Crypto Market Update: Peter Thiel Fully Exits ETHZilla, Reversing Prior Ethereum Bet

A February 17 SEC filing confirms that Peter Thiel and affiliated Founders Fund entities held zero percent beneficial ownership as of December 31, 2025.

Here's a quick recap of the crypto landscape for Wednesday (February 18) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

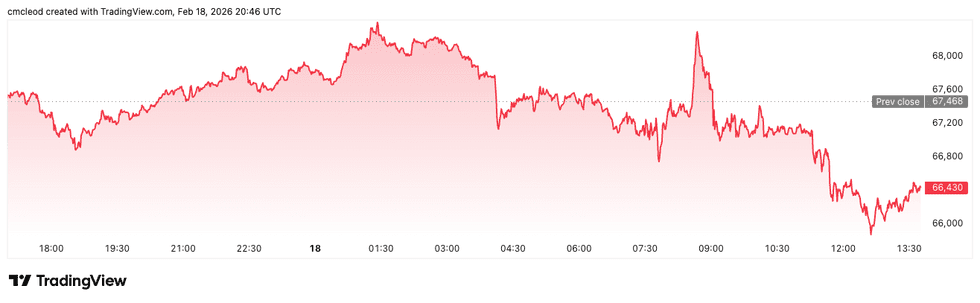

Bitcoin (BTC) was priced at US$66,439.02, down two percent over the last 24 hours.

Bitcoin price performance, February 18, 2026.

Chart via TradingView.

Glassnode's latest market report found that BTC is now range‑bound under pressure, trading between a key support zone around the Realized Price of approximately US$55,000 and a broken True Market Mean of roughly US$79,000, with the US$60k - US$69k band acting as the main demand cluster absorbing recent selling.

On‑chain, accumulation has improved from outright distribution but remains fragile and neutral‑leaning, while liquidity is constrained and profitability muted, signalling a stressed consolidation‑phase regime rather than a clear bottom.

Spot ETFs have shifted back into persistent outflows, spot‑market order flow is net‑selling, and perpetual funding has turned defensive, signs that point to a market that has moved past panic‑driven liquidations but still lacks convincing institutional or large‑holder demand to drive a durable recovery.

In an email, XS.com’s senior market analyst, Antonio Di Giacomo, noted that BTC is deepening its correction toward the US$66,600 area, driven by macroeconomic caution, reduced liquidity, the potential for a more hawkish Federal Reserve Chair and geopolitical tensions.

Corporate risk is highlighted by Strategy (NASDAQ:MSTR) unrealized losses on its large BTC holdings. According to Di Giacom, the key medium-term technical support is the $60,000–$65,000 zone.

Ether (ETH) was priced at US$1,950.20, down by 2.4 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.43, down by 3.6 percent over 24 hours.

- Solana (SOL) was trading at US$81.45, down by 4.3 percent over 24 hours.

Today's crypto news to know

Thiel exits Ethereum treasury bet

Billionaire investor Peter Thiel has fully divested his stake in ETHZilla, according to a recent SEC filing showing zero beneficial ownership as of year-end 2025.

The exit marks a sharp reversal from August, when Thiel disclosed a 7.5 percent position that was widely viewed as a vote of confidence in corporate Ethereum treasury models. The filing indicates no remaining voting or dispositive power tied to Thiel or affiliated Founders Fund entities.

CLARITY Act advances as regulators close ranks

Momentum is building behind the Digital Asset Market Clarity Act of 2025 as lawmakers and regulators signal rare alignment on crypto market structure.

The House has already passed the bill, leaving the Senate as the next hurdle, where committee markups and cross-panel negotiations will determine whether it reaches the floor. Treasury Secretary Scott Bessent said Congress should pass CLARITY "this spring."

At a recent House hearing, SEC Chair Paul S. Atkins backed the effort and outlined a joint SEC–CFTC initiative dubbed “Project Crypto” aimed at clarifying token classifications while legislation moves forward.

The Securities and Exchange Commission and Commodity Futures Trading Commission have long sparred over jurisdiction, so public coordination signals expectations that durable reform may be imminent. Meanwhile, the Senate Agriculture Committee has advanced the Digital Commodity Intermediaries Act, which lawmakers say builds on the House framework and incorporates bipartisan input.

If enacted, the bill would shift oversight from enforcement-by-interpretation to clearer statutory categories for exchanges, brokers, issuers and market makers.

California sets crypto licensing deadline under DFAL

California is moving ahead with state-level crypto oversight, confirming that firms serving residents must secure a Digital Financial Assets Law license, or apply for one, by July 1, 2026.

Applications open March 9 through the Nationwide Multistate Licensing System, according to the California Department of Financial Protection and Innovation. Signed by Governor Gavin Newsom in 2023, DFAL creates a comprehensive licensing regime covering exchanges, custodians and crypto kiosks.

The law has drawn comparisons to New York’s BitLicense, which once prompted several firms to exit that state.

“California is the fourth-largest economy in the world, so its regulatory choices inevitably carry weight,” said Joe Ciccolo of the California Blockchain Advocacy Coalition. He added that clearer rules could attract institutional capital but warned that smaller operators may opt to leave rather than meet stricter standards. With roughly a quarter of U.S. blockchain firms based in the state, the rollout could shape national compliance strategies.

Milo crosses US$100 million crypto mortgage milestone

Milo, a fintech firm, crypto lending firm and SOC 2 audited licensed lender, announced over US$100 million in crypto mortgage originations, including a US$12 million single transaction, signaling significant institutional and high-net-worth adoption of digital asset financing.

“Crossing US$100 million in originations demonstrates the maturity and stability of our lending infrastructure,” said Josip Rupena, CEO and founder of Milo, in an emailed statement to INN.

“We've moved beyond proving the concept. Now we're proving the execution. We're seeing demand across both high-net-worth individuals and institutions (that) recognize crypto as legitimate collateral. Clients are buying homes with their Bitcoin and others are cashing out home equity to buy more Bitcoin.”

Milo offers up to 100 percent financing, up to US$25 million, on home purchases, eliminating cash down payments and taxable events. Clients pledge BTC or ETH to diversify into real estate while maintaining crypto exposure. A self-custody option is also available. Client assets for the traditional mortgage are safeguarded by Coinbase and BitGo.

Adam Back, CEO of Blockstream, called Milo's product a “game changer” for Bitcoin lending, allowing buyers to build real estate equity without selling their Bitcoin.

Milo's separate crypto loan product has also quadrupled in 2025, offering rates starting at 8.25 percent for diverse needs like purchasing more BTC, land, home improvements and business investments.

Zora expands attention markets to Solana

Decentralized SocialFi platform Zora is expanding its "attention markets" product from Ethereum's Layer 2, Base, to the Solana blockchain. This new feature allows users to speculate on cultural moments and internet trends.

Users can create a new "Trend" market on Zora by paying 1 SOL and subsequently trade tokens linked to viral narratives, hashtags, and social media traction. While the initial "Trends" themselves do not offer rewards, "Pairs" created under these trends are designed to provide creator incentives.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.