Copper, commonly called an economic “bellwether” due to its many uses in industry and commerce, has not escaped the eye of the informed investor. Often overlooked in favor of gold, silver and other precious metals, copper prices have soared since hitting the recessionary bottom in late 2008.

By Vincenzo Desroches—Exclusive to Copper Investing News

As 2010 winds to a close, investors have learned that favorable returns may not always be present in stocks and bonds, but both precious and commodity metals may offer returns at times that outpace any other alternative investment vehicle available. Recent price run-ups in all metals have been dramatic, attracting both institutional investment capital and that from retail investors as well, in one of the year’s best success stories when few were worth noting at all.Copper, commonly called an economic “bellwether” due to its many uses in industry and commerce, has not escaped the eye of the informed investor. Often overlooked in favor of gold, silver and other precious metals, copper prices have soared since hitting the recessionary bottom in late 2008 as depicted below:

Copper prices have recovered previous losses and resumed historical price points, but appreciation going forward will be dictated by global demand and supply dynamics, coupled with the weakness of the U.S. Dollar. Copper prices fell this year while the U.S. Dollar enjoyed a brief strengthening period. A quick review of forex news and currency trading will reveal that prospects for the Dollar are for a continued weakening trend due to debt and deficit fundamentals.

Copper, however, will continue to be our best barometer of global economic health due to its broad breadth of applications in a variety of basic building block industries:

• Building construction;

• Power generation and transmission;

• Electronic product manufacturing;

• Production of industrial machinery;

• Wiring of appliances, heating and cooling systems, and telecommunications links;

• Basic element in the motors, wiring, radiators, connectors, brakes, and bearings used in all cars, trucks and transportation vehicles.

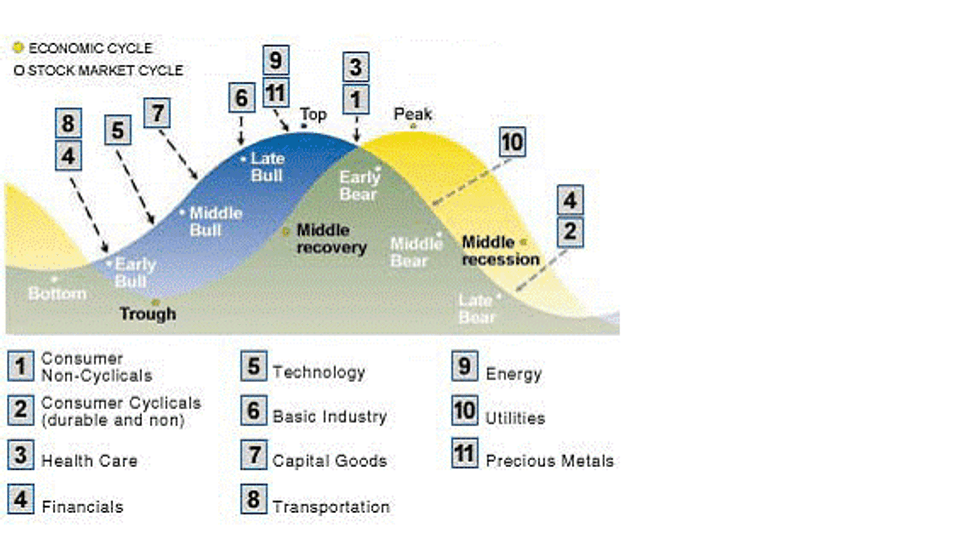

Analysts look to copper prices as a leading indicator of economic recovery as the chart shows for 2009. Any expansion in the manufacturing sector cannot take place without a healthy supply of copper on hand, and much of that expansion has occurred predictably in the developing countries of the world in Asia and Latin America. Copper mining interests are primarily diversified around the world with one major exception being Chile. Chile recently drew international attention over the entrapment and subsequent recovery of 33 of its copper miners. The list of importers reflects where global industrial output is centered in today’s recovery:

While it is evident that Copper is a basic component in nearly everything that we use today from housing and transportation to communication and entertainment, many believe that sufficient inventories have been rebuilt in 2010 to sustain moderate growth in 2011. China may have tempered its internal growth engine, but demand from its burgeoning consumer population will continue to drive its import needs.

Copper has earned its moniker as the “bellwether” of the global economy. As long as there are integrated circuits, chips and circuit boards, there will be demand for copper components. Any gaps will be filled by wiring and tubing in construction, appliances or machinery. Copper is definitely the ubiquitous metal of our day.

Vincenzo Desroches is a financial content controller for Forex Traders, which offers guided Forex courses.