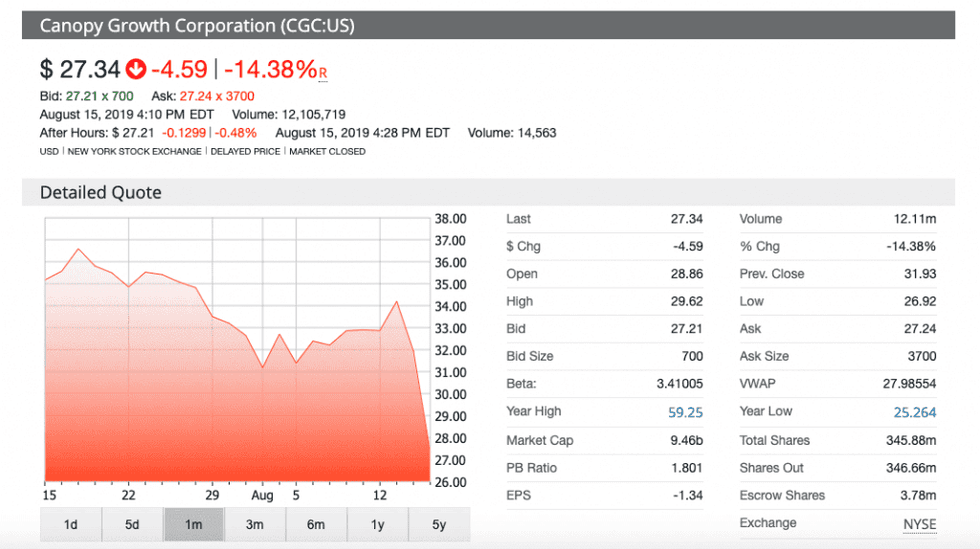

Canopy Growth Shares Slump After C$1.3 Billion Loss

Shares of Canopy opened at C$38.30 on Thursday, their lowest level since January, after the major loss was reported.

Canopy Growth’s (NYSE:CGC,TSX:WEED) share prices dropped sharply during late trading hours on Wednesday (August 14) after the company revealed a net loss of almost C$1.3 billion in its Q1 report of its fiscal 2020 year.

Shares of the company in Toronto opened at C$38.30 on Thursday (August 15), down 15 percent from the C$45.17 at Tuesday’s close, the lowest they’ve been since January. In New York, shares opened at US$28.79, down almost 16 percent from US$34.20 since closing on Tuesday.

The Ontario-based company said that loss was primarily attributed to the non-cash charge of C$1.2 billion on the retirement of warrants held by alcohol maker Constellation Brands (NYSE:STZ), which invested C$5 billion into Canopy last year.

In a statement, Canopy CEO Mark Zekulin said the company remains focused on laying the groundwork for its global operations as well as “evolving from builders to operators over the remainder of this fiscal year.”

Last month, Zekulin was appointed as CEO after the company terminated its former CEO and co-founder Bruce Linton amid disappointing quarterly results. Zekulin is helping with the search for a new leader and will step down once a replacement is found.

During a quarterly earnings call with analysts and investors, Zekulin went on to attribute the loss, in part, to the growth of their competition in the sector as well as investments into developing their operations and facilities.

Zekulin added, though, that the company is hopeful for the quarters to come.

“With the harvest that we just had, with the value added products that are coming online, … we certainly expect to maintain and increase our market share and as the market grows, to increase our revenues,” said Zekulin.

Canopy’s statement also read that the company is planning to reveal a portfolio of higher-margin products in October this year which will coincide with the legalization of edible cannabis products in Canada.

Some industry analysts, however, were discouraged by the report.

Canaccord Genuity analyst Matt Bottomley told investors in an update that the results were underwhelming.

“Canopy Growth Corp. reported FQ1/20 financial results (ended June 30) that came well under our expectations as the company posted its second quarter of sequentially lower net cannabis revenues,” wrote Bottomley.

He also wrote that based on Canopy’s current penetration into the Canadian market, it’s in the second spot in terms of market share behind Aurora Cannabis (NYSE:ACB,TSX:ACB).

Bottomley added that the overall decrease in recreational cannabis revenues — a drop of 11 percent from the last quarter to C$60.8 million — was attributed to a “surprising” shift in its oils and softgels sales mix that came in at a “minuscule” C$200,000 in the company’s first quarter of 2020. It was a drop from the C$36.5 million reported last quarter.

In a note to investors, BMO Capital Markets’ Tamy Chen said the investment bank believes “margins and cash flows could further deteriorate” with news of the results.

Chen’s report did note that the company’s first fiscal quarter of 2020 saw a harvest of 40,960 kilograms of cannabis, a big jump from the previous estimate of 34,000 kilograms.

The company also saw an increase of its international medical cannabis revenue, rising 209 percent to C$10.5 million from C$3.4 million in Q1 2019. Canopy also confirmed plans to move its CBD products into the US by the end of the fiscal 2020 year.

Analyst consensus on TipRanks has Canopy as a “moderate buy” and the price target is C$47.25 representing an upside of 74 percent from the current share price.

On Thursday, Canopy closed the trading session at a price of US$27.34 and C$36.41 in New York and Toronto respectively.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.