Fidelity’s Implementation of Strategic Project Generator Model Accelerating with Acquisition of Two Significant Projects

Fidelity Minerals Corp. (TSXV:FMN; FSE:S5GM) (“Fidelity Minerals” or “the Company”) is pleased to provide the following corporate update, including details in relation to the acquisition of two significant projects:

– The extent of major transactions at both the project & corporate level in the Andean mineral belt of Peru & Ecuador have markedly increased since early 20181.

– Fidelity Minerals is ideally positioned to transact via implementation of the Strategic Project Generator (SPG) business model.

– Two significant acquisitions in La Libertad district of Northern Peru include:

- 1) A 100% interest in a Porphyritic Copper Project with multiple high-quality targets with extensive copper anomalism (to >1% Cu).

- 2) Initial 25% interest in a project company which holds 6 concessions, one of which hosts a prospective Polymetallic Project (200 tonne bulk sample returned grades* of up to 14.5 oz/T Ag, 1.1g/T Au, 13.7% Zn and 10.4% Pb, in 2018).

* The grades outlined above have been derived from historical sampling and have not been verified by Fidelity Minerals

Fidelity Minerals Corp. (TSXV:FMN; FSE:S5GM) (“Fidelity Minerals” or “the Company”) is pleased to provide the following corporate update, including details in relation to the acquisition of two significant projects:

– A 100% interest in a Porphyritic Copper Project (1,200Ha) in La Libertad, Northern Peru.

– An initial 25% interest in a project company that holds a portfolio of project concessions (3,500Ha) also in La Libertad, including an advanced stage Polymetallic Project.

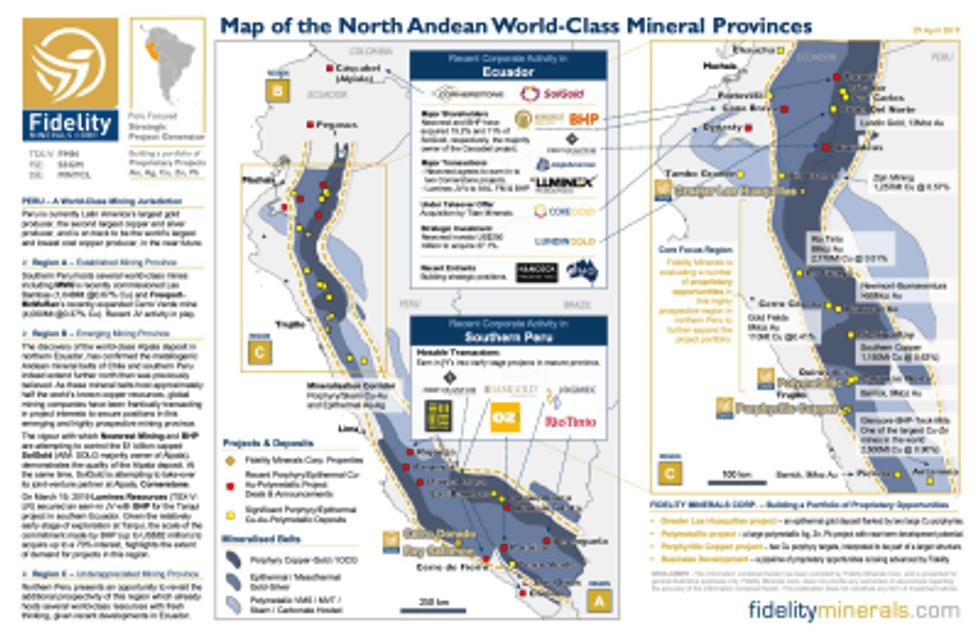

As an early mover into Northern Peru following the emergence of Ecuador as a world-class mineral exploration region, Fidelity Minerals is well placed to become a key player in this highly prospective region flanked by world-class projects to the south and frantic corporate activity to the north in Ecuador. The relevance of the Company’s Strategic Project Generator model has been validated by recent corporate transactions, including numerous project-level transactions in Ecuador and Southern Peru where the majors are aggressively acquiring large-scale copper and gold targets. For further details on recent corporate activity, refer to Figure 1.

