China’s Graphite Dominance Offers Opportunity for Canadian Juniors

China produces more than 70 percent of the world’s graphite, a mineral essential for many industries. China’s intentions to introduce a rare earth-style quota for graphite could lead to massive supply disruption. Canadian junior miners, however, are on track to exploring this critical mineral.

By Karan Kumar — Exclusive to Resource Investing News

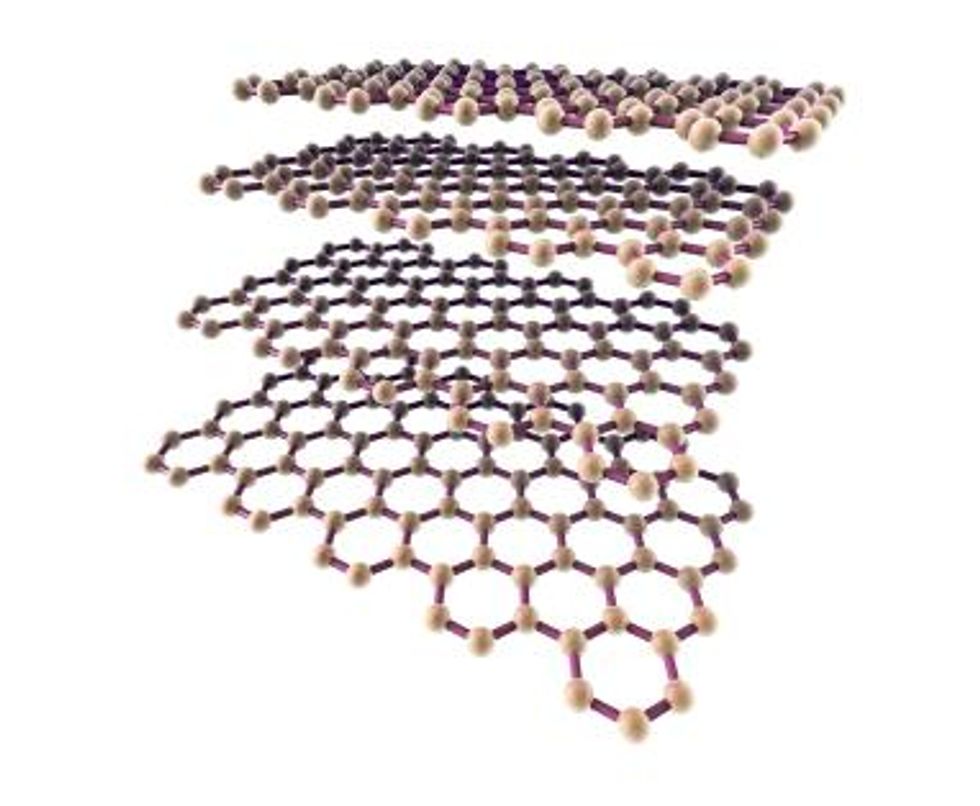

China produces more than 70 percent of the world’s graphite, according to data from the US Geological Survey. Chinese producers of the strategic metal – used alongside lithium in batteries and also in the steel and solar panel industries – are calling on their government to allow graphite the same protection as rare earth, a move that could disrupt supply and send prices up even more.“China has a stranglehold on natural graphite supply. This, together with a generation of under-investment in mines around the world, is creating a very tight supply situation,” Simon Moores of Industrial Minerals said in a recent article, which reported that the price of graphite has risen 140 percent since January 2011. Other reports say the price of graphite has more than tripled in the past seven years.

Graphite, the new rare earth?

Most western governments classify graphite as a “critical mineral” and depend on supplies from China, Brazil, and India, which produce nearly all of the world’s graphite. If China’s quota policy on rare earth was to extend to graphite, which the country currently restricts through value added and export taxes, the move would wreak havoc on world demand, supply, and prices.

Graphite production “has now held steady for several years at approximately 1.1 million tons (Mt) as China appears to have reached the limit of its productive capacity and the commodity super cycle has soaked up excess supply,” Jack Lifton, a consultant focused on market fundamentals and rare metals trends, said in a recent interview. Of the 1.1 million tons of worldwide production, about 800,000 tons come from China. The price for flake graphite is $2,000 to $3,000 per tonne, depending on flake size and grade.

