Ecuador - A Renaissance in Mining Investment Attractiveness?

Junior Stock Review founder Brian Leni shares why he thinks Ecuador represents a tremendous mining investment opportunity right now.

Lately, I’ve spent a lot of time debating the criteria I use and the level of risk I’m willing to take with regards to jurisdiction. I find the topic of jurisdictional risk very interesting because, although, there’s a quantifiable aspect to jurisdiction, I believe many of the general opinions regarding jurisdictional risk are based on qualitative observations or anecdotal themes that are proliferated through mainstream media.

A good example is Russia. Many jump to the conclusion that it’s a VERY risky country and, therefore, not a place to invest. I don’t necessarily disagree; most of the propaganda about Russia, today, is ‘negative.’

Let’s, however, take a look at one of the criteria listed by the Fraser Institute in its examination of jurisdictional risk; political stability. Relative to its peers, Russia scored low, which too many translate into ‘stay away.’ While political stability is a complex factor, I was taken aback when a friend, whose company does business in Russia, said he finds this scoring comical; “does anyone really think there’s going to be some serious political upheaval while Putin is in charge?” Given the complexity of evaluating political stability, his answer isn’t complete, but it still reveals the contrast in views – those who have experience in these ‘risky’ jurisdictions, and those who rely solely on narrative to form their opinions.

Last year, one of the mining industry’s best, Rick Rule, gave me some sage advice on jurisdictional risk;

“My own experience is that most investors equate political risk to their emotion rather than to reality, and you tend to react more strongly to political risk that you haven’t experienced or don’t understand. My own belief is that money that is stolen from me by white people in English, according to the rule of law, is just as gone as money that is extorted from me in some third world kleptocracy.

My experience, further, by doing business internationally, and this is going to sound like a generality, which it is, but it is also true, countries that can’t get any worse don’t, and countries that can’t get any better don’t, either. This plays out over time, not immediately, but the truth is, the countries that have rewarded me the best are countries that have been coming off low bottoms. An example would be Chile, with a superb exploration endowment coming off, first, the idiocy of socialism under Allende, and then, the murderous regime of Pinochet. The response of the geology in Chile to stability and the sort of social sense that they had had enough of rightist and leftist autocracy was spectacularly good for me. I made money in hard places like Russia, Sudan, Congo. The truth is that most of the great, easy to find, tier one deposits that exist in countries that have been able to be explored efficiently in the last 40 years have been made. The big tier 1 discoveries that have yet to be made are going to be made in places where there have been problems with access or problems with cost of capital. Places like the Tethyan metalagentic belt, running through Turkey, Pakistan, Kazakhstan, Afghanistan, Uzbekistan, Kyrgyzstan, Mongolia, those types of places. The easy deposits in safe places have mostly been found.” ~ A Conversation with Rick Rule, CEO of Sprott US Holdings

With this in mind, and through my process of due diligence, I believe Ecuador is a country which is coming off a bottom in terms of mining investment attractiveness. I’m a buyer of what I believe are the highest quality junior mining companies exploring and developing projects in Ecuador, and believe that money invested now, near the bottom, gives the investor a great risk to reward opportunity.

Ecuador

- Capital City — Quito

- Population — 16.529 million

- Currency — U.S. Dollar

- 2017 GDP — $70.955 billion USD

- 2017 Unemployment Rate — 4.34%

- Main Industries — Petroleum (more than 40% of exports), food processing, textiles, wood products and chemicals

- Main Export Partners — United States, Chile, Peru, Colombia, Japan and Russia

*All Figures taken from IMF website

Ecuador’s economy is the 8th largest in South America and is driven by the oil industry, where petroleum makes up almost half of the country’s exports. The agriculture sector is a distant second with a little more than 10% of exports.

NOTE: Ecuador is the largest banana producer and exporter in the world.

