Production Costs Need to Drop to Support Widespread Graphene Use

Graphene is considered a wonder material of this century because it conducts electricity and stronger than steel. Graphite companies are excited about the recent discovery of graphene, but there are concerns that the high cost of producing pristine graphene could hamper its commercial application.

By Karan Kumar — Exclusive to Graphite Investing News

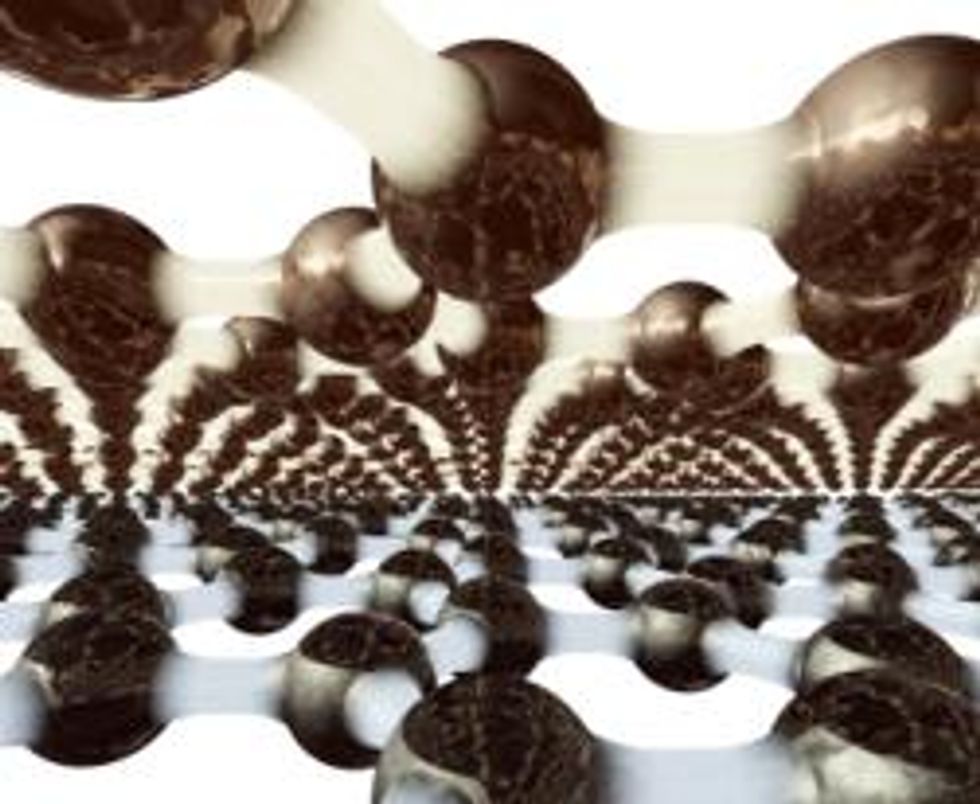

Graphene, derived from graphite, is touted as the wonder material of the 21st century. Composed of carbon atoms arranged in tightly-bound hexagons just one atom thick, it is the strongest material ever measured, about 200 to 300 times stronger than steel. It conducts electricity, is one of the most lightweight materials known to man, and researchers say the material will have a profound impact on several industries, including autos, airlines, electronics, batteries, and beyond. Many researchers say that graphene is most likely to replace silicon.The miracles of graphene, however, are still only being seen in laboratories. Chris Berry, founder of House Mountain Partners, which conducts research on the commodity and energy markets, told Resource Investing News in an interview, “I am not aware of any widespread commercial use of graphene by any firms.”

Berry added that “it’s possible” that graphene could replace silicon, but added, “I want to stress that these are very early days with graphene and associated research. It appears that graphene can bypass the challenge of making smaller chips as it’s a good conductor of electricity, but I’m not prepared to state that I think graphene will replace silicon any time soon. Price is also a factor.”

Rudy Richman, director of business development at Focus Metals Inc. (TSXV:FMS,OTC Pink:FCSMF), a diversified Canadian miner, said his company and its 40 percent partner Grafoid Inc. will be ready to start a pilot graphene plant in two to three months. Focus will provide graphite to Grafoid, which will manufacture the graphene to ship to labs and companies involved in research and development.

Focus Metals’ cheap graphene intentions

“We can be in full production of larger quantities within a year,” Richman told Resource Investing News in an interview. “Grafoid believes the cost of graphene needs to come down drastically in order for its use to become ubiquitous in the marketplace and for applications to benefit from the science. We believe we have the process to do so.”

In March, Focus Metals announced the completion of a $500,000 loan to Grafoid in connection with Grafoid’s work in transforming graphite into graphene on a commercial scale, using primarily raw unprocessed graphite ore from Focus’ Lac Knife project.

At Graphene Supermarket, an online shop, a kilo of pristine graphene costs about $40,000. Richman explained that cheaper graphene, known as graphene oxide or reduced graphene oxide, is also being produced, but it is of a lesser quality that is not as conducive or strong as pristine graphene. Along with Grafoid, Focus has the know-how to create inexpensive, pristine graphene. “Our method is economically and ecologically viable. We are going to throw down the gauntlet for others to do the same.” He did not give details.

Graphene’s market potential could be huge, with applications for the material being announced nearly daily. It is expected to change semiconductors, LCD touch screens and monitors, transistors, energy storage, solar cells, and more. The graphite industry is excited about the future of the G-word, but questions still loom about its price.

Graphene economics unclear

Berry said that the “economics surrounding graphene are unclear to me as much of what is known about graphene production is patented or a trade secret. There are several junior mining companies that are supplying ore from their deposits to end users to test graphene, but I have yet to hear of any widely successful attempts. The mining companies are going in this direction to learn more about graphene production and take advantage of any potential intellectual property advancements they can using their ore and the knowledge base of a partner.”

Northern Graphite Corp. (TSXV:NGC,OTC Pink:NGPHF) said in February that it will supply extra large flake graphite to Grafen Chemical Industries for graphene research. Northern also entered a deal to develop intellectual property rights, and will retain a 50 percent interest in the North American patent rights to any products and processes developed by Grafen.

One of the concerns about the graphite industry is that more than 70 percent of the mineral is produced in China, and the country’s graphite producers are calling on the government to allow graphite the same protection as rare earth. If that were to happen, a disruption in graphite supply could send prices higher.

“Much of the intellectual property and ‘know-how’ surrounding graphene – how it’s manufactured and its uses – exists outside of China, so it’s important for graphite mines outside of China to come on-stream soon to ensure a ready and steady supply of raw materials for end users in western countries and researchers involved with graphene,” Berry said.

According to a market analysis by research firm Technavio, investing in graphene is forecasted to produce a compound annual growth rate of 58.7 percent from 2015 t0 2020. The report points out that the main area of concern currently lies in the high cost of producing graphene.

Despite the hurdles, companies and governments are pumping billions of dollars into graphene research in the hope that they can benefit from the wonder material. Nearly 200 firms, including Intel, IBM, BASF, and Samsung, are invested in graphene research. The European Union and South Korea each have a $1.5 billion initiative to build industrial-scale display materials using graphene as a substitute for indium tin oxide. And the UK government last year granted 50 million pounds to the University of Manchester to create a technology hub to commercialize graphene.

Securities Disclosure: I, Karan Kumar, hold no direct investment interest in any company mentioned in this article.