Gold Price Above $1,200 as Market Watches US, Greece

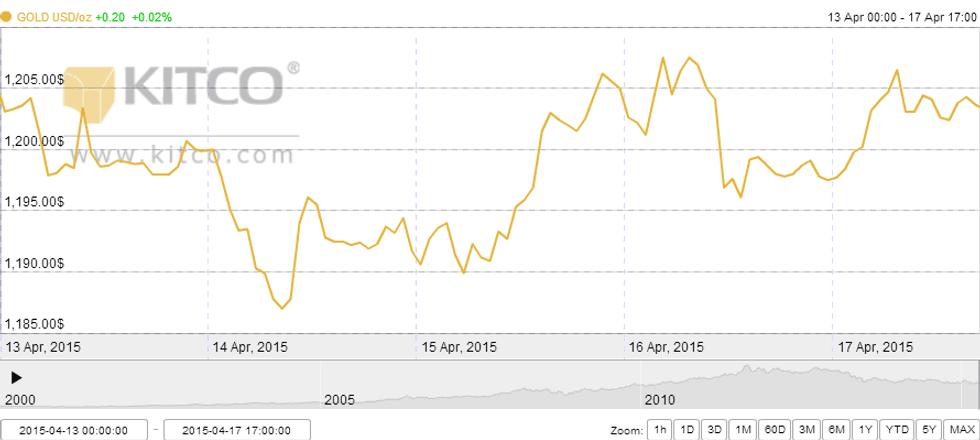

Gold broke above $1,200 per ounce this week, reaching a high of $1,207.50 on Thursday, but dropped overall for the second week in a row. Moving forward, investors will be watching the United States and Greece for clues about the metal’s price.

Gold broke above $1,200 per ounce this week, reaching a high of $1,207.50 on Thursday, but dropped overall for the second week in a row.

According to Reuters, the yellow metal was pushed downward after the release of “downbeat” US data, which spurred analysts to reassess whether they see the Fed raising interest rates in June. Inflation data in particular bumped the US dollar up and the gold price down.

The news outlet quotes Steve Scacalossi, director and head of sales for global metals at TD Securities, as saying, “[s]till seems very much (like) range bound trading in the days ahead. Some attention is now focused on the end of April for some guidance from the next FOMC meeting on 29th April.”

That’s a statement that’s reiterated in a recent Kitco News article by Neils Christensen. In it, Christensen notes that there will be little US economic data out next week, meaning that analysts will mainly be waiting and watching the US dollar and technical charts to see if the precious metal “can create any sustainable momentum.”

It’s worth noting, however, that the US isn’t the only country that gold-focused investors will be keeping an eye on in the coming weeks. Greece is also in the spotlight once again after news surfaced earlier this week that the country is prepared to declare a debt default if it doesn’t reach an agreement with its international creditors by the end of April.

Specifically, the country is ready to withhold payments worth 2.5 billion euros from the International Monetary Fund in May and June. A Financial Times article states that such a move would bring an “unprecedented shock to Europe’s 16-year-old monetary union,” and notes that a short-term effect would “almost certainly” be the suspension of European Central Bank liquidity assistance to the country’s financial sector, as well as bank closures and “wider economic instability.”

In terms of what that could mean for the gold price, there’s been plenty of speculation. The Bullion Desk’s Ian Walker has suggested that “[a]ny further doubts” about the country are likely to increase gold’s appeal as a safe haven, while a recent iNVEZZ.com article quotes Julian Jessop of Capital Economics as saying that the relationship between gold and Greek bond yields “has been more reliable than that between gold and the dollar.” He sees the gold price moving to $1,400 by the end of the year.

The upshot then is that while next week seems to be shaping up to be a quiet one for the gold space, the week after that will likely be a little more active as more US data hits the market and as the situation in Greece plays out further.

At close of day Friday, the gold price was sitting at $1,203.30.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.