Commander Update on Hammerdown Royalty, Newfoundland

Commander Resources Ltd. (TSXV:CMD) is pleased to report that Maritime Resources has released the results from a PEA completed for the Hammerdown gold project

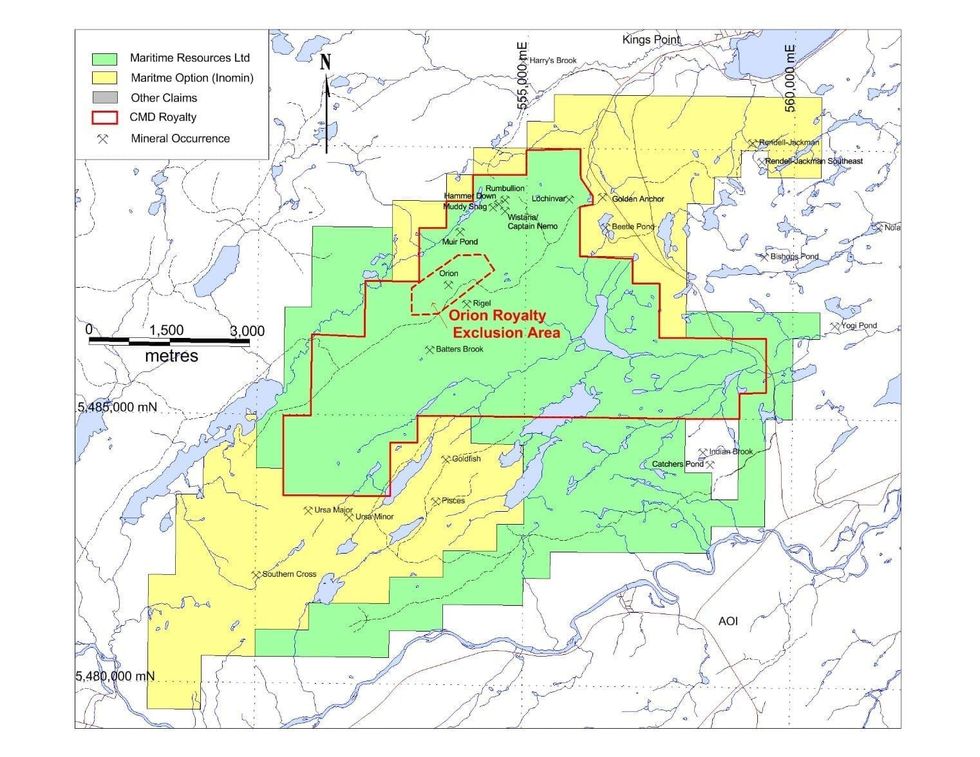

Commander Resources Ltd. (TSXV:CMD) (“Commander”) is pleased to report that Maritime Resources Corp. (“Maritime”) has released the results from a Preliminary Economic Assessment (“PEA”) completed for the Hammerdown gold project (“Hammerdown”), including the satellite Orion deposit, located in the Baie Verte mining district of Newfoundland and Labrador near the towns of King’s Point and Springdale. Commander retains a 2% Net Smelter Return Royalty (“NSR”) in which Maritime has the right to reduce to 1% for a one-time payment of $1,000,000. Commander’s royalty does not apply to the satellite Orion Deposit.

Highlights of Maritime’s Hammerdown PEA*

- After-tax NPV5% of $111.3M and 50.5% IRR (pre-tax NPV5% $191.8M and 75.4% IRR) at base case gold price of US$1,375/oz Au

- At US$1,500/oz gold the Project returns after-tax NPV5% of $154.1M and 65.1% IRR (pre-tax NPV5% $261.7M and 95.6% IRR)

- LOM total gold production of 521,500 oz, averaging 57,900 oz annually

- Average annual gold production of 69,500 oz in the first 5 years

- LOM cash costs of US$802.55/oz Au and LOM All-in sustaining costs (“AISC”) of US$938.80/oz Au

- Pre-production capital expenditures of $57.2M

- After-tax payback period of 1.5 years with base case pricing

- Commander retains a 2% NSR royalty in which Maritime has the right to reduce to 1% for a one-time payment of $1,000,000.

