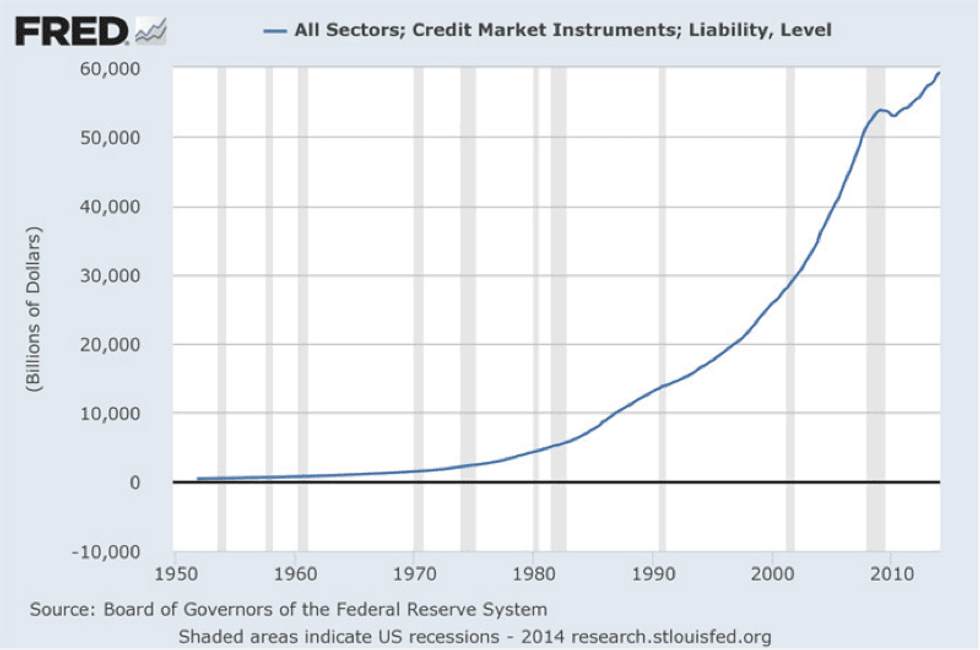

The American public is also swimming in debt. Total US debt at the end of the first quarter of 2014, on March 31st totaled almost $59.4 trillion – up nearly $500 billion from the end of the fourth quarter of 2013, according to the data. By comparison, total debt (the combination of government, business, mortgage, and consumer debt) was merely $2.2 trillion 40 years ago.

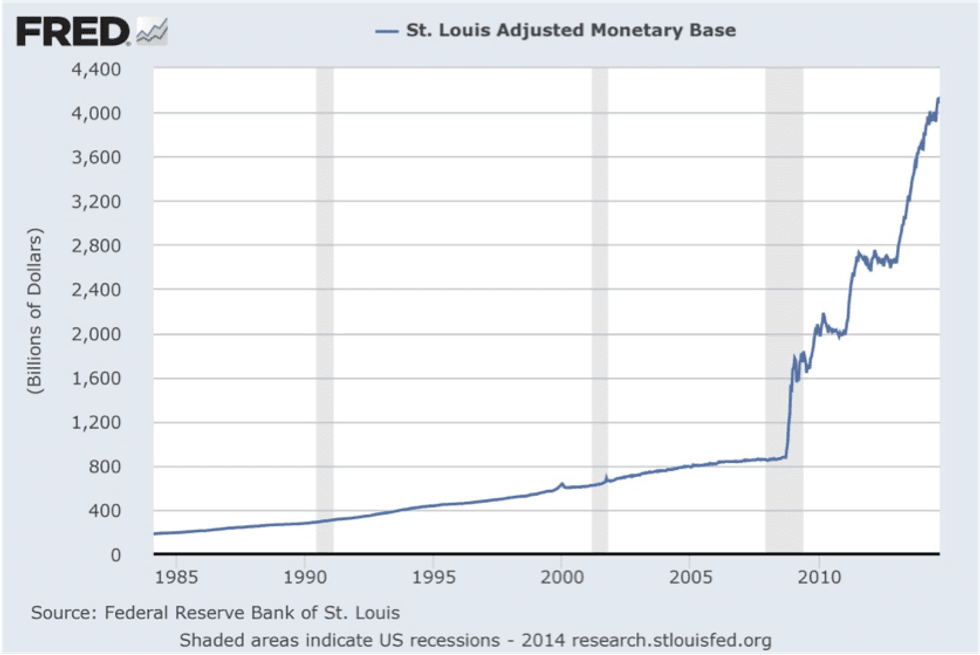

Under this scenario, it is arguable that the US will try to reduce this debt through the usage of a sustained increase in the money supply, more commonly referred to as “monetary inflation”. If you have any reservation whatsoever, take a look at the chart below, which captures the incredible expansion in the US monetary base.

As you can see, over the past six years, the monetary base in the US has expanded from approximately US $848 billion, in January of 2008, to a bewildering US $4.1 trillion! And, believe it or not (By the way I am certain this sideshow will be posted in a Ripley’s museum at some point in the future), until now, this surge in the monetary base has not produced a highly visible inflationary impact…yet that is.