Ecuador’s oil production began in the early 1970s and is clearly the main driver of the economy. In the years before oil production, Ecuador was a country whose people identified with an agrarian social philosophy, meaning they valued rural society as superior to urban society. With the influx of cash into the country, this has slowly started to change and, in my opinion, is a key point in understanding the Ecuadorian culture.

Social Unrest — Taxes and the Environment

Looking into Ecuador’s past, it’s evident that its people are not afraid to protest, especially when it comes to the environment or a number of social issues. Ultimately, moving forward, the government will have to choose how they deal with future protests but, either way, social unrest surrounding a potential mine site could have a major impact on the success of the project.

Environment

If I were to pick the most likely point of contention regarding mining’s future in Ecuador, it would be related to the environment. Ecuador is near the top of the world list of biodiversity hotspots in terms of vertebrate species, endemic vertebrates and plants. Specifically, the Intag region, named for the river that runs through it, spans two of the world’s 34 most biologically important areas.

This biodiversity is highly coveted by many who live within Ecuador and many of the environmental NGOs around the world. Doing a quick search of environmental organizations with propaganda referencing Ecuador reveals a long list of interested parties including, The Ecologist and Fund My Planet.

While there is the potential for turmoil regarding the environment, I think that the probability of there being issues can be reduced if handled correctly by the mining companies. By ‘handled correctly,’ I think it’s really important to educate and support the local communities in the region with which you’re developing or exploring. Educate on the benefits of mining and how the company intends to protect the environment in which it’s working.

Additionally, an X-Factor in this type of relationship are ties with Ecuadorian companies that have operated within the country for many years. I think the companies that leverage their relationships within Ecuador are miles ahead of those who try to navigate the culture and government from the ground floor.

There’s one such relationship which I think has a ton of potential to bring shareholders value through their expertise and recognition within the local communities. Adventus Zinc Corporation and Salazar Resources (SRL:TSXV) have this type of agreement, and I had the opportunity to ask Sam Leung, Adventus’ VP Corporate Development, about it.

Adventus Zinc Corp. (ADZN:TSXV)

MCAP — $45.5 million (at the time of writing)

Brian: In your opinion, why was it important to have a partner, such as Salazar, in Ecuador?

Sam: Local know-how is often invaluable, particularly in the mining sector and developing jurisdictions such as Ecuador. Many foreign companies and corporate personnel often fail to recognize what they do not know about a project jurisdiction and its normal business and community practices, so a trusted local partner can add significant value with operational experience and local networks. For Adventus’ Curipamba Project and the Ecuador country-wide alliance, a strong partnership has been formed with Fredy Salazar and his local Salazar Resources team, who are pioneers in Ecuadorean mineral exploration with over 30 years in their home country. The Salazar team work closely with Adventus to help expedite and complete tasks in country with minimal complications, and share important business insights from domestic developments.

Brian: What do you see as the biggest risk for mining investment in Ecuador?

Sam: We perceive community relations and integration to be the biggest risk not just for mining investment in Ecuador but most other developing countries. Each project has different stakeholders and dynamics, so investors need to be aware of management teams’ capabilities and limits in addressing social needs in project development. For the Curipamba Project, the Salazar team are well-respected members of the project communities, while Adventus brings additional resources and international best-practices to address social needs.

Left-Leaning Socialism

The political philosophy which I’m most apprehensive about, especially from an economic standpoint, is left-leaning socialism. Throughout history, political structures rooted within these frameworks have been bad for business.

I believe, however, that given the obvious PUSH toward reducing taxes and attracting mining investment dollars, at least in the short-term, the risk associated with this form of political philosophy is reduced, but never too far away.

For me, when a political philosophy is so ingrained in the culture of a country, it’s only a matter of time before the cycle shifts and once again reflects the country’s history during Correa’s rein. I’m very optimistic that the next few years will remain positive for mining investment, but will remain open-minded about the subtleties that may be indicating a reversion back to the mean!

The Last 10 Years

A major turning point in Ecuador’s history, in terms of how it relates to mining, occurred in November 2006 with the election of Rafael Correa as President. Interestingly, Correa’s 10 years as President was unusual given the fact that there had been 7 different Presidents in the previous decade.

