Fertoz Proves Potential of Wapiti Phosphate Project in BC

Fertoz upgraded the JORC resource and released scoping study results for its Wapiti phosphate project in British Columbia last week.

Specifically, the company upgraded 806 kilotonnes of the 1.54-million-tonne inferred resource to a 22.3 percent P2O5 indicated JORC resource — that “represents a conversion of 52% of the previous Inferred JORC Resource,” according to the company. The combined inferred and indicated resource now sits at 1.54 million tonnes at 21.6 percent P2O5; it was calculated to a depth of 30 meters along a strike length of 12.5 kilometers and at a 7-percent cut off.

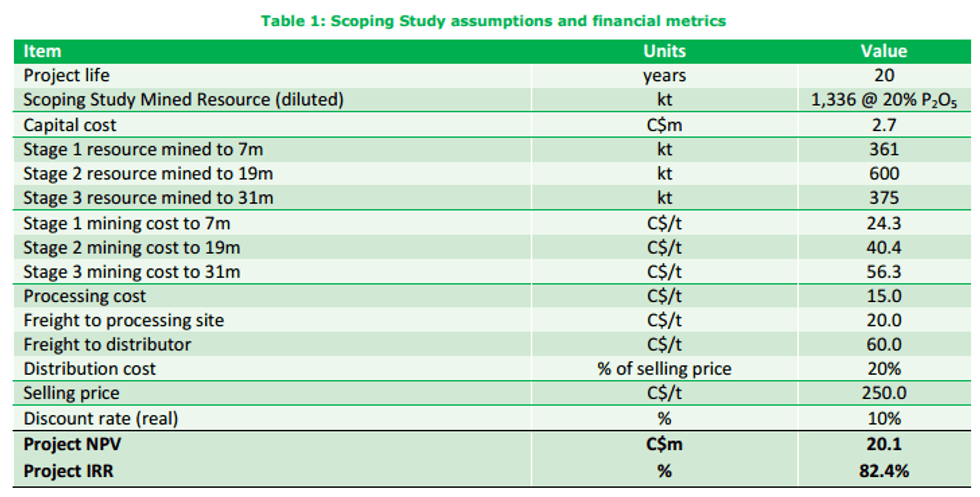

Meanwhile, the scoping study for Wapiti reveals a post-tax, unlevered IRR of 82.4 percent and a post-tax, unlevered NPV of C$20.1 million. The company’s pre-tax cash flows are set at $69.8 million over the life of the project, which should be greater than 20 years based on the indicated and inferred resources.

The study also points to low capital costs of C$2.7 million, with most capital costs expected to be funded through phosphate sales. The $2.7 million will be spent over three years as follows: $200,000 in 2015, $1.5 million in 2016 and $1 million in 2017.

“The Scoping Study has been specifically designed to minimize upfront capital expenditure and achieve near term positive cash flow with a shallow, 7m deep open pit design for the initial 7 years of the project. With fertiliser sales well underway through our FertAg JV in Australia and the likelihood of near term commercial production in North America, Fertoz continues to establish its credentials as an emerging agribusiness,” Les Szonyi, Fertoz’s managing director, said in last week’s press release.

Project background

Fertoz began drilling at Wapiti at the end of August 2013. It’s since completed 2,098 meters of diamond drilling, with preliminary assays revealing low impurity levels and high phosphate grades. Testing of a 2-tonne bulk sample collected during the drilling confirmed in March 2014 that there is “high availability” of 10 percent phosphate, which is likely to be particularly attractive to the organic fertilizer market as a direct-application natural fertilizer. Those results prompted the company to increase the project’s Wapiti East zone by 44 percent, bringing the total area up to 110 square kilometers.

What’s perhaps even more impressive is that within its first year of being a publicly listed company, Fertoz secured its first sale, selling 28 tonnes of ground 20 percent P2O5 rock to a farmer in November 2014. It went for a delivered price of C$200 per tonne. The material was part of the bulk sample mentioned above.

Moving forward, the Wapiti project is expected to begin production in 2016, with Stage 1 production accessing the resource from a 7-meter-deep open pit. During the initial seven years of production, the project is expected to deliver 361,000 tonnes of phosphate at an average strip ratio of 1.6:1. Stage 2 will extend the open pit to a depth of 19 meters below surface and deliver an additional 600,000 tonnes, while Stage 3 will extend it to 31 meters below surface and deliver another 375,000 tonnes of phosphate.

At the end of day Friday, Fertoz’s share price was trading at AU$0.25.

Securities Disclosure: I, Kristen Moran, hold no direct investment interest in any company mentioned in this article.

Related reading:

Uralkali Contract with Indian Company Could Stimulate Potash Demand