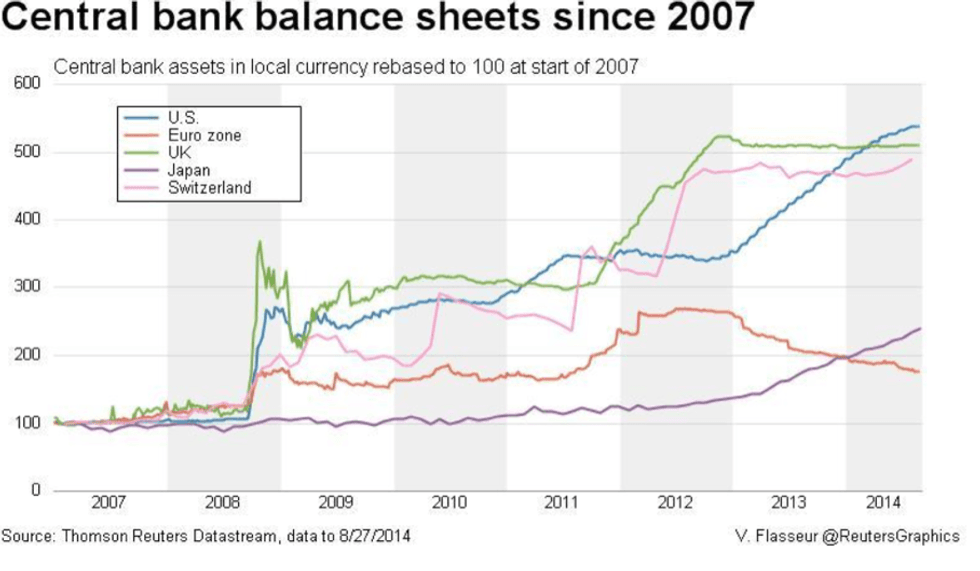

It is also noteworthy that the US is not alone in pursuing inflationary policies. All over the world developed nations are printing money and debasing their currencies. In this era of globalization no country wants a stout currency and as a result many of these very countries are betrothed in competitive currency devaluations as we speak. This massive money and debt creation will cause an inflationary explosion over the coming years at some point.

In fact, those who believe fallaciously that deflation is more likely should consider the chart below, which highlights the mind-boggling expansion in the balance sheets of various central banks.

As you can see, there are several nations participating in this economic calamity of sorts by printing copious amounts of money; many of which have been in the same race since 2008.

Despite this clarity many prominent commentators remain steadfast on calling for deflation. “After all,” they argue, “how can inflation be a problem when bond yields are so low?” Well, these deflationists seem to be missing the point because the US Treasury market is no longer an entirely free market and hasn’t been, along arguably with many other markets like silver and gold, since 2008 and perhaps much before that.

The Federal Reserve’s intervention, in the form of good ole’ dirty and excessive money printing, is largely accountable for keeping bond yields artificially low while at the same time leaving the impression that the stock market and, for that matter ,many other markets are witnessing substantiated rebounds.

However, over the past several years the Federal Reserve itself has purchased most of the net new issuance of Treasuries. This is a desperate act which the central bank in the US uses in order to keep interest rates low. However, it is buying these Treasuries by creating currency (paper money) out of thin air. This is inflationary (either now or long term) and those that do not accept this premise are, with all due respect, daft.

If our assessment is correct then somewhere in the near future the Federal Reserve will lose its battle and T-bond yields will soar. As more and more bond investors wake up to this impending inflationary hazard, they will start demanding a higher rate of return on their money. When that happens the dyke will burst and the Federal Reserve will become superfluous.

Inflation would certainly make US debt more manageable but it would also water down the purchasing power of the US dollar even more so then is happening already. Of course, this inflationary agenda is not a secret and this is why many creditor nations with huge reserves are beginning to diversify away from the US dollar and into assets such as gold and silver; it should come as no surprise that the largest holder of US debt is also now arguably the about to become largest holder of physical gold in the history. Unless of course you still believe that Fort Knox holds the gold they claim to have been keeping for decades.

In the past when chapters of inflationary stories have been written the ending has always been the same; a spiraling out of control for a period of time and a momentous growth in the value of hard assets. This trend is expected to continue. Furthermore, on a comparative basis, we expect precious metals and commodities to outperform all other asset classes.

Yours to the penny,

Darren V. Long

Guildhall Wealth Management Inc.

Darren V. Long is Senior Analyst with Guildhall Wealth Management Inc. Darren is a speaker, writer and financial commentator on gold, silver and the economy. He can be heard weekly on “The Real Money Show” on 640 am radio in Toronto discussing all facets of the precious metals markets. Listen to replays of all shows on www.therealmoneyshow.com 1.866.274.9570 www.guildhallwealth.com now with an eStore and www.guildhalldepository.com or email at: investing@guildhallwealth.com