Gold Outlook 2018: Watch the Fed, Debt and Geopolitics

Analysts share their thoughts on the gold outlook for 2018. Most agree that it will take a sharp shock to the market to move the price significantly higher.

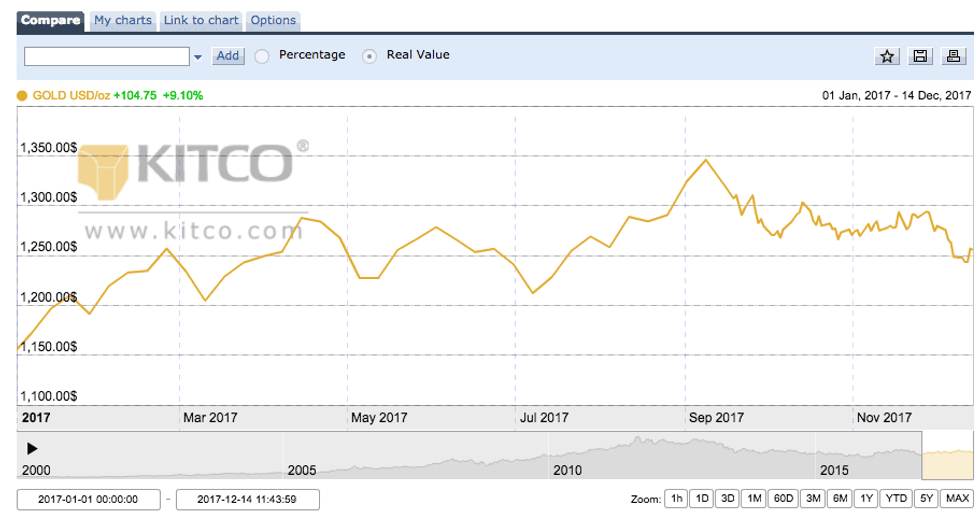

Although it’s up over 9 percent so far this year, the gold price didn’t perform as well as many predicted. In Q3, the yellow metal broke the $1,300-per-ounce-mark, but it couldn’t sustain that level for very long.

Political uncertainty, worldwide tensions and a softer US dollar supported prices, while risk appetite and a hawkish tone from the US Federal Reserve offset gains. As of Thursday (December 14), gold was trading at $1,253.21.

With the start of 2018 just around the corner, many investors are now wondering what will happen to gold next year. Here the Investing News Network looks at gold’s price performance in 2017 and what analysts believe is ahead for the yellow metal in 2018.

Gold outlook 2018: Price performance review

It comes as no surprise that the gold price performed with volatility in 2017. Even so, prices have nevertheless increased since the beginning of the year.

As the chart below from Kitco shows, the gold price reached its yearly peak in September, when it reached $1,346. At the time, tensions were escalating rapidly between North Korea and the US, turning investors to safe-haven assets such as gold. A weaker US dollar also supported prices.

Gold’s price performance from January 1, 2017 to December 14, 2017. Chart via Kitco.

In contrast, gold’s lowest point of the year came in January, when it was changing hands for $1,150.90 due to a higher US dollar. A stronger greenback tends to make assets pegged to the currency more expensive to buyers using other monetary units.

Some market participants were expecting gold prices to increase more than they did, including Rob McEwen of McEwen Mining (TSX:MUX,NYSE:MUX), who was expecting gold to move higher this year. “I didn’t anticipate how strongly the broad market would move based on expectations that US President Donald Trump’s policies would be passed,” he said.

Similarly, Brien Lundin, CEO of Jefferson Financial and editor of Gold Newsletter, was expecting to see more of what was seen in 2016; instead gold has been performing in a “kind of a stairstep fashion.”

Rick Rule of Sprott US Holdings commented that he has been satisfied with the performance of gold this year. “Gold usually mirrors a lack of confidence, and [people have been very confident in the global economy]. The fact that gold has done well during a time with minimal turbulence says that gold has performed its job in terms of maintaining or increasing people’s purchasing power,” he noted.

Frank Holmes of US Global Investors (NASDAQ:GROW) also believes bullion has been doing well this year. “What really took it on the chin for the gold stocks was the push to go into the GDXJ (ARCA:GDXJ),” which captures 95 percent of all gold equity fund flows.

“The gold stocks have been really [downtrodden] — and a lot of people don’t understand that really it has to do with the GDXJ’s success,” he added.

