What zinc trends rocked the market in 2018? We run through what happened to the metal this year, from price activity to supply pains.

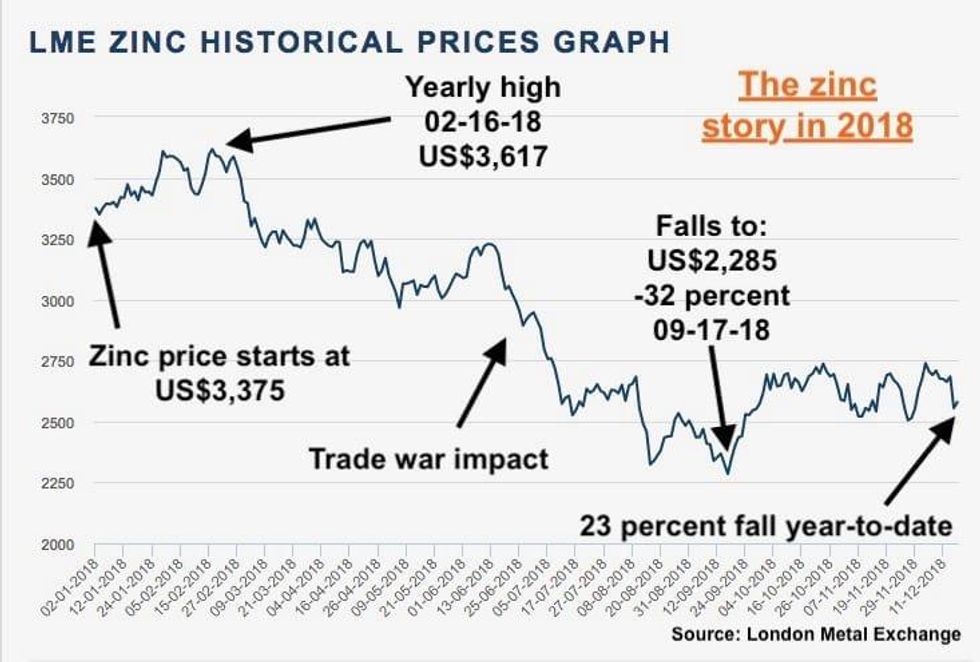

While prices for zinc surged in 2017, increasing 24 percent through the year to begin 2018 at US$3,375 a tonne, that was about the extent of the good news this year.

Zinc topped out in 2018 at US$3,617 on February 16, but then began a tumultuous fall in value as the trade war between the US and China chomped down hard on all base metals, with zinc falling the furthest percentage wise.

At its worst, zinc was a full 32 percent below its January 1 value, when it languished at US$2,285 in mid-September.

As you can see from the LME chart below, while zinc has slightly recovered since — as of mid-December it was down just 23 percent down year-to-date at US$2,579 — the base metal is very much stuck on the lower end in regards to value.

Zinc trends Q1: Early peak, supply pains

As mentioned, Q1 was the quarter that zinc hit US$3,617, its highest price of the year, in a peak that was a continuation of 2017’s hike.

The metal set records early on though, with values at a 10-year high on the second day of the year in what analysts were already calling a supply issue as larger, depleted mines were already offline.

The increase in the metal’s value remained newsworthy well into the quarter.

“Demand growth is decent, but not spectacular from a historical perspective, which tells me this is once again a supply side issue,” said Bernstein analyst Paul Gait at the time.

Healthy demand meant that early in the year, inventories were already falling dramatically.

Despite the issues with supply there was news in the pipeline, with Arizona Mining — bought out later in the year by South32 (ASX:S32) — showing off an attractive preliminary economic assessment for its Hermosa project in Arizona.

Meanwhile, New Century Resources (ASX:NCZ) was keeping busy striking offtake deals with traders for the former Century zinc mine (one of the huge mines the market was missing), where it was looking to refine tailings.

While the Century mine eventually re-entered production as a tailings refining project during the year, early in 2018 a dearth of large projects was already biting smelters, which were keen for product. During Q1, analysts predicted that treatment charges could fall by at least 13 percent.

The quarter ended with a report by the International Lead and Zinc Study Group predicting that zinc output was set to increase over 2018.

Zinc trends Q2: Falling value, treatment charges down

Zinc fell in value through the second quarter, reaching a quarterly low of US$2,894 towards the end of June, while a pipeline of new and reopened projects delivered the goods.

