Here’s an overview of the main factors that impacted the copper market in Q1 2020, and what’s ahead for the rest of the year.

Click here for the latest copper price update.

Uncertainty reigned during the first quarter of the year, with base metals prices hitting multi-year lows on the back of the potential impact of the coronavirus outbreak on the global economy.

Copper was no exception, with many analysts predicting a sharp decline in demand from China and a fall in demand from the rest of the world that has yet to be fully seen.

With Q2 already in motion, the Investing News Network (INN) caught up with analysts, economists and experts alike to find out what’s ahead for copper supply, demand and prices.

Copper price update: Q1 overview

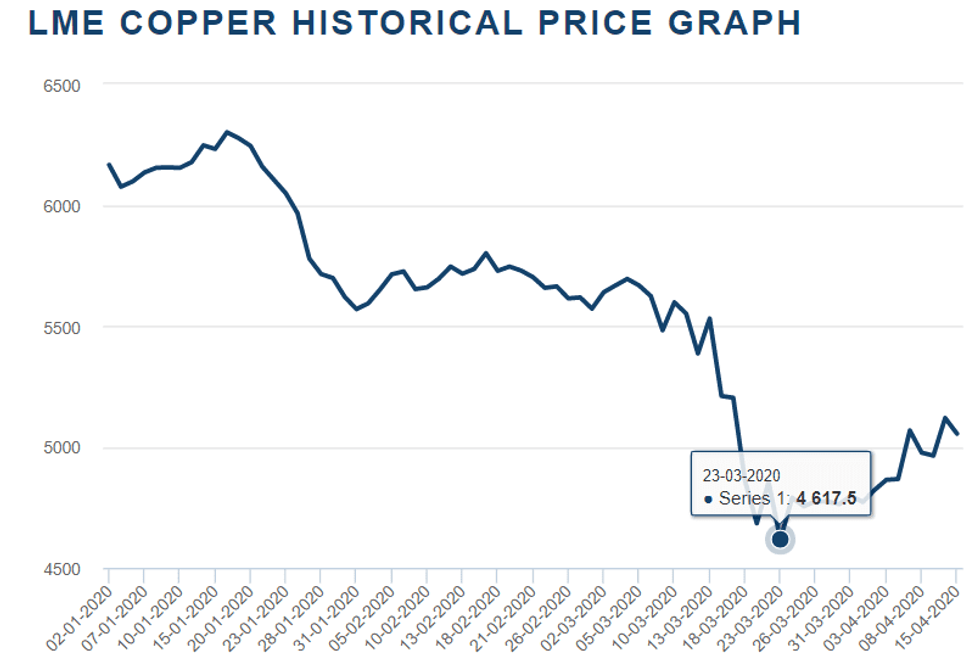

The trend in copper prices was downward for most of the first quarter, with the red metal breaking several marks to the downside. Copper prices kicked off the year at US$6,165 per tonne, reaching their highest point for the quarter on January 16 at US$6,300.

Chart via London Metal Exchange.

Since then, the red metal has taken a hit as fears of sluggish demand in China, the world’s top consumer, have increased. Copper prices plummeted to their lowest point on March 23 at US$4,617.50, a more than 20 percent decrease since January.

As of Thursday (April 16), prices were back up above the U$5,000 mark, trading at US$5,054.50.

Copper price update: COVID-19 hits demand

The coronavirus outbreak, which originated in China, started spreading around the world in Q1, hitting most countries and increasing market volatility to the highest level in recent history.

As China shut down its production lines and implemented virus containment measures, demand for infrastructure metals was hurt — but how much and to what extent remains to be seen.

In the first three months of the year, copper demand in China is estimated to have fallen by a quarter, but the impact elsewhere will be felt more keenly in Q2, Karen Norton of Refinitiv told INN.

“Globally, we were looking for a decline in demand in the order of 2 percent this year, although with the prospects of a V-shaped recovery widely dismissed, the risks are now heavily skewed to the downside in this regard,” she explained.

Capital Economics’ Kieran Clancy said that after suffering for the first three months of the year, copper won’t take a breather, with demand for the red metal expected to be sluggish in Q2.

“With the virus-related disruption still yet to peak in most major copper consumers (other than China), we expect copper demand to remain incredibly weak in Q2 as well,” Clancy said.

But as the rest of the world is now in lockdown, practicing social distancing and operating on essential business only, the Asian copper giant is getting back to a post-coronavirus new normal.

“It is a tricky time because the Chinese are starting to get back to work, with domestic rates of infection almost stopped and industry, particularly infrastructure projects, getting back on track,” Ryan Cochrane of Open Mineral said. “However, as China has started recovering, the rest of the world has locked down, which will obviously affect the export markets (which tend to drive a fair amount of demand for China).”

