Spirit Banner and Ion Energy Announce Signing of Definitive Agreement

Spirit Banner Capital Corp. is pleased to announce that it has entered into a definitive agreement with Ion Energy Ltd.

Spirit Banner Capital Corp. (“Spirit Banner” or the “Corporation”) (TSXV:SBCC) is pleased to announce that it has entered into a definitive agreement (the “Definitive Agreement”) with Ion Energy Ltd. (“Ion Energy”) to complete a business combination (“Business Combination”) as previously announced on March 4, 2019. Pursuant to the Definitive Agreement, Spirit Banner will acquire all of the outstanding and issued Ion Energy common shares (“Ion Energy Shares”).

The Definitive Agreement stipulates that a wholly owned subsidiary of Spirit Banner, incorporated in the province of Ontario by Spirit Banner, will amalgamate with Ion Energy to form a corporation to continue under the name, Ion Energy Holdings Inc. Immediately following completion of the Business Combination, Ion Energy Holdings Inc. will be a wholly owned subsidiary of Spirit Banner and will hold all of Ion Energy’s assets and conduct the business of Ion Energy, which is classified as being part of the mining sector. Upon the completion of the Business Combination, Spirit Banner will change its name to “Ion Energy Ltd.” (the “Resulting Issuer”).

Pursuant to the Definitive Agreement, Spirit Banner and Ion Energy have agreed that the Business Combination is conditional upon certain conditions precedent, including, but not limited to, the consolidation of the Spirit Banner common shares (“Spirit Banner Shares”) prior to completion of the Business Combination on the basis of one post-consolidation Spirit Banner Share for each two pre-consolidation Spirit Banner Shares (the “Spirit Banner Consolidation”), as well as the consolidation of the Ion Energy Shares prior to completion of the Business Combination on the basis of one post-consolidation Ion Energy Share for each two pre-consolidation Ion Energy Shares (the “Ion Energy Consolidation”).

The Business Combination will result in Spirit Banner acquiring all of the issued and outstanding Ion Energy Shares in consideration for the issuance of common shares of the Resulting Issuer (“Resulting Issuer Shares”) to holders of Ion Energy Shares on a one-to-one basis. The deemed issue price per Resulting Issuer Share to be issued to the Ion Energy shareholders in consideration for the Ion Energy Shares pursuant to the Definitive Agreement is $0.20 per Resulting Issuer Share.

Ion Energy Ltd.

Ion Energy is a private company incorporated under the Business Corporations Act (Ontario) on August 3, 2017, and has been engaged in the business of seeking and identifying lithium assets in Asia since incorporation.

Ion Energy LLC, a company incorporated in Mongolia and a wholly owned subsidiary of Ion Energy, is the owner of a lithium exploration license (the “License”) to explore an area approximately 81,758 hectares in size containing lithium brine targets (the “Baavhai-Uul Project” or the “Property”). Limited work by the Mongolian University of Science and Technology has indicated lithium content in brines of up to 810ppm Li for brine and lake sediment samples on the Baavhai-Uul Project.

As at August 20, 2019, Ion Energy had 104,484,820 shares outstanding and C$317,300 in cash and cash equivalents.

Spirit Banner Capital Corp.

Spirit Banner was incorporated under the Business Corporations Act (Alberta) on June 5, 2017 and is a Capital Pool Company (as defined in the policies of the TSX Venture Exchange) listed on the TSX Venture Exchange. Spirit Banner has no commercial operations and no assets other than cash.

The principal business of Spirit Banner is to identify and evaluate businesses and assets with a view to completing a Qualifying Transaction, and, once identified and evaluated, to negotiate an acquisition or participation in such assets or businesses. Until the completion of the Business Combination, Spirit Banner will not carry on business other than the identification and evaluation of assets or businesses in connection with a potential Qualifying Transaction. The Business Combination is intended to be Spirit Banner’s Qualifying Transaction.

Ion Energy Financing

In order to obtain working capital for the Business Combination, it is anticipated Ion Energy will conduct a non-brokered offering of post-consolidation units (“Units”) offered at $0.30 per Unit for minimum gross proceeds of $1,000,000 (the “Financing”). Each Unit will be comprised of one post-consolidation Ion Energy Share (“Ion Energy Private Placement Shares”) and one warrant to purchase one post-consolidation Ion Energy Share (“Ion Energy Private Placement Warrants”) at an exercise price of $0.50 for a period of twenty-four months from the date of issuance. The Ion Energy Private Placement Shares and Ion Energy Private Placement Warrants will be exchanged for equivalent Resulting Issuer securities on a one-to-one basis.