On the same note, Adrian Day of Adrian Day Asset Management said gold stocks are “incredibly depressed,” explaining that “if gold is cheap relative to the financial assets … gold stocks are even cheaper because they’re cheap relative to gold on a fundamental basis, on a price basis.”

Junior Stock Review founder Brien Leni agreed, saying he was expecting to see a rebound in gold stocks prior to 2018, but “the emergence of cryptocurrencies and blockchain have taken center stage in 2017.”

Indeed, the cryptocurrency vs. gold debate has been a key trend this year, as bitcoin has outperformed the yellow metal. However, most gold market participants agree that the assets don’t compete with each other and are not comparable.

Rule commented, “I’m a fan of cryptocurrencies … [but] I think ultimately that the cryptocurrencies and gold serve a very, very different purpose, and I see them as being complementary, not competitive.”

Meanwhile, Holmes said he doesn’t think bitcoin is dismantling gold, but it’s “waking up the world on blockchain technology — the ability to send transactions inexpensively, no counterfeits [and] decentralized around the world in 10 minutes.”

Gold outlook 2018: Key factors and price predictions

The year has been full of political turmoil, with investors turning to safe-haven assets on escalating geopolitical tensions. But what will happen to the gold price in 2018?

In the longer term, Lundin believes a gold price rise is inevitable. Why? “The easy answer is debt,” he explained. “The debt load in the US is over $20 trillion. If it performs to past form, by the time Donald Trump gets out of office, it should be about $40 trillion — the record has shown that federal debt has doubled during every eight-year term of the president recently, so it’s growing. At this level it’s too large to be handled by tax hikes, spending cuts, growth.”

Similarly, David Morgan of the Morgan Report said debt remains a major issue that could impact precious metals going forward. “I think 2018 is when [the debt bomb] is going to be noticed — maybe out of the corner of your eye kind of thing — and then it’s going to become more and more apparent as we march through 2018,” he said.

Another key factor to consider moving forward is the Fed’s monetary policy. The central bank decided midway through December to hike interest rates for the third time in 2017, and market watchers are expecting at least three more rate increases in 2018.

According to Lundin, investors should not be cognizant of interest rate increases, but not necessarily concerned. The Fed’s latest policy statement “has once again straddled the line between the doves and hawks — noting how inflation has remained persistently and confoundingly low, but that economic growth remains sufficient for the central bank to plan for more rate increases in 2018,” he said.

In addition, what happens to the US dollar next year will be crucial for gold’s performance, as a softer greenback makes commodities priced in dollars cheaper for investors using other currencies.

“If 2017 marks the end of a multi-year period of U.S. dollar strength, gold could benefit from that tailwind, unlike the headwind that it has experienced since 2001,” John Reade, chief market strategist for the World Gold Council, said in a report.

Meanwhile, Holmes mentioned another point to pay attention to next year, which is that the market has reached peak gold due to a lack of technological breakthroughs. He expects that small- and mid-cap companies will be bought by the Newmont Minings (NYSE:NEM) of the world, which is an important sign that they are not, in their own exploration, finding reserves fast enough to replace their production.

“[We’re also seeing] supply restrictions from bullion hitting the market, global GDP churning up with PMI, money printing continuing along with negative interest rates,” he added.

In contrast, Louis James, editor of the International Speculator, said he doesn’t believe we have reached peak gold, but that there’s a lack of certain kinds of discoveries. “There are lower-grade deposits out there, there’s a lot of gold out there. All you have to do is notch down the grade, and at higher prices those become economic. So no, I don’t see gold being driven by a lack of discovery,” he said.

In terms of price, Leni is expecting the next leg up in the gold bull market to happen in 2018, with gold trading above $1,300 for the majority of the year. Factors supporting this price level include geopolitical tensions and a slower pace in interest rate increases.

“If we don’t see strength in the gold price, I think the next most likely scenario for the gold price is to trade within a range of $1,100 and $1,300, much like we have seen in 2017,” he added.

Firms polled by FocusEconomics estimate that the average gold price for 2018 will be $1,268. The most bullish forecast for the year comes from CPM Group, which is calling for a price of $1,322; meanwhile, Itau BBA is the most bearish with a forecast of $1,170.

Leni also mentioned that in order to manage their expectations investors should understand the difference between investing in gold and buying gold stocks. “While there is leverage, so to speak, in buying the companies, they come with much more risk and complexity” than investing in gold.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.