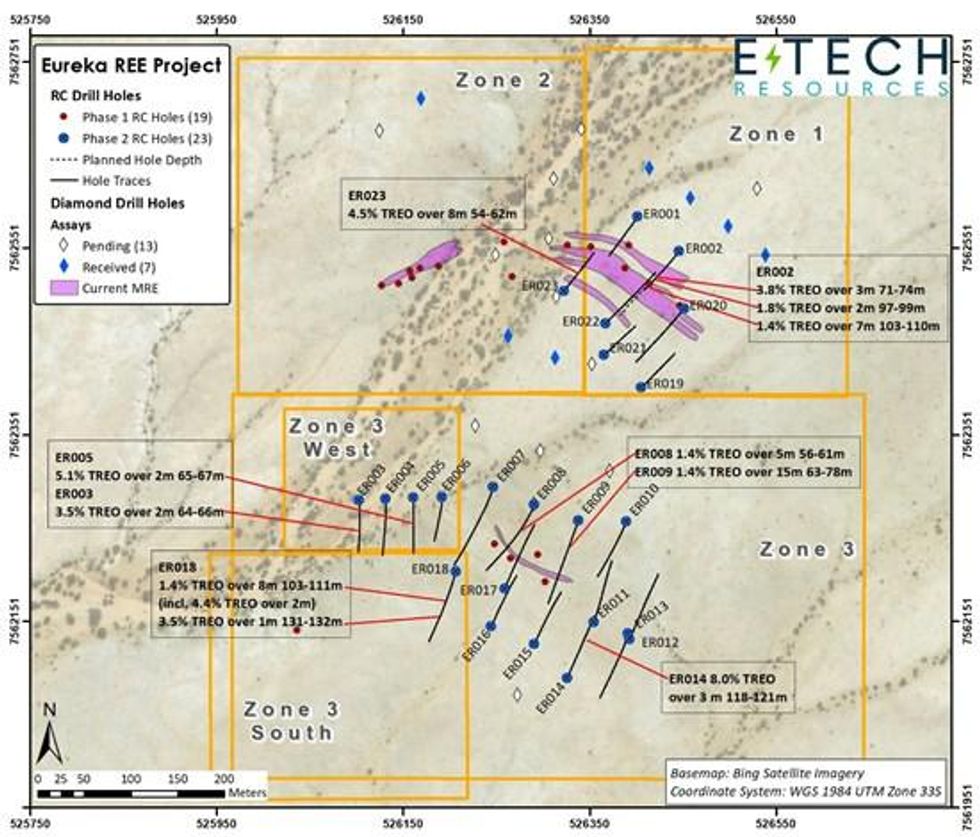

E-Tech Resources Inc. (TSXV: REE) ("E-Tech or the Corporation") is pleased to announce high grade REE assays from Reverse Circulation ("RC") drilling which includes 3 meters of 8.0% TREO and 8 meters of 4.5% TREO (see highlights below). The Corporation is also pleased to announce the expanded surface delineation of Zone 1 and Zone 3 to the south and west by approximately 100 meters and 140 meters, respectively (see map below).

Highlights from the RC drilling include:

Zone 1:

- Drill Hole ER002: 3.8% TREO over 3 meters from 71m to 74m

- Drill Hole ER002: 1.4% TREO over 7 meters (including 2.3% TREO over 3 meters) from 103m to 110m

- Drill Hole ER020: 1.4% TREO over 6 meters (2.7% TREO over 2 meters) from 15m to 21m

- Drill Hole ER023: 4.5% TREO over 8 meters (including 17% TREO over 2 meters) from 54m to 62m

Zone 3 Central:

- Drill Hole ER009: 1.4% TREO over 15 meters (including 3.2% TREO over 3 meters) from 63m to 78m

- Drill Hole ER014: 8.0% TREO over 3 meters from 118m to 121m

Zone 3 West:

- Drill Hole ER003: 3.5% TREO over 2 meters from 64m to 66m

- Drill Hole ER005: 5.1% TREO over 2 meters from 65m to 67m

Zone 3 South:

- Drill Hole ER018: 1.4% TREO over 8 meters (including 4.4% TREO over 2 meters) from 103m to 111m.

Elbert Loois, E-Tech Resources Inc. CEO, commented, "These positive results at Zone 1, Zone 3, Zone 3 West and Zone 3 South are highly encouraging and indicate that we have now increased the Eureka Project's footprint significantly. These results follow the recent diamond drilling results, which show REE mineralization 100 meters below the depth used to calculate the existing resource estimate and give us further confidence in the potential of the Eureka REE project. We look forward to our upcoming drill program as well as receiving the outstanding diamond core assays."

