LiCo Energy Metals Intersects 8.42% Co over 0.30 metres on the Glencore Bucke Property

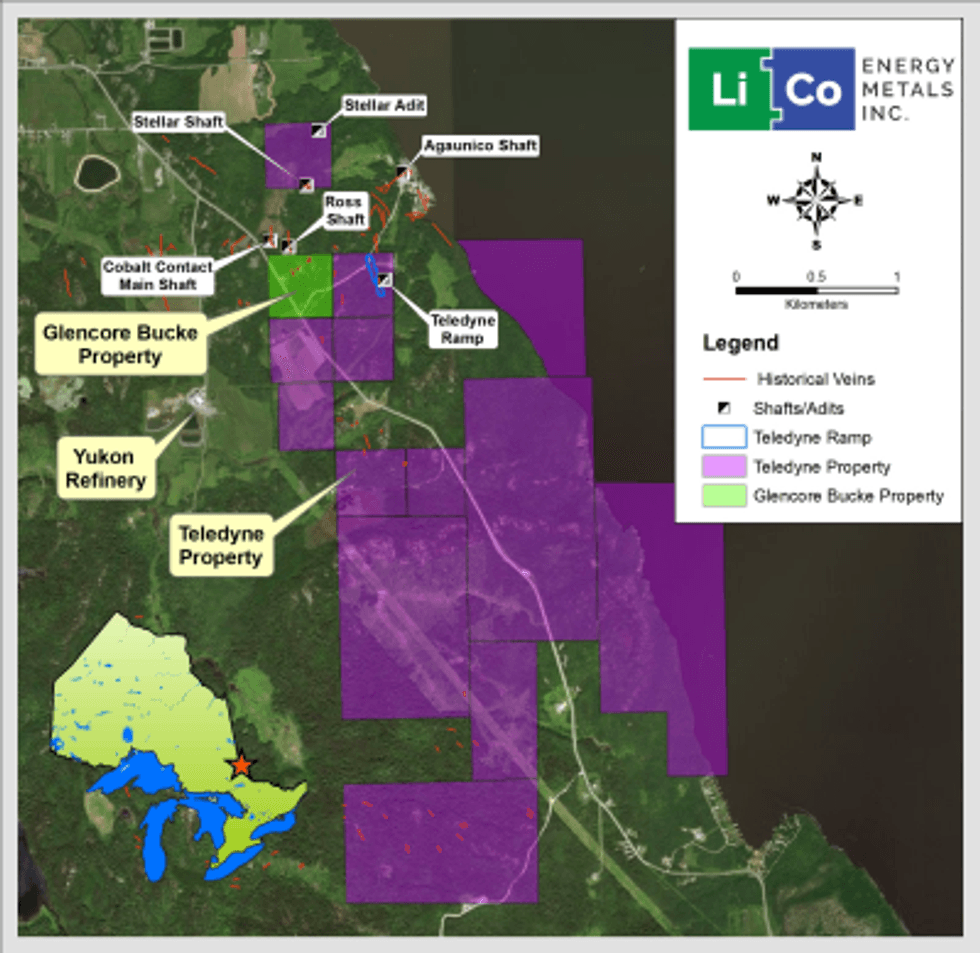

LiCo Energy Metals Inc. (TSXV:LIC, OTCQB:WCTXF) is pleased to the report assay results for drill holes GB17-15 through to GB17-19, completed on the Glencore Bucke Property, located 6 km northeast of Cobalt, Ontario.

LiCo Energy Metals Inc. (TSXV:LIC, OTCQB:WCTXF) is pleased to the report assay results for drill holes GB17-15 through to GB17-19, completed on the Glencore Bucke Property, located 6 km northeast of Cobalt, Ontario. The current drill program was designed to confirm and extend the existing known mineralization along strike and up and down dip and LiCo was successful in completing this objective.

A summary of the most significant results of the recent drill core assays are:

- – GB17-15 0.17 % Co, 19.9 ppm Ag, and 0.90% Cu over 20.20 m from 42.50 to 62.70 m, including 8.42 % Co, 136 ppm Ag over 0.30 m from 62.40 to 62.70 m.

