Joe Lowry + lithium = true love forever?

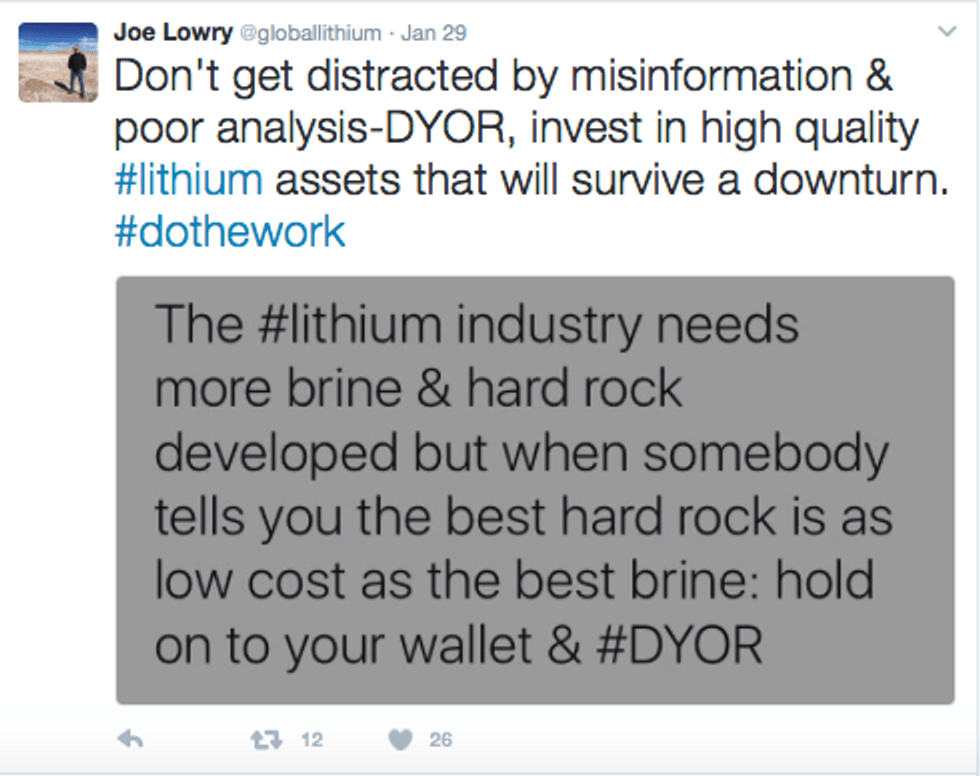

This is my 4th interview of Joe Lowry, aka “Mr. Lithium,” the first was in June 2015, the 2nd, January 2016, the 3rd March 2016. In the past several years, Mr. Lithium’s prominence has grown tremendously through his contributions on Linked-In andTwitter. That’s on top of his world renowned role as one of the most sought after consultants in the lithium industry. While his clients get 110% of Joe’s best insights, ideas, commentary and analysis (in real time), readers of this interview are about to receive something thought to be impossible, a free lunch. One of the key takeaways from following Joe’s work is his frequent warnings that retail investors need to,”do the work.” Much of what one reads about lithium juniors can be filed under the category, “Fake News.” DYOR. Caveat Emptor, etc.

When one needs to know the state of the world, one can turn to Trump’s twitter feed. For the latest and greatest assessment of the lithium sector/market/industry/players, it’s here and here….

Joe will be the first to tell you he’s not the only expert. We agree that Simon Moores of Benchmark Mineral Intelligence andChris Berry, Editor of the Disruptive Discoveries Journal are very valuable resources as well. In addition to lithium, they cover other green-high tech/energy metals including cobalt, graphite, vanadium & rare earths. This interview is entirely about lithium.

Joe, you continue to be one of the top Li market experts, can you comment on what you’ve gotten right (and wrong) over the past few years?

