Investing in Graphene Companies

Hydrogen Stocks: 9 Biggest Companies

Overview

Electric vehicles aren’t just the hottest trend in Silicon Valley anymore. With wider cultural acceptance of green power alternatives, more accessible technologies and increasingly supportive legislative action, analysts expect this market and the demand for metals that supply it to climb to exponential highs.

In the United States, the government has named lithium a vital component in electric vehicle batteries and a strategic metal of importance. In 2021, President Joe Biden announced a US$2.3 trillion Infrastructure Plan, which outlines the intent to bring electric cars fully to the mainstream with investments of US$174 billion to promote this technology and construct necessary charging stations. This significant spending demonstrates exciting early-mover investment opportunities for lithium production companies and electric industries alike.

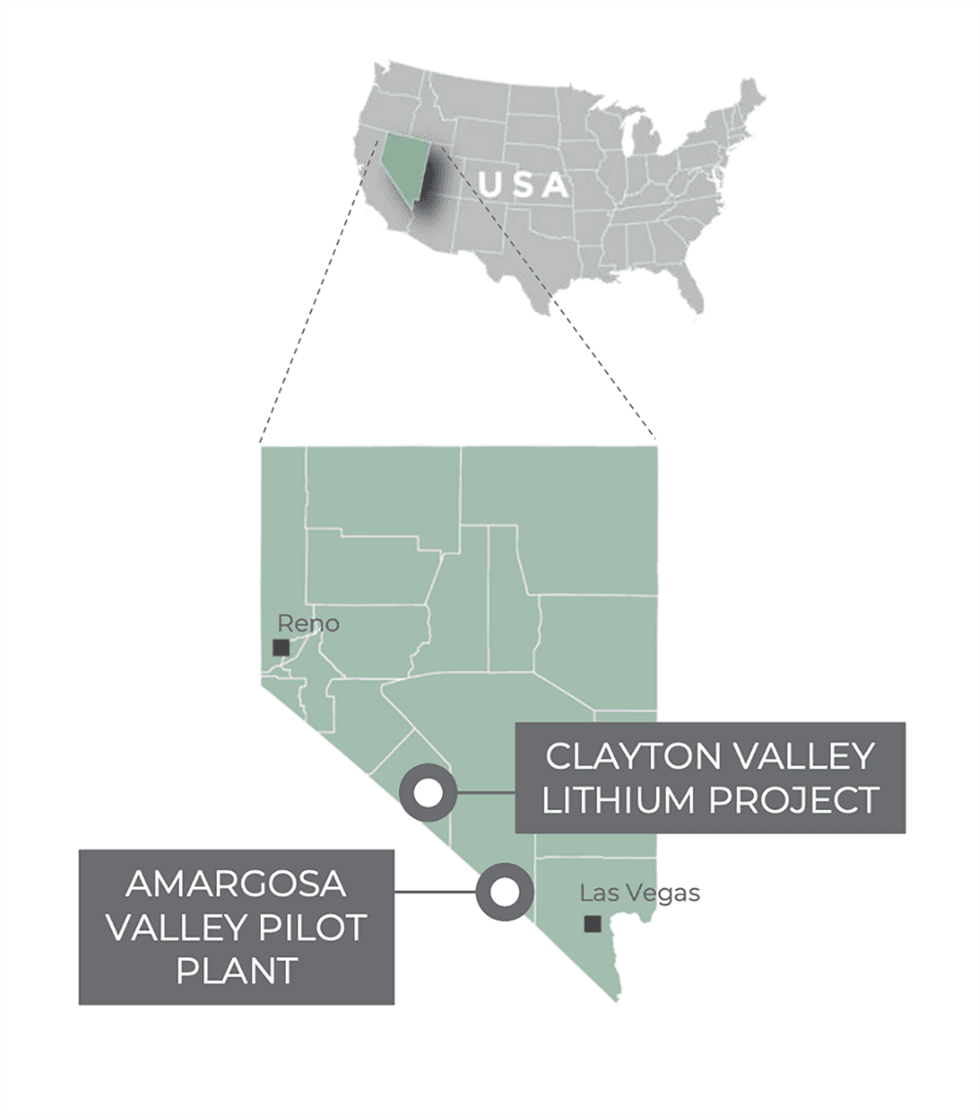

Century Lithium (TSXV:LCE,OTCQX: CYDVF, Frankfurt:C1Z ) is a Canada-based advanced-stage lithium company, focused on developing its 100-percent-owned Clayton Valley Lithium Project in Nevada. Century Lithium is in the pilot stage of testing material from its lithium-bearing claystone deposit and progressing towards completing a feasibility study and permitting, with the goal of becoming a domestic producer of lithium for the growing electric vehicle and battery storage market.

In June 2022, Century Lithium announced positive results from the DLE portion of its lithium extraction facility (pilot plant) in Amargosa Valley, Nevada. Assays received from samples collected during continuous operating cycles in 2022 revealed an average lithium recovery of 99.5 percent within the DLE portion of the pilot plant. These high lithium recoveries were accompanied by high levels of impurity rejection.