– GB17-15 0.55 % Co over 0.90 m from 27.50 to 28.40 m, including 0.92 % Co over 0.30 m from 27.80 to 28.10 m.

– GB17-18 0.43 % Co, 86.8 ppm Ag, 0.52% Cu over 0.90 m from 80.10 to 81.00 m.

– GB17-19 0.75 % Co, 111.1 ppm Ag over 0.60 m from 46.00 to 46.60 m, including 1.33 % Co, 208 ppm Ag over 0.30 m from 46.00 to 46.30 m.

“We have consistently seen higher grade cobalt mineralization being intersected throughout the drilling completed at Glencore Bucke” says Tim Fernback, President & CEO of LiCo. “Along with the cobalt, appreciable copper values have been intersected over larger intervals such as 0.90 % over 20.20 m. These additional base metal zones that have been reported over the last several months were not expected”.

On the Glencore Bucke Property, the Company has completed a total of 21 diamond drill holes totaling 1,900 m, testing the Main and Northwest zones. The final assay results for the Glencore Bucke Property have been released, however, the Company will continue to release drill results from the Teledyne Cobalt Property as they are received.

The results and drill hole collar information for diamond drill holes GB17-15 through to GB17-19 are summarized in Tables 1 & 2 below.

Table 1: Summary of Diamond Drill Results

| DDH | From (m) | To (m) | Core Length (m) | Co (%) | Ag (ppm) | Cu (ppm) | Zn (ppm) | Pb (ppm) |

