Policymakers appear divided on whether to raise rates as early as June.

The gold price surged Wednesday (May 24) after minutes from the US Federal Reserve’s latest meeting showed that policymakers agree that interest rates should not be raised until it’s clear that the recent US economic slowdown is temporary.

“Most participants judged that if economic information came in about in line with their expectations, it would soon be appropriate for the Committee to take another step in removing some policy accommodation,” the minutes say.

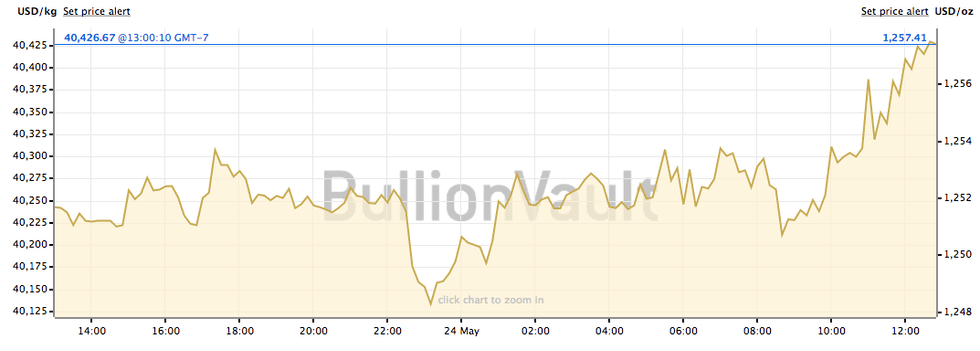

Gold was trading at $1,256.02 an ounce as of 2:50 p.m. EST, up 0.42 percent from Tuesday (May 23), when it slipped 0.7 percent following two days of gains.

The yellow metal tends to fare better when interest rates are low and often struggles when interest rates are higher. That’s largely because higher rates increase the opportunity cost of holding non-yielding bullion while boosting the dollar, in which the metal is priced.

Chart via BullionVault. Gold’s price movement between May 23 at 4:00 p.m. EST and May 24 at 4:00 p.m. EST.

However, after its initial rise the gold price saw little movement. “Gold is largely unchanged after an initial burst higher failed as May’s Fed minutes offered little to suggest that the Committee was seriously reconsidering a widely anticipated June rate hike,” Tai Wong, director of base and precious metals trading for BMO Capital Markets in New York, told Reuters.

While the minutes indicate that most Fed officials believe it won’t be long before the US economy picks up again, they appear divided on whether to raise rates as early as June.

“Gold’s instant reaction to the Fed minutes was positive, as there weren’t any hawkish surprises to jolt the market,” Brien Lundin, editor of Gold Newsletter, said to MarketWatch. “Still, the minutes confirmed the Fed’s intent to continue normalizing monetary policy.”

He added, “[w]ith investors still expecting the Fed to hike at its next meeting, some shorts likely took the occasion to cover their trades by buying gold, essentially a ‘sell the news’ dynamic.”

For now it’s unclear whether a June hike is in the cards. That said, according to CME Group’s FedWatch tool, market participants believe there is a 83.1 percent chance that it will happen. The committee is also expected to raise rates two more times later this year.

“My expectations are that the pace of interest rate hikes will be kept steady and stable regardless of the short-term fluctuations in the US economic data,” said Mark To, head of research at Hong Kong’s Wing Fung Financial Group.

Until the Fed meets again from June 13 to 14, market participants should closely watch US economic data for any clues about future interest rate increases.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.