Final Stats, Event Sentiment and More: PDAC 2020, Days 3 and 4

PDAC is over, and while attendance was impacted by coronavirus concerns, sentiment among those walking the floor was generally positive.

It’s a wrap for this year’s Prospectors & Developers Association of Canada (PDAC) convention.

Booths and displays are packed up, final numbers on attendance are out and those who came to the event are recovering from four days of walking the floor.

If you didn’t make it to the show or just weren’t able to take everything in, read on for a brief overview of the third and fourth days. You can also click here for day one coverage and here for day two.

Coronavirus impact stretches beyond gold

Conversations about the impact the COVID-19 coronavirus could have on commodities continued throughout PDAC. While gold was the primary metal discussed (for more, see our day one round-up), it’s worth highlighting some of the commentary on other metals.

For example, CRU Group’s Vanessa Davidson said her firm expects the disease to have at least a short-term effect on copper.

Vanessa Davidson of @CRUGROUP : #Coronovirius has cancelled out any short-term growth in #copper. #PDAC2020 #INNatPDAC

— Resource Investing (@INN_Resource) March 1, 2020

Ryan Cochrane of Open Mineral spoke about how COVID-19 has changed the market dynamics for zinc, another base metal.

Ryan Cochrane: expectations from Chinese #zinc smelters were high for mine supply, so they were aggressive about TCs, but #coronavirus has changed that. #PDAC2020 #INNatPDAC

— Resource Investing (@INN_Resource) March 1, 2020

Finally, Alex Laugharne, also of CRU Group, spoke to the Investing News Network (INN) about how lithium is weathering coronavirus developments, saying that while it’s early days yet, it will make working in the space more challenging.

Attendance strong despite coronavirus worries

PDAC was marked this year by speculation about attendance, with coronavirus concerns causing both companies and individuals to pull out in the days and weeks before it kicked off.

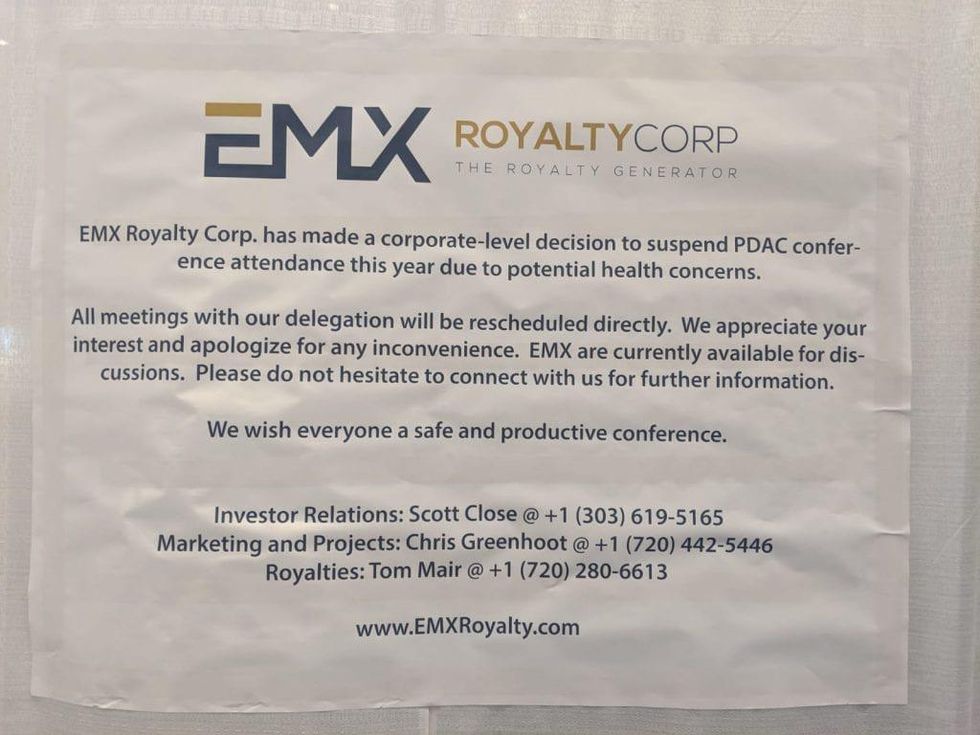

Absences include EMX Royalty (TSXV:EMX,NYSEAMERICAN:EMX), which left a sign in its booth explaining that it was suspending its attendance due to “potential health concerns.”

Image credit: Scott Tibballs.

Once the convention began, speculation only intensified — day one was widely regarded as slow, but the general consensus seemed to be that days two and three felt more normal.

Speaking with INN on the second day of the convention, PDAC President Felix Lee said that while he and other organizers were concerned about attendance in the lead up to the show, he began feeling more positive once it was underway.

“I would be lying if I said that we didn’t consider (canceling the show), we definitely did,” said Lee.

Final attendance numbers shared by PDAC on Wednesday (March 4) afternoon show that Lee wasn’t wrong to be optimistic — in total, 23,144 people came to the event.

#PDAC2020 exceeds 23,000 attendees! Read the full press release on our website.

— The Official PDAC (@the_PDAC) March 4, 2020

This year’s number “highlight(s) the resilience and innovation of the international mineral exploration and mining sector,” according to PDAC. It’s down from 25,843 in 2019 and 25,606 in 2018.

PDAC attendees upbeat about sentiment

Discussions about the mood at PDAC went hand in hand with talk of attendance, and INN’s final poll focused on sentiment compared to other years.

Interestingly, despite the headwinds, over 50 percent of respondents said that sentiment was better than in previous years. Around 25 percent said sentiment was the same as in other years, and only about 18 percent described it as worse.

It’s time for our final #PDAC2020 poll! We want to know how you think sentiment at this year’s convention compares to previous years. We’ll share the answers in a video later today! #INNatPDAC

— Charlotte McLeod (@Charlotte_McL) March 3, 2020

To learn more about what happened at PDAC, click here for our coverage of day one and click here for details on day two. PDAC will be held next year from March 7 to 10. We’ll see you there!

Image courtesy of www.pdac.ca.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Western Copper and Gold is a client of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.