As of July 31, 2019, there are 19,030,780 Spirit Banner Shares issued and outstanding and 104,484,820 Ion Energy Shares issued and outstanding. After completion of the Spirit Banner Consolidation and Ion Energy Consolidation, there will be 9,515,390 Spirit Banner Shares and 52,242,410 Ion Energy Shares outstanding immediately prior to the Business Combination. As a result of the Business Combination, the Resulting Issuer expects to have approximately 61,757,800 Resulting Issuer Shares issued and outstanding on an undiluted basis, not accounting for Resulting Issuer securities to be issued to Ion Energy shareholders pursuant to the Financing. Without accounting for the issuance of Units pursuant to the Financing, former shareholders of Spirit Banner will hold 15.4% of the Resulting Issuer Shares and former shareholders of Ion Energy will hold 84.6% of the Resulting Issuer Shares, on an undiluted basis.

For further information regarding the Business Combination, please refer to the press release of Spirit Banner dated March 4, 2019, which can be found on the Corporation’s SEDAR profile at www.sedar.com. The Business Combination and terms of the Financing remain subject to TSXV approval. Spirit Banner will provide further details and updates in respect of the Business Combination and Financing in due course by way of press release.

Baavhai-Uul Project (81,758.9 ha)

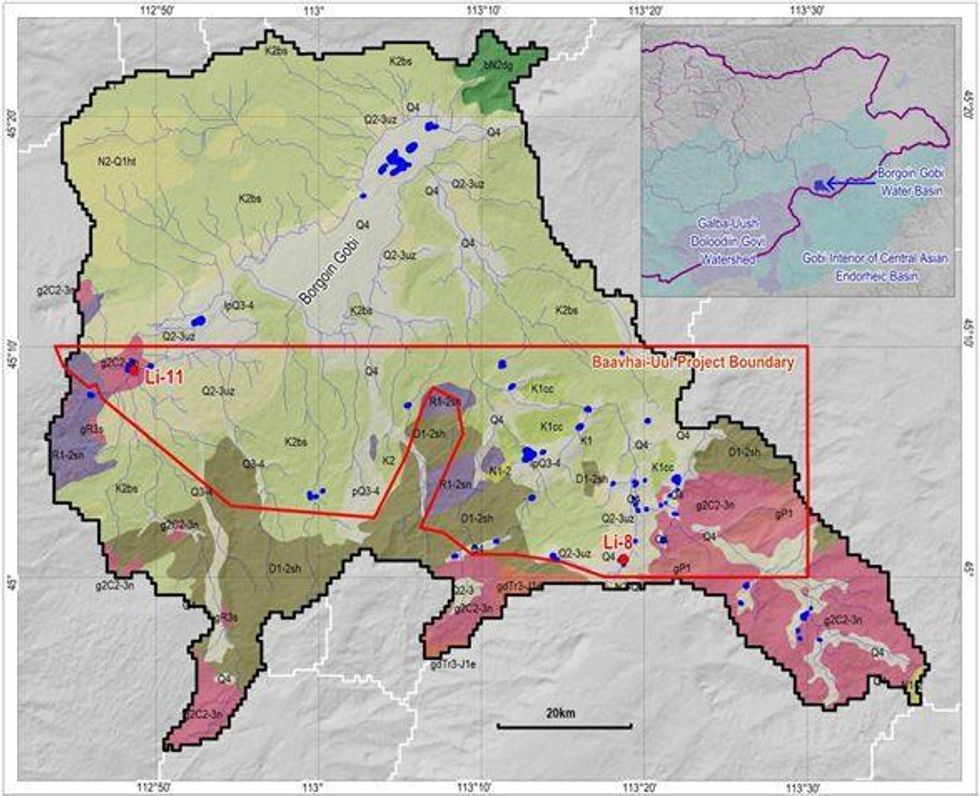

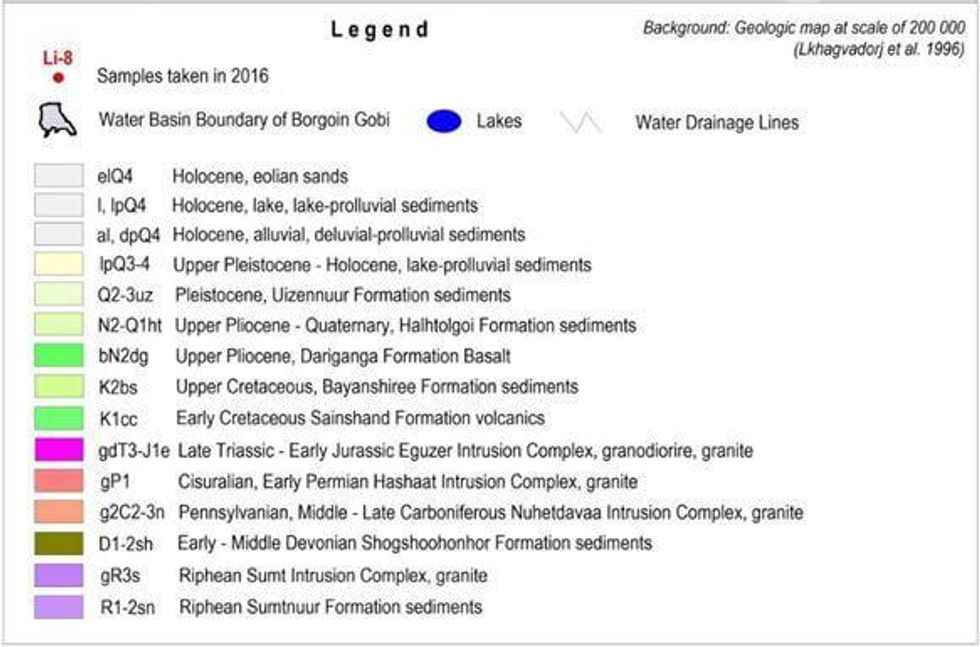

The Baavhai-Uul Project is located in Sukhbaatar province, southeastern Mongolia, approximately 800 km southeast from the capital, Ulaanbaatar, 200 km south from the province centre, Baruun-Urt and 24 km north of the border with China. The Property belongs to Ongon and Naran sub-provinces administratively, nearly 30-40 km from its centres and covers an area of approximately 81,758 hectares in size (Figure 1).

Almost all province centres have been connected by paved roads to the capital city Ulaanbaatar. Thus, paved roads (approximately 800 km – 8 hours) are accessible during all seasons between the capital and Baruun-Urt, Sukhbaatar province centre. From Baruun-Urt, Sukhbaatar province centre, gravel roads are utilized to reach the Property (about 200 km – 4 hours), through Ongon sub-province centre.

