Ontario Cannabis Regulators Under Fire for Lottery System

After confirming 42 new cannabis retail license lottery winners, Ontario is facing exasperation from industry players.

Ontario’s alcohol and gaming regulator is facing criticism from the cannabis industry after naming the winners of the province’s second marijuana retail license lottery.

On Wednesday (August 21), the Alcohol and Gaming Commission of Ontario (AGCO) released the results of the lottery, adding 42 new store licenses plus eight more for stores on First Nations reserves.

Toronto will get the largest amount of brick-and-mortar stores, adding 13 new locations to the existing five that opened in April after the first round of the lottery. The other locations are spread across the Greater Toronto Area and the north, east and west regions.

According to the AGCO, about 60 percent of applications were sent in by sole proprietors, while the rest were from corporations and partnerships, a similar breakdown to the previous draw.

Winners have until August 28 to apply for a retail operator license and a retail store authorization, after which the AGCO will start its full eligibility and licensing review.

The AGCO said the new selected stores are set to open in October of this year.

Really surprised to see that 60% of the entrants (and 70% of the winners) entered as sole proprietors…thought this percentage would be much lower this go round.

— Trina Fraser (@trinafraser) August 21, 2019

Legal cannabis sales doubled in the province once the original retail stores opened, rising to C$19.6 million from the C$7 million to C$8 million per month generated through online sales.

One unsuccessful lottery applicant, mīhī cannabis CEO Tom Dyck, told the Investing News Network (INN) that he’s not impressed with the government’s lottery system.

This is the second time mīhī has failed to draw a license in the lottery system, and while Dyck said he’s disappointed about not being selected, he also said, “(I’m) equally disappointed that the government should continue to build this really important industry through a game of chance.”

Dyck said that, since the legal cannabis industry has the potential to generate hundreds of millions of dollars in tax revenue and could combat the black market for the drug, a lottery system isn’t the best way to develop the industry when it is potentially this important to Ontario.

He added that his company is open to partnering with one of the lottery winners.

The provincial regulator said it received more than 4,800 expressions of interest for this round. The first lottery brought in almost 17,000 applicants back in January, before the AGCO tightened the application criteria after receiving criticism about the lack of a merit component in the application process.

This time around, applicants needed confirmation of access to C$250,000 in liquid assets as well as a bank letter stating that the applicant could get a C$50,000 standby letter of credit. The AGCO also required candidates to have already secured suitable retail spaces.

As of Wednesday, 24 of the 25 stores that were initially awarded retail licenses had been approved to operate by the AGCO.

Pretty sad that a merit-based process couldn’t have been implemented @Ont_AGCO. Only encourages gaming of the system by larger organizations, and greedy monetization by people/groups who have no interest in running a store in the first place… #SAD

— Aaron Salz (@StoicAdvisory) August 21, 2019

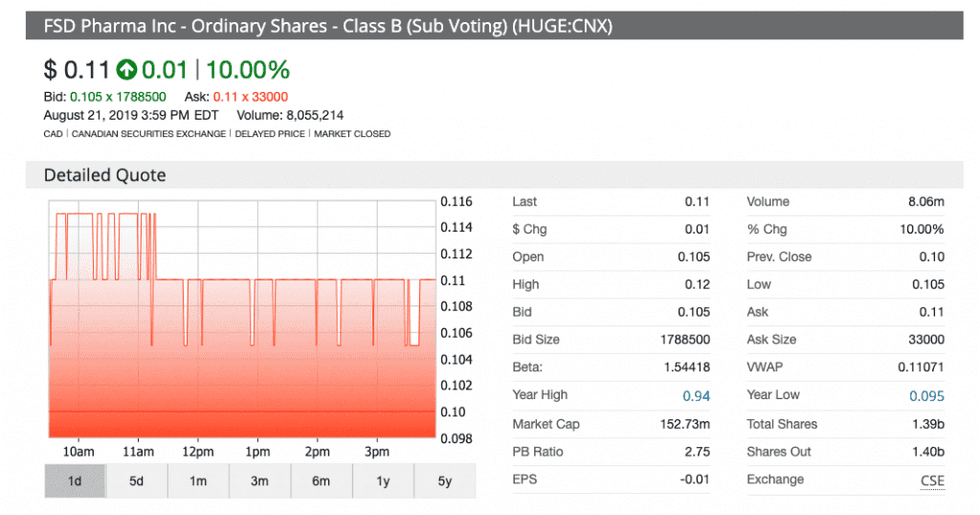

One cannabis company, FSD Pharma (CSE:HUGE,OTCQB:FSDDF), is now getting its chance to enter Ontario’s retail market. In December, the company announced a C$1.3 million investment in Toronto-based cannabis retailer Huge Shops. This lottery, the shop was awarded a license for a retail location in Kawartha Lakes.

The previous lottery saw a variety of partnerships between winners and public cannabis companies, such as Fire & Flower Holdings (TSXV:FAF,OTC Pink:FFLWF) and High Tide (CSE:HITI,OTCQB:HITIF). Fire & Flower announced deals with two lottery winners located in Kingston and Ottawa in February.

Fellow cannabis retailer Choom Holdings (CSE:CHOO,OTCQB:CHOOF) also got into Ontario’s retail space after signing a letter of agreement with a winner and creating a branded store in Niagara Falls that opened earlier this summer.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: High Tide and FSD Pharma are clients of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.