| GB17-15 | 22.65 | 23.05 | 0.40 | 0.23 | 1.7 | 66 | 41 | 2 |

| GB17-15 | 27.50 | 28.40 | 0.90 | 0.55 | 2.1 | 29 | 126 | 18 |

| incl. | 27.80 | 28.10 | 0.30 | 0.92 | 2.9 | 40 | 208 | 29 |

| GB17-15 | 42.50 | 62.70 | 20.20 | 0.17 | 19.9 | 8983 | 2638 | 4747 |

| incl. | 45.30 | 45.60 | 0.30 | 0.37 | 27.4 | 9100 | 135 | 4440 |

| incl. | 54.00 | 54.30 | 0.30 | 0.21 | 9.9 | 5370 | 148 | 114 |

| incl. | 55.80 | 57.50 | 1.70 | 0.22 | 32.1 | 18797 | 268 | 103 |

| incl. | 56.30 | 56.70 | 0.40 | 0.48 | 67.6 | 40500 | 271 | 164 |

| incl. | 62.40 | 62.70 | 0.30 | 8.42 | 136 | 1280 | 884 | 447 |

| GB17-15 | 72.00 | 72.50 | 0.50 | 0.12 | 9.9 | 7650 | 2430 | 738 |

| GB17-16 | 34.50 | 35.50 | 1.00 | 0.27 | 1 | 4 | 81 | 7 |

| GB17-16 | 83.40 | 83.70 | 0.30 | 0.15 | 26 | 4190 | 300 | 513 |

| GB17-16 | 89.40 | 90.00 | 0.60 | 0.01 | 6.8 | 7990 | 729 | 770 |

| GB17-16 | 92.00 | 93.90 | 1.90 | 0.00 | 4.3 | 280 | 9768 | 2924 |

| incl. | 92.00 | 93.00 | 1.00 | 0.00 | 5.1 | 245 | 13720 | 4532 |

| GB17-17 | 34.70 | 35.50 | 0.80 | 0.20 | 1 | 92 | 40 | 4 |

| GB17-17 | 42.80 | 51.80 | 9.00 | 0.02 | 4.7 | 5118 | 358 | 118 |

| incl. | 44.60 | 49.00 | 4.40 | 0.02 | 6.9 | 7763 | 171 | 54 |

| incl. | 45.00 | 45.60 | 0.60 | 0.01 | 12.8 | 22450 | 134 | 8 |

| GB17-18 | 76.50 | 82.00 | 5.50 | 0.11 | 25.9 | 6567 | 1812 | 4795 |

| incl. | 78.30 | 81.00 | 2.70 | 0.23 | 37 | 7411 | 283 | 566 |

| incl. | 79.80 | 81.00 | 1.20 | 0.38 | 66.6 | 5228 | 134 | 523 |

| incl. | 80.10 | 81.00 | 0.90 | 0.43 | 86.8 | 5177 | 133 | 662 |

| GB17-19 | 37.70 | 38.10 | 0.40 | 0.11 | 0.2 | 18 | 46 | 2 |

| GB17-19 | 44.50 | 47.40 | 2.90 | 0.16 | 24.9 | 2981 | 62 | 1421 |

| incl. | 46.00 | 46.60 | 0.60 | 0.75 | 111.1 | 689 | 44 | 6745 |

| incl. | 46.00 | 46.30 | 0.30 | 1.33 | 208 | 1210 | 59 | 12400 |

| GB17-19 | 47.40 | 47.80 | 0.40 | 0.30 | 5.4 | 392 | 59 | 179 |

| GB17-19 | 46.00 | 51.00 | 5.00 | 0.16 | 15.6 | 1271 | 54 | 882 |

| incl. | 50.50 | 51.00 | 0.50 | 0.28 | 5.6 | 77 | 55 | 216 |

| GB17-19 | 90.00 | 93.00 | 3.00 | 0.05 | 15.9 | 6456 | 830 | 615 |

| incl. | 91.30 | 91.60 | 0.30 | 0.38 | 49.2 | 17100 | 88 | 410 |

Note: Intervals reported in Table 1 represent core lengths and not true widths.

Table 2: Drill hole Collar Information

| DDH | Azm | Dip |

| GB17-15 | 270 | -45 |

| GB17-16 | 270 | -45 |

| GB17-17 | 270 | -60 |

| GB17-18 | 270 | -45 |

| GB17-19 | 270 | -45 |

As reported on the Company’s November 30th, 2017 news release, LiCo has recently completed its 2017 diamond drilling program on its Teledyne and Glencore Bucke Properties completing a total of 32 diamond drill holes, drilling 4,100 m of core. This exploration work satisfies both its flow-through financing obligations and the contractual obligations outlined in the recently acquired Glencore Bucke Property from Glencore plc of Baar Switzerland (LSE: GLEN).

LiCo Energy Metals Inc. has implemented a quality assurance/quality control (QA/QC) program for both the Glencore Bucke and Teledyne Property drill programs.

Diamond drill core was logged, then sawed in half, with one half placed in a labelled bag, and the remaining half placed back into the core box and stored in a secured compound. Either a standard or a blank was inserted every 20th sample. All samples were shipped to Activation Laboratories in Ancaster, Ontario. Each sample is coarsely crushed and a 250 g aliquot is pulverized for analysis. A 0.25g sample is digested with a near total digestion (4 acids) and then analyzed using an ICP. QC for the digestion is 14% for each batch, 5 method reagent blanks, 10 in-house controls, 10 samples duplicates, and 8 certified reference materials. An additional 13% QC is performed as part of the instrumental analysis to ensure quality in the areas of instrumental drift. If over limits for Cu, Pb, Zn, and Co are encountered, a sodium peroxide fusion, acid dissolution followed by ICP-OES is completed. For Ag over limits, a four acid digestion is completed followed by ICP-OES.

Qualified Person

The technical content of this news release has been reviewed and approved Joerg Kleinboeck, P.Geo., an independent consulting geologist and a qualified person as defined in NI 43-101.

Click Image To View Full Size

About LiCo Energy Metals: https://licoenergymetals.com/

LiCo Energy Metals Inc. is a Canadian based exploration company whose primary listing is on the TSX Venture Exchange. The Company’s focus is directed towards exploration for high value metals integral to the manufacture of lithium ion batteries.

