Zinc Trends 2017: Prices at Decade High After Supply Crunch

What zinc trends rocked the market in 2017? We run through what happened to the metal this year, from production cuts to falling stockpiles.

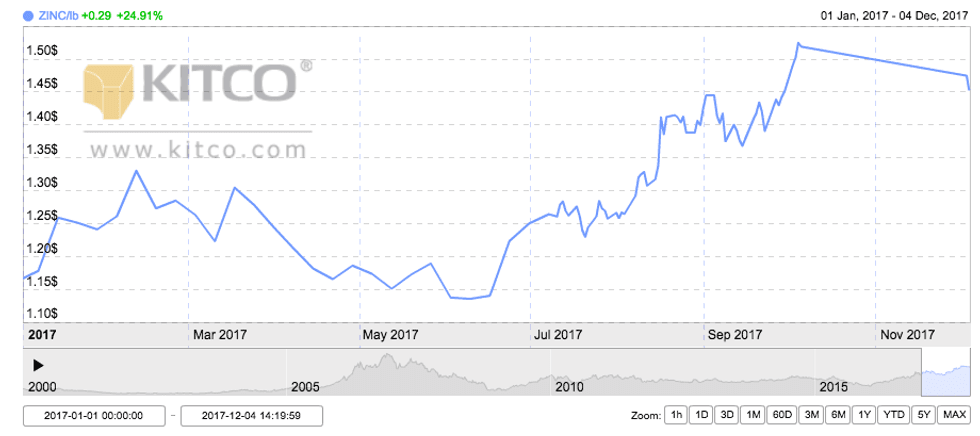

Zinc prices have surged more than 24 percent this year on the back of production cuts, falling stockpiles and a weaker US dollar.

In fact, the base metal hit a 10-year high in August, breaking the $3,000-per-tonne-mark.

As the year comes to a close, the Investing News Network is looking back at the main zinc trends this year, from surging prices to declining warehouse inventories.

Read on to learn what happened in the zinc market in 2017, from the key supply and demand dynamics to how analysts thought the market performed in every quarter.

Zinc’s price performance from January 1, 2017 to December 4, 2017. Chart via Kitco.

Zinc trends Q1: Production cuts and smelter charges

During the first three months of the year, zinc prices gained more than 4 percent on the back of supply worries. Zinc mine output dropped significantly in 2016, largely due to the closure of MMG’s (HKEX:1208) Century mine and Vedanta Resources’ (LSE:VED) Lisheen mine; Glencore’s (LSE:GLEN) 500,000-tonne reduction in annual mine capacity was also a factor.

In Q1, this shortfall appeared to emerge in the refined zinc market. Lower zinc mine supply pressured smelters to decrease treatment charges — the fees they charge to process ore into zinc — to historic lows of around $30 a tonne. As a result, some smelters were forced to cut refined zinc production.

“Everyone is scratching around for mine supply. The winners are the guys who mine the stuff, the big diversifiers. The losers are the zinc smelters who are fighting for concentrates,” noted analyst Daniel Morgan of UBS (NYSE:UBS) at the time.

Also in the news was a strike at Noranda Income Fund’s (TSX:NIF.UN) processing facility in Quebec. It is the biggest in Eastern North America, and the strike increased worries about refined zinc supply.

Overall, analysts were bullish on zinc at the beginning of 2017, as it was the best-performing LME metal the previous year. “I could easily see prices getting up to $1.50 or $1.60 this year and continuing the enthusiasm that we got last year,” Brien Lundin, CEO of Jefferson Financial, said back in January.

Similarly, Andrew Thomas, senior analyst – zinc markets, at Wood Mackenzie, was also bullish on zinc. “It’s become very difficult to derail the zinc story,” he said earlier this year. “A recession would do it, possibly,” he added, “but it would delay it rather than wholly derail it.”

During the first quarter, zinc traded between $2,529 and $2,970.

Zinc trends Q2: Supply worries rise as stockpiles fall

Zinc prices increased almost 2 percent in the second quarter of the year, despite falling to their lowest level this year in June, when prices touched $2,434.

Declining stockpiles and supply worries supported prices during the period. In fact, orders to withdraw zinc from LME stockpiles jumped 10 percent, to the highest level in three years, SP Angel analysts said in a June note. As the quarter ended, stockpiles touched their lowest level since 2009.

Keeping an eye on stockpile levels is important for zinc-focused investors, as they show how much zinc is readily available to end users. “Inventory [levels] can swing market balance and, to some extent, prices too,” CPM Group commodity analyst Yvonne Li explained in May.

Some market watchers were expecting zinc stocks to continue to fall this year. For example, in May, Wood Mackenzie’s Jonathan Leng said that he was expecting to see acute tightness in the zinc market later this year, with stocks “projected to fall to historically low levels and remain so until 2020.”

Geopolitical tensions during the first half of the year pressured zinc, with investors turning to safe-haven assets like precious metals and moving away from riskier assets, such as base and industrial metals.

During the second quarter, zinc traded between $2,434 and $2,776.

Zinc trends Q3: Prices hit decade high

Zinc prices hit their highest level in 10 years in August, breaking the $3,000 mark, and have traded above that level since then. Supply concerns, a strong demand outlook from China and a decline in warehouse inventories supported the price rally.

“Improving demand sentiment has been fueled by a resurgence in Chinese economic growth. However, we continue to look to supply as the primary driver underpinning increasing zinc prices,” Cormark Securities mining equity research analyst Stefan Ioannou said at the time.

During the quarter, China started to strictly monitor its domestic production of the metal. Environmental inspectors targeted zinc mines in Sichuan province, restricting or stopping some production, which increased supply worries.

Another factor impacting prices was the ease in geopolitical tensions. As a result, investor sentiment switched to risk-on.“When geopolitical tensions increase again we would expect zinc prices to be impacted, along with the rest of the LME metals,” CRU analysts commented in August.

During the period, analyst John Kaiser of Kaiser Research explained that zinc prices had the potential to soar as a result of China’s environmental awakening. Similarly, Hard Rock Analyst Editor Eric Coffin said he was bullish on the base metal for the rest of the year.

During the third quarter, zinc traded between $2,736 and $3,215.

Zinc trends Q4: All eyes on mine production

As mentioned, zinc prices have continued to trade above $3,000 since August. Q4 price drivers included global supply worries, China’s environmental crackdown and a weaker US dollar. Output cuts in other key zinc-producing countries have also pushed prices higher.

“Additionally, reports of declining inventories and the latest demand forecast for the commodity suggests that the market will remain tight for the foreseeable future,” analysts at FocusEconomics said in their latest commodities report.

Another sign that the zinc market is tight are the low levels for treatment charges — those indicate that concentrate supplies are thin, Robin Bhar, head of metals research at Societe Generale (EPA:GLE), recently commented. “I still think prices need to stay at this level to get more supply. Spot TCs are still low, they haven’t picked up, so there’s a need to incentivise more supply,” he added.

During the last quarter of the year, zinc has been trading between $3,129.50 and $3,369.50.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.