RC Drilling Results

Assay results have now been received from the RC drilling campaign which took place between December 2020 and March 2021. A total of 3000 meters of drilling in 23 holes tested both lateral and depth targets over Zone 1 and Zone 3 to a vertical depth of up to 170 meters. A total of 1725 RC drilling samples (including standards, duplicates and blanks) have been assayed to date. Figure 1 below shows the location of the RC drill holes over Zone 1 and Zone 3.

FIGURE 1: Plan view of drill hole positions at Eureka illustrating all assay results received to date. The red dots are RC drill holes completed in 2017, while the purple areas represent the current 2021 Mineral Resource Estimate (MRE).

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/6102/105961_c73e9d05f4fbf8c2_001full.jpg

Zone 1

Zone 1 targets were selected to provide further support for lateral and depth extent of the current known resource. 7 RC holes in a scissor configuration were drilled in Zone 1 to extend the current resource to depth. Scissor holes ER001 with ER023, ER002 with ER022 and ER020 with ER019 were scissored from the northeast and southwest respectively (see Figure 1). All the holes were compromised by underground water ingress.

These RC drill holes, although unable to reach the target depths planned, indicate continuation of the dykes within Zone 1 - which constitute the bulk of the current MRE - to an additional 60 meters vertical depth. Combined with information from the recently announced diamond drilling on the same Zone 1 which intercepted dykes at a vertical depth of 180m, the continuation of the dykes at intermediate depths is confirmed.

Zone 3 West

The RC drilling over Zone 3 was planned to test the scale of this area and to test if the dykes exposed by trenching at surface continue to depth. Holes ER003 to ER006 specifically targeted the obscured western extension of known carbonatite dyke outcrops.

The carbonatite dykes intersected on this western area are typically 2 meters in apparent thickness, carry appreciable grade across meter intervals (as seen in ER003 and ER005) and suggest continuation of Zone 3 to the West.

Zone 3 Central

Holes ER007 through to ER017 were planned to investigate the size extent of obscured carbonantite dykes at depth, which are known from outcrop or were revealed by trenching.

A series of carbonatite dykes were intercepted in this area displaying variable thicknesses from under 1 meter to up to 15 meters in apparent width, returning interval grades from between 0.3% TREO to 11.6% TREO.

Zone 3 South

Hole ER018 tested the south-westward area of Zone 3 to explore the dyke continuity in this direction as indicated by historical trenching. Four (4) REE-mineralised dykes were intersected in this hole. These results therefore confirm the continuity of the dykes into the southern part of Zone 3 and correspond with indicator anomalies encountered in the test-trenches dug at surface.

Table 1 presented on the next page gives a summary of all the significant intercepts in total rare earth oxide (TREO) grade from all Zones.

Geochemical Analysis

As an additional validation of the received geochemical analysis of all RC and DD assays to date, there is an observed strong correlation between phosphorous and REE, and between REE and thorium which reinforces the almost exclusive monomineralic character of the REE host mineral monazite across all Zones.

TABLE 1: Significant intercepts from the 2021 Reverse Circulation (RC) campaign.*

| Hole | Planned Depth | EOH | Azi | From | To | Width (m) | Grade TREO % | X | Y | Location |