During the quarter, Indian diversified miner Vedanta (NSE:VEDL) revealed its optimism for zinc, with big plans to massively increase production in South Africa through the construction of a smelter at its Gamsberg operations. The move is part of a push to ensure its operations there remain viable as older mines are depleted, and new deposits are exploited.

Canada’s Ivanhoe Mines (TSX:IVN) also made strides towards reopening its Kipushi zinc mine in the Democratic Republic of the Congo — a mammoth project with projected annual zinc production of 225,000 tonnes.

Meanwhile, Australian base metals miner MMG (HKEX:MMG) brought its Dugald River project in Queensland up to commercial production. It will deliver 170,000 tonnes of zinc per year when fully operational.

There were various smaller operations chugging along through the quarter as well, from exploration to estimates to commissioning — such as Titan Mining’s (TSX:TI) Empire State mine in New York.

Finally, on the development front, Australia’s South32 decided to buy Arizona Mining during the quarter, spending a cool C$1.8 billion for the Canadian company and its Hermosa project.

On the refining front, zinc smelters cut their treatment charges by 15 percent to US$147 a tonne in order to woo suppliers in May as a supply shortfall caught up with them.

As the quarter drew to a close, the trade war kicked into gear and zinc — along with all the other base metals — took a dive in value.

Zinc trends Q3: Supply crunch on the horizon

During Q3 zinc continued to fall, losing another 11 percent of its value by falling from US$2,914 at the beginning of the quarter to US$2,572.50 by the end. Q3 also included the yearly low of US$2,285 — a price zinc touched on September 17.

South32 was quick to announce plans for its newly acquired Hermosa project in Arizona, which is slated for production start in 2020.

Staying in the region, Consolidated Zinc (ASX:CZL) moved quickly to begin production at its Plomosas project in Northern Mexico.

There were numerous other developments from smaller miners, and while that was happening Ivanhoe Mines improved the resource estimate for its Kipushi zinc mine (again), with the measured and indicated zinc resources up by 16 percent, from 10.2 million tonnes to 11.8 million tonnes, and an increase in zinc grade from 34.89 percent to 35.34 percent.

During the quarter, the Century zinc mine also came back online, with New Century Resources picking up where previous owner MMG left off in 2016. The company also quickly began working on a mine expansion plan, which it announced in the same quarter.

While all the miners were talking about new supply, stockpiles continued to fall, and analyst Stefan Ioannou of Cormark Securities told INN that the ongoing effects of the trade war were hiding a looming supply shortfall.

He said that even though there are projects moving forward, between 10 and 15 percent of world supply has gone offline in the years prior as huge mines (like Century) have shut down — meaning that the world is in for a supply crunch because big projects can’t just be switched on overnight.

At the time, LME zinc stockpiles stood at 215,975 tonnes, while Shanghai had 37,239 tonnes in its warehouses.

Zinc trends Q4: Prices stay down

The fall in zinc stockpiles continued into Q4, with Scotiabank analysts noting that global inventories of zinc were at “extreme lows — below the levels that were ringing industry alarm bells in November 2017.”

Falling stockpiles made zinc miners work faster, with Azure Minerals (ASX:AZS) posting an encouraging scoping study for its Oposura project in Mexico. The company’s CEO said Azure would move forward rapidly with the project to take advantage of the “strong zinc thematic.”

At the Mines and Money conference in Toronto, Pasinex Resources (CSE:PSE) CEO Steve Williams said what everyone was thinking when he described zinc as the “least-loved metal” out there in 2018 given the “odd” situation it is facing with falling supply, falling stockpiles and depressed prices.

That “odd” situation was certainly taking a financial toll on miners by Q4, with Ascendant Resources (TSX:ASND) posting a quarterly report showing that despite increases in production and efficiency, it still posted a net loss of US$3.85 million in the September quarter.

Lower prices didn’t stop South32 from banging around during Q4 though, delivering plenty of love to zinc projects through the Americas.

Elsewhere, Nyrstar received a lifeline in late November, with a major shareholder throwing it a US$650-million working capital facility to ensure it could continue its day-to-day operations. The news allowed a look in at the depth of the trouble the major global smelter was in over the year, as it required an interim payment before the US$650 million kicked in to cover nine working days of operations.

Wrapping up the theme of the zinc story, as of writing LME zinc stockpiles stood at 127,850 tonnes — up from a low in late November of 115,000 tonnes.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Scott Tibballs, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Pasinex Resources is a client of the Investing News Network. This article is not paid-for content.