Top 7 Lead-producing Countries

China produces the most of the base metal, but US Geological Survey data shows six other countries also mined notable amounts in 2022.

The lead price surged past the US$2,500 per metric ton (MT) level in early 2022, and the rest of last year saw periods of volatility. Rising energy costs for smelting and China's COVID-19 recovery are key factors to watch in 2023.

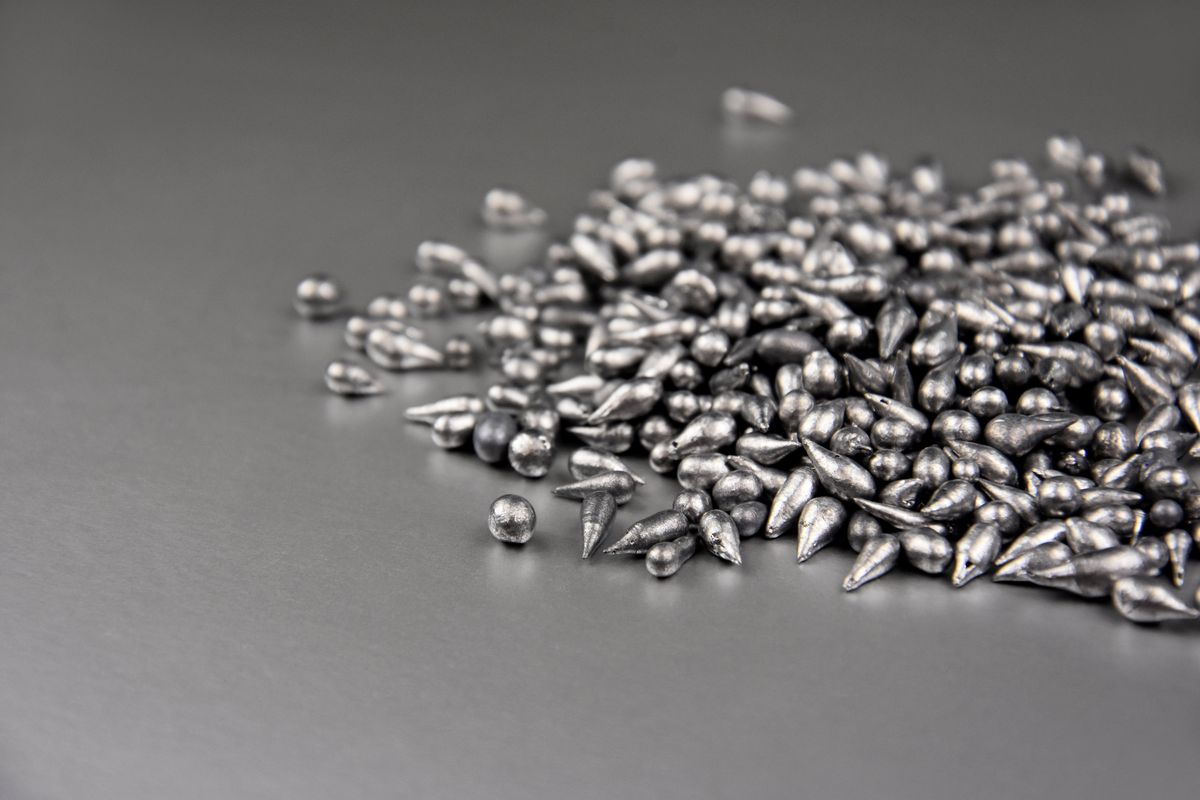

Most lead is used to make lead-acid batteries, primarily to power vehicles, but these batteries are also used in small-scale power storage or even large, grid-scale power systems. In fact, according to the US Geological Survey’s latest report on lead, the lead-acid battery market accounted for over 92 percent of US lead consumption in 2022.

Given the importance of lead, it's helpful to know which countries are the world’s top producers of the metal. Last year, China mined the most of the metal, and a number of other countries also put out significant amounts. Without further ado, here’s a look at the seven top lead-producing countries of 2022, as per US Geological Survey data.

1. China

Mine production: 2 million MT

China produced 2 million MT of lead last year, up slightly from its 2021 output of 1.96 million MT. Interestingly, the increase came despite a surplus of lead in warehouses. The country flipped from a net importer of lead to a net exporter for a short time last year as it fed western supply chains hamstrung by higher power costs and operational setbacks.

China is home to a number of large lead mines, including the Yinshan mine, owned by Jiangxi Copper (OTC Pink:JIAXF,HKEX:0358,SHA:600362), the Fankou mine, owned by Shenzhen Zhongjin Lingnan Nonfemet (SZSE:000060), and the Ying mine, owned by Silvercorp Metals (TSX:SVM,NYSEAMERICAN:SVM).

2. Australia

Mine production: 440,000 MT

Second on the list is Australia, whose 2022 lead production of 440,000 MT was a drop from its 2021 output of 485,000 MT.

A world-leading exporter of lead, much of the lead ore, lead concentrate and refined lead produced in Australia is shipped to the UK, South Korea, Japan, Taiwan, Indonesia, India and Malaysia. The country’s largest lead-producing mines include Shenzhen Zhongjin’s Broken Hill and Glencore’s (LSE:GLEN,OTC Pink:GLCNF) Mount Isa and McArthur River.

3. United States

Mine production: 280,000 MT

Lead production dropped in the US in 2022, totaling 280,000 MT. According to the US Geological Survey, domestic mine production and secondary lead production decreased in 2022 by 5 percent and 3 percent, respectively, from the previous year.

The country has five lead mines in Missouri, and lead is produced as a by-product at two zinc mines in Alaska and two silver mines in Idaho. These mines include the Renco Group’s Sweetwater mine in Missouri and Teck Resources’ (TSX:TECK.A,TSX:TECK.B,NYSE:TECK) Red Dog mine in Alaska.

4. Mexico

Mine production: 270,000 MT

In Mexico, lead production came in at 270,000 MT last year, down slightly from the nation's 2021 production of 272,000 MT. Newmont's (TSX:NGT,NYSE:NEM) Penasquito mine was the country's biggest lead producer last year, with over 70,000 MT alone. Other major mines in the country include the Fresnillo and Saucito mines owned by Industrias Peñoles (BMV:PE&OLES) and the Los Gatos mine owned by Gatos Silver (TSX:GATO,NYSE:GATO).

5. Peru

Mine production: 250,000 MT

Peru saw a decrease in lead production in 2022. Last year, the country put out 250,000 MT of lead, while its 2021 production totaled 264,000 MT. The largest lead mines in Peru include Buenaventura Mining Company's (NYSE:BVN) Colquijirca mine, Glencore’s Chungar Mining Unit in Pasco and Sierra Metals’ (TSX:SMT,OTC Pink:SMTSF) Yauricocha mine.

6. India

Mine production: 240,000 MT

The sixth largest producer of lead is India, whose production increased in 2022 to hit 240,000 MT, up from 215,000 MT in 2021. The country’s largest lead mines include the Sindesar Khurd, Rampura Agucha and Zawar mines, all owned by Vedanta (NSE:VEDL,BOM:500295) subsidiary Hindustan Zinc (NSE:HINDZINC,BOM:500188).

7. Russia

Mine production: 200,000 MT

Unlike the countries mentioned above, Russia’s lead production remained unchanged from 2021 to 2022 at 200,000 MT. The country’s largest lead mines include the government-owned Uchalinsk mine, as well as Ural Mining and Metallurgical’s Volkovskoye mine. It seems Russia's war in Ukraine has had little impact on the nation’s lead-mining industry.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.