Correa’s appeal to the Ecuadorian people appears to have been rooted within socialist or left-leaning political philosophy, which saw a major portion of tax dollars diverted into social causes, such as healthcare, education and agricultural subsidies. Additionally, and more to the point of this article, Correa focused his attention on extracting more cash from the mining business.

In April of 2008, Correa’s government adopted a new mining mandate which restricted companies to holding a maximum of three concessions and instilled a 180-day suspension of activities for almost all mining concessions in Ecuador while a new mining law was put together. This controversial move did not go over well with investors, and most of the mining companies which held property in Ecuador, as they saw their share prices fall in response to the news.

Months after, still under the guise of the new mining mandate, Aurelian Resources sold their multi-million gold ounce deposit, Fruta del Norte, to Kinross Gold Corporation for $1.2 billion. I believe this deal single-handedly marked the height of ‘doom,’ so-to-speak, of the hard-rock mining industry within Ecuador. Over the coming years, Kinross participated in negotiations with the government over terms to develop Fruta del Norte into a mine but, ultimately, couldn’t come to an agreement.

As cited in many articles relating to the negotiations, the Ecuadorian Government insisted on a 70% windfall profits tax, which, in essence, would limit the profitability of the mine in a rising gold price environment. Ultimately, this led to negotiations falling apart in 2013. Within a year, Kinross formally stepped away from Fruta del Norte with its sale to Lundin gold for $240 million – a whopping 80% loss!

As I stated, I believe this marked the low point for hard-rock mining in Ecuador; outside of nationalizing Fruta del Norte, selling it for a fraction of the purchase price because of negotiations with the government had a major effect on how the mining industry viewed investment within Ecuador’s borders.

The failure of these negotiations is clearly visible in the popular Fraser Institute Rankings, as Ecuador’s score for mining investment attractiveness fell to a low of 38.1, ranking it 80th out of the 122 countries that were covered by the 2013 report. In the years since, Ecuador has slowly improved its ranking with a score of 45.9 in 2014, 45.36 in 2015, 50.38 in 2016, and 52.09 in 2017. While this is a marginal improvement year over year, the score is headed in the right direction, and one which, I believe, will improve again in 2018.

2018

Why do I believe that Ecuador’s mining investment attractiveness score is going to continue to improve in 2018? Great question and one that needs to be explained in further detail, as Ecuador’s past needs to be kept in perspective when making prognostications.

Goal of Attracting $4.6 Billion Investment Dollars Over the Next 4 Years (2021)

In May 2017, Lenin Moreno replaced Correa as President of Ecuador. While much of what I have read describes Moreno as having a socialist or leftist political philosophy that’s very similar to Correa’s, Moreno has publicly stated a desire to attract close to $5 billion for Ecuador’s mining sector. This is a lofty goal because, in my opinion, they will have to make great strides with regards to changing their image in the mining sector in order to accomplish this.

At this year’s PDAC, Ecuador may have made a crucial step in improving their image, as they were the headline country sponsor for the event and had a large booth at the show. While advertising is great and a step in the right direction, if they don’t take action to improve the country’s mining investment attractiveness, it may be all for not.

Even before this advertising PUSH, however, Ecuador has shown that it’s poised to change. The biggest change, in my mind, comes with hiring Wood Mackenzie as a consultant to assist in changing Ecuador’s mining tax regime, making it competitive with the rest of the world.

Here’s a list of some of the positive fiscal and financial reforms made over the last few years:

- Value Added Tax (VAT) Recovery — Starting in 2018, VAT will be recoverable for mineral exports

- Windfall Tax — A bill has been expedite to remove the windfall tax, and should be approved in the next 30 days.

