The World Gold Council recently highlighted four gold market trends that are expected to impact the market as 2018 continues.

The gold price experienced its largest annual gain since 2010 last year, says the World Gold Council (WGC) in its latest report.

Investors continued to add the yellow metal to their portfolios “as incomes increased, uncertainty loomed, and gold’s positive price momentum continued.” Overall, gold rose 13.5 percent in US dollars in 2017.

Heading into 2018, the WGC has identified four key gold market trends that it believes will support gold demand and maintain the precious metal‘s relevance as a strategic asset. Read on to learn about those factors.

1. Global economic growth

It’s been a decade since the last financial crisis, and according to the WGC, “the world is returning to economic normality,” with growth seen in 2017 expected to continue in 2018.

Europe and the US have experienced economic growth, decreasing unemployment and rising wages amidst low inflation indices.

Meanwhile, the WGC anticipates that growth in the Chinese economy will continue, albeit at a slower rate than in previous years. And in India, the second-largest gold market, demonetization policies, plus a new goods and services tax, will have a “positive effect on the economy.”

Altogether, this widespread economic growth is forecast to increase consumer demand for gold jewelry, gold-containing technology and gold itself as a form of savings.

2. Tighter monetary policy

The WGC is calling for global economic expansion to result in tighter monetary policy in 2018. It sees the US Federal Reserve taking the lead as it looks to shrink its balance sheet by allowing $50 billion in treasuries and mortgage-backed securities to mature each month, resulting in a decrease from $4.5 trillion to about $2.5 trillion by 2020.

Additionally, the Fed anticipates three rate hikes for 2018. Higher rates generally raise the opportunity cost of investing in gold, but the WGC says it believes the implications for the yellow metal “are more nuanced.” It sees rates remaining low from a historical perspective, and notes that in its view, “the potential headwinds to gold may not be as strong as some think.”

3. Frothy asset prices

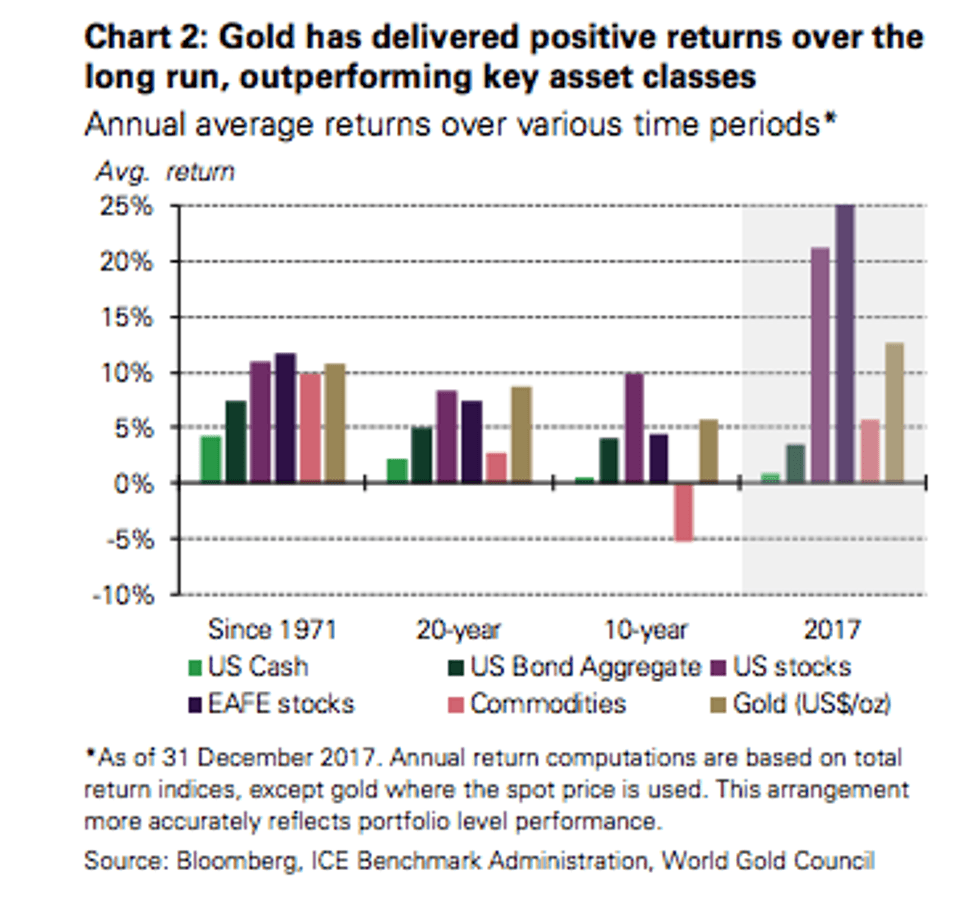

The WGC says asset prices reached multi-year highs worldwide in 2017 — even now, the S&P 500 (INDEXSP:.INX) is at an all-time high. That has led investors to take on additional risks to generate returns, increasing their exposure to lower-quality companies in the credit markets or fueling asset growth elsewhere.

For example, in China, property prices almost doubled between January 2015 and October 2017 before regulators intervened. Equity markets are moving steadily higher while credit standards slip lower, leaving investors wary of asset valuations and cautious about risk exposure in the face of changing central bank policies. The WGC notes that if “global financial markets correct, investors could benefit from having an exposure to gold as it has historically reduced losses during periods of financial distress.”

4. Market transparency, efficiency and access

The WGC explains that several initiatives are “helping to create a more efficient gold market and ensure that customers are well served by the gold industry.” The London Bullion Market Association launched a trade data reporting initiative in 2017, and the London Metal Exchange launched LMEprecious to “improve price transparency and efficiency of transacting in the London wholesale market.” India plans to develop and launch a national spot exchange and the government plans to introduce jewelry hallmarking to decrease the number of under-carating incidents.

In other areas, the WGC sees “signs of progress in reducing barriers to investing in gold.” One is a draft amendment to Russia’s tax code, which proposes an exemption to an 18-percent value-added tax. The organization says it may “herald the development of a new gold investment market” if it gains approval. Altogether, the WGC sees these circumstances creating an inviting environment for diverse investors.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Shaw, hold no direct investment interest in any company mentioned in this article.