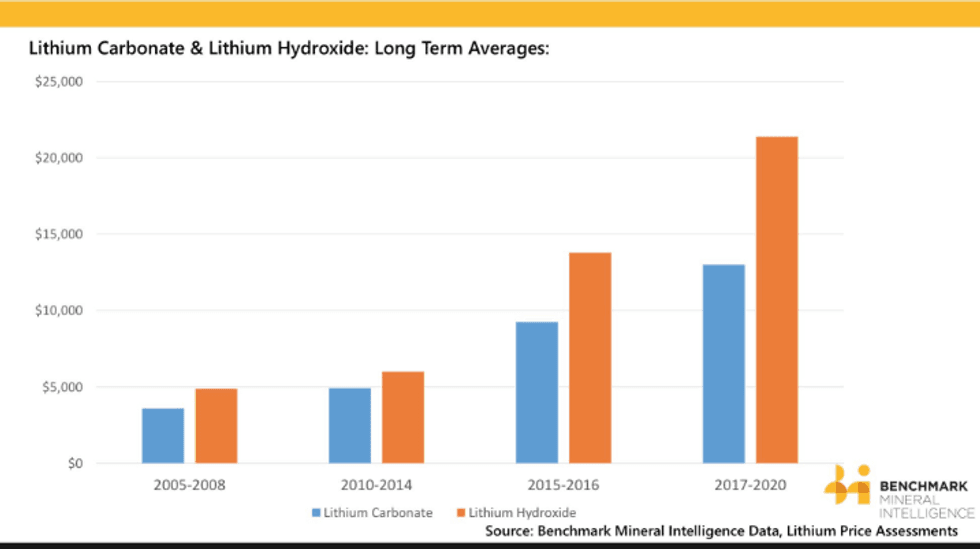

You don’t have to go beyond the price question to see what I’ve gotten right and wrong. In the summer of 2014 I did the keynote talk at the Qinghai Green Energy Festival in Qinghai Province China and said, quite correctly, that hydroxide prices would spike, “in the next couple years” driven by the growth of nickel based cathode. Unfortunately, I also said, incorrectly, that there was, “no reason for carbonate prices to increase more than the rate of GDP for the next few years.”

Why did I get hydroxide right and carbonate wrong? Hydroxide was simple supply/demand analysis. But with carbonate, while I didn’t think Rockwood (now part of Albemarle Corp. (NYSE: ALB) [“ALB”]), Orocobre Ltd. (“ORE”) and RB Energy, Inc. would be on time with new capacity, I didn’t expect the extreme under-performance that resulted in a market shortage that continues to this day. NOTE: {RB Energy failed in 4th qtr 2014 due to lack of funding}.

Large lithium consumers have complained for years about the opaque nature of the lithium industry. Pricing has been hard to understand and plan for. In the past,Roskill and Industrial Minerals tried to provide price information, but they simply didn’t do a very good job. Simon and his team are taking on the challenge of putting together a pricing benchmark that can be used for contracts. I like what they’re doing, and I’m fully supportive. NOTE: {Joe Lowry has no financial interest in BMI}. Since I’m still active in the market trading product, I have a unique window into actual pricing, especially on the high end which is where I participate.

Given considerable lead times, isn’t the list of new projects and operating expansions coming online in 2017 – 2021 fairly well known? Could projects be added to the pipeline?

No, I don’t think so. Look at what people expected in 2014 to come online in 2015 – ALB’s La Negra 2, ORE and RB Energy. What happened? Of approximately 60k metric tonnes (“mt”) of expected production, less than 15k mt has materialized so far. Execution is everything. Knowing the “plan” and knowing the “result” are two different things. Nothing will be added to the current pipeline that will produce before 2021.

The next world-class project is the Sociedad Química y Minera de Chile S.A [NYSE: SQM)(“SQM”)/Lithium Americas’ (“LAC”) Cauchari project. [Minera Exar SA – Cauchari-Olaroz]

SQM is the world’s best brine operator, certainly better than ALB, and there’s no comparison with ORE. I’m confident SQM/LAC will bring phase 1 of Cauchari online by 2020 (they will say 2019 and I hope they are correct).

Ramp up to the full 25k mt and start of phase 2 will likely follow within 18 months. Galaxy at Sal de Vida is a bit more of a challenge to call. Cash flow from Mt Cattlin and a recent capital raise should enable them to start advancing the project in 2017. So, in the next five years brine projects and expansions will get developed, but probably not at a sufficient rate to meet market growth. As far as I’m concerned, the rest of the lot in Argentina is still too speculative to consider in a 5-6 year time horizon. Enirgi, Eramet, Lithium Xet al.

At times you question the research, analysis / commentary from peers. What might they be missing in their assessments of key metrics like supply, demand & pricing?

