Cobalt Outlook 2015: Market Entering Deficit Territory

Tesla Motors and its lithium-ion battery gigafactory definitely stole the show in the cobalt market this past year. Looking forward, it appears that increased demand from that facility and others will begin to push the market into deficit.

For our 2016 Cobalt outlook, please see: Cobalt Outlook 2016: Near-term Deficit Still Expected.

Tesla Motors (NASDAQ:TSLA) and its lithium-ion battery gigafactory took center stage in the graphite and lithium markets in 2014, and the cobalt space was no different.

The Elon Musk-led electric-car maker burst onto the scene in February with plans to build the $5-billion facility, and has kept the news coming ever since. It announced the location of the gigafactory — Nevada — in September, and at the end of November, analyst Simon Moores of Benchmark Mineral Intelligence revealed that construction is running ahead of schedule.

Cobalt market participants have good reason to be excited. As a number of companies emphasized shortly after the gigafactory’s announcement, that’s largely because once it’s operating Tesla will require a steady, stable supply of graphite, lithium and cobalt — and more importantly it will require a lot of those materials.

Just how much is up for debate. Tesla itself has not made a statement, but Moores estimated earlier this year that the gigafactory could push cobalt demand from the battery sector up by as much as 17 percent from the 2013 level. That’s fairly substantial, but the implications become even greater when Tesla’s mandate to source its material from North America is taken into account — the US Geological Survey pegs Canada’s 2013 cobalt production at 8,000 tonnes, while United States produces none.

And of course, it’s not just Tesla that has an interest in electric-vehicle (EV) technology. Responding to a survey, Robin Goad, president and CEO of Fortune Minerals (TSX:FT), whose assets include the NICO gold-cobalt-bismuth-copper project in the Northwest Territories, reminded Cobalt Investing News that LG Chem (KRX:051910) and Foxconn Technology (TPE:2354) are also constructing “battery super plants targeting the EV market.”

Clearly Deutsche Bank’s (NYSE:DB) recent statement that EVs “will not be niche” is an accurate summary of what’s in store.

What about that export ban?

Tesla’s gigafactory announcement was certainly a cobalt market highlight in 2014, but that’s not to say nothing else happened. In fact, about this time last year news of a much different sort was making headlines.

As some market participants may remember, the Democratic Republic of the Congo (DRC) banned the export of copper and cobalt concentrate as 2013 drew to a close; however, at the same time it granted producers of the metals a moratorium until December 31, 2014 — essentially rendering the ban toothless.

The end of the moratorium is now fast approaching, but so far there appears to have been little commentary on how it may affect the metal’s supply. It will thus be interesting to see what happens come January 1, especially given the fact that the moratorium was granted in the face of ongoing electricity supply constraints in the DRC — many had raised concerns that the country would be unable to provide enough electricity to run the refining and processing equipment required by the ban, and the country still seems to be suffering from a lack of power.

Cobalt in 2015

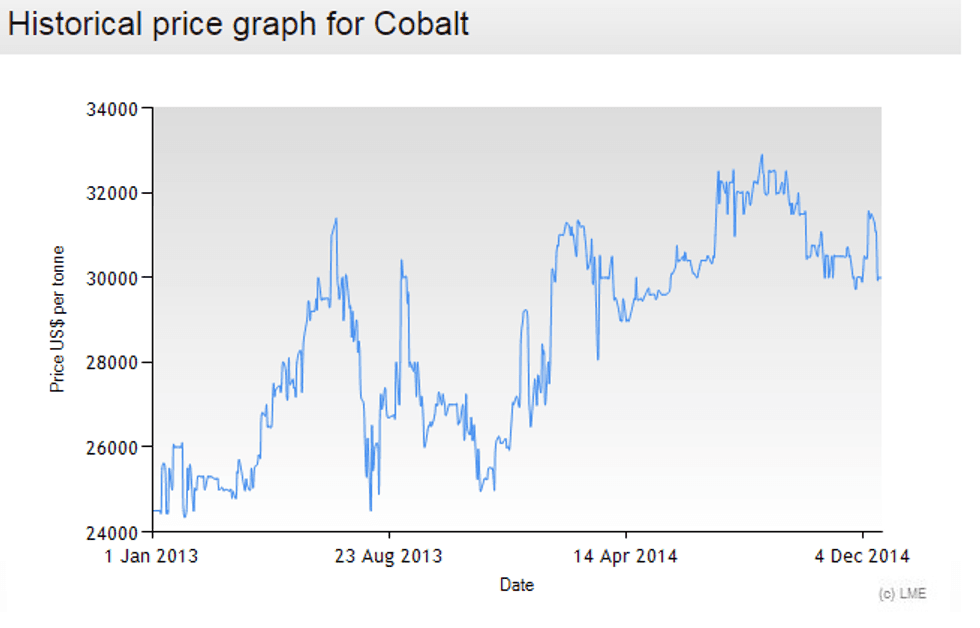

As the LME chart below shows, the cobalt price was for the most part higher in 2014 than it was in 2013. And encouragingly, those in the industry appear to see that trend continuing.

Case in point: this past summer, Erin Chutter, president and CEO of Global Cobalt (TSXV:GCO,OTCBB:GLBCF), commented that in the last 18 to 24 months or so there had been a “significant rebound” in the cobalt price; she was also quick to identify the rise as a long-term trend, not a blip on the radar. She reiterated that view more recently, stating in a video, “we’re at this really neat … break point where the cobalt price has climbed up to absorb a bunch of new supply that came into the market in 2012, 2013 — it’s consolidated really nicely and we know from our Chinese partners and other people in the Asian market that there’s a new scramble out there for cobalt supply.”

Fortune Minerals’ Goad agrees, and explained that “the CRU is forecasting a cobalt chemical deficit in 2015 and a deficit for the entire cobalt market in 2017.” He sees “additional growth of cobalt consumption in EVs” contributing to that outlook and added that “beyond batteries, the next largest use of cobalt is in superalloys (19 percent of demand) due to its use in jet engine and wind power turbines that are also expanding markets.”

It will certainly be interesting to see how the market develops in 2015, and to watch for the next steps of companies in the space. For its part, Fortune will be looking to secure project financing for NICO, while Global Cobalt will no doubt be looking to start exploration at its newly acquired Iron Creek cobalt-copper project, which is located in the same area as Formation Metals‘ (TSX:FCO) proposed Idaho cobalt mine.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading:

Powering the Future: 3 Cobalt Juniors Explain the Impact of Tesla’s Gigafactory

DRC Delays Copper, Cobalt Export Ban Once Again