- Commander’s royalty does not apply to the satellite Orion Deposit.

The PEA highlights are based on the following:

- Exchange Rate (US$/C$) of $0.75

- Cash costs are inclusive of mining costs, processing costs, on-site general and administrative (“G&A”) costs, treatment and refining charges and royalties

- AISC includes cash costs plus estimated corporate G&A, sustaining capital and closure costs

*Cautionary Statement: The reader is advised that the PEA summarized in this press release was completed by Maritime and presented in a news release dated February 29th, 2020. Maritime sates that it is “preliminary in nature and is intended to provide only an initial, high-level review of the Project potential and design options. Readers are encouraged to read the PEA in its entirety, including all qualifications and assumptions. The PEA is intended to be read as a whole, and sections should not be read or relied upon out of context. The PEA mine plan and economic model include numerous assumptions and the use of Inferred Resources. Inferred Resources are considered to be too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and to be used in an economic analysis except as allowed for by NI 43-101 in PEA studies. There is no guarantee that Inferred Resources can be converted to Indicated or Measured Resources, and as such, there is no guarantee the Combined Project economics described herein will be achieved. The PEA will replace the 2017 pre-feasibility study technical report. The PEA was prepared in accordance with Canadian Securities Administrators’ National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101″)”

“The PEA provides an updated resource estimate and a base case assessment of developing the Project as a combined open pit and underground ramp-access mine (the “Combined Project”) with an on-site gold pre-concentration plant and mineral processing through the Nugget Pond mill gold circuit. A current PEA Technical Report will be filed on SEDAR under the Company’s profile within 45 days of the date of this news release. All financial figures are presented in Canadian dollars (C$) unless otherwise noted.”

“The PEA was prepared through the collaboration of the following firms: WSP Canada Inc. (Sudbury, ON) (“WSP”), AGP Mining Consultants Inc. (Toronto, ON) (“AGP”), Halyard (Toronto, ON), Canenco Consulting Corp. (Vancouver, BC), SRK Consulting UK (Cardiff, UK), and GEMTEC Consulting Engineers and Scientists (St. John’s, NL). These firms provided Mineral Resource estimates, mine design and cost estimates for mine operations, process facilities, major equipment selection, waste rock and tailings storage, reclamation, permitting, and operating and capital expenditures.”

The Hammerdown Mine was last operated by Richmont Mines between 2000-2004 producing 143,000 ounces of gold at an average mine grade of 15.7 g/t gold through a combination of narrow vein open pit and underground mining. About 270,000 tonnes of ore mined from Hammerdown was processed at the Nugget Pond mill with recoveries over 97% in a conventional carbon-in-pulp (CIP) gold circuit.

About Commander’s Royalty

Commander retains a 2% Net Smelter Return Royalty (“NSR”) in which Maritime has the right to reduce to 1% for a one-time payment of $1,000,000. Commander’s royalty does not apply to the satellite Orion Deposit (Figure 1). Allowed deductions include transportation costs and toll milling charges.

Robert Cameron, P. Geo. is a qualified person within the context of National Instrument 43-101 and has read and takes responsibility for the technical aspects of this release.

About Commander Resources:

Commander Resources is a Canadian focused exploration company that has leveraged its success in exploration through partnerships and sale of properties, while retaining equity and royalty interests. Commander has a portfolio of base and precious metal projects across Canada. Commander also retains royalties from properties that have been partnered, optioned or sold.

On behalf of the Board of Directors

Robert Cameron, P. Geo.

President and CEO

For further information, please call:

Robert Cameron, President and CEO

Toll Free: 1-800-667-7866

info@commanderresources.com

@CommanderCMD

www.commanderresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may include forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements except as required under the applicable laws.