In light of this unprecedented recent interest in high quality projects in the world-class mineral provinces of the Northern Andes, Fidelity Minerals has moved to rapidly evaluate a large number of proprietary opportunities which are not readily available to the major miners. The significant acquisitions announced today reflect the Company’s initial success in rapidly implementing its recently announced Strategic Project Generator model.

Since BHP’s investment in late 2018 in SolGold (the operator of the Alpala project in Northern Ecuador), BHP has announced a transaction with Luminex Resources where BHP has the right to earn up to a 70% interest in Tarqui, a relatively early stage copper exploration project in Southern Ecuador, through the staged investment of up to US$82 million (on March 19, 2019). Together with other recent transactions, the implied value of the Luminex-BHP deal highlights the demand and the relatively high valuations realisable for quality projects in this region, even at a relatively early stage of appraisal.

Fidelity Minerals is positioned to immediately benefit from the increased appetite for prospective projects in northern Peru through the origination and acquisition of proprietary opportunities at low cost. Fidelity Minerals will immediately add value and endeavour to secure farm-out commitments with the majors that are actively participating in regional transactions. By way of comparison, the acquisition of the Porphyritic Copper Project announced today by Fidelity Minerals, whilst at a relatively early stage of exploration, does not appear dissimilar to the Luminex-BHP Tarqui project.

Figure 1: Map Outlining Recent Corporate Activity

Click Image To View Full Size

The above Map of the North Andean World-Class Mineral Provinces and the superimposition of recent corporate activity has been prepared by the Company for general illustrative purposes.

A large poster-sized version of the above Map of North Andean World-Class Mineral Provinces is available at https://www.fidelityminerals.com/north-andean-mine-map.

Acquisition 1 – Porphyritic Copper Project Overview (FMN: 100%)

