Crypto Market Update: Crypto Bill Clears Senate Panel in Narrow Vote

A US Senate committee has advanced the long-stalled crypto market structure bill on a razor-thin 12 to 11 vote, moving it forward for the first time despite unified Democratic opposition.

Here's a quick recap of the crypto landscape for Friday (January 30) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

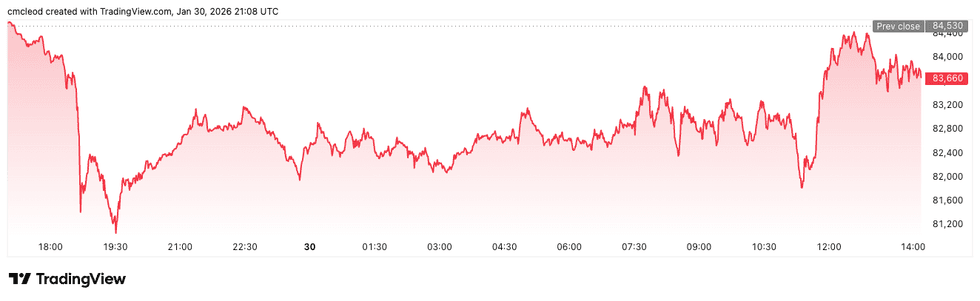

Bitcoin (BTC) was priced at US$83,812.01, down by 0.4 percent over 24 hours.

Bitcoin price performance, January 30, 2026.

Chart via TradingView.

Linh Tran, senior market analyst at XS.com, wrote of cautious optimism in an email to the Investing News Network, saying she views the current decline in Bitcoin as cyclical rather than structural.

“From my personal perspective, the market is currently undergoing a necessary rebalancing phase. The previous strong rally had, to some extent, run ahead of prevailing monetary conditions, making a corrective phase necessary to realign prices with the broader macroeconomic backdrop. This process is healthy, as it helps flush out excessive leverage and FOMO-driven behavior — factors that often destabilize long-term trends," she said.

“Over the medium to long term, I believe BTC will continue to benefit from a gradual shift in confidence away from traditional monetary systems and from the growing need for asset diversification in an increasingly uncertain macroeconomic environment. Corrections like the current one should therefore be viewed as an inherent part of market dynamics, rather than as a signal that the broader trend has come to an end.”

Ether (ETH) was priced at US$2,688.63, down by 4.3 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.74, down by 3.4 percent over 24 hours.

- Solana (SOL) was trading at US$116.99, trading flat over 24 hours.

Today's crypto news to know

Senate panel advances crypto market structure bill

A US Senate committee pushed the crypto market structure bill forward this week, marking the furthest the industry’s flagship policy effort has ever advanced in the chamber.

The legislation cleared the Senate Agriculture Committee on a narrow 12 to 11 vote, split strictly along party lines after Republicans chose to move ahead without Democrat backing.

Committee Chair John Boozman said months of negotiations had produced “significant progress,” and argued that the bill was ready for its next stage despite unresolved disputes. Democrats opposed the markup as a bloc, warning that the current text falls short on ethics safeguards and consumer protections.

Despite the progress, ranking Democrat Amy Klobuchar said negotiations are not over and signaled openness to further talks as the bill advances. One of the sharpest flashpoints remains restrictions on senior government officials profiting from crypto ventures, an issue Democrats want written directly into the law.

The bill must still clear the Senate Banking Committee, where disagreements over stablecoin yield and regulatory scope have already delayed progress. Any final version would also need to reconcile differences with the House-passed bill before heading to the Senate floor.

SEC, CFTC launch joint push to unify crypto oversight

The US Securities and Exchange Commission (SEC) and US Commodity Futures Trading Commission (CFTC) recently unveiled a joint initiative aimed at aligning rules for digital asset markets.

Speaking at CFTC headquarters, SEC Chair Paul Atkins said fragmented regulations have created confusion rather than protection for investors. CFTC Chair Michael Selig said unclear jurisdiction has pushed innovation offshore, leading to firms exhibiting reluctance in US investment without regulatory clarity.

The new effort, dubbed Project Crypto, is intended to reduce uncertainty over whether digital assets fall under securities or commodities law.

Binance to convert US$1 billion SAFU to Bitcoin

Binance announced on Thursday (January 29) that it will convert the US$1 billion in stablecoin reserves held in its Secure Asset Fund for Users (SAFU) entirely into Bitcoin over the next 30 days.

The decision, outlined in a letter published on Friday, aims to support the crypto industry and reflects Binance's belief in Bitcoin's long-term value. SAFU was established to protect users from unexpected losses.

To manage volatility, Binance will conduct regular audits and rebalance the fund. Specifically, if the fund's market value drops below US$800 million due to Bitcoin price fluctuations, Binance will restore its value to US$1 billion.

Kraken‑backed SPAC raises US$345 million in upsized Nasdaq IPO

KRAKacquisition Units (NASDAQ:KRAQU), a Kraken-backed special purpose acquisition company (SPAC), raised US$345 million in an upsized initial public offering (IPO), selling 34.5 million units at US$10 each.

Each unit includes one common stock share and a quarter warrant exercisable at US$11.50. Sponsored by Kraken, Tribe Capital and Natural Capital, the SPAC will target digital asset economy infrastructure businesses, such as payment rails, tokenization platforms, blockchain infrastructure and compliance services.

Santander US Capital Markets led the deal, signaling a reopening of the US crypto-linked IPO market. This SPAC is a capital-raising and strategic move for Kraken, which confidentially filed for its own standalone IPO last year.

Nu wins conditional US approval to form national bank

Nu Holdings (NYSE:NU) has received conditional approval from the US Office of the Comptroller of the Currency (OCC) to form a new national bank called Nubank. The conditional charter allows Nubank to offer deposit accounts, credit cards, lending and digital asset custody services under a federal banking framework, pending full approval.

Nu is now in the “bank organization” phase, needing to meet OCC conditions and gain approval from the Federal Deposit Insurance Corporation and Federal Reserve, committing to full capitalization within 12 months and operations starting within 18 months. Nu co-founder Cristina Junqueira will lead US operations, with former Brazilian central bank president Roberto Campos Neto as board chair.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.