Q2 Lithium Results Are In - Key Takeaways from Top Miners

Market watchers have been wondering how COVID-19 will affect lithium miners. What’s the story behind top companies’ Q2 results?

Click here to read about the previous quarterly lithium results from top miners.

During the first half of the year, the coronavirus pandemic took over the world’s attention, with the unpredictable outbreak impacting every industry at different levels, including lithium.

Lithium was already experiencing tough market conditions prior to COVID-19, but 2020 was expected to kick off a decade of increasing demand due to the unfolding of the energy revolution — and many would argue that in the long term that still may be the case.

However, right now lithium miners have had to pivot to face the challenge brought by the pandemic. Many have put significant effort into slowing down the spread of the virus, as well as into trying to maintain healthy balance sheets to survive this season.

The first few months of the year saw lithium demand slow down from China, the biggest player in the sector; they also brought a steep decline in electric vehicle (EV) production and sales, as automakers took preventive measures and paused their ambitious electrification plans.

Lithium producers had already initiated a supply response to this challenging environment prior to the outbreak, but COVID-19 brought temporary suspensions and revisions of expansion plans.

With lithium demand unlikely to recover to pre-COVID-19 levels this year, and a low price environment expected to continue for the rest of 2020, the question now is how lithium producers are weathering the coronavirus storm. The short-term outlook seems bearish for sales, with a big focus on cutting spending.

Below the Investing News Network runs through the top lithium miners’ key results from Q2. This article will be updated as results are released.

1. Ganfeng Lithium (OTC Pink:GNENF,SZSE:002460)

Market cap: 63.27 billion yuan; Share price: 50.51 yuan; Year-to-date move: +42.44 percent

- H1 profit: 157.69 million yuan

- H1 revenue: 2.37 billion yuan

Top Chinese lithium producer Ganfeng released its half-year results at the end of August, showing a 46.94 percent decline in profit compared to 2019. Half-year revenues were also down by 15.26 percent.

Except for temporary production suspensions for some of Ganfeng’s product lines in February due to the pandemic, the company “has tried its best to fulfill the orders of customers,” it said.

Ganfeng also remains optimistic about the future of the lithium space, saying the outbreak of COVID-19 will not stop the development trend of EVs in the short term.

“It is expected that global electrification of vehicles is entering into a period of accelerated growth driven by new high-quality EV launches from Chinese and overseas OEMs in the near future,” it noted.

2. Tianqi Lithium (SZSE:002466)

Market cap: 33.83 billion yuan; Share price: 22.70 yuan; Year-to-date move: – 26.03 percent

- H1 operating income: 1.87 billion yuan

- H1 loss: 696.565 million yuan

Tianqi Lithium has been in a tight spot financially for some time, with the company posting a net loss of 696.57 million yuan in H1 — down 460.15 percent compared to the same period last year.

On the back of low lithium prices and coronavirus-related disruptions, Tianqi Lithium also posted an operating income decline of 27.44 percent year-on-year.

“Sales volume and price of lithium chemical products and lithium concentrate products decreased significantly compared with the same period the previous year,” the company said in a statement.

The company’s net cash flow year-to-date was down 85.37 percent, from 944.9 million yuan last year to 138.23 million yuan this year.

Over the last four quarters, Tianqi, which bought a minority stake in top producer SQM (NYSE:SQM) for US$4.1 billion, has posted losses of US$1 billion, company filings and Refinitiv Eikon data show.

Earlier this month, Tianqi said president Vivian Wu has resigned from the company for personal reasons.