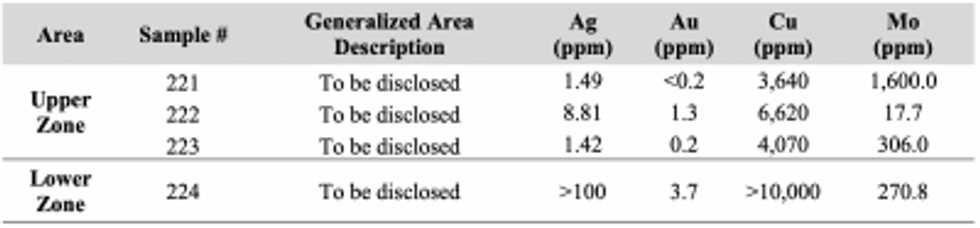

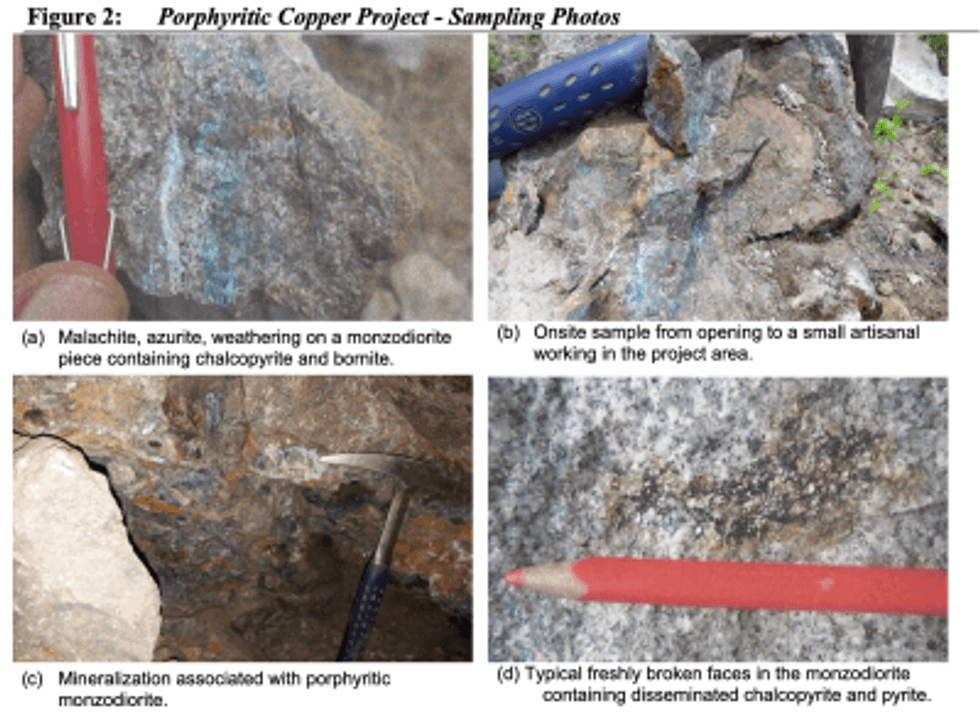

The Porphyritic Copper Project comprises three contiguous concessions covering 1,200Ha, located in an active mining and development district in La Libertad, Northern Peru. The project hosts near surface manifestations of visible copper mineralization (Figure 2), as well as small-scale artisanal workings developed for the purposes of producing small tonnages of gold bearing ore. A recent assessment of the “Upper” and “Lower” Zones has identified similarities in the type of mineralization hosted at the two zones that are situated approximately 4,000m apart. Both the zones of interest are in each case located immediately adjacent to a major regional (+60km) fault structure that is regionally associated with known copper projects. Encouragingly, at both the project and the regional copper projects, the mineralization is associated with variably altered monzodiorite(s) displaying copper sulphide (including bornite) and copper oxide mineralization.

Historical sampling at the project indicates grades2 of 0.36% – 0.66% Cu at the Upper Zone and higher grades at the Lower Zone including >1% Cu. Selected sampling results are outlined below.

Click Image To View Full Size

During due-diligence activities relating to the acquisition of the project, Fidelity Minerals identified additional prospective geological features that extend beyond the current project area. In order to secure a larger footprint surrounding the project, the Company is in the process of acquiring adjoining concessions. Until such time that the Company has secured the adjoining concessions, additional details including the name of the project or the specific location will not be released.

Click Image To View Full Size

Fidelity Minerals considers the similarities of the Porphyritic Copper Project to the Magistral project to be highly encouraging as the Magistral project owned by Minera Milpo hosts significant mineralization with published mineral resources of 232 Mt @0.55% Cu, 0.05% Mo, 3.2g/t Ag.In 2018 the project vendor commissioned a QP based in Canada to prepare a geological report3 in order to summarise the geological prospectivity of the project. The data relating to the project presented in this release has been largely taken from this geological report with the consent of the vendor. In the geological report, the QP states that “there is the distinct possibility that the two mineralized locations at the Project represent two exposed areas of mineralization that form part of a typical Cu-Mo Porphyry Copper System. The mineralogy, host rock type and texture, plus the presence of a skarn-type mineralized zone at the Lower Location, are very much the same characteristics to be seen at the Magistral Cu-Mo-Ag Porphyry Deposit in Ancash Province.”

Next Steps

The Company intends to perform an initial assessment of the prospectivity of the project by commencing with detailed geological mapping and a systematic surface sampling program to better define the extent of the surface manifestations of the interpreted zones of mineralization.

Acquisition Terms

Fidelity Minerals is acquiring a 100% interest in the Porphyritic Copper Project. The acquisition consideration consists of the issuance of 4,000,000 common shares in Fidelity Minerals to the vendor. At completion of the acquisition, a cash payment of US$7,000 is payable to the vendor.

