Drill Tracker Weekly: Fission Adds Additional High-grade Uranium to 600W Discovery

Fission Uranium announced results from an additional 10 angled holes its Patterson Lake South project in the Southwestern Athabasca Basin in Saskatchewan. They include high-grade uranium from its recently discovered 600W zone.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Fission Uranium (TSX:FCU)

Price: $1.14

Market cap: $435 million

Cash estimate: $29 million

Project: Patterson Lake South

Country: Canada

Ownership: 100 percent

Resources: 79.6 M pounds @ 1.58% U3O8 (indicated); 25.8 M pounds @ 1.30% U3O8

Project status: Resource definition, PEA in summer 2015

- Fission Uranium announced results from an additional 10 angled holes its 100% owned Patterson Lake South project in the southwestern Athabasca Basin in Saskatchewan. This included high-grade uranium from its recently discovered 600W Zone. The new zone is located 555 metres west of the Company’s basement hosted Triple R resource announced on January 9, 2015.

- Highlights from the current angled drillhole include 31.5 metres grading 11.09% U3O8 starting at a core depth of 102 metres, including a higher grade interval of 28.32% U3O8 over 12.0 metres. The 600 Zone has been intersected from 585W, where a narrow zone of strong mineralization was intersected at 300 metres depth to line 645W were near surface drilling has intersected 56 metres of anomalous mineralization with locally high scintillometer readings. (Assays pending)

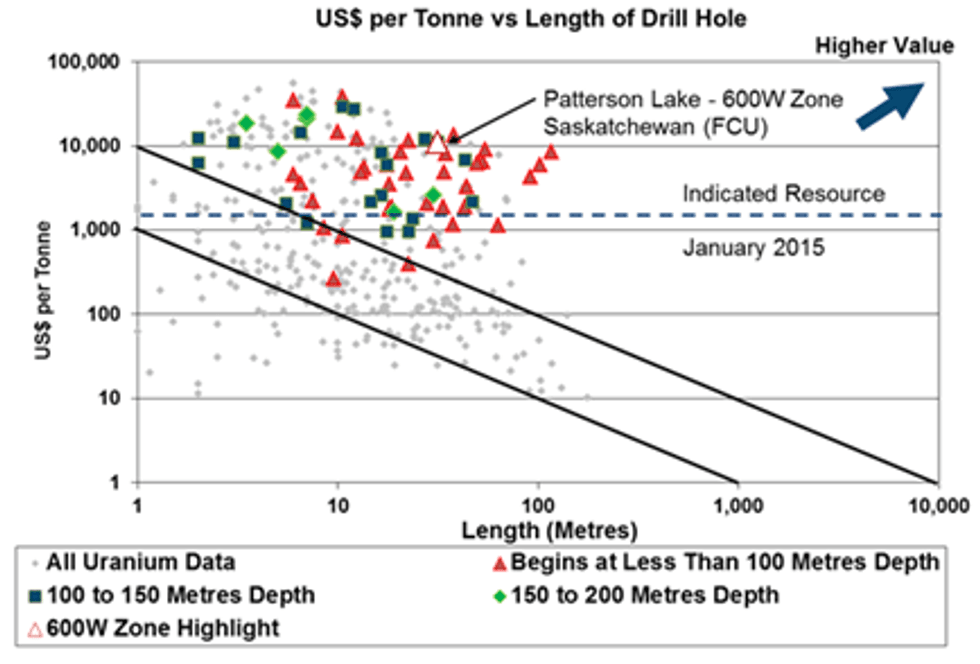

- In January 2015, the Company announced a preliminary 43-101 compliant indicated resource estimate of 79.6 million pounds at a grade of 1.58%U3O8 including high-grade core of 44.2 million pounds at 18.21% U3O8. The 43-101 resource also included an inferred resource estimate of 25.8 million pounds grading 1.30% U3O8. The Drill Tracker Chart for Fission plots the previous drillholes based on the starting depth of the mineralization showing the abundant number of near surface holes above 150 metres depth.

- The near surface basement hosted mineralization is contained within four separate zones extending over 2.25 kilometres of strike length. Additional targets occur to the south in the Forrest Lake Corridor which has a similar geophysical signature. The 780 Zone is located beneath the 6 metre deep Paterson Lake.

- The Company plans to complete a PEA for summer 2015.

Discovery hole Patterson Lake South (Nov 2012): 8.5 metres @ 1.07% U3O8

Discovery hole 600W (March 2015): 9.0 metres @ 14.74% U3O8

Current holes (600W discovery): 31.5 metres @ 11.09% U3O8 including: 12.0 metres @ 28.32% U3O8

Risks Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

1. The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns shares in the following companies: Fission Uranium Corp. (TSX.FCU), Roxgold Inc (TSX:ROG).

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.