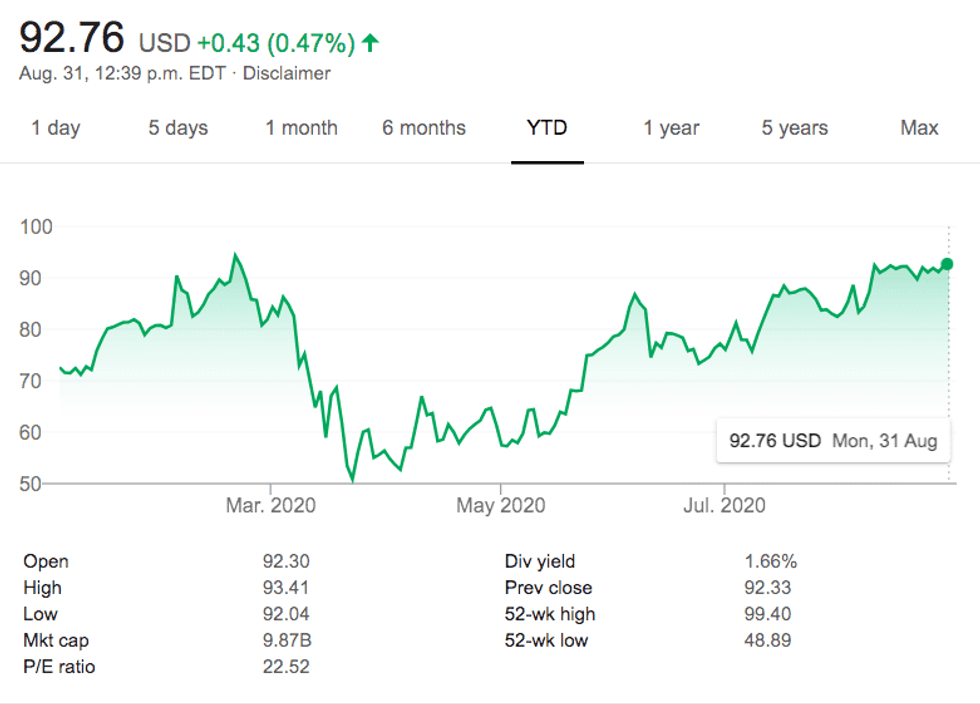

3. Albemarle (NYSE:ALB)

Market cap: US$9.87 billion; Share price: US$92.76; Year-to-date move: +27.75 percent

- Q2 adjusted EBITDA: US$185 million

- Q2 net income: US$86 million

- Q2 lithium net sales: US$$283.7 million

“We remain confident that we have the right strategy in place to deliver value to our stakeholders by investing in and growing our lithium business,” said Albemarle CEO Kent Masters. “While our strategy has not materially changed, the environment in which we operate has changed dramatically.”

The North Carolina-based company saw its lithium net sales decline by US$41 million year-on-year, driven by lower market and contract pricing.

“Lower contract pricing reflects 2020 battery-grade price adjustments that were agreed to in late 2019,” Albemarle said, adding that it is expecting this year’s Q3 EBITDA for its lithium segment to be down about 10 to 20 percent compared to Q2.

“We expect the impact of low OEM automotive production to be felt more acutely in Q3 2020,” it noted. “At the same time, we are seeing impacts of lower market prices, higher inventory in the battery channel, and reduced demand in the glass and ceramics markets.”

The COVID-19 outbreak has led the company to withdraw its full-year 2020 outlook given the uncertainty around the duration and economic impact of the pandemic.

Albemarle anticipates that its third quarter performance will be lower year-over-year based on reduced global economic activity due to the global pandemic. For Q3, the company is expecting net sales to be in the range of US$700 to US$775 million.

Analysts at BMO Capital Markets remain constructive despite slightly lowering their estimates.

“We recognize the challenging near-term market backdrop for lithium and catalysts … but also that catalysts will normalize (eventually), and underlying EV trends seem sufficient to also eventually normalize a large lithium supply/inventory imbalance into 2021 (and, hopefully, let prices rise),” they said.

