As 2017 comes to a close, experts share their thoughts on the lithium outlook. Overall a strong future is expected for this crucial battery metal.

Demand for electric cars continued to grow in 2017, and lithium, a key metal used in the batteries that power them, performed better than many expected.

Investor interest in the metal surged as lithium and electric vehicles (EVs) made news headlines throughout the year. Prices were up, and many TSX- and TSXV-listed stocks jumped over 100 percent in 2017.

With the start of 2018 just around the corner, many investors are now wondering what will happen to lithium next year. Here, the Investing News Network looks at lithium’s 2017 price performance, what analysts had to say about the market and what’s ahead for the metal in 2018. Overall, market participants continue to be optimistic about lithium’s future.

Lithium outlook 2018: Price performance review

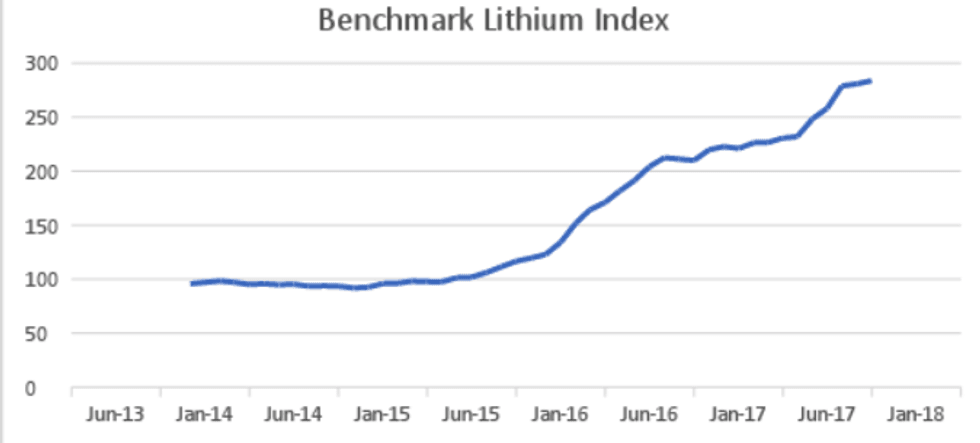

Looking back at how lithium prices performed in 2017, it’s clear that prices remained strong throughout the year. As the chart below from Benchmark Mineral Intelligence shows, that has been the trend for the last few years as well.

Chart via Benchmark Mineral Intelligence.

“The continued pricing strength in lithium has been a surprise,” said Chris Berry of House Mountain Partners and the Disruptive Discoveries Journal. He added that his previous demand forecast out to 2025 for lithium ended up being too low.

“I thought the lithium market (on a LCE basis) would grow to roughly 550,000 tonnes per year, [but] in the middle of the year I adjusted this upwards to 617,000 tonnes by 2025. This still appears too conservative based on potential gigafactory-scale expansion,” he added.

In fact, Benchmark Mineral Intelligence is now tracking 26 megafactories, up from just three back in 2014. The combined planned capacity of these plants is 344.5 GWh. To put that into perspective, total lithium-ion cell demand in 2017 is estimated at 100 GWh.

While that number might seem high, global lithium-ion battery demand is expected to grow between six and seven times by 2026, which will require a battery pipeline of nearly double what exists today.

“We said a few years ago that the present lithium price run will continue, and it has. It has, and it’s gone into a second phase now,” Benchmark Mineral Intelligence Managing Director Simon Moores told the Investing News Network at this year’s Cathodes conference.

“Quite simply, there’s not enough supply to meet the demand, and the demand is increasing quicker than the supply is. Much, much quicker. Therefore, lithium’s price will remain strong for some time,” he added.

For his part, lithium expert Joe Lowry said in his Lithium in Review report that “2017 was a year when virtually all the positive surprises were on the demand side and most of the negative surprises were on the supply side.” The expert also recently explained that the “Star Alliance of the lithium market” was one of the major trends this past year.

For investors interested in knowing what else happened in 2017, we’ve put together a lithium 2017 trends article. Click here to read more.

Lithium outlook 2018: Supply and demand

Looking ahead to 2018, supply constraints look set to continue as the lithium demand forecast rises.

In terms of demand, analysts agree that the lithium space will be led by battery production. “While most of the major battery expansions are due to come into production closer to 2020, a lot of battery producers will be looking to secure their raw material supply chains ahead of these expansions,” Benchmark Mineral Intelligence analyst Andrew Miller explained.

He also expects to see continued growth in the volume of lithium carbonate and lithium hydroxide sold into the battery sector in 2018.

Looking over to supply, many existing producers are seen expanding production in 2018, such as Albemarle (NYSE:ALB) in Chile and hard-rock producers in Western Australia. “In terms of new projects, spodumene will be the main source of expansion in the short term,” Miller said.