The acquisition of the Porphyritic Copper Project remains subject to the satisfaction of customary conditions before closing, including exchange approval for the issuance of Consideration Shares.

Acquisition 2 – Polymetallic Project Overview (FMN: 25%, initially)

The Polymetallic Project comprises of 6 concessions covering 3,500Ha, located in an active mining and development district in La Libertad, Northern Peru. Fidelity Minerals has acquired a 25% interest the Polymetallic Project by acquiring a 25% interest in Norsemont II Resources Inc4. (“Norsemont”), the project company that holds the 6 concessions including the advanced stage Polymetallic Project, previously referenced by the Company in a Press Release dated March 13th, 2019.

The Polymetallic Project is proximal to Barrick’s Lagunas Norte mine (9Moz Au resource) with both projects located within a proven mineralized belt that hosts several world-class precious metal projects, including Newmont’s Yanacocha mine (>50Moz Au resource). For regional context, refer to the map outlined in Figure 1.

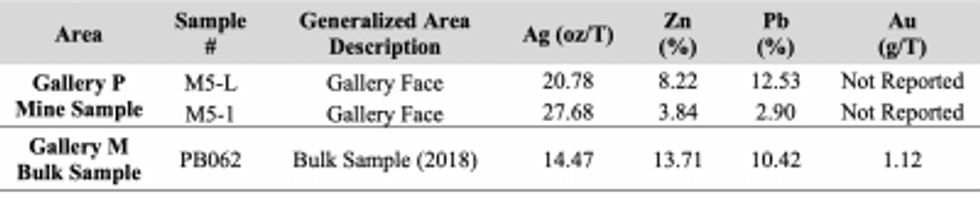

Mineralization at the Polymetallic Project is interpreted to be controlled by a series of ENE-striking polymetallic (Ag/Pb/Zn) veins which are understood to have extensive vertical and lateral continuity.

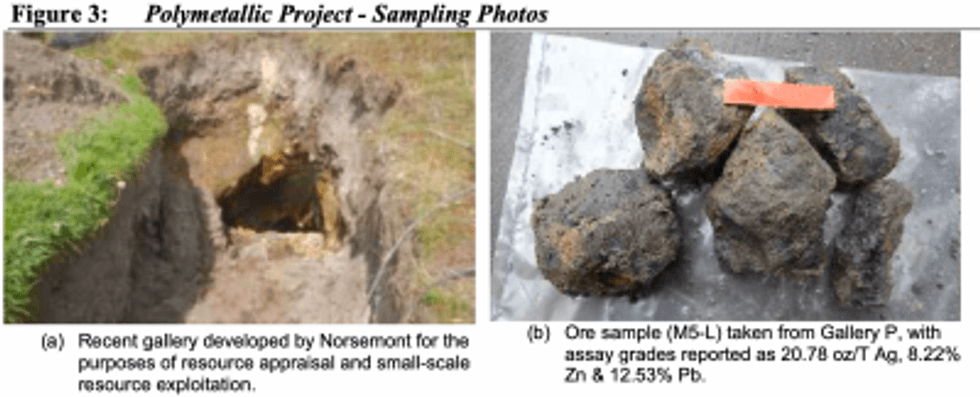

The project hosts near surface manifestations of visible polymetallic mineralization (Figure 3), as well as relatively small-scale underground development for the purposes of producing small tonnages of high-grade ore. An access tunnel has been driven into the primary vein system confirming the downdip continuity of mineralization encountered from surface outcrop.

Historical sampling at the project confirms the presence of high grades5 of polymetallic mineralization. Selected higher grade sampling results are outlined below.

Click Image To View Full Size

Preliminary studies on samples taken from the 2018 bulk sample (PB062) outlined above have indicated that high metallurgical recoveries (>95% for Ag, Zn and Pb) are likely to be achievable.