Glencore Bucke Cobalt Project, Cobalt, Ontario: The Company has entered into a property purchase agreement to acquire a 100% interest from Glencore Canada Corporation (subsidiary of Glencore plc) in the Glencore Bucke Property, situated in Bucke Township, 6 km east-northeast of Cobalt, Ontario, subject to a back-in provision, production royalty and off-take agreement. Strategically, the Glencore Bucke Property consists of 16.2 hectares and sits along the west boundary of LiCo’s Teledyne Cobalt Project. The Property covers the southern extension of the #3 vein that was historically mined on the neighbouring Cobalt Contact Property located to the north of the Glencore Bucke Property. Diamond drilling in 1981 on the Glencore Bucke Property delineated two zones of mineralization measuring 150 m and 70 m in length.

Ontario Teledyne Cobalt Project:

The Company has an option to earn 100% ownership, subject to a royalty, in the Teledyne Project located near Cobalt. Ontario. The Property adjoins the south and west boundaries of claims that hosted the Agaunico Mine. From 1905 through to 1961, the Agaunico Mine produced a total of 4,350,000 lbs. of cobalt and 980,000 oz. of silver. A significant portion of the cobalt that was produced at the Agaunico Mine located along structures that extended southward onto the Teledyne property. The Company completed a total of 11 diamond drill holes totaling 2,200 m in the fall of 2017. The drilling has confirmed cobalt mineralization present on the Property which is consistent with historical grades as reported historically by Cunningham-Dunlop (1979) and Bressee (1981), disclosed in earlier news releases. These reports are available in the public domain through MNDM’s AFRI database.

NI 43-101 Reports for both the Teledyne and Glencore Bucke Properties, are publicly available on www.SEDAR.com as well as the Company’s website. LiCo’s recently completed diamond drilling program (September to December 2017) consisted of both twinning and infill drilling of the historical drill holes located on both the Teledyne Cobalt and Glencore Bucke Properties.

Chile Purickuta Lithium Project:

The Purickuta Project is located within Salar de Atacama, a salt flat encompassing 3,000 km2, being about 100 km long, 80 km wide and home to approximately 37% of the worlds Lithium production and Chile itself holds 53% of the world’s known lithium reserves (Source: Bloomberg Markets – June 23, 2017, “Lithium Squeeze Looms as Top Miner Front-Loads, Chile Says”). The property is 160 hectares large and is enveloped by a concession owned by Sociedad Quimica y Minera (“SQM”) and lies within a few kilometers of a property owned by CORFO (the Chilean Economic Development Agency) where its leases land to both SQM and Albermarle’s Rockwood Lithium Corp. (“Albermarle”) for lithium extraction. Together these two companies, SQM and Albermarle, have a combined annual production of over 62,000 tonnes of LCE (Lithium Carbonate Equivalent) making up 100% of Chile’s current lithium output. As reported in The Economist (June 15, 2017 – A battle for supremacy in the lithium triangle), the Salar de Atacama has the largest and highest quality proven reserves of lithium. The combination of the desert’s hot sun, scarce rainfall, and the mineral-rich brines make Chile’s production costs the world’s lowest. This together with a favourable investment climate, low levels of corruption, and the quality of its bureaucracy and courts makes Chile a favourable place to conduct business.

Nevada Dixie Valley Lithium Project:

The Company has an option to acquire a 100% interest, subject to a 3% NSR, on a large lithium exploration project at the Humboldt Salt Marsh in Dixie Valley, Nevada. Some important geological similarities exist between various lithium brines, notably geothermal activity, a dry climate, a closed basin, an aquifer, and tectonically driven subsistence exist at Dixie Valley along with Clayton Valley and various lithium bearing salars in Chile, Argentina and Bolivia.

Nevada Black Rock Desert Lithium Project:

The Company has entered into an option agreement whereby the Company may earn an undivided 100% interest, subject to a 3% NSR, in the Black Rock Desert Lithium Project in southwest Black Rock Desert, Washoe County, Nevada.

The technical content of this news release has been reviewed and approved Joerg Kleinboeck, P.Geo., an independent consulting geologist and a qualified person as defined in NI 43-101.

On Behalf of the Board of Directors

Tim Fernback, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements.

Click here to connect with LiCo Energy Metals Inc. (TSXV:LIC, OTCQB:WCTXF) for an Investor Presentation

Source: www.thenewswire.com