The Conversation (0)

Strong European Demand Leads 2017 Rise in Gold ETF Holdings

Jan. 09, 2018 04:50PM PST

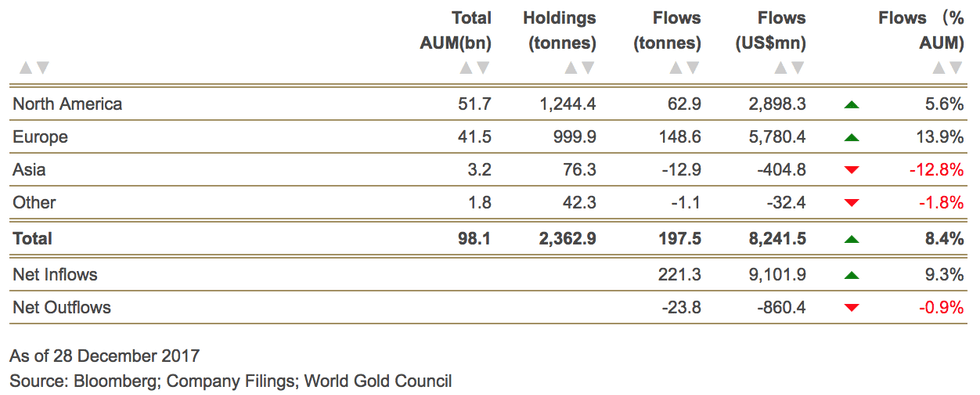

Precious Metals InvestingGlobal gold-backed exchange-traded fund holdings rose 8.4 percent in 2017, the latest data from the World Gold Council shows.

Global gold-backed exchange-traded fund (ETF) holdings rose 8.4 percent in 2017, spurred largely by European demand.

According to the World Gold Council’s latest analysis of gold-backed ETFs and similar products, European funds accounted for 75 percent of global ETF inflows last year.

In total, European funds added 148.6 tonnes of gold in 2017, with holdings reaching 999.9 tonnes by the end of the year. That’s a 13.9-percent increase year-on-year. Globally, holdings of gold-backed ETFs were at 2,369.2 tonnes as of the end of December.

German-listed ETFs alone were responsible for an impressive 35 percent of global ETF inflows. In fact, holdings of Xetra-Gold, a German gold-backed security, reached an all-time high of 175.04 tons of gold at the end of 2017, up significantly from 117.59 tons at the end of 2016.

According to a recent release from Deutsche Boerse (ETR:DB1), a German marketplace exchange organizer, 2017 demand for gold in the country was “mainly due to the high demand from institutional investors.” However, an increasing number of asset managers, family offices and private investors are showing interest in gold as an asset class.

Gold-backed ETF inflows for 2017. Chart via the World Gold Council.

It is also worth nothing that last year Germany’s central bank completed the transfer of US$27.9 billion worth of gold bars held by France’s central bank and the Federal Reserve in New York. Germany stored the gold abroad fearing it could fall under Soviet control during the Cold War.

Aside from Europe, North American funds were the only other major grouping that saw inflows last year, with holdings increasing 62.9 tonnes to reach 1,244.4 tonnes. Asian gold-backed ETFs incurred outflows of 12.9 tonnes, while other regions had marginal outflows of 1.1 tonnes for the year.

The World Gold Council’s report does not offer insight on how gold-backed ETFs may fare in 2018, but the year appears to be starting off positively. Last week, the SPDR Gold Trust (ARCA:GLD) rallied for 11 days in a row, marking its longest winning streak since 2004, when it first came to market.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.