Lithium-ion batteries and pebble-bed nuclear reactors raise demand

China’s dominance and the rising demand for graphite – about a five percent increase per year – offer a lucrative opportunity for juniors looking to explore the metal. The Financial Post reported from North America’s recent graphite conference – the first of its kind – that the outlook for graphite is highly positive, adding that demand for the metal is likely to increase. Speakers at the conference said that lithium-ion batteries use anywhere from ten to 30 times more graphite than lithium. Lithium-ion demand is expected to grow by 25 percent a year once the batteries become standard for phones, cameras, and especially electric vehicles. Keynote speaker Chris Berry said that pebble-bed nuclear reactors could use as much flake graphite as the world now produces, which raised concerns about supply.

“Fortunately, graphite reserves are present around the world, though many sites would require several years of development and significant investment to begin production,” Lifton said. “Countries known to have reserves of highly valuable flake or crystalline graphite include Austria, Norway, Germany, Italy, Madagascar, Sri Lanka, Russia and Canada.”

Canadian juniors could fill growing demand

Canadian miners have taken the lead in graphite exploration. Even though there are presently very few advanced-stage deposits in the country, Canada holds potential in the graphite space. Ontario Graphite Ltd., a privately-owned Canadian mining company that is financed by a consortium of private equity firms, is slated to begin production in mid-2012 at its Kearney mine.

Oakville, Ontario-based MEGA Graphite Inc. said earlier this year that it is on target for its Canadian listing at the end of the first quarter, adding that the money from the IPO will be used to increase production at its Uley Graphite Mine in Australia and to develop its four other projects in Canada.

Below is a selection of publicly-traded Canadian graphite juniors whose properties range from recent acquisitions to advanced-stage projects.

Northern Graphite Corp. (TSXV:NGC): The company’s Bissett Creek project, located about 100 kilometers east of North Bay, Ontario, is expected to produce 19,000 tonnes of graphite per year with commercial production expected to start in the third quarter of 2013.

Focus Metals Inc. (TSXV:FMS): The company owns 100 percent of the Lac Knife, Quebec graphite deposit. The property, some 35 kilometers south of Fermont, Quebec, is at the pre-development stage. Scheduled for commissioning in 2014, the mine is expected to produce 25,000 tons of graphite per year.

Strike Graphite Corp. (TSXV:SRK): Formerly known as Strike Gold Corp., the Vancouver-based company has two graphite projects in Saskatchewan and one in Quebec. Though still exploring, the company says it can have an initial resource estimate on the three properties by the fourth quarter of this year.

Standard Graphite Corp. (TSXV:SGH): The company holds 100 percent interest in twelve prospective graphite properties within known graphite districts in Quebec and Ontario.

GreenLight Resources Inc. (TSXV:GR): The company owns the Golden Grove deposit some 24 kilometers northeast of Saint John, New Brunswick. Just this month, the company entered into an option agreement to acquire a 100 percent stake in the Christmas Island gold and graphite property in Nova Scotia.

Cedar Mountain Exploration Inc. (TSXV:CED): The Vancouver-based company is currently advancing its flagship project, Graphite Creek, in Alaska. The graphite deposit offers potential for the discovery of large-flake, high-purity graphite exposed at surface, and is well-positioned to host an open-pit mine.

Energizer Resources Inc. (TSX:EGZ): Energizer has found a number of outcroppings of graphite on their graphite/vanadium projects in Madagascar. The company has been moving quickly on exploring these areas and has already returned both trenching and drilling results.

Flinders Resources Ltd. (TSXV:FDR): The company acquired 100% of the Kringel graphite mine in Sweden in August 2011. The Kringle Mine, some 300 kilometers north of of Stockholm, has a historic graphite resource of 6.9 million tonnes containing 8.8% graphite in 4 separate deposits. The mine is fully permitted to produce up to 13,000 tonnes per year of graphite.

Securities Disclosure: I, Karan Kumar, hold no direct investment interest in any company mentioned in this article.