For over 3,000 years, the most reliable asset for wealth protection has been physical gold and silver bullion.

Gold, Silver and Common Sense Investing

By Darren V. Long Guildhallwealth.com

March 27, 2014

There are many pieces to the investment puzzle. Some we know, but the most important pieces are unknown to the great majority. All one can do is to continually monitor events and adjust accordingly. The best predictor of the future has always been past monetary cycles. For over 3000 years, the most reliable asset for wealth protection has been physical gold and silver bullion. Mainstream news does not usually present this message hence this bit of humour. None of us want to be sheeple.

Image Courtesy Of TopYaps Dot Com

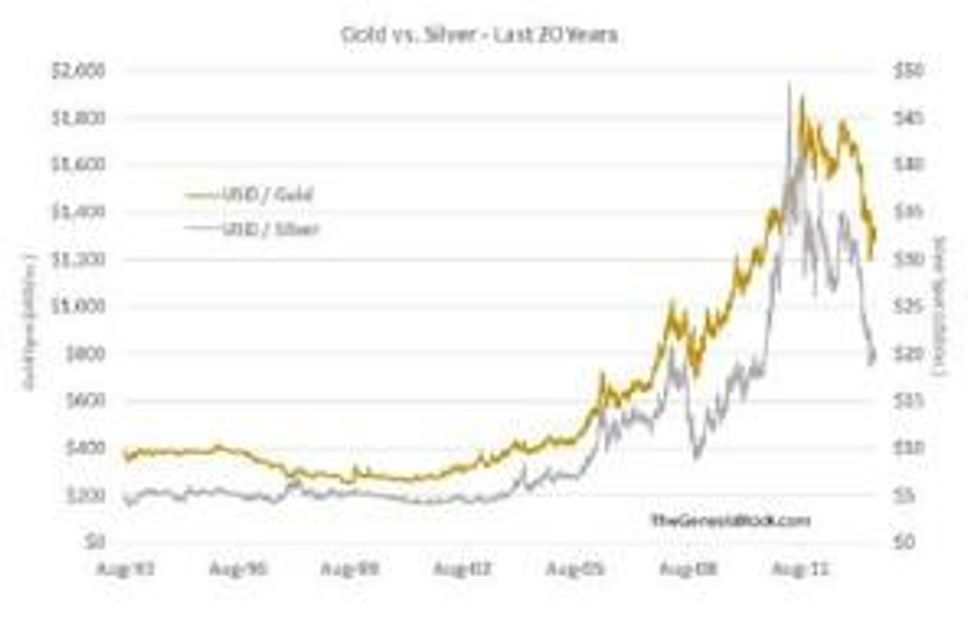

Since 2002, there have been at least four major rallies and subsequent peaks in both gold and silver. Throughout that time the markets have still managed to yield an overall generous return on investment despite what appears to be manipulation at times. There is no evidence to suggest that it will be any different in the coming months or years either.

Four Fundamentals to Drive Bullion Prices Higher

There are four major fundamentals at work that can explain the precious metals markets and in particular silver the best. Each has had an unequivocal impact on pricing thus far in this secular bull market for precious metals and each fundamental can be argued alone or as a group.

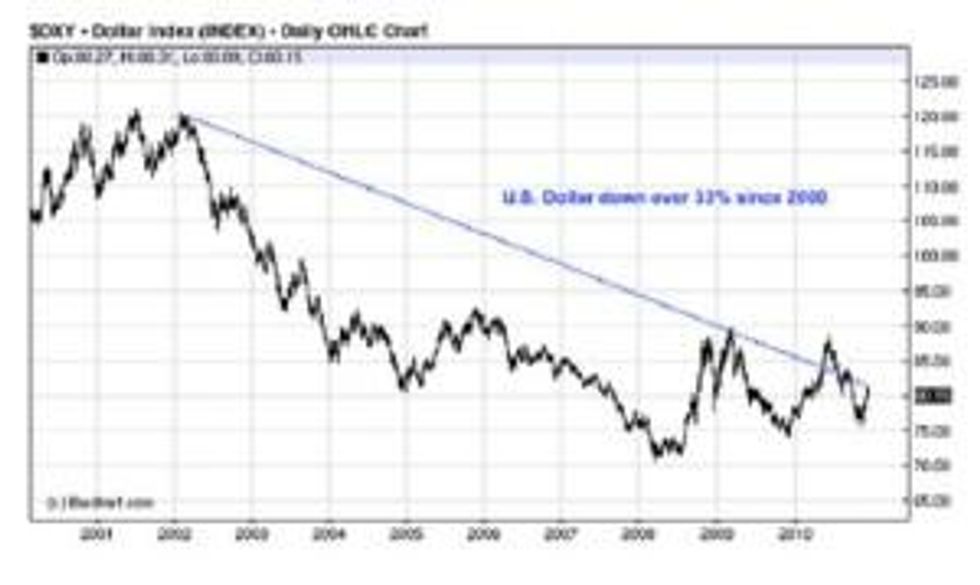

US Dollar and World Currency Depreciation

The first fundamental is US long-term fiat dollar depreciation and fiat currency depreciation all over the world. It is happening folks. The purchasing power of the US dollar, both domestically and abroad has dropped ominously since the last century.