There are a number of communities in the region. The largest town is Baruun-Urt, which is the centre of the Sukhbaatar province and located 200 km north of the Baavhai-Uul Project. The closest towns to the property are Ongon and Naran sub-province centres located about 30 km to north and 40 km to south, respectively. These local towns could potentially supply the most basic needs for the early stages of exploration and project development including food, labour, and other supplies. However, the majority of mining-related equipment and services for more advanced projects should be obtained from Ulaanbaatar.

The Baavhai-Uul Project is situated in the Dariganga platform, at an elevation of approximately 1,100-1,200 meters above sea level. Dry, wide valleys, a series of hills, volcanic craters with flat-like tops, small lakes, and sand dunes are widespread throughout the region. The highest mountain is Jargalant, approximately 1,238m above sea level. Generally, the region lacks running water sources at surface; however numerous small lakes are distributed on the property mostly in quaternary sediments and contain shallow water during the rainy season or immediately after rainfall. The lakes are mostly saline and suitable for industrial uses such as drilling.

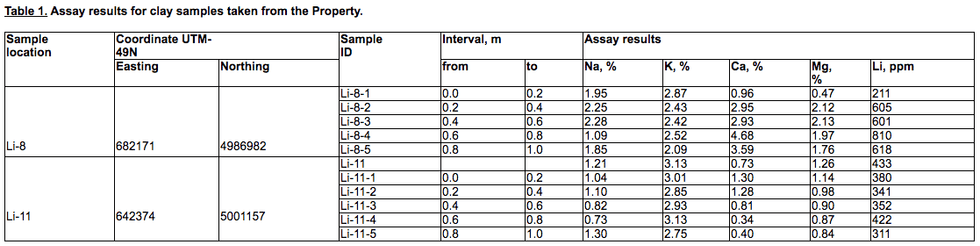

Recent sampling work done by geoscientists from the Technical University of Mongolia in dry lake areas of the Baavhai-Uul Project indicated an average of 463ppm Li. The sampling consisted of 2 pits drilled by hand auger in the lake bottom and collected in 20 cm intervals. The team collected 11 samples from the two dry lakes located spatially in the property as shown in Figure 2. The lithium samples were sent to and assayed by the independent certified assay lab Khanlab LLC located in Ulaanbaatar, Mongolia. Khanlab LLC is a certified assay lab pursuant to the ILAC Mutual Recognition Arrangement (IILAC MRA).

