The Investing News Network rounds up some of the biggest company and market news in the cannabis market for the past trading week.

During the past trading week (January 20 to 31), the cannabis industry saw a pair of executive changes as the industry continues to see CEO shake-ups.

The marijuana space also saw its latest high-profile lawsuit as it was revealed HEXO (NYSE:HEXO,TSX:HEXO) is the company at the center of the missing payment claim made by MediPharm Labs (TSX:LABS,OTCQX:MEDIF).

Here’s a closer look at some of the biggest cannabis news over the week.

CEO changes in the cannabis space

Sundial Growers (NASDAQ:SNDL) and MedMen Enterprises (CSE:MMEN,OTCQX:MMNFF) are the latest cannabis companies to see a change in the CEO position.

Shares of MedMen jumped on Friday’s trading session by 9.26 percent as of 1:11 p.m. EST to a price of C$0.59 following the announced departure of Adam Bierman as CEO.

“I continue to believe that MedMen is positioned to thrive. It’s time for our next iteration of leadership to capitalize on the opportunity we have created,” Bierman said in a statement.

The multi-state operator confirmed Bierman, a co-founder of the company, would give all of the class A super voting shares under his name back to the firm. MedMen announced that Chief Operating Officer and Chief Technology Officer Ryan Lissack will take over as interim CEO.

As a part of this executive shake-up, MedMen co-founder Andrew Modlin will also submit his Class A super voting shares. Due to these share changes, the company said by the end of 2020 it will only count with class B subordinate voting shares, each representing one vote.

On the other hand, Sundial saw both Torsten Kuenzlen and Brian Harriman, CEO and chief operating officer respectively, leave the company. The company indicated that Kuenzlen’s decision to leave was to “pursue other interests.”

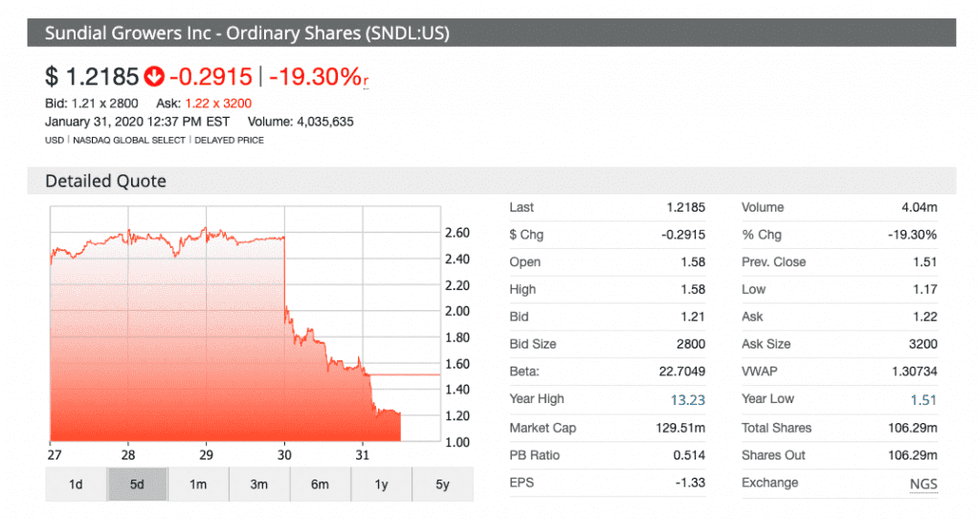

The executive changes caused the company to face a severe drop off in valuation. Shares of Sundial dropped nearly 40 percent during last Thursday’s (January 30) trading session.

The losses continued on Friday (January 31) for Sundial as it saw an additional double-digit drop in value.

So far in January, TerrAscend (CSE:TER,OTCQX:TRSSF) and The Supreme Cannabis Company (TSX:FIRE,OTCQX:SPRWF) have also faced executive changes.

New lawsuit traced back to LP acquisition deal

After MediPharm told investors about a claim filed against an undisclosed licensed producer (LP), the identity of the company it’s chasing was revealed.

HEXO is facing the fallout of this deal gone wrong since it was a transaction done between MediPharm and UP Cannabis, a division of Newstrike Brands. HEXO completed its acquisition of Newstrike in March 2019.

MediPharm claims wrongdoing from a missing C$9.8 million payment as part of an agreed upon transaction with UP Cannabis for cannabis oil items.

“The contract is a supply agreement for which we had serious concerns and, in an effort to drive value for our shareholders, we attempted to work in good faith towards a resolution that was suitable for both parties. Unfortunately, these efforts were unsuccessful,” a HEXO spokesperson told BNN Bloomberg.

Market updates

An audio recording from a donor’s dinner in 2018 showed an inside conversation of US President Donald Trump discussing cannabis policy in the US and its benefits.

This tape was part of the larger releases done by an attorney of Lev Parnas, a Soviet-born businessman who worked alongside Trump’s associate and lawyer Rudy Giuliani and is now at the center of the impeachment inquiries held against Trump.

This past week, Ontario Premier Doug Ford made a fiery television appearance to defending the roll-out of his province’s marijuana retail plan.

“We’re doing it responsibly,” Ford said to BNN Bloomberg. “We’re going to roll out the market and keep in mind it’s only been a little over a year and a bit and we’re opening up to the market.”

The slow Ontario roll-out of cannabis shops has become the de-facto punching bag for Canadian cannabis producers when it comes to the poor performance of the sector. The province has decided to take away a lottery system to open up the entire retail model based on standardized license applications.

“We’re going to have more stores than all the provinces combined, so we’re going to make everything we can to help the cannabis industry,” Ford said.

Florida-based cannabis operator Liberty Health Sciences (CSE:LHS,OTCQX:LHSIF) issued its latest quarterly results report to investors. The firm credited the development of the Florida market as the main driver of its growth year-over-year.

Liberty Health Sciences reported a net income of US$6.9 million thanks to a net sales mark of US$16.1 million for the period ended on November 30, 2019. The company manages 23 dispensaries in the state of Florida, which has proven to be one of the more intriguing cannabis markets in the US.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.