Ely Gold Royalties Announces Purchase of Isabella Pearl Royalty

Ely Gold Royalties (TSXV:ELY, OTC:ELYGF) (“Ely Gold”) is pleased to announce that it has entered into a binding letter agreement (the “Agreement”) with a private individual (“the Owner”) whereby Ely Gold, through its wholly-owned subsidiary Nevada Select Royalty, Inc. (“Nevada Select”), a Nevada corporation, will acquire 100% of all rights and interests in the 0.75% (three quarters of one percent) Gross Receipts Royalty (the “Royalty”) of the Isabella Pearl Property (“Isabella Pearl” ), operated by Gold Resource Corp. (“GORO”) (NYSE American: GORO).

Ely Gold Royalties (TSXV:ELY, OTC:ELYGF) (“Ely Gold”) is pleased to announce that it has entered into a binding letter agreement (the “Agreement”) with a private individual (“the Owner”) whereby Ely Gold, through its wholly-owned subsidiary Nevada Select Royalty, Inc. (“Nevada Select”), a Nevada corporation, will acquire 100% of all rights and interests in the 0.75% (three quarters of one percent) Gross Receipts Royalty (the “Royalty”) of the Isabella Pearl Property (“Isabella Pearl” ), operated by Gold Resource Corp. (“GORO”) (NYSE American: GORO). Isabella Pearl is located in Mineral County, Nevada (see Figure #1) and GORO anticipates mid-year 2019 production.

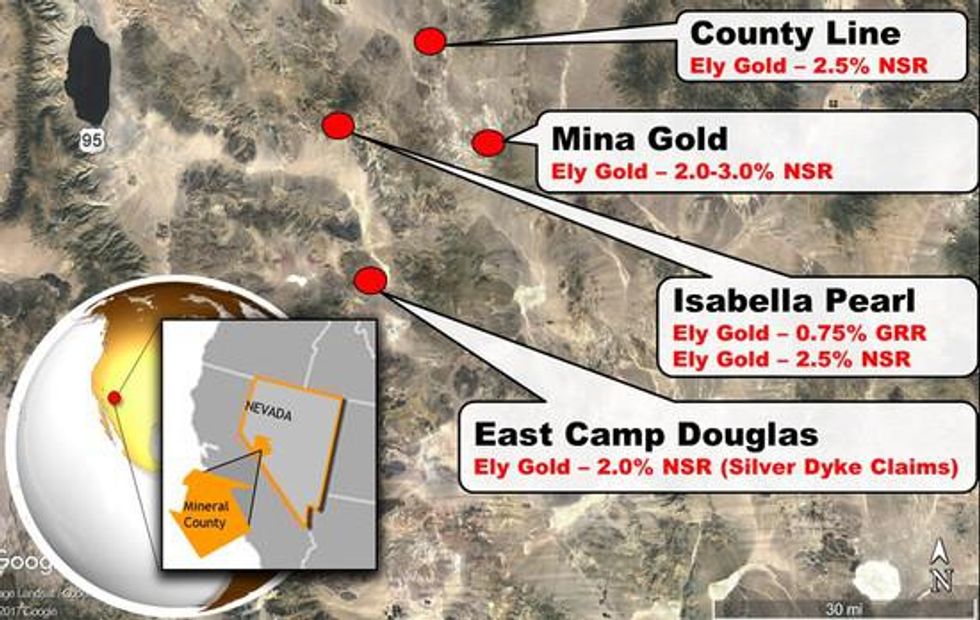

Ely’s purchase of the Isabella Pearl Royalty marks the fifth transaction that the Company has completed in concert with GORO’s consolidation of its Nevada Mining Unit (see figure #1). Total Ely Gold property sales to GORO of US$1,500,000 have created the following royalty structure:

- 0.75% GRR on current reserves on the Isabella Claims;

- 2.5% NSR on the exploration ground at Isabella Pearl;

- 2.5% NSR at County Line;

- 2-3% NSR at Mina Gold; and

- 2% NSR on certain claims at Camp Douglas.

Trey Wasser, President and CEO of Ely Gold Royalties commented, “We are very pleased to add this near-term production royalty to our rapidly growing portfolio. Our relationship with GORO continues to be an important part of our strategic growth profile.The purchase of the Isabella Pearl near-term producing royalty, and the other development assets operated by GORO, are one of the important foundations of our royalty portfolio. In addition to GORO, several of our option partners have now purchased multiple properties on which we hold option contracts or royalties. The ongoing purchases of multiple projects speaks to the quality of our properties and supports Ely Gold’s unique option model for generating revenue and royalties”

Under the Agreement, Ely Gold will pay the Owner a cash consideration of US$300,000. The closing date of the proposed transaction is expected to be on or around November 15, 2018 and is subject to completion of a definitive purchase and assignment agreement, Letters of Administration or Letters of Testamentary in the estate of John C. Longhurst, allowing for transfer of the Isabella claims and the Isabella Lease. The Royalty was created through a 0.125% (1/8%) interest in ten unpatented mining claims (the “Isabella Claims”), which are part of the property and a 0.125% (1/8%) interest in the Lease of Isabella Claims (the “Isabella Lease”) dated April 12, 1992. The Isabella Lease reserves a six percent (6%) Gross Receipts Royalty (“GRR”) on the Isabella Claims.