Click Image To View Full Size

Next Steps

The core concession that hosts the high-grade mineralization has been granted a small-scale mining permit, so it is possible small-scale production could occur in the near-term, as part of a larger resource appraisal program. There are also additional opportunities to contemplate a much larger operation based on integration with regional infrastructure, which may also present an opportunity for Fidelity Minerals to consolidate ownership of the project.

Fidelity Minerals is in the process of developing an appraisal program in order to guide potential development discussions with the majority owner of the Polymetallic Project. As Fidelity Minerals is currently exploring a number of strategic initiatives in relation the project, additional details including the name of the project will be released in due course.

Acquisition Terms

Fidelity Minerals is acquiring an initial 25% interest in the Polymetallic Project by acquiring a 25% interest in Norsemont II Resources Inc., a private Ontario project company that holds the six concessions minerals concessions in La Libertad, Northern Peru.

The acquisition consideration consists of the issuance of 3,000,000 common shares in Fidelity Minerals to the vendor. Fidelity Minerals is also required to make a number of staged cash payments totalling US$84,000. Total cash payments made to the vendor to date total US$28,000, with a final cash payment of US$56,000 payable to the vendor, at completion of the acquisition.

The acquisition remains subject to the satisfaction of customary conditions before closing, including exchange approval for the issuance of Consideration Shares.

Management Commentary

Proactive Investors Interview

Director & CEO of Fidelity Minerals, Mr. Ian Graham has given an interview with Steve Darling of Proactive Investors where he discusses the acquisitions announced today by Fidelity Minerals.

The interview can be accessed by visiting:

Director & CEO of Fidelity Minerals, Mr. Ian Graham commented: “The two acquisitions we announce today are the culmination of an extensive project origination, evaluation and acquisition effort that has been ongoing for some time. Whilst the two projects are quite different, they each provide Fidelity Minerals with a clear pathway to near-term value creation. The Porphyritic Copper Project is an exciting opportunity as we are acquiring 100% of this highly prospective project; we’ve moved quickly to make efforts to further expand the footprint of the project owing to its potential to host big copper of a scale that would interest the majors. In addition, we are acquiring an initial minority interest in the Polymetallic Project as this project provides Fidelity Minerals with great optionality. In addition to possibly delineating a sizeable Ag-Zn-Pb resource, and potentially commencing small-scale mining in the relatively near-term, we see this project as a platform for access to a number adjacent or synergistic opportunities with material scale. As we integrate these two acquisitions into the growing Fidelity Minerals portfolio, we continue to advance our assessment of the Greater Las Huaquillas project which has generated significant industry interest: we expect to have established a project dataroom around July this year.”

Executive Chairman of Fidelity Minerals, Mr. Bahay Ozcakmak added: “In December 2018, when we announced the acquisition of an interest in the Greater Las Huaquillas project, we noted the increased industry interest to our immediate north in Ecuador. Since this time, the number and scale of transactions in both Ecuador and Southern Peru has only accelerated. In light of this increased interest by the majors to enter prospective projects, particularly copper focused projects, even at a relatively early stage, we decided to leverage our extensive in-country experience and to rapidly position Fidelity Minerals to opportunistically take advantage of this new interest. It is our expectation that as the realisation sets-in that the metallogenic belts of Chile and Southern Peru in-fact extend much further north than previously interpreted, we expect the regional transaction activity to spill-over into Northern Peru, a region that already hosts numerous truly world-class projects, but which has been overlooked in recent times. In order to benefit from this emerging interest, Fidelity Minerals is implementing what we are calling our Strategic Project Generator model. Through this strategy Fidelity Minerals is assembling a high-quality portfolio of proprietary project opportunities in Northern Peru, at attractive valuations, at a time when the global majors are frantically acquiring projects to backfill their depleted project pipelines. With the announcement of two significant project acquisitions today, our Strategic Project Generator model is already starting to bear fruit. We look forward to providing further updates on the composition of our project portfolio, in the near future.”

About Fidelity Minerals Corp.

