Price Premium Narrows Between Lithium Hydroxide and Carbonate

Benchmark Mineral Intelligence expects lithium hydroxide prices to keep softening in 2019, with the premium over carbonate narrowing down.

The summer months have not given lithium prices a break, with the downward trend continuing over the past two months.

Prices for lithium hydroxide and carbonate, key raw materials used in electric car batteries, have been under pressure since the start of the year, while lower spodumene prices are allowing for more discounts on chemical sales, particularly in China, according to Benchmark Mineral Intelligence.

“Prices have continued to soften over the past couple of months,” Andrew Miller, the firm’s head of price assessment, told the Investing News Network. “And there were some adjustments to pricing terms for H2 contracts, which have seen the carbonate/hydroxide premium narrow as we were expecting.”

According to the expert, the main adjustment impacting prices in the second half of 2019 has been the reduction in Chinese subsidies.

“(This) has led to a reduction in order volumes and liquidity issues along the supply chain,” Miller said. “Cathode suppliers have excess supplies and this is limiting their willingness to commit to new raw material orders.”

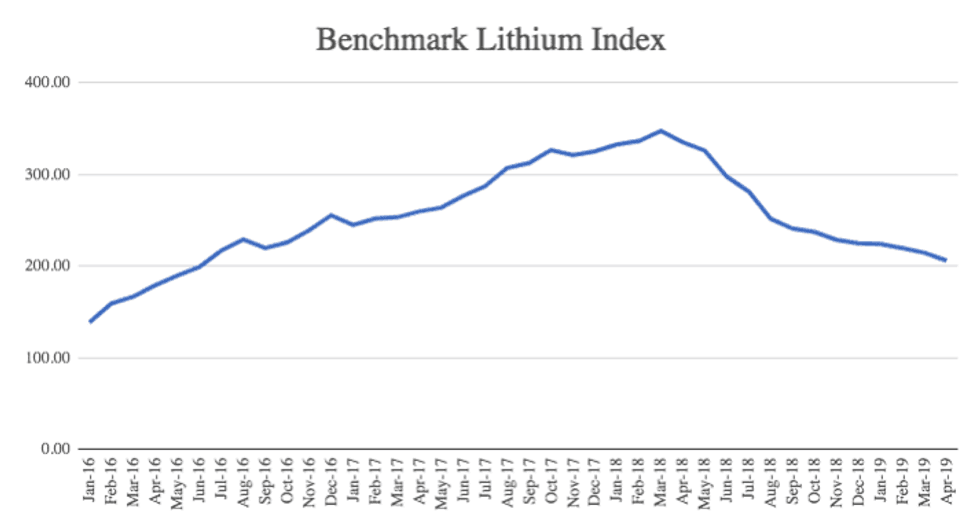

Price chart via Benchmark Mineral Intelligence.

Looking ahead, Miller said he expects lithium prices to continue to soften for the rest of the year.

“Particularly for hydroxide where production capacity expansions and a slower-than-expected transition to high-nickel cathodes is likely to take its toll,” he said.

In terms of spodumene, prices are likely to trend below the US$550 per tonne level in the coming months, and prices could trend closer to US$500 by the fourth quarter.

For Miller, one of the factors to keep in mind in the next few months is how the premium for battery spec material develops — because even though there are new supplies entering the market, not all of this material has been qualified.

“How quickly this new material is integrated into the supply chain could have an impact on the supply/demand balance as we approach what is typically peak EV production season in China,” he added.

Lithium prices continue to be a hot topic for seasoned investors as well as new entrants to the space, with one of the biggest misconceptions being that there is one daily price in the market.

“The way the industry operates today means there is no spot market and suppliers provide specialist products, tailored to the needs of consumers,” Miller said.

“The private nature of transactions makes it difficult for those outside of the industry to understand pricing,” he said; that is the reason behind Benchmark Mineral Intelligence’s “independent and accurate” approach to price reporting.

On Tuesday (August 20), the London-based firm was awarded the highest International Organization of Securities Commissions (IOSCO) assurance, known as Type 1 Reasonable assurance.

The achievement was the result of a rigorous and independent process run by EY according to a set of principles created by IOSCO, originally for oil price reporting in 2012.

“Not only are we the most specialized price report agency for our industry but now have demonstrated the highest level of IOSCO compliance,” Benchmark Mineral Intelligence Managing Director Simon Moores said after the news.

“EY’s independent assurance judgement on our lithium prices will give further confidence to those outside of the lithium industry who are seeking to create new financial instruments, including exchanges in the US, Asia and Europe.”

Don’t forget to follow us at @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.