| ER001 | 200 | 105 | 220° | 73 | 75 | 2 | 2.3 | 526405 | 7562581 | Zone 1 |

| ER002 | 200 | 121 | 220° | 71 | 74 | 3 | 3.8 | 526453 | 7562544 | Zone 1 |

| ER002 | 97 | 99 | 2 | 1.8 | Zone 1 | |||||

| ER002 | 103 | 110 | 7 | 1.4 | Zone 1 | |||||

| incl. | 107 | 110 | 3 | 2.3 | Zone 1 | |||||

| ER003 | 120 | 130 | 180° | 14 | 15 | 1 | 0.4 | 526101 | 7562283 | Zone 3 W |

| ER003 | 64 | 66 | 2 | 3.5 | Zone 3 W | |||||

| ER003 | 82 | 83 | 1 | 0.5 | Zone 3 W | |||||

| ER004 | 120 | 120 | 180° | 5 | 6 | 1 | 2.0 | 526132 | 7562285 | Zone 3 W |

| ER004 | 66 | 67 | 1 | 0.5 | Zone 3 W | |||||

| ER004 | 108 | 110 | 2 | 1.2 | Zone 3 W | |||||

| ER005 | 120 | 180 | 180° | 14 | 15 | 1 | 0.5 | 526164 | 7562283 | Zone 3 W |

| ER005 | 65 | 67 | 2 | 5.1 | Zone 3 W | |||||

| ER005 | 86 | 88 | 2 | 2.5 | Zone 3 W | |||||

| ER005 | 91 | 92 | 1 | 0.4 | Zone 3 W | |||||

| ER006 | 120 | 180 | 180° | 26 | 32 | 6 | 0.5 | 526192 | 7562285 | Zone 3 W |

| ER006 | 102 | 105 | 3 | 1.2 | Zone 3 W | |||||

| ER007 | 180 | 200 | 200° | 12 | 13 | 1 | 0.6 | 526242 | 7562224 | Zone 3 W |

| ER007 | 105 | 106 | 1 | 0.9 | Zone 3 W | |||||

| ER007 | 199 | 200 | 1 | 0.9 | Zone 3 W | |||||

| ER008 | 160 | 190 | 200° | 8 | 10 | 2 | 0.6 | 526293 | 7562278 | Zone 3 |

| ER008 | 32 | 36 | 4 | 1.1 | Zone 3 | |||||

| ER008 | 51 | 54 | 3 | 0.6 | Zone 3 | |||||

| ER008 | 56 | 61 | 5 | 1.4 | Zone 3 | |||||

| incl. | 58 | 60 | 2 | 3.0 | Zone 3 | |||||

| ER008 | 67 | 69 | 2 | 0.5 | Zone 3 | |||||

| ER008 | 135 | 136 | 1 | 0.5 | Zone 3 | |||||

| ER009 | 160 | 190 | 200° | 8 | 10 | 2 | 0.7 | 526338 | 7562260 | Zone 3 |

| ER009 | 20 | 23 | 3 | 1.1 | Zone 3 | |||||

| ER009 | 63 | 78 | 15 | 1.4 | Zone 3 | |||||

| incl. | 63 | 66 | 3 | 3.2 | Zone 3 | |||||

| ER009 | 80 | 82 | 2 | 0.9 | Zone 3 | |||||

| ER010 | 160 | 134 | 200° | 121 | 125 | 4 | 0.3 | 526386 | 7562260 | Zone 3 |

| ER011 | 160 | 160 | 020° | 26 | 27 | 1 | 2.5 | 526356 | 7562147 | Zone 3 |

| ER011 | 79 | 81 | 3 | 1.0 | Zone 3 | |||||

| ER012 | 150 | 180 | 020° | No intersection | 526393 | 7562133 | Zone 3 | |||

| ER013 | 150 | 165 | 200° | 144 | 147 | 3 | 1.0 | 526389 | 7562138 | Zone 3 |

| ER014 | 100 | 160 | 020° | 111 | 112 | 1 | 3.0 | 526325 | 7562090 | Zone 3 |

| ER014 | 118 | 121 | 3 | 8.0 | Zone 3 | |||||

| incl. | 119 | 121 | 2 | 11.6 | Zone 3 | |||||

| ER015 | 100 | 130 | 020° | 14 | 16 | 2 | 1.2 | 526293 | 7562124 | Zone 3 |

| ER015 | 84 | 85 | 1 | 1.1 | Zone 3 | |||||

| ER015 | 101 | 103 | 2 | 0.5 | Zone 3 | |||||

| ER016 | 100 | 120 | 020° | 64 | 65 | 1 | 0.6 | 526243 | 7562147 | Zone 3 |

| ER016 | 90 | 93 | 3 | 0.5 | Zone 3 | |||||

| ER017 | 160 | 160 | 020° | No intersection | 526260 | 7562188 | Zone 3 | |||

| ER018 | 160 | 160 | 200° | 103 | 111 | 8 | 1.4 | 526196 | 7562192 | Zone 3 S |

| incl. | 103 | 105 | 2 | 4.4 | Zone 3 S | |||||

| ER018 | 131 | 132 | 1 | 3.5 | Zone 3 S | |||||

| ER018 | 153 | 155 | 2 | 1.1 | Zone 3 S | |||||

| ER018 | 157 | 158 | 1 | 1.1 | Zone 3 S | |||||

| ER019 | 160 | 113 | 040° | 55 | 56 | 1 | 0.5 | 526406 | 7562404 | Zone 1 |

| ER019 | 57 | 58 | 1 | 0.5 | Zone 1 | |||||

| ER020 | 160 | 148 | 220° | 15 | 21 | 6 | 1.4 | 526452 | 7562486 | Zone 1 |

| incl. | 16 | 18 | 2 | 2.7 | Zone 1 | |||||

| ER021 | 160 | 97 | 040° | 78 | 81 | 3 | 0.7 | 526365 | 7562437 | Zone 1 |

| incl. | 80 | 81 | 1 | 1.8 | Zone 1 | |||||

| ER022 | 175 | 156 | 040° | 43 | 46 | 3 | 1.2 | 526368 | 7562472 | Zone 1 |

| incl. | 45 | 46 | 1 | 2.3 | Zone 1 | |||||

| ER023 | 150 | 103 | 040° | 25 | 27 | 2 | 1.4 | 526340 | 7562497 | Zone 1 |

| ER023 | 54 | 62 | 8 | 4.5 | Zone 1 | |||||

| incl. | 55 | 57 | 2 | 17.0 | Zone 1 | |||||

*Hole locations are provided in UTM Zone 33S. Inclination angle at 60 degrees for all RC holes. Reported intercepts are drilled lengths while the true thickness of the mineralization is estimated to range between 60 and 80 per cent of the drilled lengths.

Eureka Project Technical Disclosure

The Corporation produced its current Mineral Resource Estimate ("MRE") for the Eureka Project with an effective date of 2 August 2021. The MRE was prepared by SRK Consulting (UK) ("SRK"). An Independent Technical Report titled "Independent Technical Report: Eureka, Rare Earth Project, Namibia" was released on the 15 September 2021 and prepared by SRK, supporting the disclosure of the MRE, and is available on SEDAR and the Corporation's website. (https://etech-resources.com)