Central banks and the world’s largest institutions of power know it. For this reason gold and silver can act as an insurance policy in the event it gets too overheated in the global economy. Remember the lower the value of the currency the easier the time a country will have paying its debt. Without getting to far into the discussion silver has followed gold’s lead in this area on numerous profitable occasions as the US dollar index has traversed lower in a secular bear market.

Long Term Inflation

The second fundamental is a wave of inflation that I expect to hit markets with a vengeance because of the fiat paper being recklessly printed during this unprecedented phase of currency depreciation. (Please see John Williams of www.Shadowstats.com for more on the subject of inflation and the true rate of inflation at street level). Leading up to an inflationary event bullion has historically performed extremely well. Look back at the 1970’s when each precious metal rose dramatically as the fear of inflation also rose. Gold during that decade managed a climb of 2300 percent while Silver fared even better gaining 3200 percent by January of 1980.

The third fundamental is a repetitive wave of geo-political instability in the form of regime overthrow, regional instability from economic fallout, poorly diversified countries, and yes even war. I suggest repetitive because this particular fundamental rears its ugly head time and time again. Simply look back to the 1970’s Russia and Afghanistan war and the Iran Hostage situation to name a couple. Today we have Syria, Iran, North Korea and now especially Ukraine as new and potentially larger threats.

Geo-Political Instability

In the past several years Geo-Political Instability has expanded to include Geo-Political Positioning. Entire nations and geographical regions have come to identify with assets such as gold and silver, and their central banks change policy to acquire in a net sense as much as they can. This has generally been the case now with many central bank buyers of gold since at least 2009. China has been the brazen in their acquisition of Gold. So too has Russia and India. Look to countries like Iran, Germany, Venezuela and many others for more insight on the topic of central bank buying and the repatriation of gold by countries.

Supply and Demand

Supply is tight and physical demand is high for both metals. However, in this category silver really shines. Some of the greatest writers in the bullion field have already laid the foundation for understanding how much above ground silver there really is. Look no further than Ted Butler or Eric Sprott. In short it has been used and abused at very low prices for more than three decades. In the case of Butler, his arguments have been so compelling that he makes a case for there actually being less above ground silver than gold at present time.

There were billions of ounces in January of 1980 when silver reached its all-time historical high of $52 per ounce. Fast forward to 2014 and it is said that there is now less than 900 million above ground ounces available not just for the thousands of applications and critical industrial uses but for all of the world’s total demand.

At today’s price of approximately $20.00 per ounce, 900 million ounces would be valued at about $18 billion dollars. One large investor could literally turn the market on its head. (Store this little tidbit and recall it when you have already purchased bullion and you are trying to convince others to do the same.)

Conclusion

We are arguably in the worst period of economic experimentation/upheaval we have seen in our lifetimes. Look around and see the unemployed or underemployed, the droves of foreclosed homes and the bankrupt cities like Detroit. Go view how many people are on food stamps in the US and the amount of debt owed by each man, woman and child (Now approaching $55,000 per person in the US and $35,000 in Canada at last check).

Participation rates continue to drop for those in the US job force and the number of those on social assistance is increasing rapidly. The sobering conclusion is that things are far from rosy. Since 2008 alone the US has increased its monetary base faster than in any other time in history. There will be more “bail-ins”, more lending, failure and white collar crime to come. It is only a matter of time.

Physical bullion gold and silver demand is not only growing in places we already know about but it is also burgeoning faster than ever before in places like India, China, Russia, Brazil and other countries where there is a growing population that is becoming more and more inured to the potential of a long term financial disaster.

When you recognize these facts it quickly becomes overwhelmingly apparent that one should run, not walk, to their nearest bullion dealer to add some physical bullion to your portfolio today. Be it for protection or insurance, for gain or simply for speculation, all of these reasons will seem so obvious when the fireworks take gold and silver prices higher than ever before.

Yours to the penny,

Darren V. Long

Darren V. Long is Senior Analyst with Guildhall Wealth Management Inc. Darren is a speaker, writer and financial commentator on gold, silver and the economy. He can be heard weekly on “The Real Money Show” on 640 am radio in Toronto discussing all facets of the precious metals markets. Listen to replays of all shows on www.therealmoneyshow.com 1.866.274.9570 www.guildhallwealth.com and www.guildhalldepository.com or email at: investing@guildhallwealth.com