Drill Tracker Weekly: NexGen Drills Best Interval to Date at Arrow Zone

NexGen Energy announced the strongest mineralized interval to date from drilling at the Arrow target at its Rook 1 project. The project is located in the Athabasca Basin 2.1 kilometers north of Fission Uranium’s PLS project.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

NexGen Energy (TSXV:NXE)

Price: $0.77

Market cap: $151 million

Cash estimate: $28 million

Project: Rook 1

Country: Canada

Ownership: 100 percent

Resources: N/A

Project status: Exploration drilling

- NexGen Energy announced the return of the strongest mineralized interval to date from its winter drilling campaign from the Arrow target on its 100% owned Rook 1 project. The project is located in the southwestern Athabasca Basin 2.1 kilometres north of Fission Uranium’s (TSX.FCU) Patterson Lake project.

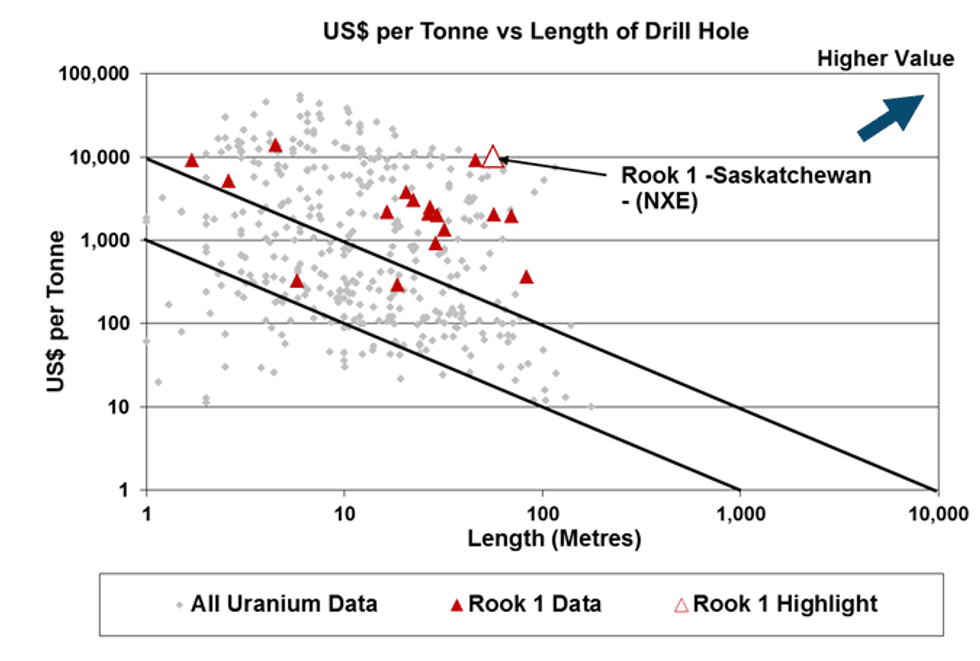

- Angled drilling intersected the best mineralized interval to date from the steeply dipping zones of basement hosted mineralization in the A2 Shear and A3 shear zones. AR-15-44 intersected a 168 metre long zone (43.6 metres estimated true thickness) grading 5.00% U3O8 (allowing for 4.5 metres of internal dilution – 1.1 metres estimated true thickness). Highlights include 68.5 metres grading 9.56% U3O8 starting from 499 metresdepth including 20.0 metres of 20.68% U3O8.

- The Arrow zone has now been outlined in three separate shear zones with A2 and A3 being the most significant. The total area of the three zones extends over an area of 515 metres by 215 metres with a core strike length of 300 metres. The vertical extent starts at 100 metres depth extending to 920 metres.

- It is significant to note that the new high-grade interval not only represents the longest mineralized interval to date, but it occurs on the southwest extent of the mineralized A2 and A3 shears at a point where the two zones appear to be getting closer together. Sections on the Company presentation show the analogy with Cameco’s (TSX:CCO) operating basement hosted Eagle Point Mine on the eastern edge of the Athabasca basin.

- The Company has commenced a five rig, 25,000 metres drilling program targeting a 43-101 resource by late Q4/2015. The Company is well financed with $30 million in working capital. Recent drilling at the Bow target 3.7 kilometres to the northwest of Arrow intersected a 2.5 metre zone of anomalous mineralization including 10 centimetres of off-scale mineralization with assays pending

Discovery Hole (February 2014): 5.75 meters at 0.37 percent U308

Current Drilling: 56.5 meters at 11.5 U308 including 20.0 meters at 20.68 percent U308

Risk Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns shares in the following companies in this report: Fission Uranium Corporation (TSX:FCU)

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.