Sample coordinates, descriptions, and analytical results are listed in Table 1. Significant anomalous lithium grades ranging from 211 ppm to 810 ppm were returned from both locations and might be indicating the presence of continental lithium brine.

A two-stage exploration program is being designed to evaluate the Baavhai-Uul Project. Phase 1 of the proposed exploration program will consist of surface and near surface geochemical sampling of sediments and brines using auger drill holes, initial geophysical surveys of the basins, drilling to establish basin stratigraphy and conducting water and lake sediment analytical works. Regional hydrogeologic water sampling is planned for at least 50% of the Property. Rock chip sampling of bedrock intrusion dykes is also planned for Phase 1 to aid in the determination of source of lithium mineralization on the Property. Phase 2 is dependent on positive results from the Phase 1 brine and sediment sampling and characterization of the basin geometry. Phase 2 of the proposed exploration program consists of deeper drilling for a more extensive characterization of the basin geometry and brine and lake sediments chemistry at depth, along with pumping tests in wide diameter holes in order to investigate various hydrological features.

All technical information in this press release has been reviewed and approved by Khurelbaatar Lamzav, P.Geo., an independent consultant to the Corporation and Ion Energy and a “Qualified Person” under National Instrument 43-101.

Directors and Management of the Resulting Issuer

Subject to applicable approvals, it is anticipated that the directors of the Resulting Issuer will be Mathew Wood, Ali Haji, Aneel Waraich, Bataa Tumur-Ochir and Enkhtuvshin Khishigsuren. Management of the resulting issuer will include Ali Haji as Chief Executive Officer and a Chief Financial Officer to be determined at a later date. Biographies for the officers and directors of the Resulting Issuer are described below.

Ali Haji – Chief Executive Officer and Director

Mr. Haji has extensive knowledge of the financial services sector after having spent over 11 years in the asset management industry performing strategic and process improvement roles. He started his career as a technology analyst at Invesco Ltd. in 2006 and advanced into various roles including technology risk, controls, program management, and process improvement with international assignments involving mergers and acquisitions in Hong Kong, U.S.A and Australia. Most recently, he was also a principal contributor to the creation of a Center of Excellence in London, England for Invesco Ltd.

Mr. Haji currently serves as an advisor to ATMA Capital Markets Ltd. and ATMACORP Ltd., a merchant bank providing advisory services to public companies such as Steppe Gold Ltd. and Five Star Diamonds Ltd., in addition to multiple private companies in the mining space.

Mr. Haji currently serves on the board of Antler Hill Mining Ltd. (TSXV: AHM.H) and is the CEO of Spirit Banner II Capital Corp. (TSXV: SBTC.P)

Mr. Haji attended The University of Western Ontario and holds a BSc in Computer Science.

Matthew Wood – Chairman of the Board

Mr. Wood is a mineral resource explorer and developer with over 25 years of global industry experience in mining and commodities investments.

Mr. Wood has managed investment deals in diamonds, coal, energy, ferrous metals, base and precious metals, and other commodities. His skills in technical and economic evaluation of resource opportunities have resulted in an established record of developing resource deals from early stage, to market listings and exit strategies for his investors.

Mr. Wood is CEO and co-founder of Steppe Gold Ltd. (TSX: STGO), a listed near-term gold producer in Mongolia. He was formally the founder and executive Chairman of Mongolian coal company, Hunnu Coal Limited. Hunnu Coal was IPO of the year for all sectors on the ASX in 2010, and its sale for approximately A$500M in 2011 to Banpu PCL was recognized as the Mines and Money 2012 Deal of the Year. Mr. Wood has founded and been involved in many other resource companies and investments through the years.

Mr. Wood has an Honours Degree in Geology from the University of New South Wales and a Graduate Certificate in Mineral Economics from the Western Australian School of Mines.

