Interested in the lead market? Lead has a wide range of applications, and it’s important for investors to understand these key lead demand factors.

Lead, the fourth-most-used metal worldwide, has a wide range of applications. It was once used extensively in plumbing due to its high resistance to corrosion, but today lead demand is driven mostly by batteries, rolled and extruded products and pigments.

China is the largest producer of lead by far, though Australia and the US are also significant producers of the metal. Interestingly, lead can be recycled indefinitely without losing its properties, and has one of the highest recycling rates of any material in common use today.

In terms of demand, the International Lead and Zinc Study Group states that lead demand is expected to grow in the coming years. Global demand for refined lead metal is seen increasing by 2.3 percent in 2017 to 11.39 million tonnes, supported by higher Chinese usage. To help investors learn more about which industries demand will come from, we’ve put together an overview of three key sources of lead demand.

1. Lead demand: Batteries

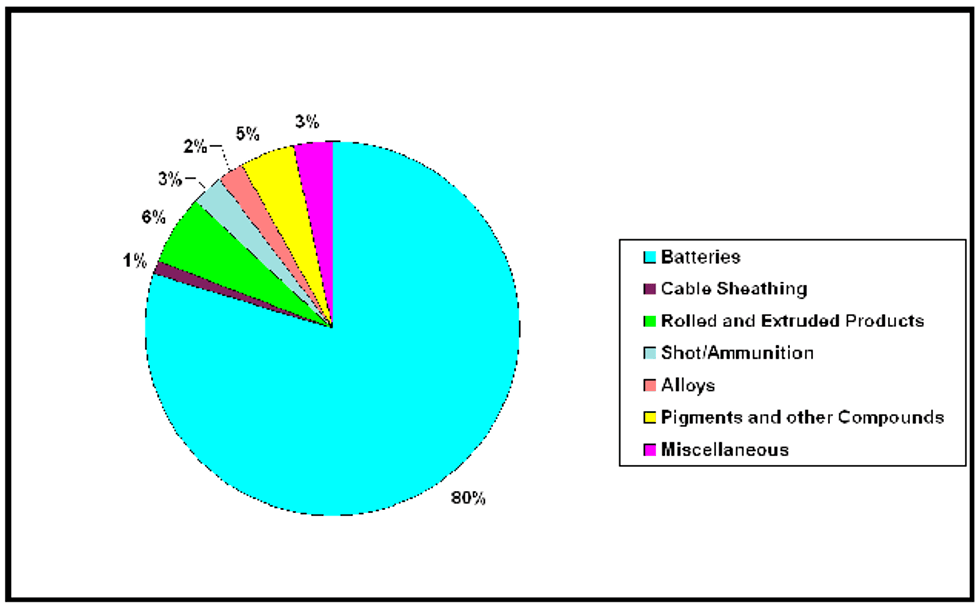

As mentioned, batteries are a key source of lead demand. In fact, lead-acid batteries account for 80 percent of lead’s total end uses. Lead-acid batteries are used in vehicles, in emergency systems and in industrial batteries found in computers and forklift trucks.

Lead-acid batteries are expected to remain in high demand despite the growing focus on lithium-ion batteries. A recent report from Grand View Research shows that the global lead-acid battery market could reach $84.46 billion by 2025, almost double the 2015 total of $46.6 billion. Demand from the vehicle space, as well as higher uptake of consumer electronics in developing countries, will boost demand for these batteries in the near future.

Chart via the International Lead Zinc Study Group.

2. Lead demand: Rolled and extruded products

Since lead is a very soft metal, it can be easily extruded into a variety of shapes. Lead extrusions are used in the construction industry for wires, rods, anodes, burning bars, weights, ballast and other applications, though in some countries zinc is preferred for these types of products. In total, rolled and extruded products account for 6 percent of lead demand.

3. Lead demand: Pigments

Lead can also be combined with other elements to form compounds and pigments that can be used to manufacture batteries, lead glass, rust-proof primer paints and plastics. Lead demand from the pigments industry has accounted for only 5 percent of lead consumption in the last five years. This number has been declining as lead paint is being replaced with titanium dioxide in most cases.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.