Lithium Oversupply to Remain in 2020, Prices to Stabilize in H2

Andrew Miller of Benchmark Mineral Intelligence expects the lithium market to move more into balance in 2021 to 2022, before seeing a structural deficit emerge from 2023 onward.

Weaker battery consumption and slower diversification of electric vehicle (EV) consumption outside of China will impact the lithium demand outlook this year, Benchmark Mineral Intelligence Product Director Andrew Miller told the Investing News Network.

“In the near term this will continue to impact prices and stunt efforts to work through backlogs in the supply chain,” he said.

For the expert, looking at the longer term, the bigger risk is that these short-term dynamics will provide further obstacles to developing new lithium projects.

“While the timing may have changed for 2020 to 2021, the longer-term picture remains strong, and the response from the lithium supply side will be hindered by prolonged low prices and wider macroeconomic uncertainties,” he said.

The economic downturn has led Benchmark Mineral Intelligence to change its outlook for 2020. At the start of the year, the firm was expecting a more balanced market for 2020 and a tightening into 2021.

“The global economic shutdown means we now project the market to remain in oversupply for this year and ultimately the evolution of the market balance will be pushed back six to 12 months,” Miller said.

He expects the market to move more into balance in 2021 to 2022, before seeing a structural deficit emerge from 2023 onwards.

Demand diversification outside China was a key catalyst expected in 2020, with eyes on Europe.

“You still have auto OEM commitments and government directives that will push that forward longer term, but closures will disrupt this adoption in the near term,” he said.

Once the coronavirus outbreak is under control, and countries begin to recover, Miller said it will be interesting to see how stimulus packages are directed and whether this actually pushes forward the case for EVs longer term.

“We’re already seeing a bigger commitment from the Chinese government in terms of new subsidies and potential directives for public transportation and taxis,” he said. “If there are similar policies in Europe and North America, the long-term outlook for the market could actually strengthen.”

Looking back at Q1, Miller said there has been a limited impact on lithium so far; however, the bigger risk remains the prevailing demand outlook for the rest of the year.

The demand impact has been most notable in China, where Miller said he expects to see a swift correction as the government seeks to stimulate the economy.

“There will be more demand pressures outside China in Q2, but from a battery perspective, China already plays a major role, so will likely play a big role in propping up the supply chain in the coming months,” he added.

From the supply side, the biggest challenges so far have been around logistics.

“Despite some temporary closures in Argentina, the bigger concern remains distribution channels and availability of reagents, etc.,” he said.

Speaking about what he expects to see in Q2 of this year, Miller said supply will be less operationally constrained and more challenged by logistics and the ability of consumers to accept orders.

“Some plants may be closed temporarily as we’ve seen in Argentina, but we don’t expect this to have a major impact on availability,” he said.

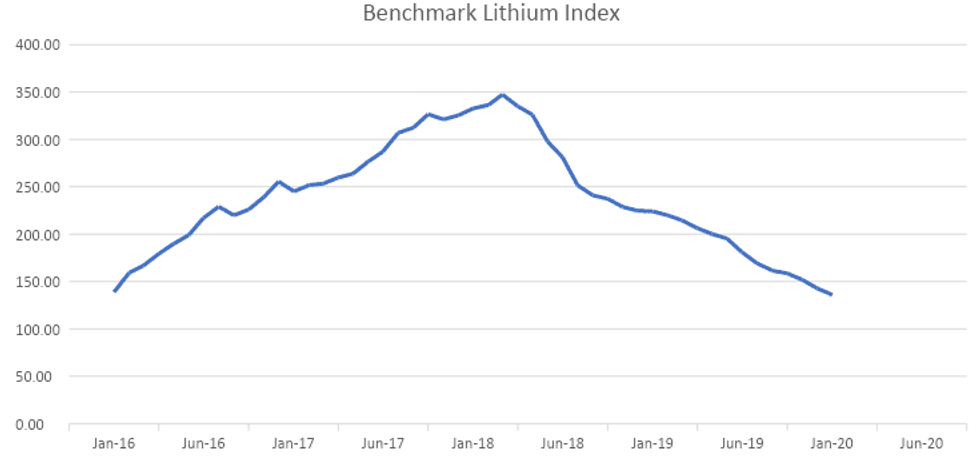

In terms of prices, Miller thinks pressures will continue in Q2, taking pricing in the rest of the world more in line with Chinese levels.

Chart via Benchmark Mineral Intelligence.

“Ultimately we are close to cost for many suppliers, so we expect prices to stabilize in H2 as the market surplus decreases,” he added.

One thing COVID-19 has not changed for the lithium market is its biggest challenge — which is ramping up capacity in line with where the market is projected to be by the 2022 to 2023 time horizon.

“The lead time to develop new projects — both for existing producers and newcomers — means money needs to start going into new projects now to meet the growth of three to four years time,” Miller said. “Ultimately the industry isn’t set up for what is approaching, and the wider economic environment will only add to the difficulties in meeting future needs.”

For investors looking for cues as where the market is going, Miller said one key factor to watch will be China’s stimulus strategy.

“If the government goes aggressively after EVs and ESS, then this will have an impact on demand, but also the type of chemistries required (which could impact the carbonate/hydroxide balance),” Miller said.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.