Century Lithium’s pilot plant reached a milestone in the delivery of about 4,000 liters of concentrated lithium chloride solution to two laboratories in Canada for further testing in the production of lithium products.

Century Lithium’s pilot plant

“Each laboratory is now working to further treat the solutions – one to produce lithium carbonate, and the other, lithium hydroxide, as the final end product,” commented Bill Willoughby, president and CEO of Century Lithium. “These results will then be used to determine what additional steps are needed, if any, to attain battery-grade standards and evaluate the alternatives for producing these products in the ongoing feasibility study.”

In May 2022, Century Lithium acquired Enertopia’s (OTCMKTS:ENRT) 160-acre lithium project, located adjacent to its Clayton Valley Lithium Project in Nevada. Willoughby said the strategic acquisition will potentially aid in optimization and production schedule development for the company’s upcoming feasibility study.

The feasibility study is being conducted by Wood PLC, which has completed numerous studies for mining projects in Nevada, as well as relevant studies for various lithium projects globally. It was recently awarded a contract by Green Lithium, a mineral processing company, to build and operate the UK’s first large-scale commercial lithium refinery. Century Lithium also engaged thyssenkrupp nucera USA to provide the design and engineering for the chlor-alkali plant as part of the ongoing feasibility study on the Clayton Valley Lithium project.

The pilot plant has been designed for correct interaction and testing of the major components within the extraction process and assessment of the resulting lithium products. In May 2023, Century Lithium further confirmed the production of high-purity lithium carbonate grading 99.87 percent with lithium-bearing claystone. Several kilograms of high-purity lithium carbonate were made from the intermediate lithium solutions generated in January 2023 at the company's lithium extraction pilot plant. Following leaching and direct lithium extraction (DLE), solutions were shipped to Saltworks Technologies for final processing. Results showed consistency in the composition of both the DLE eluent produced by the pilot plant achieving 99.87 percent content versus 99.87 percent reported previously.

At the end of 2021, Century Lithium acquired a water rights permit from the state of Nevada, which allows for the appropriation of 1,770 acre-feet of groundwater per year for mining, milling and domestic applications. This amount represents the largest single volume of permitted water available in the Clayton Valley, which is a fully appropriated hydrogeographic basin. “Water resources in Nevada are limited, therefore the acquisition of this permit by Century Lithium represents a milestone which will secure a majority of the project’s future water requirements,” said Willoughby.

The company’s discovery of the massive resource made Clayton Valley a premium American source of lithium that has the potential to impact the supply of lithium for the fast-growing energy storage battery market.

Sample material from the pilot plant for testing

“We’re in Nevada and we’re in a country that badly needs lithium. We would be the most environmentally friendly project and the lowest acid consumer. We’re able to eliminate sulfuric acid in our process and that would make us an extremely environmentally friendly, large, inexpensive, low-cost producer in the heart of the United States.” said Willoughby.

The company is using environment-friendly mining alternatives through saltwater and hydrochloric acid instead of the traditional freshwater and sulfuric acid methods. This significant proposal could mean Century Lithium will no longer compete for Nevada’s scarce freshwater resources for project advancement when it comes time for mining.