From a press release issued by GORO and dated June 18, 2018; “GORO has officially begun construction activities with the Ledcor Group commencing clearing and grubbing operations in preparation of heap leach pad construction. Processing equipment including the crushing plant and radial stackers, previously purchased are being stored in a nearby laydown yard, are being readied for transport to the Project site. One of two previously drilled water wells have had its pump set and completed for on-site water supply. The Isabella Pearl Gold Project is GORO’s flagship property in its Nevada Mining Unit, which also contains the Mina Gold, County Line, and East Camp Douglas properties. Production is expected to begin in June 2019.”

For information on Isabella Pearl Mineral Reserves and production estimates refer to report dated December 31, 2017 “Report on the Estimate of Reserves and the Feasibility Study on the Isabella Pearl Project” at https://www.goldresourcecorp.com/NV-development.php

Jerry Baughman, President of Nevada Select commented: “We continue to see robust demand for our U.S. properties. The strong, continuous growth in revenue from our royalty and option portfolio is now allowing us to purchase near-term production royalties such as Isabella Pearl and Fenelon (refer to news release dated October 10, 2018). Ely Gold has now successfullytransitioned from a prospect generator to a royalty company with assets in production and steady exploration news flow”.

Stephen Kenwood, P. Geo, is a director of the Company and a Qualified Person as defined by NI 43-101. Mr. Kenwood has reviewed and approved the technical information in this press release.

About Ely Gold Royalties

Ely Gold Royalties Inc. is a Vancouver-based, emerging royalty company with development assets focused in Nevada and the Western US. Its current portfolio includes 27 Deeded Royalties and 24 properties optioned to third parties. Ely Gold’s royalty portfolio includes fully permitted mines, mines under construction and development projects that are being permitted for mine construction. The Company is actively purchasing existing third-party royalties for its portfolio and all the Company’s Option Properties will produce royalties, if exercised. The royalty and option portfolios are currently generating significant revenue. Ely Gold is well positioned with its current portfolio of over 20 available properties to generate additional operating revenue through option and sale transactions. The Company has a proven track record of maximizing the value of its properties through claim consolidation and advancement using its extensive, proprietary data base. All portfolio properties are sold or optioned on a 100% basis, while the Company retains net smelter royalty interests. Management believes that due to the Company’s ability to generate royalty transactions, its successful strategy of organically creating royalties, its equity portfolio and its current low valuation, Ely Gold offers shareholders a low-risk leverage to the current price of gold and low-cost access to long-term mineral royalties.

On Behalf of the Board of Directors

Signed “Trey Wasser”

Trey Wasser, President & CEO

For further information, please contact:

Trey Wasser, President & CEO

trey@elygoldinc.com

972-803-3087

Joanne Jobin, Investor Relations Officer

jjobin@elygoldinc.com

604-488-1104

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer: This press release contains certain “forward-looking statements” within the meaning of Canadian securities legislation, including statements regarding the Company’s contemplated acquisition of the Royalty relating to Isabella Pearl, and GORO’s stated plans for further near-term exploration and development of the Isabella Pearl, Property. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “aims,” “potential,” “goal,” “objective,” “prospective,” and similar expressions, or that events or conditions “will,” “would,” “may,” “can,” “could” or “should” occur, or are those statements, which, by their nature, refer to future events. The Company cautions that Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the risk of accidents and other risks associated with GORO’s mineral exploration, development and extraction operations, the risk that GORO will encounter unanticipated geological factors, or the possibility that GORO may not be able to secure permitting, financing and other governmental clearances, necessary to carry out its stated plans for the Isabella Pearl Property, the Company’s inability to secure the required TSXV acceptance required for the Transaction, and the risk of political uncertainties and regulatory or legal disputes or changes in the jurisdictions where the Company carries on its business that might interfere with the Company’s business and prospects. The reader is urged to refer to the Company’s reports, publicly available through the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects

Figure #1

GORO Nevada Mining Unit

Ely Gold Royalty Structure

To view an enhanced version of Figure #1, please visit:

https://orders.newsfilecorp.com/files/4181/40572_a1540325248198_58.jpg

Click here to connect with Ely Gold Royalties (TSXV:ELY, OTC:ELYGF) for an Investor Presentation.

Source: www.newsfilecorp.com