Drill Tracker Weekly: Novo Drills Out Near Surface Oxide at Beatons Creek

Drill Tracker Weekly highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Drill Tracker Weekly highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Novo Resources Corp. (CSE:NVO)

Price: C$1.32

Market cap: C$80 million

Cash estimate: C$11.0 million

Project: Beatons Creek

Country: Australia

Ownership: Option to earn 70 percent

Resources: 8.9 million tonnes at 1.47 g/t gold

Project status: Additional resource drilling and deep hole

- Novo Resources announced additional holes from its Beatons Creek project in the Western Australia. The Company may earn a 70 percent interest in the project from Millennium Minerals (ASX:MOY) by completing a bankable feasibility study by August 2, 2016. The Company is 28 percent owned by an affiliate of Newmont Mining Corporation (NYSE:NEM).

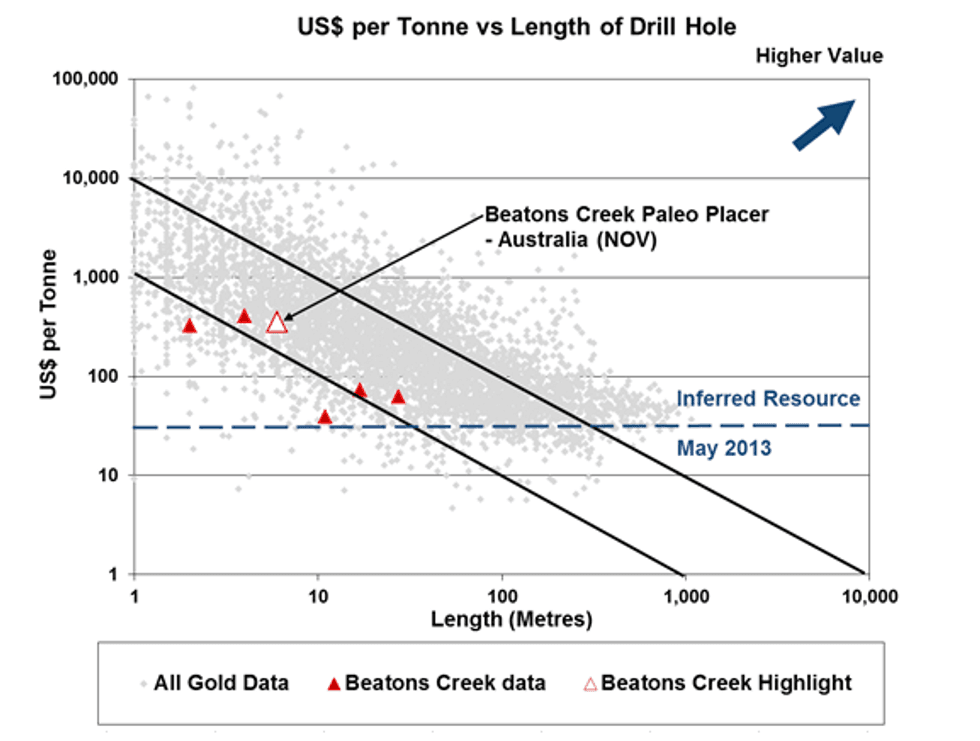

- The Beatons Creek prospect is a laterally continuous, near surface and oxidized “Witwatersrand type” gold prospect first confirmed with drilling in 1983. Highlights from the current near surface drilling include 6 meters of 8.77 g/t gold.

- In May 2013, the Company announced an initial resource estimate outlining 8.9 million tonnes averaging 1.47 g/t gold using a 0.5 g/t gold cut-off. The shallow drilling resulted in an exploration discovery cost of $6 per ounce gold. While the Beatons Creek grades are significantly lower than those from the Witwatersrand, preliminary metallurgical work indicates that the gold may be liberated by low cost gravity separation due to the almost complete oxidation of the near surface material.

- The Company has also drilled a deep hole 4 kilometers to the southwest of the oxide zone to test the lateral and vertical extent of the system. At a depth of 530 metres, the hole intersected narrow zones of “buckshot” pyrite in a conglomeritic layer typical of the higher-grade zones in the Witwatersrand deposit. Assays are expected later in March.

Early Discovery Holes: 2 meters at 10.8 g/t gold (Metana:1983); 7 meters at 2.88 g/t gold (Wedgetail:2007)

Current Holes: 6 meters at 8.77 g/t gold; 3 meters at 2.59 g/t gold; 4 meters at 3.70 g/t gold

Disclosure: I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable, but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. At the date of this release the author, Wayne Hewgill, owns no shares in the companies in this report.

This report makes not recommendations to buy sell or hold.