Fidelity Minerals Corp. is assembling a portfolio of high-quality mining assets in Peru through the implementation of our Strategic Project Generator (SPG) model. The project generator model involves the identification and acquisition of appraisal stage opportunities with near-term valuation catalysts, including potential for high-impact M&A. The company is backed by an experienced management team with diverse technical, market, and commercial expertise and is supported by committed and sophisticated investors focused on building long term value.

On behalf of the Board of Fidelity Minerals;

Ian Graham

CEO and Director

Tel: +1.604.671.1353

Email: igraham@fidelityminerals.com

Investor Contact:

Bahay Ozcakmak

Executive Chairman

Tel: +61.3.9236.2800

Email: bahay@fidelityminerals.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

Disclaimer & Forward-Looking Statements: This news release contains forward-looking statements. Forward-looking statements are statements that relate to future events or future financial performance. In some cases, you can identify forward-looking statements by the use of terminology such as “may”, “should”, “intend”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “predict”, “potential”, or “continue” or the negative of these terms or other comparable terminology. These statements speak only as of the date of this news release. This news release may also contain inferences to future oriented financial information (“FOFI”) within the meaning of applicable securities laws. The information in this news release has been prepared by our management to provide a context for the project acquisition and to provide the reader with an outlook for our future activities and anticipated key projects and may not be appropriate for other purposes. Forward-looking statements in this announcement include, (but are not limited to) advancing certain key project activities that could represent important milestones which the Company expects may represent material valuation catalysts, such as the design of a suitable geological or geophysical program; and that through the Strategic Project Generator model Fidelity Minerals is positioning itself to be a beneficiary in this environment of increased appetite for prospective projects in this region. The reader is further cautioned that certain sampling data has been referenced: however, the collection of samples was not supervised by an independent QP on behalf of the Company, and from the information supplied to the QP who prepared the unreleased NI43-101 report on behalf of the Vendors, there are four grab samples that were taken for assay, three at the Upper Location, and One at the Lower Location. The amount and weight of each sample is not known, nor is there any sketch or record of the precise location of each sample. With regard to Sample Preparation Analysis and Security it is not known whether any particular collection and preparation and security was taken by the field crew, but it is expected that they would have followed the normal protocols that are followed with initial sample collection, whereby each sample was taken, secured, and kept secured, without tampering, until it’s final delivery to the laboratory. Although the specific ALS laboratory used is not known, it is expected that they would follow the normal industry protocol in the preparation and assay procedures of the samples. With respect to Data Verification, only an individual representing the Vendor was on site, to verify the samples as they were taken, and no check or duplicate samples were taken. In addition, the Company has reported certain grades for the Polymetallic Project, taken from certain underground workings, including certain samples taken from a 200-tonne bulk sample from a selected Gallery. There has been no independent verification of the sampling protocols or analytic methods on behalf of Fidelity Minerals, and there were no duplicate or control samples used in the process. Further, forward-looking statements in this release include that the Company believes that recent project-level transactions in both Peru and neighbouring Ecuador provides evidence that high quality projects in the Northern Andean Copper Belt could deliver excellent potential transaction-based outcomes for the Company, and that through the Strategic Project Generator model the Company is positioning itself to be a beneficiary in this environment of increased appetite for prospective projects in this region.

1 A summary of recent transactions is outlined in Figure 1.

2 ALS Method Code ME-MS41. The laboratory location, chain of custody record, use of blanks and standards by the Vendor is not recorded or independently verified by a Qualified Person. The Certificate of Assay / Analysis has not been independently verified for Fidelity Minerals Corp.

3 Draft NI43-101 Report: not finalized or published.

4 Norsemont holds six (6) concessions totalling 3,500Ha, all located in the Alto Chicama mining district of La Libertad, Northern Peru.

5 G&S Laboratory SRL (August 2018). The laboratory location, chain of custody record, use of blanks and standards by the vendor is not recorded or independently verified by a Qualified Person. The Certificate of Assay / Analysis has not been independently verified for Fidelity Minerals Corp.