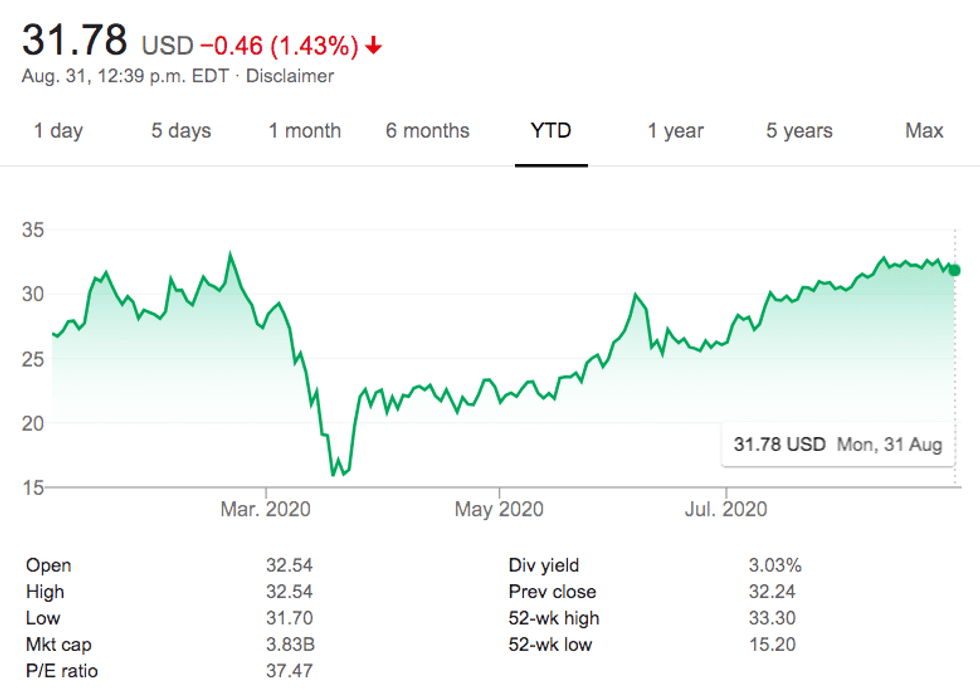

4. SQM

Market cap: US$3.83 billion; Share price: US$31.78; Year-to-date move: +18.01 percent

- Q2 revenue: US$458.5 million

- Q2 revenue from lithium sales: US$85.9 million

- Q2 net income: US$50.8 million

SQM, which has faced opposition from indigenous communities over its water use, released its Q2 earnings on August 19, reporting a decline of 36.4 percent in revenues from lithium sales year-on-year, with lithium prices coming in an average of 45 percent lower than during the first half of 2019.

“Although the downward lithium pricing trend continued during (Q2), I would like to highlight that lithium sales volumes exceeded 12,600 metric tons, almost 50 percent higher than sales volumes reported in the first quarter of the year, in line with our goal of selling higher lithium sales volumes this year, when compared with last year, thus increasing our market share,” SQM CEO Ricardo Ramos said.

Despite the challenges brought by the coronavirus outbreak, the company expects demand to be similar to the level seen in 2019.

“Given the uncertainty surrounding the lithium market in the short-term, it is impossible to confidently gage when prices may begin to recover,” the firm noted in its results release. “We believe that prices will be lower during the second half of the year compared to prices seen in the first half of the year, but sales volumes should be higher.”

The company, which adjusted its capital expenditure plans to US$350 million from US$450 million previously, said it continues to be committed to the lithium space, and hopes to complete its carbonate and hydroxide expansions by the end of 2021.

SQM’s production levels are at an all-time high, and the company said it is currently producing at a rate of approximately 70,000 metric tons this year. “Given the demand growth expectations in coming years, we feel comfortable with the higher level of inventories that are being built,” it said.

Despite slightly lowering their estimates, BMO Capital Markets analysts have raised their target price on SQM to US$30.

“SQM has a strong balance sheet and EV data points continue to improve, but we remain neutral on valuation amid continued concerns over SQM’s lithium inventory build and potash/fertilizer fundamentals, plus consensus numbers seem far too high considering current fundamentals and management’s H2 outlook commentary,” they said.

