For the few past months, governments have been announcing millions in stimulus packages to get the economy back on track — but will they help copper?

Copper felt the impact of the COVID-19 pandemic during Q1, with prices declining more than 20 percent, demand plummeting and supply curtailed by measures to contain the novel virus.

After reaching a low of US$4,617.50 per tonne on March 23, copper prices have rebounded since then to their current level of US$5,680.50.

Countries have started to lift lockdown restrictions, and China, the top consumer of the red metal, has been giving signs of a slow but steady recovery.

The resumption of the Chinese economy has been a central factor in the recent recovery in copper prices, Eleni Joannides, Wood Mackenzie’s principal analyst, told the Investing News Network (INN).

“Additional support has come in the form of ongoing supply disruptions, tightness in scrap availability and cautious optimism about a demand-led recovery as economies have started to scale back containment measures,” she added.

In addition, the unprecedented fiscal and monetary easing from governments around the world has been fueling the broader recovery in asset prices, CRU Group’s Robert Edwards said.

“For copper, expectations around the Chinese government stimulus have been key, alongside what appears to be a relatively strong recovery from COVID-19 during March to mid-June,” he noted.

For months governments have been announcing millions in stimulus packages to get the economy back on track, with the most important ones coming from the US Federal Reserve, the European Central Bank and China — but whether this economic stimulus can help copper this year is yet to be seen.

So far, outside of China’s stimulus outcomes from the “Two Sessions,” most of the stimulus that has come through has been focused on limiting damage to support economies and help those who have lost their jobs, with little or no impact on copper demand, Joannides explained.

“Any impact on copper will more likely come in the second/third tranches of stimulus that governments are currently considering,” she added.

Dan Smith of Commodity Market Analytics told INN that the world’s central banks have produced a lot of positive surprises as they are fearful about deflationary forces and rising unemployment.

“While the most recent fiscal stimulus from China has been less aggressive than the 2008/2009 boost, the market is still likely to see a massive 10 percent fiscal deficit this year in the country, nearly double the level of 2019,” he said. “Also important is that the emphasis is now on boosting investment in construction and infrastructure — both important sectors for copper demand.”

However, there are still many details that are yet to be released by governments related to these stimulus packages.

In China in particular, the danger is that extra money will just translate into housing and infrastructure that nobody needs, which could add to deflationary risks going forward, Smith said.

For Edwards, a key detail yet to materialize is the extent to which ex-China government commitments, such as the 750 billion euro European Union stimulus package, may translate into metals demand.

What impact this could have on copper will depend much on how governments lead their economies out of this recession. The amount of fiscal and monetary policy support and how long it will take for economic activity to normalize from suppressed levels will be key factors to watch, Joannides said.

“Economies will all emerge out of lockdown at different rates, and thus there will not (be) a synchronized global economic recovery, unlike during the financial crisis,” the Wood Mackenzie analyst added. “A key challenge for the market is the rate at which this enforced containment will be relaxed and the pace at which industrial activity will resume.”

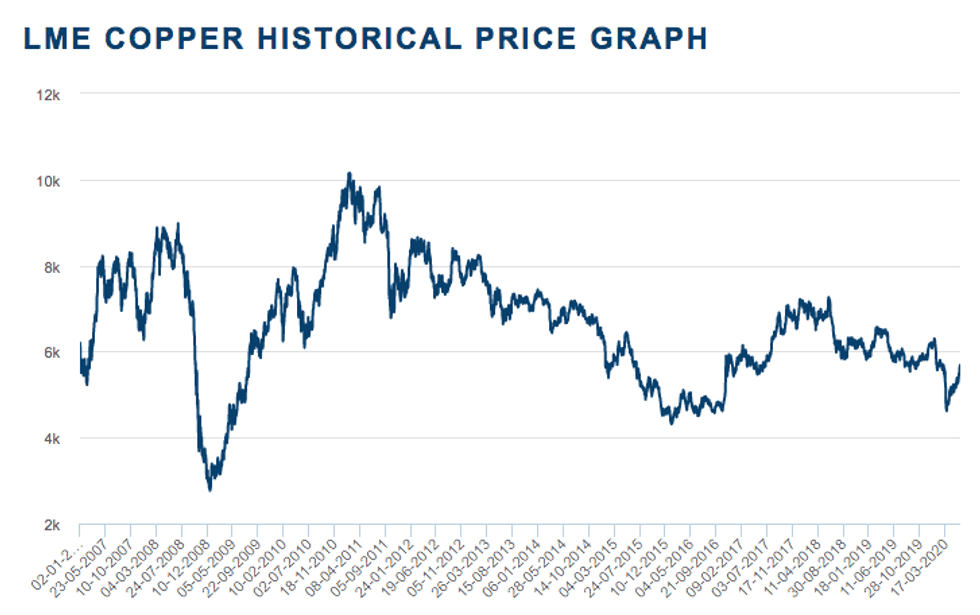

Looking at how copper has reacted to past crises and recoveries, Smith explained that copper had a massive sustained rise in price back in 2008 and 2009, with prices rallying for over two years without a significant correction.

Chart via London Metal Exchange.

“This time around copper is still more vulnerable to further falls because the drop in prices has not been that deep and the global economy has been hit harder in this cycle,” he added.

Similarly, Joannides said the current situation cannot be compared to the global financial crisis (GFC) of 2008 to 2009 as this has been a self-imposed shutdown of the global economy to control the pandemic.

“In addition, China, which back in 2008/2009 was in a growth phase of its economy, is now in a transitional phase, so the government will not push for economic growth at the cost of creating even more imbalances within its economy,” she said.

For the expert, top consumer China will continue to shift from a low-end manufacturing economy to higher-end manufacturing and service-led economy, and from investment to consumption.

“During the GFC, China continued to expand, and with that demand for copper grew at a fast pace,” Joannides said. “This will not be repeated this time around as there is limited need for the same level of infrastructure buildout in China.”

Edwards also pointed out that this time around in China there is more emphasis on, for example, so-called new infrastructure such as 5G, which is less copper-intensive.

Looking ahead, if the stimulus comes in the form of infrastructure investment, this will support demand for copper and in turn copper miners, Wood Mackenzie’s Joannides said.

“However, even before the emergence of this pandemic, the copper market was moving into a period of surplus and lower prices as new projects were due to come to market,” she added.

“This trend is unlikely to be derailed, with producers unlikely to pull back on projects as they are too far down the line of development. While we may see slower ramp ups of some projects, this is unlikely to change the outlook of a period of surpluses emerging.”

For Smith, one of the sector’s biggest challenges is that vaccines in progress could fail to solve the COVID-19 problem, and the world could face a second wave of infections as lockdowns are being eased.

“This would see risk appetite falter and copper would be dragged down by gloomy sentiment spreading through financial markets. While miners will see production hit by a lack of workers, the demand side of copper will be impacted to a greater extent, resulting in a swing back into oversupply for the industry.”

For Joannides, whether prices at this level are sustained throughout 2020 will depend on how economies perform and how quickly industrial activity starts to pick up both in China and in the rest of the world.

“The road ahead is likely to be bumpy, but copper prices should trend higher in the year ahead and into 2021 given its superior fundamentals and the improving demand environment,” Smith said.

Meanwhile, for CRU Group a short-term push to US$6,000 is possible, but eventually the firm expects prices to move back towards the lower US$5,000s, where industry marginal costs lie.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.