Granada Gold Mine Inc. (TSXV:GGM) (the “Company” or “Granada”) is pleased to announce that the Company has closed the first tranche of its non-brokered private placement financing raising gross proceeds of $818,000.

Granada Gold Mine Inc. (TSXV:GGM) (the “Company” or “Granada”) is pleased to announce that the Company has closed the first tranche of its non-brokered private placement financing raising gross proceeds of $818,000.

A total of 8,180,000 units were issued at $0.10 per unit. Each unit consists of one common share in the capital of the Company and one share purchase warrant. Each warrant entitles the holder to purchase one share of the Company for a period of two years from closing at an exercise price of $0.12 cents per share.

Certain directors and officers (the “Insiders”) participated in the first tranche closing and purchased an aggregate of 825,000 units for aggregate gross proceeds of $82,500. Participation by Insiders of the Company in the private placement is considered a “related party transaction” pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company is exempt from the requirements to obtain a formal valuation and minority shareholder approval in connection with the Insiders’ participation in the financing in reliance of sections 5.5(a) and 5.7(a) of MI 61-101, respectively, on the basis that participation in the private placement by the Insiders did not exceed 25% of the fair market value of the Company’s market capitalization.

All securities issued are subject to a four-month-and-a-day hold period expiring on September 9, 2020, in accordance with applicable securities laws. The private placement is subject to final Exchange approval.

The proceeds of the private placement will be used for surface exploration, trenching, and historical resampling of drill core on the Company’s Granada Gold Property in Québec and for general working capital purposes.

About Granada Gold Mine Inc.

Granada Gold Mine Inc. continues to develop the Granada Gold Property near Rouyn-Noranda, Quebec. Approximately 120,000 meters of drilling has been completed to date on the property, focused mainly on the extended LONG Bars zone which trends 2 kilometers east-west over a potential 5.5 kilometers of mineralized structure. The highly prolific Cadillac Break, the source of more than 75 million plus ounces of gold production in the past century, cuts through the north part of the Granada property.

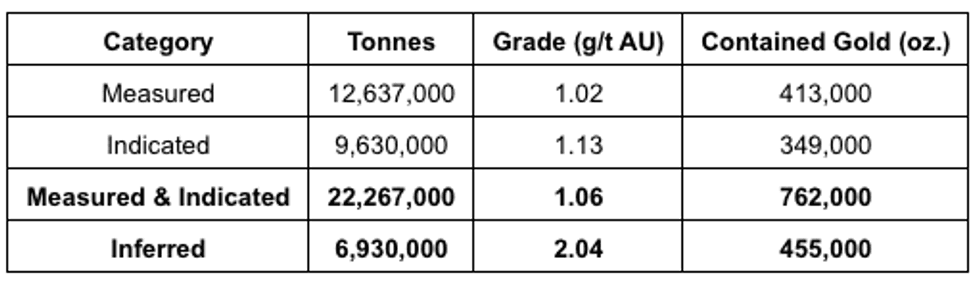

Pit-Constrained Mineral Resources at Granada disclosed on February 13th, 2019 Press Release prepared by SGS independent QP stand at:

Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

+ Open pit mineral resources are reported at a cut-off grade of 0.4 g/t Au within a conceptual pit shell. Cut-off grades are based on a gold price of US$1,300 per ounce, a foreign exchange rate of US$0.76, and a gold recovery of 95%.

The Granada Shear Zone and the South Shear Zone contains, based on historical detailed mapping as well as from current and historical drilling, up to twenty-two mineralized structures trending east-west over five and half kilometers. Three of these structures were mined historically from two shafts and two open pits. Historical underground grades were 8 to 10 grams per tonne gold from two shafts down to 236 m and 498 m with open pit grades from 5 to 3.5 grams per tonne gold

The Company is in possession of all mining permits that are required to commence the initial mining phase, known as the “Rolling Start”, which allows the company to mine up to 550 tonnes per day. Additional information is available at www.granadagoldmine.com.

“Frank J. Basa”

Frank J. Basa P. Eng.

President and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

Click here to connect with Granada Gold Mines (TSXV:GGM) for an Investor Presentation