- Sovereign Adjustment

- Currency Transaction Tax — exemption on tax relating to currency outflows

- Accelerated Depreciation — Investors’ choice of 5-10 years (locked in fiscal stability contract)

- Fiscal Burden — For example, the fiscal burden on a large scale copper project has dropped from 30% to 23% with the changes to the tax regime

NOTE: Review Wood Mackenzie “Ecuador Tax Regime”

Brian: Of the positive fiscal and financial reforms made by the Ecuadorian government to date, which do you feel will be the most effective in changing perception of the mining community?

Sam: We believe the significant reduction in the Windfall Tax terms over the past few years has been integral to changing the investment perception. Due to the negative connotations, we also believe the government of Ecuador could go further and remove the Windfall Tax outright, but that remains to be seen. Please refer to our corporate presentation on the Adventus website for more details on the Windfall Tax.

Brian: In your opinion, is there anything else that needs to occur to change the perception of the mining and investment communities?

Sam: With regards to exploration investment jurisdictions globally, Ecuador has been arguably the hottest over the past 12 months and this momentum continues. Longer term, we believe a significant milestone for Ecuador will be the completion and successful commercial operation of the first large mines which are currently in construction. Once these foreign companies demonstrate returns on their investments, many more deep-pocketed investors will be drawn into Ecuador.

Cash Flow Back Into Ecuador

As Ecuador’s actions align with the statements they’ve made about bringing mining investment dollars to the country, cash has begun to flow back into the country’s hard-rock mining sector. Arguably the best example of this comes from Lundin Gold and their push toward the development of Fruta del Norte.

Fruta del Norte

On January 14th, 2016, Lundin Gold announced that they had completed the negotiation of the definitive form of the Exploitation Agreement for the Fruta del Norte Project with the Government of Ecuador. The completion of this Agreement is a huge milestone given the controversy associated with its history. For those interested in reviewing the details of the Agreement, please follow the link to the news release.

The completion of the Agreement was very important, but most important is Lundin’s ability to take the Agreement and put it into action via financing for the development of the Fruta del Norte Project. On March 26, 2018, Lundin Gold took a major step forward by announcing that they would be closing their $400 million USD equity private placement. In my opinion, while the risk to reward ratio is very much in favour of Lundin Gold, considering the upfront capital cost vs. upside potential related to expected gold production, raising this amount of cash for a gold project located in Ecuador speaks volumes about how the market is changing its view of the country, and Lundin’s level of influence within the industry.

Collaboration — Chile and Ecuador

On March 10th, 2018 Codelco, the world’s largest copper miner, announced that Chile’s Minister of Mining, Aurora Williams, and her counterpart in Ecuador, Rebecca Illescas, signed a joint declaration that strengthens the agreements of the Codelco-Enami EP alliance, and expedites the execution of the Llurimagua bi-national copper project, located in northeast Ecuador.

To date, there has been $34 million USD spent on the Llurimagua Project. It’s expected that the total will be upwards of $50 million USD by the end of the advanced exploration phase. The signing of the agreement and the money being spent by Codelco on the Llurimagua Project is another example of the changing tides in Ecuador.

Cascabel

One of the hottest stories in the junior mining sector in 2017 was about Sol Gold, which is developing Cascabel, its porphyry copper-gold deposit, located in the Imbabura province in the northwest region of Ecuador.

Cascabel is a great example of the mineral potential that exists within Ecuador. Clearly, investors are attracted to Sol Gold with their high-grade copper over wide intervals, such as that which was found in Cascabel Hole 12 and produced an interval of 1560 meters at 0.93% CuEq, or Hole 9, which produced an interval of 1197.4 meters at 1.16% CuEq.

Are mining investors avoiding Ecuador? Glancing at Sol Gold’s stock chart, I think the answer is no. With Ecuador’s push toward change in its hard-rock mining policy, and what looks to be world-class mineral potential, investors are clearly interested in the risk to reward potential.

Ecuador’s Potential

In my opinion, the top reason for investing in junior mining companies that are exploring or developing projects in Ecuador is the mineral potential that exists within its under explored borders. Also, more with regards to the projects that are in development, Ecuador produces 90% of its internal energy requirements via hydro electric dams, giving Ecuador some of the cheapest electricity in the world.