In fact, 30 percent of China’s copper demand is exported in the form of semi-fabricated products, plus wire, cable and copper-containing finished goods.

As a result, according to Charlie Durant of CRU Group, the negative demand shock from the spread of COVID-19 to the rest of the world is a threat to any recovery in China as well.

“The impact on demand outside of China will be pronounced, and there is a risk that demand declines by double digits this year as the global economic downturn takes hold,” he added.

Copper price update: Supply dynamics uncertain

The coronavirus outbreak has not only been a demand-side story — a supply response once the virus spread around the globe came fast as well.

Major copper powerhouses Peru and Chile imposed restrictions to contain COVID-19, and miners in those countries and elsewhere have stepped up preventative measures, including halting production, suspending expansions and reviewing future plans.

According to Norton, copper mine supply was already on course to decline this year, but recent events make a larger fall more likely, with Refinitiv forecasting about a 3 percent year-on-year decline in global mine output in 2020. However, the market will not be balanced by the end of the 12 month period.

“At the moment prices seem to support our view that the supply response will prevent the copper market from plunging into massive surplus,” she said. “We are currently looking for a surplus in the order of around 200,000 tonnes this year, which is fairly insubstantial in this market.”

Durant pointed out that copper prices remain below the 90th percentile of global cash costs, and more challenges are ahead in the coming quarters, which could lead to further and longer disruptions.

“Other existing mine supply challenges should not be forgotten, and there remain risks to copper mining beyond COVID-19,” he said.

“While we expect the pace and magnitude of supply cuts to gather momentum in the coming months, the near-term decline in demand is likely to outpace cuts to supply.”

Durant said that with demand falling so rapidly in 2020, this year will see a surplus.

“The question remains how large the inventory build will be,” he added. “Without closures or significant disruptions to global mining, a surplus of 1 million tonnes is possible.”

Another major catalyst in Q1 has been the low copper price environment putting further strains on mining companies, which were already experiencing pressure before the coronavirus pandemic.

“Production was already set to be constrained this year, so producers’ ability to (ramp up output as soon as the outbreak is controlled) is limited,” Norton said. “Significantly, some major miners are also delaying work on new projects, which will have the knock-on effect of restricting growth over a medium-term view where growth was already quite limited.”

Over the longer term, CRU Group is forecasting that production from existing copper mines will decline by 2024, and mine projects will be key to sustaining supply growth.

“The difficulty is that at today’s low prices, these projects are not getting the green light to move into the construction phase. However, most existing mines remain cash positive, even at current prices.”

For Cochrane, delays to construction (and capital spending) are inevitable, which will push out expected supply from projects and ramp-ups.

“Miners will preserve as much cash as possible, like any downturn, and this will push out the project pipeline as well as delay the recovery of mine supply growth,” he said.

Aside from the time it will take for demand and prices to recover, another point worth considering is the cost of production itself. With oil prices plummeting and foreign currencies dropping in value consistently throughout 2020, costs for many producers are now down.

“Even though again, low prices may not bring the higher-cost guys back on immediately, their pricing threshold to actually make money has also gone down,” Cormark Securities analyst Stefan Ioannou said.

While that should give hope to miners, it might not be enough to bring back supply as fast as could potentially be needed.

Copper price update: What’s ahead?

Looking at what catalysts investors should pay attention to in Q2, Durant said April is shaping up to be a critical month, as the market waits to see whether the spread of COVID-19 is slowed outside China.

“The focus is now on the depth and duration of the current global economic downturn, which is expected to provide significant near-term headwinds for copper prices, despite China’s recovery,” he added.

CRU Group is expecting copper prices to average US$4,850 in Q2. Capital Economics expects copper to fall further in Q2, potentially reaching a low of US$4,000.

“By the second half of the year, we expect the price of copper to start rising again,” Clancy said. “However, and this is crucial to stress, our more positive view on copper prices in H2 rests on the assumption that measures to contain the virus begin to be relaxed during this period.”

For Norton, prices look to have bottomed for now, but further volatile swings seem likely in a market where sentiment can change very quickly.

“Much will depend on how quickly major consuming nations are able to flatten their respective coronavirus curves, and in this regard China obviously will be monitored very closely,” she said.

“Overall though we believe the fact that there is already a supply response will help to limit the downside beyond the recent lows.”

Looking at what factors could impact copper in the second quarter of the year, Cochrane said investors should keep an eye on treatment and refining charges, as these are the leading indicator of what’s happening at the upper portion of the value chain.

For investors interested in copper, Ioannou said that in the next three months they should be wary of financial results for the first quarter.

“Q1 wasn’t a stellar quarter metal price-wise, but it’s better than it is now on an average basis,” he said.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.