Quality Assurance / Quality Control

All E-Tech sample assay results have been independently monitored through a quality assurance / quality control ("QA/QC") program including the insertion of blind standards, blanks and duplicate samples. QA/QC samples make up 10% of all samples submitted. Sampling of RC chips from drilling was conducted in two stages. The initial stage of sampling was conducted during the drilling, each drilled meter was collected from the rig mounted cyclone and were then split in a 7:1 (8 way) splitter, the split fraction was then split again 1:1 (2 way) to create two approximately 2 kg samples. One sample was retained as a reference sample for future work, the other sample was then collected as a laboratory sample stream and transported to Activation Laboratories Ltd. sample preparation facility in Windhoek, Namibia. The sample is dried, crushed to 90% passing 2 mm, riffle splitting a 250 g sub-sample and pulverizing to 95% passing 105 µm. Sample pulps are sent to Activation Laboratories Ltd. in Ontario, Canada for analysis. REE analysis is by method 8-REE. The sample is milled to 95% -200 mesh. To ensure complete fusion of resistate minerals; lithium metaborate/tetraborate fusion is used with analysis by ICP-OES and ICP-MS. Mass balance is calculated as an additional quality control technique to ensure complete analysis.

Qualified Person

Pete Siegfried, BSc. (Hons), M.Sc., is a Consulting Geologist and director of GeoAfrica Prospecting Services CC. Mr Siegfried has reviewed and approved the scientific and technical information in this news release. Mr. Siegfried is a member of The Australasian Institute of Mining and Metallurgy (AusIMM) membership number: 221116 (CP Geology), and a Qualified Person for the purposes of National Instrument 43-101.

About E-Tech Resources Inc.

E-Tech Resources Inc. (TSXV: REE) is a rare earth exploration and development company focused on developing its Eureka Rare Earths Project in Namibia. The Eureka Project is located approximately 250 km north-west of Namibia's capital city Windhoek and 140 km east of Namibia's main industrial port Walvis Bay. The project is situated next to the national B1 highway in the Erongo Region of Namibia. The Eureka deposit lies in the Southern Central Zone of the Neoproterozoic Damara Belt within Exclusive Prospecting Licence ("EPL") number EPL 6762; which covers Eureka Farm 99 and Sukses Farm 90. Namibia is recognized as one of Africa's most politically stable jurisdictions, with an extremely well-established national infrastructure and a clear and transparent mining law. The Corporation continues to assess new project opportunities and expand its Southern African portfolio.

Further details are available on the Corporation's website at www.etech-resources.com or contact Elbert Loois, CEO of E-Tech Resources Inc., at +1 (902) 334 1949.

Cautionary Statements

This press release may contain forward-looking information, such as statements regarding the completion of the work in Namibia by E-Tech and future plans and objectives of E-Tech. This information is based on current expectations and assumptions (including assumptions in connection with the continuance of the applicable company as a going concern and general economic and market conditions) that are subject to significant risks and uncertainties that are difficult to predict, including risks relating to the ability to satisfy the conditions to completion of exploration programmes and work in Namibia. Actual results may differ materially from results suggested in any forward-looking information. E-Tech assumes no obligation to update forward-looking information in this release, or to update the reasons why actual results could differ from those reflected in the forward-looking information unless and until required by applicable securities laws. Additional information identifying risks and uncertainties is contained in filings made by E-Tech with Canadian securities regulators, copies of which are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/105961