I’m not a research analyst. I have a narrowly defined area of expertise that my clients, as well as Twitter and Linked-In followers, seem to appreciate. The banks who publish, “research” on lithium aren’t my peers in the traditional sense of the word.

I sometimes criticize poor quality research by banks and others without holding back too much. I don’t have the resources of a Macquarie, but in the lithium area I may have forgotten more than they seem to collectively know. What many of the big banks don’t do is, “the work.” Taking a company’s press release or presentation at face value, perhaps calling one or two contacts at a lithium producer or battery company, writing down what they say and calling it research is nonsense. Over time, as lithium becomes more prominent, I believe research will improve. That said, I think Deutsche Bank has done some good work, so there are points of light out there. I do have clients ask me about who they should pay attention to.

There’s been a lot of buzz around a keynote presentation by Lithium Americas’ David Deak on January 25th. Do you have view on what Deak is saying about Li demand?

Yes, I know David’s thesis, in fact I was at that same conference in Toronto and conducted an (unrelated) Q&A session at the lunch break. He believes we will need 20x the current annual supply of lithium to electrify the world’s transportation fleet. A key quote from his talk…. “Almost 100 Giga-factories, [defined as a 100 GWh/yr facility] operating for 20 years each, are needed to electrify the world’s fleet of vehicles, and enable segments of the energy storage market.” This is inline with what Elon Musk has said. David’s analysis is straightforward and thought provoking. NOTE: {On January 26th, Joe tweeted, “Dr. D makes me look like an abject pessimist. That said, I am coming around.“}

Do Orocobre’s operating and quality problems portend challenges for Argentina’s next wave of brine producers?

Not at all. Orocobre made rookie mistakes across the board – ponds, process, etc. Their failure to execute says nothing about the quality of Argentina’s resources or the operating environment. ORE had the misfortune to start the project under the former government which, to be fair, was also an issue. On balance though, ORE had the best entry opportunity in the history of lithium – market shortage, rising pricing, etc. If they had executed in a similar fashion ten years ago, they would already be bankrupt.

Please explain China’s growing role in the global Li market.

China is the world’s largest lithium consumer overall and largest producer of cathode materials for lithium ion batteries. I don’t expect that to change in the coming five years. More importantly, China’s hard rock converters have kept the market in balance via processing spodumene concentrate from Australia. China now has two major lithium companies – Ganfeng and Tianqi. Both have resource assets outside of China and are rapidly transitioning from regional to global players.

You’ve been vocal about the importance of Argentinean brines and the likelihood of investment and market consolidation. What are your latest views?

By 2021 you will have four significant lithium operations in Argentina vs two in Chile. Minera Exar SA (SQM/LAC’s JV), andGalaxy will join FMC Corp (NYSE: FMC) and Orocobre. Ganfeng now owns ~20% of LAC so we have an emerging alliance with SQM/Ganfeng/LAC being formed. The big question mark is what Luke Kissam does with his cash hoard and stated ambition to grow ALB’s lithium business. ORE and Galaxy seem like takeout candidates, but both are probably too expensive to make sense for ALB. ORE requires a major investment to produce a high percentage of world class product.

Many Li juniors are planning to deploy largely untested (at commercial scale) direct brine extraction technologies. What are you hearing lately about these technologies?

Some of these technologies have been around for years. At some point I expect one or more will be implemented at scale, but the benefits are still unknown. I’m agnostic at this point and certainly think investors have better options than a project that depends on new technology.

Albemarle’s approach to the business continues to mystify me. From my perspective the deal with Chile was too one-sided in a negative way for ALB shareholders. ALB’s pricing is well below their major competitors for no real long-term benefit in a market that will be tight for an extended period.

What are the top 1 or 2 misconceptions investors have in gauging the prospects of Li junior companies?

#1 – most hard rock investors seem not to understand that mining is the easy part of a hard rock project. Even in the production of spodumene concentrate, chemistry is critical.

#2 – despite a great long-term demand trend in lithium, the world doesn’t need 20 “lithium” companies, let alone the dozens we now have. I don’t give investment advice but I can only think of five juniors that are viable even for speculative capital.

Joe, thank you, as always, for sharing your latest views on the lithium industry. 2017 is likely to be a very interesting year.