Mineral Potential

Ecuador is located on the northwest coast of South America and is host to the northern portion of the Andes Mountain chain. The Andes are famous for their mineral endowment, as a couple of South America’s most prolific mining countries, Chile and Peru, have produced some of the richest deposits in the world.

In a presentation entitled, Geological and Mining Potential in Ecuador, John Efrain Bolanos cites,

“the spatial-time distribution of the Cu porphyries and related epithermal mineralizations of the Peru metallogenic belts are very similar to those ones in Ecuador.”

Source: John Efrain Bolanos Presentation — Geological and Mining Potential of Ecuador

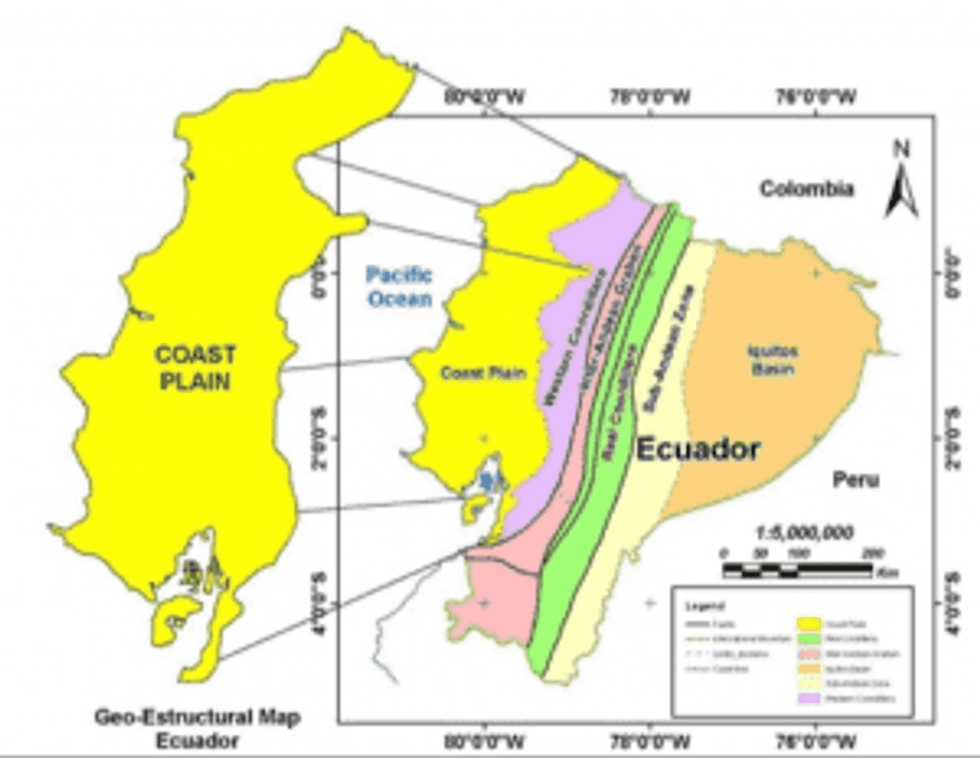

From Bolanos’ presentation, Ecuador can be broken down into 6 geo-structural domains, which showcase Ecuador’s geological potential:

- The Fore Arc Basin of the Coast

- Cretaceous to Cenozoic basin underlain by aloctonous basaltic ocean crust

- Western Cordilera

- Formed by an accretionary prism mainly of ocean crust composition, continental crust and accreted Late Mesozoic to Cenozoic ocean terrains

- Interandean Graven

- Formed by thick and large Oligocene to Miocene volcano-sedimentary sequences

- Real of Central Cordilera

- Formed by several litho-tectonic divisions of Andean bearing and separated by regional faults. Guamote division, Alao division, Loja division, Salado division and Zamora division

- Eastern Subandean Zone

- Formed by forearc belt of the basement covered by volcano-sedimentary sequences

- Back Arc Basin of Iquitos

- Comprises of Oriente or Amazonian basin mainly formed by sedimentary and volcano-sedimentary sequences

Given Ecuador’s favourable geography, similarities to a couple of the world’s most prolific mining countries and lack of modern exploration activity, Ecuador may be one of the world’s last frontiers for potential world-class deposit discoveries.

