In its latest Base Metals Monthly Watch, CIBC notes that on May 28, the seaborne metallurgical coal price saw its largest rise since November 4 of last year. Overall, CIBC is forecasting an average met coal price of $114.

In its latest Base Metals Monthly Watch, CIBC notes that on May 28, the seaborne metallurgical coal price saw its largest rise since November 4 of last year.

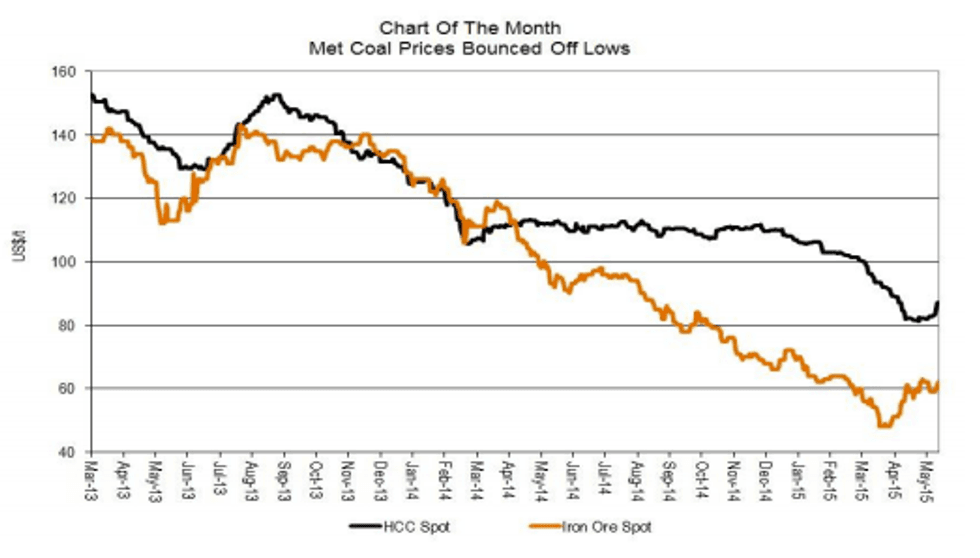

The price of spot FOB hard coking coal from Australia gained $1.90 to reach $85.20 per tonne. Though that’s still well below where met coal was at the start of the year — around $110 per tonne — CIBC states that it’s gaining confidence that met coal’s 11-year low of $81.15 “will not be tested again.”

“In the coming months, we see an eventual constructive dynamic for the met coal market and expect that at current spot prices of ~$85/t, further production cuts will have to be made by higher-cost producers,” the report reads. “Ultimately, this should prove positive for coal pricing.”

CIBC estimates that about 25 percent of global seaborne met coal production is “underwater on a cash cost basis at current spot prices,” adding that roughly 40 million tonnes of production have come offline in the past few years. Indeed, low prices forcing production offline has been a running theme in the coal space as of late. Joe Aldina of Wood Mackenzie said back in September that although coal producers have held against ever-falling prices by continuing to cut costs, he didn’t see costs going appreciably lower, and anticipated some producers “finally, at long last” dropping out of the market.

However, “finally” is the operative word there. CIBC, Wood Mackenzie and other firms have noted that coal producers held on longer than expected in the face of falling prices, and that the slower-than-expected response has weighed on coal forecasts.

“While coal producers have announced cutbacks and mine closures under the current weak prices, the implementation of these cuts was slower than anticipated,” CIBC states in its report, adding, “[f]urther production cuts will have to be made by higher-cost producers.”

Certainly there’s more pressure on producers to implement production cuts. The firm points out that despite the price rise, the spot met coal price is still near an 11-year low, which is causing some suffering for higher-cost producers. In recent weeks, Glencore (LSE:GLEN) has cut 80 jobs from its Collinsville coal mine in Queensland, and Alpha Natural Resources (NYSE:ANR) has announced plans to idle more of its coal operations in the Central Appalachian region of the United States.

Even Teck Resources (TSE:TCK.B,NYSE:TCK), which has been cited for keeping its operations above water, announced plans for staggered, three-week shutdowns at each of its Canadian coal mines in Q3 to “align production and inventories with changing coal market conditions.”

“Rather than push incremental tonnes into an over-supplied market, we are taking a disciplined approach to managing our mine production in line with market conditions,” said Teck CEO Donald Lindsay in a statement. Certainly, coal investors will be heartened to see producers taking a more measured response to oversupply, even if they’ll still have to wait for those changes to come through in pricing.

Overall, CIBC is forecasting an average met coal price of $114. The firm expects met coal to reach $140 in 2016 after announced supply cuts come into effect.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Related reading:

Morgan Stanley Coal Price Outlook

Jonny Sultoon Talks Coal Price and Coal Market Outlook at PDAC 2015