Aneel Waraich – Director

Mr. Waraich is the President, Chief Executive Officer and a director of Spirit Banner. Mr. Waraich is also Executive Vice-President and co-founder of Steppe Gold Ltd., a listed near-term gold producer in Mongolia, founder of ATMA Capital Markets Ltd. and ATMACORP Ltd. and a financial services professional with experience in both the asset management and corporate finance businesses.

Mr. Waraich focuses primarily on advising public and private companies in the Natural Resources sector. In previous roles at Goodman and Company Investment Counsel and Dundee Capital Markets he worked as an analyst valuing private companies. Most recently Mr. Waraich worked as an investment banker focusing on deal origination, going-public transactions and financings for both public and private companies in the resource and technology sectors.

Mr. Waraich completed his MBA from the Goodman Institute of Investment Management at the John Molson School of Business.

Bataa Tumur-Ochir – Director

Mr. Tumur-Ochir is a director of Spirit Banner as well as a director and Vice-President (Mongolia) of Steppe Gold Ltd. Mr. Tumur-Ochir is a Mongolian citizen and will be responsible for new business acquisitions, development and government and community relations. Mr. Tumur-Ochir will be responsible for daily operations in Mongolia. Mr. Tumur-Ochir is currently executive director of ASX listed Wolf Petroleum.

Mr. Tumur-Ochir has relationships at all levels of government in Mongolia and was recently appointed independent advisor to the Ministry of Mining and Heavy Industry responsible for foreign investment and promotion.

Mr. Tumur-Ochir holds a bachelor’s degree in business administration and graduate certificates in international business and marketing from Australia and Singapore.

Enkhtuvshin Khishigsuren – Director

Mr. Khishigsuren has over 30 years of Mongolian mineral exploration experience. He has focused his expertise on the precious metals exploration sector resulting in successes for numerous companies. Mr. Khishigsuren spent the first 10-12 years of his career at Central Geological Expedition doing regional geological mapping in various areas of Mongolia, followed by 7 years as senior exploration manager on exploration of precious metal in Mongolia for Harrods Minerals (a privately funded exploration company). Mr. Khishigsuren is currently the executive director of Erdenyn Erel, a mining consulting company.

Mr. Khishigsuren has been responsible for identifying targets and properties based on his knowledge and experience that have resulted in the discovery of several prospective gold and copper deposits in Mongolia; such as the multimillion ounce gold deposit Olon Ovoot, a large molybdenum porphyry deposit Zuun mod and the Shand copper porphyry deposit near Erdenet copper mine.

Mr. Khishigsuren holds bachelor’s degree of Geological exploration from Azerbaijan State University (former Soviet Union) and a master’s degree of Geological Science from Shimane University, Japan

For further information, contact:

Spirit Banner Capital Corp.

Aneel Waraich, CEO

+1.647.998.4149

Awaraich@atmacapitalmarkets.com

Ion Energy Ltd.

Ali Haji, CEO

+1.647.951.6508

Ali@IonEnergy.ca

Cautionary Note Regarding Forward-Looking Information

Information set forth in this news release contains forward‐looking statements. These statements reflect management’s current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Spirit Banner cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Spirit Banner’s control. Such factors include, among other things: risks and uncertainties relating to Spirit Banner’s ability to complete the proposed Qualifying Transaction, including those described in Spirit Banner’s Prospectus dated December 12, 2017, available on the Corporation’s SEDAR profile at www.sedar.com. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward‐looking information. Except as required under applicable securities legislation, Spirit Banner undertakes no obligation to publicly update or revise forward‐looking information.

Completion of the transaction is subject to a number of conditions, including but not limited to, Exchange acceptance and if applicable pursuant to Exchange Requirements, majority of the minority shareholder approval. Where applicable, the transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the transaction, any information released or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release. A halt in trading shall remain in place until after the Qualifying Transaction is completed or such time that acceptable documentation is filed with the TSX Venture Exchange.

The information contained in this press release relating to Ion Energy and the Baavhai-Uul Project has been furnished by Ion Energy. Although Spirit Banner has no knowledge that would indicate that any statements contained herein concerning Ion Energy and the projects are untrue or incomplete, neither Spirit Banner nor any of its directors or officers assumes any responsibility for the accuracy or completeness of such information or for any failure by Ion Energy to ensure disclosure of events or facts that may have occurred which may affect the significance or accuracy of any such information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.