Health Canada Finds Second Non-compliant CannTrust Facility

CannTrust shares dropped on Monday after its Vaughan, Ontario, facility was deemed non-compliant by Health Canada.

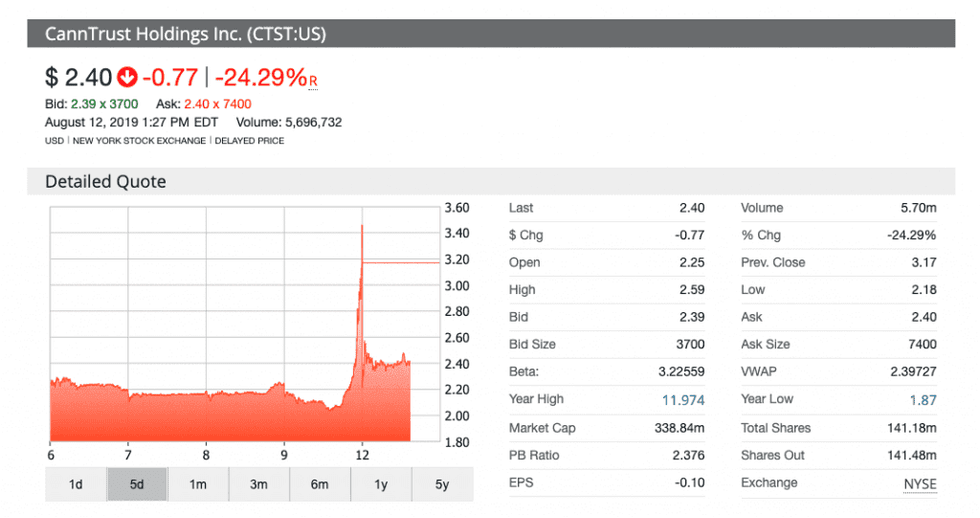

On Monday (August 12), shares of CannTrust Holdings (NYSE:CTST,TSX:TRST) dropped dramatically after regulators found the company has been operating a second non-compliant facility.

The company first made headlines for non-compliance last month, when Health Canada uncovered an unlicensed CannTrust growing operation in Pelham, Ontario. Now the federal agency has revealed that CannTrust’s manufacturing facility in Vaughan, Ontario, is also non-compliant.

According to the cannabis firm’s press release, the Health Canada inspection that led to the second non-compliant rating was done in mid-July.

The probe found that the following actions were done without approval from Health Canada: five rooms in the facility had been changed to storage areas since June, two areas in the facility had been constructed and one had been used for storage since November.

Additionally, the entire facility failed to meet the standards for operating procedures, lacked adequate security controls and operated with a poor quality of assurance investigations and controls. The team also didn’t file the documents needed for an audit in an appropriate timetable.

After seeing a late surge last Friday (August 9), CannTrust investors are once again seeing the value of the company drop after the confirmation of non-compliance.

CannTrust opened in New York and Toronto, respectively, at US$2.25 and C$2.98 on Monday.

As of 12:12 p.m. EDT that day, the company had seen a decline in value of 24.92 percent in New York and 24.7 percent in Toronto.

Last Friday, shares of CannTrust mysteriously surged by 40 percent with less than 20 minutes left on the trading session to close the week. MarketWatch reported that a block trade done at about 3:30 p.m. EDT may have launched the run up.

The newly instated interim CEO for CannTrust, Robert Marcovitch, who is the former president and CEO of K2 Sports, said the company has retained the services of independent consultants to fix the problems highlighted by the regulators.

“We are looking at the root causes of these issues and will take whatever remedial steps are necessary to bring the company into full regulatory compliance as quickly as possible,” Marcovitch said.

As mentioned, the CannTrust scandal started in July when regulators signaled improper growing done by the company at its Pelham, Ontario, facility. A hold was placed on 5,200 kilograms of dried cannabis, alongside a voluntary hold on 7,500 kilograms of dried product from the company.

CannTrust elected to halt operations, including sales to medical patients, but unlicensed product had already reached provincial and international distributors.

The leadership team at CannTrust was found to have willingly participated in the inappropriate operations, according to email records obtained by the Globe and Mail.

Eric Paul, co-founder, former CEO and active chair of the board, was asked to resign from the company at the end of July as CannTrust completed an internal investigation. Marcovitch was given the role of CEO following the firing of former CEO Peter Aceto as part of the review.

Ultimately, a sale of assets may be on the horizon for CannTrust; the company announced on August 1 that it has secured Greenhill & Co. Canada as a financial advisor to consult in strategic alternatives.

As CannTrust confronts the new image it has gained in the marijuana market — from a leader on senior exchanges in Canada and the US to a much-maligned company operating beyond the regulations for licensed producers — its share price has suffered. As a result, the firm will face an investigation from securities regulators.

In an update about a projected delay in the filing of its financial reports due on Wednesday (August 14), the company was forced to inform investors that the Ontario Securities Commission (OSC) has begun an official review of the company.

“Today, staff of the OSC advised the Special Committee’s legal counsel that an investigation has been opened into matters and parties related to CannTrust and the investigation has been assigned to the Joint Serious Offences Team of the Enforcement Branch of the OSC,” the Canadian firm told investors.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.