He mentioned Pilbara Minerals (ASX:PLS), which expects to be in production by the second half of 2018, and Nemaska Lithium (TSX:NMX), which recently announced its first delivery of lithium hydroxide, as some examples. “A number of others are pushing ahead with developments in 2018, but it will likely be 2019 onwards before they reach significant volumes,” Miller added.

Similarly, Berry said that more hard-rock lithium supply from Australia is expected to hit the market in 2018, with a wave of brine supply following later in 2019, “so I don’t see any real moderation in pricing until later in 2018 at the earliest.”

For his part, Lowry said in his report that execution of the key hard-rock projects in Australia, such as Pilbara Minerals and Altura Mining (ASX:AJM), will be “a bellwether for future pricing trends.” He added, “[h]owever, the most important supply side story from my perspective in 2018 will be the resolution of the SQM/CORFO situation.”

Moores said the biggest challenge for the industry will be to bring lithium into the mainstream. “The industry needs big money to come into the space, it needs for the big players to understand the opportunities here. It needs these companies to understand that they have to secure the whole supply chain, from the mine to the battery, if they’re going to realize [their] very bullish targets,” he commented.

He believes the industry needs to raise another $7 to $9 billion to get to where it needs to be by about 2025 to 2026. Meanwhile, Lowry said earlier this year that because investments have been delayed for so long, he doesn’t believe that enough lithium can be brought into the market by 2025 to do more than 10-percent EV penetration.

Lithium outlook 2018: Key factors to watch

After another strong year, lithium-focused investors are wondering what to expect in 2018. For Miller, one of the biggest trends for the industry in 2018 will be the introduction of more raw material feedstock and whether there is the necessary capacity to process this material in the short term.

“This has been a development in the market throughout H2 2017 as the market has shifted from an undersupply of raw material to conversion capacity,” he said, adding that this trend will likely continue with the additional raw material expansions planned for 2018. “The question is how quickly this feedstock material can be converted and integrated into the supply chain,” Miller noted.

In terms of prices, Miller expects them to be “more stable next year,” although the market will remain finely balanced. “New raw material supply will continue to enter the market, and although there will be significant growth in battery demand, lithium-ion battery production won’t reach the levels expected 2020 onwards,” he explained. He believes a lot will hinge on conversion capacity and producers’ ability to increase battery-grade production.

For his part, Lowry said that this year the new normal for lithium carbonate was $12 to $14 per kilogram outside of China, and $18 to $22 per kilogram for lithium hydroxide. “Going forward, I see a gradual convergence of the prices, just because most of the capacity, as for hydroxide now, are based on the hard rock process, which has similar cost structures for carbonate and hydroxide,” he added.

Most recently, Lowry said in his report that if some of the anticipated new capacity is delayed, “pricing in the $30s is not out of the question.”

Another factor to keep an eye on is China, which will continue to lead the way in 2018, “both in terms of lithium-ion expansions and raw materials sourcing,” Miller said. An interesting development that the analyst expects to continue is ongoing efforts from auto original equipment manufacturers (OEMs) to secure raw material supply chains.

“With the major targets for EVs, producers will have to look further upstream than ever before, and this could change the dynamics of raw material markets,” Miller added.

Similarly, Lowry said that the problem is that car and battery companies want to negotiate from strength and “tend to be bullies when dealing with their suppliers.” He added, “they are trying to price shop in a seller’s market. It will take time for them to realize the reality of the lithium market — lithium suppliers are in the driver’s seat,” he added.

For his part, Berry said interest in lithium opportunities has only intensified this year, and he expects this level of interest to continue going forward. “I have been bullish on this sector for several years now, and see no reason to change that view as the market cap expansion of various companies has opened them up as investment opportunities to a whole new class of investor,” he said.

Berry summarized the factors investors interested in lithium should pay attention to in 2018 as follows:

- Keep a close eye on the trend in EV sales both inside and outside of China;

- Watch for any deal between CORFO and SQM (NYSE:SQM) in Chile;

- Watch to see how Albemarle is able to ramp its operations in Chile;

- Watch to see the valuation and success of FMC’s (NYSE:FMC) spin out of its lithium business;

- Watch for the pace of project development in Argentina and the maturing political situation in the country;

- Watch the pace of funding in the lithium sector for any drop off;

- Watch to see how all of the announced lithium-ion battery factory capacity gets funded;

- Watch for advances in autonomous vehicle technology and adoption — understanding how this will affect the insurance markets is important;

- Watch for a major downstream player such as an OEM to make a sizeable investment in mining capacity — this is the real key to growth in the sector going forward

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Nemaska Lithium is a client of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.