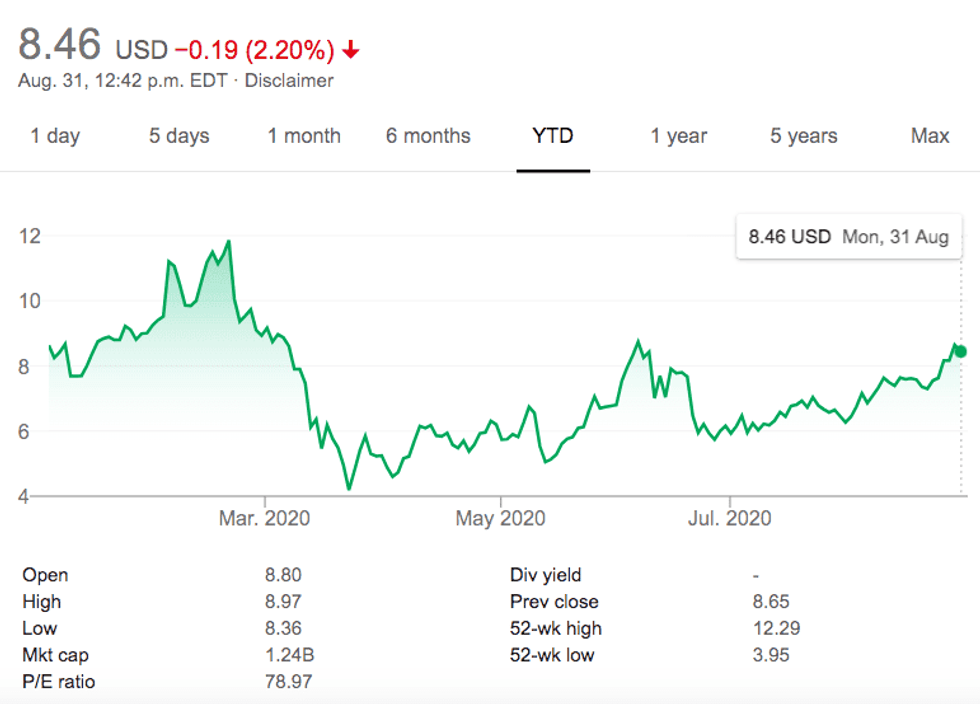

5. Livent (NYSE:LTHM)

Market cap: US$1.24 billion; Share price: US$8.46; Year-to-date move: -1.97 percent

- Q2 revenue: US$64.9 million

- Q2 adjusted EBITDA: US$6.4 million

- Q2 net loss: US$200,000

Livent had a challenging Q2, with quarterly results impacted by difficult market conditions; these were exacerbated by COVID-19-related supply chain disruptions and related customer order delays.

That said, all Livent production facilities are operational and have been working without material disruptions.

“Lithium demand was very weak in the second quarter, particularly in EV applications, as COVID-19 caused serious disruption and uncertainty throughout supply chains,” said CEO and President Paul Graves. “While our other end-markets fared better, they also were impacted by the broader macroeconomic weakness caused by the pandemic.”

Due to the uncertainty, certain customers have delayed planned orders until later in the year.

Livent expects near-term demand to continue to be challenged by weakness in key global markets, although in the long term it continues to expect significant EV demand growth.

Commenting on future supply, Graves recently told Reuters that the EV industry must pay more for lithium in order to spur investment and prevent future supply crunches.

“If every EV company took their 2023 plans and went to the lithium market today, they’d probably only get about 15 percent of their needed supply of lithium,” he said.

After the company’s latest results came out, BMO Capital Markets analysts lowered their 2020 to 2021 estimates by 25 to 30 percent due to Livent’s Q2 miss.

“It was another bearish update with limited visibility,” they said. “While other lithium peers face similar macro/industry headwinds, we are concerned an already highly-leveraged Livent seems to be losing disproportionate LCE/hydroxide share amid ongoing lack of customer engagement.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.