Brian: Was Ecuador’s mineral potential a factor, first, in choosing the Curipamba Project, and second, in expanding upon the exploration and development deal with Salazar?

Sam: In our global hunt for zinc-related projects in 2017, the quality of the Curipamba Project with respect to its high grade El Domo deposit and the additional exploration potential over its 22,000 hectare area stood out when compared with other known projects and operations globally. During our due diligence process, we also recognized the scale of potential discoveries within under-explored Ecuador and how a well-aligned partnership with Salazar would provide us with first-mover advantages during Ecuador’s adolescence as a mining jurisdiction. Ecuador’s mineral potential, located between Peru and Colombia, is at the heart of the investment thesis.

Concluding Remarks

It’s my contention that Ecuador is in the midst of a renaissance toward perceived mining investment attractiveness. While there’s a conscious effort being made by the Ecuadorian government to attract global mining industry investment, I believe investors and mining companies are rightly skeptical about placing their money in a place where so much destruction to capital has occurred in the past.

In my opinion, the risks that pose the largest threat to investment dollars still exist and will not cease to exist at any point in the future. I believe the Ecuadorian people have a culture which is rooted in left-leaning socialism. Currently, the pendulum, while still hanging under the socialist umbrella, has pushed further right and will remain there for the next few years, but will revert back to the mean at some point in the future – to that I think it’s inevitable.

Additionally, given the biodiversity of Ecuador and the global push toward environmental diligence, mining within Ecuador’s borders will always ‘walk the line’ between being accepted and being protested. Companies that do not make an effort to explain how they will protect the environment and the other benefits of mining to the communities will not be successful.

While the risk associated with investing in Ecuador is very real, I believe there’s tremendous opportunity in Ecuador right now. This is based on the following:

- Current President, Lenin Moreno, has stated that it’s his goal to attract close to $5 billion in mining investment dollars over the course of his 4 years as President. Lundin Gold’s $400 million financing for the development of Fruta del Norte speaks to the market beginning to turn in favour of investment within Ecuador.

- Adventus Zinc, Lundin Gold, Codelco, BHP and Sol Gold are all examples of companies that have started putting investment dollars to work within Ecuador. It’s my opinion that smart money begins to flow into the smart contrarian markets first.

- Wood Mackenzie’s influence in Ecuador’s mining taxes is a major step toward becoming a world-class destination for mining exploration and development. Reductions in VAT and the company’s fiscal burden, along with the proposed elimination of the windfall tax, are all integral steps in attracting further investment dollars.

- Immense mineral potential — Much of Ecuador has not been explored with modern exploration techniques. Given Ecuador’s geographical location, I believe it’s safe to say that Ecuador may be one of the world’s last remaining jurisdictions with tier 1 deposit type discovery upside potential.

I’m investing my money in Ecuador and believe it’s just a matter of time before the market recognizes the changes that have been made and will follow suit.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now — it’s FREE!

Until next time,

Brian Leni P.Eng

Founder — Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do own shares in Adventus Zinc Corporation. Junior Stock Review and/or Brian Leni has NO business relationship with Adventus Zinc or any other company mentioned within this article.

About the author — Junior Stock Review provides investors with in-depth analysis of junior resource companies and interviews with key players from the industry. It’s also a platform through which its founder, Brian Leni, discusses where it is that he’s investing his money, and the people who have and do influence the way he looks for opportunity in the market.

Brian is a Professional Engineer by trade, and worked in heavy industry for over 10 years. As a process engineer and then a manager of the steel rolling process, Brian honed analytical skills that lend themselves very well to the world of investing and speculation.