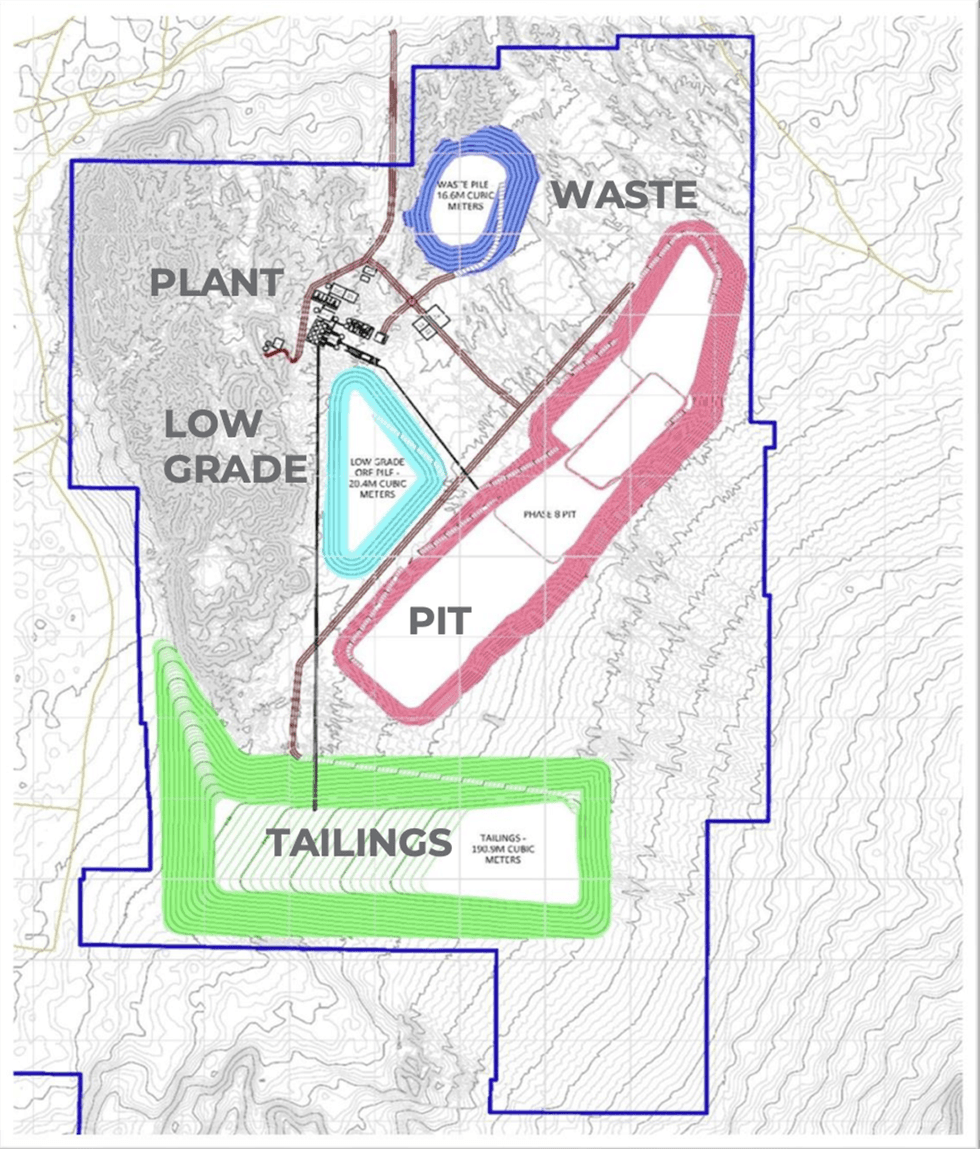

In August 2020, Century Lithium released the results of its pre-feasibility report (PFS), which provided a positive snapshot of Clayton Valley’s prospective production scope using sulfuric acid (the feasibility study will use hydrochloric acid – a greener alternative to sulfuric acid). Probable reserves stand at 213 million tonnes at 1,129 ppm lithium, with an average annual production of 27,400 tonnes of lithium carbonate equivalent and a mine life of over 40 years. Net present value (NPV 8 percent) was at US$1.03 billion, and the after-tax IRR stood at 25.8 percent, using a base case lithium carbonate price of US$9,500.

“This PFS is a major milestone for Century Lithium. These positive results take us closer to our goal of developing a potential world-class lithium deposit. Century Lithium’s land position and resources afford us the opportunity for a long-life project with low operating costs and potential to be a significant source of lithium for the United States,” Willoughby said at the time.

The company further announced its utilization of Koch Technology Solutions' (KTS) Li-Pro process for direct lithium extraction. The KTS equipment has been installed and is now operating at Century Lithium's lithium extraction pilot plant in Amargosa Valley, Nevada, USA.

Century Lithium received a provisional patent from the US Patent and Trademark Office. The patent-pending process encompasses the company's flowsheet, as developed at its pilot plant in Amargosa Valley, Nevada, and protects the company's intellectual property about the handling of solutions derived from the treatment of solid materials including clays from the Clayton Valley Lithium Project.

Company Highlights

- Century Lithium is one of a handful of advanced-stage companies that are working at a feasibility study level with an active pilot plant, and advancing towards production.

- The company has confirmed the production of high-purity lithium carbonate grading 99.87 percent with lithium-bearing claystone from its Clayton Valley Lithium project in Nevada, USA.

- Century Lithium has a water rights permit in place, thus securing a majority of the project’s future water requirement – something that very few companies hold.

- The Clayton Valley lithium project has an extensive surface deposit adjacent to Albemarle’s Silver Peak brine operation.

- The company released strong economic standing with its pre-feasibility study, using $9,500 as a base price of lithium carbonate, including a probable reserve estimate of 213 million tonnes (Mt) at 1,129 parts per million (ppm) lithium, internal rate of return (IRR) of 25.8 percent and capex of C$493 million. Lithium carbonate is now being contracted at $20,000 to $40,000/tonne.

- Century Lithium possesses very favorable economic and geographic positioning in leveraging current strong demand for lithium, world-class mining jurisdiction and an advanced-stage operation in their flagship Clayton Valley lithium project.

- The company is well-positioned to become a long-term, low-cost lithium domestic producer for the growing electric vehicle and battery storage market.

- The company achieved a significant milestone with the production of 99.94 percent lithium carbonate made from lithium-bearing claystone from its 100-percent-owned Clayton Valley Lithium Project.

- The company recently engaged thyssenkrupp nucera to provide the design and engineering for the chlor-alkali plant as part of the ongoing feasibility study on the company’s Clayton Valley Lithium Project. The chlor-alkali plant is an essential component that will allow the Project to self-generate two key reagents required for processing lithium-bearing claystone through to a lithium carbonate product.

- Century Lithium has engaged Koch Technology Solutions' (KTS) equipment for KTS' Li-Pro process for direct lithium extraction.

Get access to more exclusive Lithium Investing Stock profiles here